Medical Imaging Informatics Market Research, 2030

The global medical imaging informatics market size was valued at $2.6 billion in 2020, and is projected to reach $4.8 billion by 2030, growing at a CAGR of 6.2% from 2021 to 2030. Medical imaging informatics, also referred as imaging informatics and radiology informatics, is used to exchange and transfer medical images throughout the healthcare systems. The medical imaging informatics market is the point of interest in the healthcare IT market, as it is one of the emerging medical image processing and analysis techniques. Moreover, technological advancements in the diagnostic imaging procedures provide advanced imaging techniques for the visualization of organs.

The growth of the global medical imaging informatics market size is majorly driven by increase in number of diagnostic imaging procedures, high prevalence of chronic diseases, decrease in cost of storage platforms, and improvements in healthcare ecosystem. The major players such as Esaote SpA, Cartestream Health, and Hologic, Inc., and Koninklijke Philips N.V. are adopting the product launch strategy to improve their product portfolio to sustain in the competitive market. For instance, in May 2021, Esaote SpA launched the new MyLab X75 ultrasound system, which offers access to specific clinical solutions such as micro-vascularization assessment, liver stiffness quantification, as well as Zero-Click left ventricle functional analysis. This will improve the product portfolio of the company. Such developments are expected to provide medical imaging informatics market opportunity for major players. However, lack of expertise to operate medical imaging informatics systems and high installation cost of medical imaging informatics solutions hamper the medical imaging informatics market growth. The medical imaging informatics market forecast from 2020 to 2030.

The COVID-19 pandemic forced many companies in the global medical imaging informatics market to halt business operations for a short term to comply with new government regulations to curb the spread of the disease. This halt in operations directly impacted the revenue flow of the global medical imaging informatics market. In addition, manufacturing of industrial products ceased, owing to lack of raw materials and manpower during the lockdown period. Furthermore, no new consignments were received by companies that operate in this sector. Hence, halt in industrial activities and lockdown for several months affected the global medical imaging informatics industry. On the contrary, the market is anticipated to witness a slow recovery during the forecast period. The medical imaging informatics market forecast from 2021 to 2030.

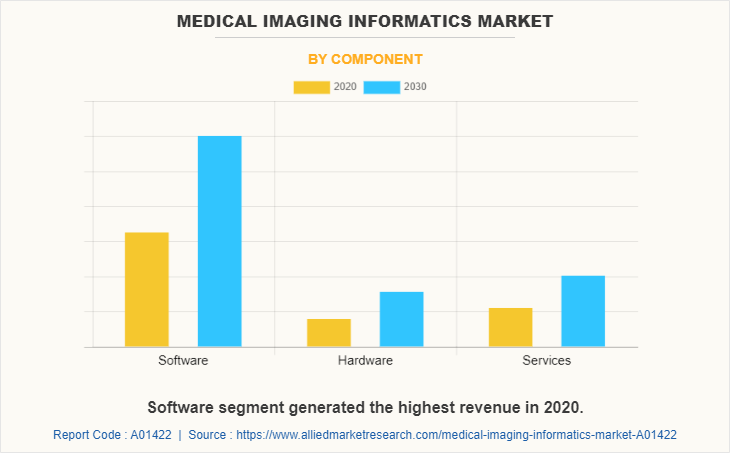

The global medical imaging informatics market is segmented into component, application, deployment mode, end user, and region. Depending on component, the market is segregated into software, hardware, and services. The software segment dominated the market in 2020.

