Medical Gases Market Size & Trends

The global medical gases market size was valued at $8.5 billion in 2022, and is projected to reach $16.7 billion by 2032, growing at a CAGR of 7% from 2023 to 2032. The medical gases market growth is driven by rise in prevalence of respiratory disorders, increase in surgical procedures, and advancements in medical technologies. In addition, the rise in geriatric population contributes significantly to the growth of the market. According to National Library of Medicine, the at a global level, COPD prevalence in 2020, across both males and females, was estimated to be 10.6%, which translates to 480 million cases (Table). The number of Chronic obstructive pulmonary disease (COPD) cases was projected to increase by 112 million to a total of 592 million by 2050, a relative increase of 23.3% from 2020 to 2050.

Key Takeaways

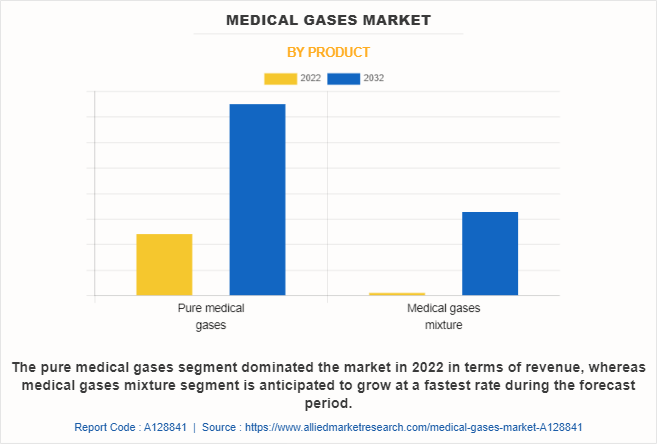

- By product, the pure medical gases segment was the highest contributor to the market in 2022.

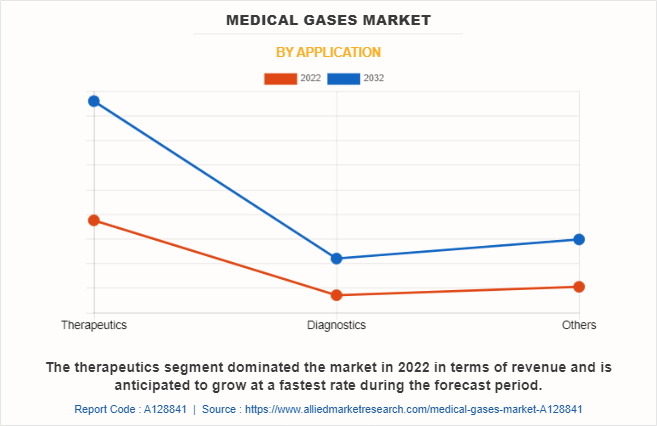

- By application, therapeutics segment dominated the market in terms of revenue in 2022.

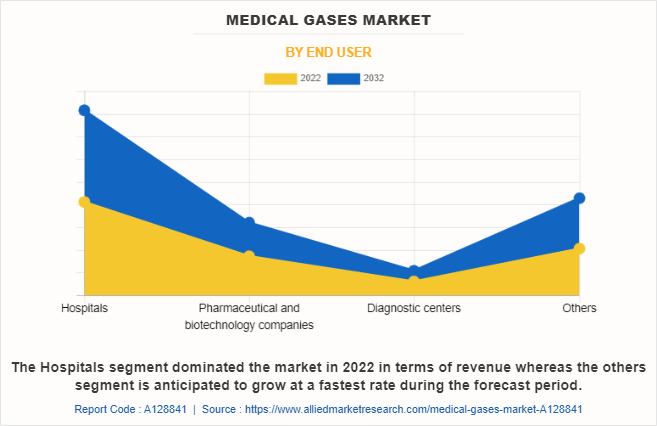

- By end user, the hospitals segment dominated the market terms of revenue in 2022. However, the other segment is expected to experience the fastest growth rate during the forecast period.

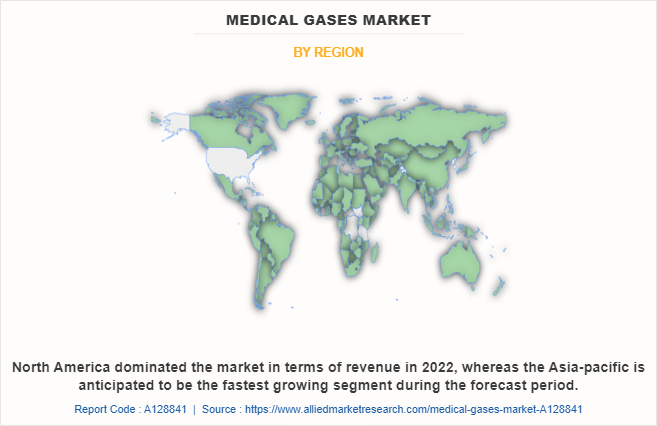

- By region, North America was the highest contributor to the market in 2022. However, Asia-Pacific is expected to register the highest CAGR during the forecast period.

