Medical Insurance Market Research, 2033

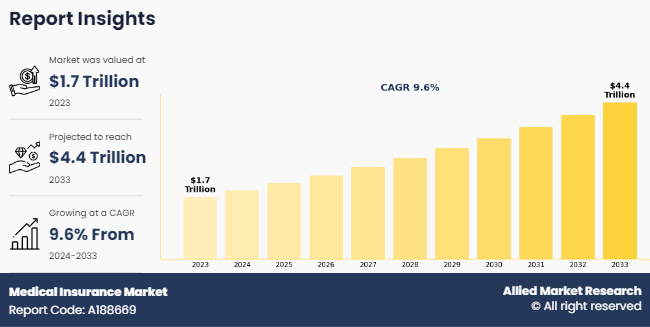

The global medical insurance market size was valued at $1.7 trillion in 2023, and is projected to reach $4.4 trillion by 2033, growing at a CAGR of 9.6% from 2024 to 2033.

Medical insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It covers a range of services such as doctor visits, hospital stays, medications, preventive care, and more specialized treatments. The primary purpose of medical insurance is to protect individuals from the financial burden of healthcare costs, which are unpredictable and substantial. In addition, Medical insurance adoption increased as policies are usually available through employers, government programs, or are purchased individually. The coverage levels, premiums, and out-of-pocket costs vary widely, with factors such as age, location, and pre-existing conditions influencing these variables. In some countries, medical insurance is mandatory, while in others, it remains optional but highly recommended due to the rising costs of healthcare. Medical insurance plays a critical role in ensuring access to necessary healthcare services while mitigating the financial risks associated with medical expenses.

Key Takeaway

- By age group, the 25-34 segment held the largest share in the medical insurance market for 2023.

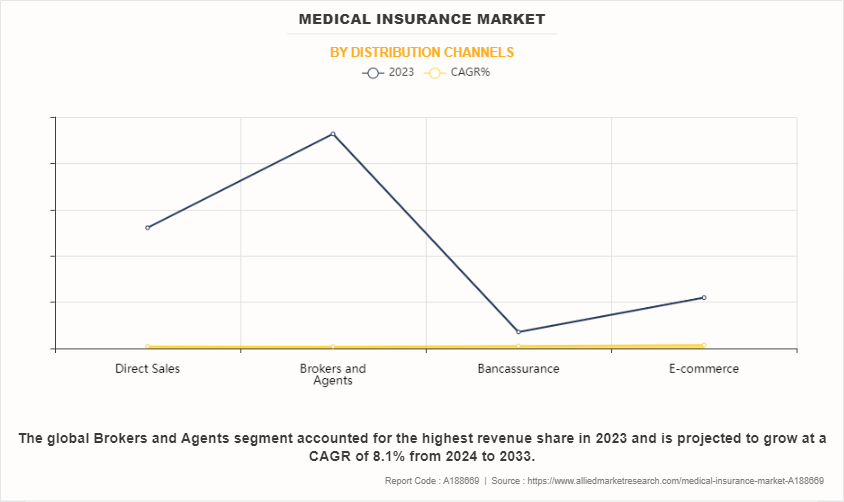

- By distribution channel, the brokers and agents segment held the largest share in the medical insurance market for 2023.

- By claim type, the cashless claims segment is expected to show the fastest market growth during the forecast period.

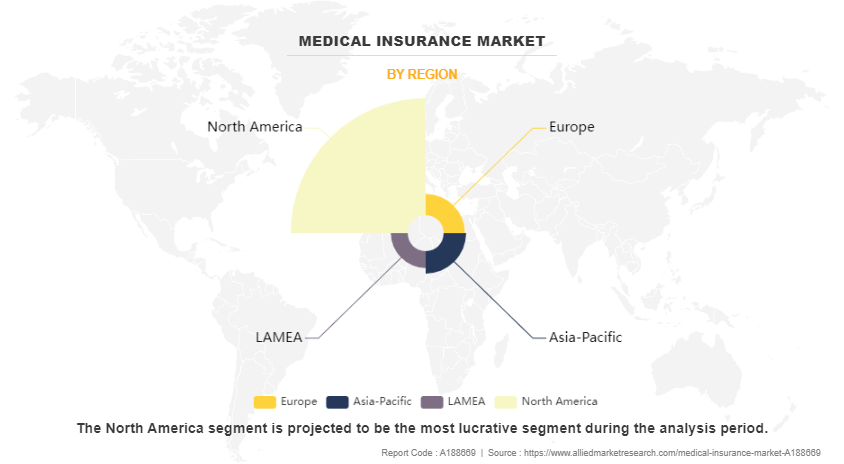

- Region-wise, North America held largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the medical insurance market forecast period.

The rise in the cost of healthcare services globally pushes more individuals and families to seek protection against potentially disturbing medical expenses. This has increased demand for comprehensive medical insurance service, which drives the medical insurance market. However, regulatory challenges, including stringent government policies and market saturation in developed regions, pose barriers to medical insurance market expansion. On the other hand, the integration of technology, such as telemedicine and mobile health apps, enhances customer engagement and service delivery, thereby creating new avenues for medical insurance market growth.

Segment Review

The medical insurance market outlook is segmented into age group, distribution channel, claim type, and region. By age group, it is classified into below 25, 25-34, 35-50, 50-64, and 65 and above. By distribution channel, it is divided into direct sales, brokers & agents, bancassurance, and e-commerce. By claim type, it is segregated into cashless claims and reimbursement claims. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of distribution channel, the global medical insurance market share was dominated by the brokers & agents segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to their ability to provide personalized services and navigate complex insurance options for consumers. However, the e-commerce segment is expected to grow at the highest rate during the forecast period, owing to increasing digitalization, enhanced consumer convenience, and the rising demand for online services.