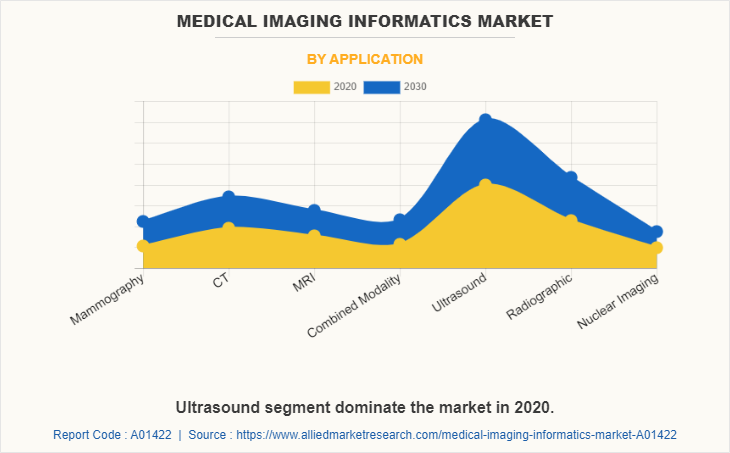

On the basis of application, the medical imaging informatics market size is categorized into digital radiography and computed radiography; ultrasound; magnetic resonance imaging (MRI); computed tomography (CT); nuclear imaging, and mammography. The ultrasound segment held the largest medical imaging informatics market share of 31.0% of the medical imaging informatics market in 2020.

By deployment mode, the market is bifurcated into standalone and integrated. The standalone segment led the market in 2020. As per end user, the market is segmented into hospitals, specialized clinics, and others. The hospitals segment held the largest medical imaging informatics market share of 67.0% of the medical imaging informatics industry in 2020.

Region wise, the medical imaging informatics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America registers the highest revenue growth, followed by Europe. LAMEA is predicted to grow faster than Asia-Pacific with a CAGR of 8.1% during the forecast period.

COMPETITION ANALYSIS

The key companies operating in the medical imaging informatics market are Afga-Gevaert N.V., Carestream Health, General Electric Company, Hologic, Inc., Konica Minolta, Inc., Koninklijke Philips N.V., Mindray Medical International Ltd., Siemens AG, Esaote SpA, and Mckesson Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical imaging informatics market analysis from 2020 to 2030 to identify the prevailing medical imaging informatics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical imaging informatics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical imaging informatics market trends, key players, market segments, application areas, and market growth strategies.

Medical Imaging Informatics Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Deployment |

|

| By End User |

|

| By Region |

|

| Key Market Players | lexmark international, inc., Esaote SpA, Koninklijke Philips N.V., General Electric Company, Agfa Gevaert N.V., Medtronic, Inc., McKesson Corporation, toshiba corporation, Siemens AG, Dell Technologies Inc. |

Analyst Review

This section provides various opinions of the top-level CXOs in the medical imaging informatics sector. In accordance to several interviews conducted, the implementation of medical imaging informatics is expected to witness a significant rise with increasing focus on advancement in imaging software solutions.

The medical imaging informatics market is the point of interest in the healthcare IT market, as it is one of the emerging medical image processing and analysis techniques. Moreover, technological advancements in diagnostic imaging procedures provide advanced imaging techniques for the visualization of organs.

Increase in number of diagnostic imaging procedures, high prevalence of chronic diseases, decrease in cost of storage platforms, and improvements in healthcare ecosystem are some of the major factors driving the market growth. Major players are adopting product launch and acquisition as key developmental strategies to improve the product portfolio of warehouse robots. For instance, in May 2021, Esaote SpA launched the powerful innovative MyLab"X9, which guarantees the highest level of image quality and processing capability. This will improve the product portfolio of the company.

However, lack of expertise to operate medical imaging informatics solutions and their high installation cost hamper the growth of the market.

An rise in medical diagnostics, and rise in incidence of medical mammography systems,. and the key trends in the medical imaging informatics market.

Medical imaging informatics are used in application such as mammography, CT, nuclear imaging, and combined modality.

North America region dominate the market in 2020.

The global medical imaging informatics market was valued at $2,572.9 million in 2020 and is projected to reach $4,795.9 million by 2030, growing at a CAGR of 6.2% from 2020 to 2030.

General Electric Company, SIemens AG, and Mckesson Corporation are the top compnaies which holds the largest share in the market.

Loading Table Of Content...