Medical gases are specialized gases used across various healthcare settings for patient care, diagnosis, and treatment. These gases include oxygen, nitrogen, nitrous oxide, carbon dioxide, and medical air, each serving distinct purposes. Oxygen, essential for respiration therapy, is widely used in emergencies and intensive care to maintain sufficient oxygen levels in patients. Nitrous oxide acts as an anesthetic and sedative, commonly used in surgery and dentistry for its pain-relieving properties. Carbon dioxide, meanwhile, aids in insufflation during minimally invasive surgeries, creating space in body cavities for better visualization

Market Dynamics

The growth of the medical gases market is driven by several key factors, including a rise in geriatric population, development of healthcare infrastructure, and surge in prevalence of respiratory disorders.

The rise in the geriatric population is a key factor driving growth in the medical gases market. According to the United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050. As aging individuals often experience chronic conditions such as respiratory disorders, cardiovascular diseases, and other age-related health complications that necessitate the use of medical gases. Conditions such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea, which are prevalent among older adults, require oxygen therapy and other medical gases for effective treatment. As the global elderly population increases, healthcare systems are experiencing a surge in demand for oxygen, nitrous oxide, and other gases essential for both therapeutic and diagnostic purposes. In addition, aging patients are more likely to undergo surgical procedures, which further boosts demand for anesthetic gases.

In addition, the development of healthcare infrastructure plays a pivotal role in driving the medical gases market expansion. According to International Trade Administration, the Indian healthcare industry reached over $370 billion in 2022 and is expected to reach over $610 billion by 2026. As governments and private sectors invest in expanding healthcare facilities, especially in emerging regions, the demand for essential medical gases such as oxygen, nitrous oxide, and carbon dioxide continues to rise. New hospitals, specialized clinics, and emergency care centers require a constant supply of these gases for various treatments, surgeries, and respiratory therapies. In addition, improvements in hospital infrastructure often include advanced storage and distribution systems, which streamline the supply and utilization of medical gases, ensuring safety and compliance with regulatory standards. Thus, the developing healthcare infrastructure is expected to drive the growth of the market.

The increasing prevalence of respiratory disorders significantly drives the growth of the medical gases market, as demand for gases such as oxygen, nitrous oxide, and carbon dioxide continues to rise for treatment and diagnostic purposes. According to article by Center of Disease Control and Prevention, an estimated 14.2 million (6.5%) U.S. adults had physician-diagnosed COPD in 2021. With respiratory conditions such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea becoming more common globally, healthcare providers are relying on medical gases to improve patient outcomes and enhance respiratory function. Factors such as rising air pollution, smoking, and an aging population, which are closely linked to respiratory illnesses, amplify this demand. Oxygen therapy is essential for patients with severe respiratory conditions, necessitating a steady supply of medical-grade oxygen to healthcare facilities and homecare settings. In addition, nitrous oxide is frequently used in surgeries and dental procedures as an analgesic, while carbon dioxide plays a crucial role in various minimally invasive procedures. This increase in respiratory-related cases and the expanding use of medical gases in clinical settings significantly fuel the medical gases market's growth.

However, a key restraint in the medical gases market is the stringent regulatory requirements and supply chain disruptions. Medical gases are highly regulated due to their direct impact on patient health and safety. Compliance with various standards (e.g., FDA regulations, EU standards) can be time-consuming and costly, deterring some smaller players from entering the market. Furthermore, the medical gases market is sensitive to supply chain disruptions, which can impact the availability of gases such as oxygen and nitrous oxide, especially in times of high demand such as during a pandemic.

Segments Overview

The medical gases market is segmented into product, application, end user, and region. On the basis of the product, the market is bifurcated into pure medical gases and medical gases mixture. The pure gases segment is further categorized into oxygen, carbon dioxide, nitrogen, nitrous oxide, and others. Whereas the medical gas mixture segment is further divided into medical air and others. On the basis of application, the market is categorized into therapeutics, diagnostics and others. By end user, the market is classified into hospitals, pharmaceutical and biotechnology companies, diagnostic centers, and others.

By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

By Product

Depending on product, the pure medical gases segment dominated the medical gases market in 2022 in terms of revenue. This growth is attributed to the surge in demand for pure medical gases, especially oxygen, in the diagnosis and treatment of various diseases. In addition, surge in investments by the key players and the government support for the manufacturing of oxygen gas is driving the growth of the segment.

For instance, in October 2021, Indian Prime Minister Shri Narendra Modi announced to dedicate 35 PSA Oxygen Plants across 35 States and Union Territories, as a proactive measures to address oxygen shortage. Such initiatives taken up by the government and key players are anticipated to contribute to market growth.

On the other hand, the medical gases mixture segment is anticipated to grow at the fastest rate during the forecast period. The surge in demand for medical gases mixture for calibration of medical instruments, and its application in diagnosis of various diseases is expected to drive the market growth during the forecast period. In addition, key players are offering a wide range of medical gas mixtures having wide applications in the healthcare sector, which is further expected to drive the market growth.

By Application

On the basis of application, the therapeutics segment dominated the market in terms of revenue in 2022 owing to the surge in demand for medical gases which are administered to patients for the treatment of various medical conditions or to support vital bodily functions. For instance, oxygen therapy is used for anemia, a condition in which the body has fewer red blood cells, leading to a reduced oxygen-carrying capacity. Such applications of medical gases in treatment of various conditions increases its demand and thus fosters the segment growth.

By End User

Based on end user, the hospitals segment dominated the market terms of revenue in 2022 owing to the rise in demand for medical gases from the hospitals. Rise in the number of hospitalizations owing to the increase in number of patients suffering from respiratory disease act as one of the major factors driving the growth of the medical gases market.

However, the others segment is expected to experience the fastest growth rate during the forecast period. This growth is attributed to the rise in geriatric population and the subsequent surge in demand for home healthcare. Many of these patients prefer to receive medical care and treatment in the comfort of their homes rather than in hospitals or medical facilities. This contributes to the demand for medical gases in home healthcare and drives the growth of others segment.

By Region

The market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the medical gases market in 2022 in terms of revenue. The growth is attributed to the well-established healthcare infrastructure, which includes advanced hospital facilities and high demand for respiratory and anesthesia gases for various medical procedures. Furthermore, the region has a high prevalence of chronic respiratory diseases such as asthma, COPD, and sleep apnea, which increases the demand for oxygen and other therapeutic gases.

However, the Asia-Pacific region is anticipated to grow at a fastest CAGR during the forecast period. This growth is attributed to the expanding healthcare sector and increased government investment in healthcare infrastructure. Furthermore, rising air pollution and smoking rates have contributed to a surge in respiratory issues across the region, further driving demand for medical gases. In addition, growing awareness of healthcare and an increase in disposable incomes are fueling the adoption of advanced medical treatments that rely on medical gases. Large population in countries, such as China and India, has created a substantial demand base, which is expected to contribute to high growth in the Asia Pacific medical gases market.

In addition, oxygen is the most essential medical gas, and there is a significant investment by the government for establishing oxygen plants in this region. This is anticipated to boost the revenue generation from the Asia-Pacific region.

Competitive Analysis

Major key players that operate in the global medical gases market are DCC Plc, Linde plc, Nippon Sanso Holdings Corporation, Messer Holding GmbH, Air Liquide, PT Samator Indo Gas Tbk., Air Products and Chemicals, Inc., WestAir Gases and Equipment Inc., SOL Spa, NOL Group. Key players have adopted acquisition and business expansion as key developmental strategies to improve the product portfolio of the medical gases market.

Recent Developments in the Medical Gases Industry

- In July 2020, Air Liquide announced the acquisition of Sasol's 16 Air Separation Units (ASU) located in Secunda, South Africa. Air Liquide will operate the biggest oxygen production site in the world with a plan to reduce its CO2 emissions by 30% to 40% within the next ten years.

- In November 2021, Nippon Sanso Holdings Corporation (NSHD), announced the execution of a raw gas supply agreement with Enlink Midstream, LLC and is expected to be constructing a state-of-the-art facility in Texas dedicated to the production of liquefied carbon dioxide and dry ice.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical gases market analysis from 2023 to 2032 to identify the prevailing medical gases market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical gases market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global medical gases market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional and global medical gases market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

The medical gases market presents several opportunities and challenges. The medical gases market has witnessed notable growth owing to a rise in prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), and asthma, which further increases the demand for medical gases.

In addition, the expanding global population, particularly the aging demographics, contributes to the demand for medical gases as the susceptibility geriatric patients are more prone to chronic disorders. Moreover, surge in demand for oxygen therapies as a lifesaving treatment in various conditions is further boosting the market growth. In addition, improved healthcare infrastructure, especially in developing regions, enhances access to diagnosis and treatment, contributing to the growing demand for medical gases.

Furthermore, in North America, several driving factors contribute to the growth of the medical gases market. Increase in cases of cardiac diseases and respiratory diseases, rise in surgical procedures, availability of robust healthcare infrastructure, and strong presence of key players are contributing to the market growth. On the other hand, Asia-Pacific is anticipated to witness notable growth during the forecast period owing to rise in investments by the key players in production and development of medical gases to fulfill the local needs of oxygen, large population base, and surge in access to healthcare services.

The forecast period for medical gases market is 2023 to 2032.

The base year is 2022 in medical gases market.

Major players that operate in the medical gases market are Air Products and Chemicals, Inc., DCC Plc, Linde plc, Messer Holding GmbH, SOL Spa, Nippon Sanso Holdings Corporation, Air Liquide, Samator Group, NOL Group and WestAir Gases and Equipment Inc.

Key factors driving the growth of the medical gases market includes increase in prevalence of respiratory diseases, rise in number of surgical procedures and rise in adoption of home healthcare.

Asia-Pacific has the highest growth rate in the market with 7.8% CAGR owing to to rise in investments by the key players in production and development of medical gases to fulfill the local needs of oxygen, large population base, and surge in access to healthcare services.

The pure medical gases segment is the most influencing segment in the market owing to the surge in demand for these medical gases in the treatment of various diseases.

The total market value of medical gases market is $8.5 billion in 2022.

The market value of medical gases market in 2032 is $16.7 billion.

Loading Table Of Content...

Loading Research Methodology...