Region wise, the medical insurance market was dominated by North America in 2023 and is expected to retain its position during the forecast period, owing to its advanced healthcare infrastructure, high levels of disposable income, and robust insurance frameworks. The region benefits from a strong regulatory environment, a well-established insurance industry, and a high demand for comprehensive health coverage driven by a growing population and increasing healthcare costs, which drives the medical insurance market growth in the region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to factors such as rapid urbanization, increase in middle-class population, rise in healthcare costs, and surge in awareness about health insurance benefits. In addition, government initiatives to expand healthcare coverage and the region's expanding digital infrastructure further fuel growth in the medical insurance market

Competition Analysis

The report analyzes the profiles of key medical insurance companies operating in the market such as BUPA, Medibank Private Limited, UnitedHealth Group, Aetna Inc., Allianz SE, AXA Group, Humana, Inc., Kaiser Foundation Health Plan, Inc., Ping An Insurance (Group) Company of China, Ltd., Zurich Insurance Company Ltd, Aviva, AIA Group, MetLife, Inc., Munich Re Group, The Cigna Group, and Anthem Insurance Companies, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the medical insurance market.

Recent Product Launch in the Medical Insurance Industry

- In January 2024, The Cigna Group agreed to sell its Medicare Advantage, Cigna Supplemental Benefits, Medicare Part D, and CareAllies businesses to Health Care Service Corporation (HCSC) for approximately $3.7 billion. Under a four-year agreement, Cigna's subsidiary, Evernorth Health Services, will continue providing pharmacy benefit services to the Medicare businesses after the transaction closes

- In August 2023, AXA announced an agreement to acquire Laya Healthcare Limited from Corebridge Financial Inc., a subsidiary of AIG. This acquisition is part of AXA's strategic expansion, enhancing its presence in the healthcare sector.

- In August 2024, Medibank launched a pioneering corporate health cover program, aligning with its 2030 vision to provide the highest level of health and wellbeing for Australians.

Top Impacting Factors

Driver

Rise in Demand for Insurance Solutions

The rise in demand for insurance solutions drives growth in medical insurance domain due to increased awareness of the need for financial protection against health-related risks. The healthcare insurance costs continue to rise due to which more individuals and families have realized the importance of having comprehensive insurance coverage to protect themselves from unexpected medical expenses. This surge in demand is particularly pronounced in emerging markets that have witnessed a rise in income and improved access to healthcare, which boosts the adoption of insurance products. For instance, according to the Centers for Medicare & Medicaid Services (CMS), the average annual Medicare insurance expenditure growth is projected to be 7.4% for 2023-2032 and the average rate of growth for Medicaid spending is projected to be 5.2% for 2023-2032.

In addition, the rise in demand for insurance solutions is fueled by surge in geriatric population, with older adults requiring more comprehensive and specialized insurance plans that cater to their specific health needs. Technological advancements made it easier for consumers to compare and purchase insurance online, further contributing to growth of medical insurance market. Moreover, the insurers respond to their increased demand for medical insurance solutions by offering more tailored options, such as telemedicine services, chronic disease management plans, and wellness programs, making insurance more accessible and relevant to a broader audience. This significant shift enhances medical insurance market penetration and drives innovation within the medical insurance industry, as insurers work to address the evolving needs of their customers

Restraints

High Premium Costs and Affordability Issues

One of the significant restraints in the medical insurance market is the high cost of premiums, which makes it difficult for many individuals and families to afford adequate coverage. Premiums have been steadily increasing, driven by rising healthcare costs, which in turn are influenced by factors such as technological advancements, the growing prevalence of chronic diseases, and administrative expenses. For instance, in 2024, according to a survey by LocalCircles, 52% of health insurance policy owners experienced a premium increase of over 25% in the last 12 months. This survey gathered insights from 11,000 individuals across 324 districts in India, which highlights a critical challenge. The sharp rise in premiums is driven by various factors, including escalating healthcare expenses, advancements in medical technology, and administrative overhead, which represents a substantial financial burden for middle-income families. This medical insurance challenge characterized by high cost of insurance premiums often leads to underinsurance or complete lack of insurance, particularly among low-income populations, thereby limiting the growth of medical insurance market.

Opportunity

Digital Transformation and Telemedicine

Digital transformation and the rise of telemedicine offer substantial opportunities for the medical insurance market growth. The COVID-19 pandemic accelerated the adoption of telemedicine, as patients and healthcare providers sought safe and convenient alternatives to in-person visits. This shift has been supported by advances in digital health technologies, such as mobile health apps, wearable devices, and electronic health records (EHRs). Telemedicine allows for more frequent and accessible healthcare interactions, particularly for individuals in remote or underserved areas.

For instance, Teladoc Health, a leader in virtual care, reported a significant increase in telemedicine visits during the pandemic, a trend that continues as patients appreciate the convenience and immediacy of virtual consultations. Insurance companies seize this opportunity by integrating telemedicine into their coverage plans, offering policyholders access to virtual care services as part of their health insurance benefits. In addition, the Medical Council of India (MCI) issued guidelines for telemedicine on March 25, 2020, which provide a framework for the practice of telemedicine in India. These guidelines allow registered medical practitioners to offer healthcare services remotely, using digital platforms.

As a result of these guidelines, insurers in India are advised to include telemedicine consultations in their policy terms and conditions wherever applicable. This means that if a medical insurance policy allows for consultations with medical practitioners, it should also cover telemedicine consultations, reflecting the evolving nature of healthcare delivery and ensuring that policyholders access care through digital means when needed. Furthermore, the use of digital tools enhances customer engagement, improves the efficiency of claims processing, and enables personalized insurance products, thereby driving customer satisfaction and contributing toward medical insurance market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical insurance market analysis from 2023 to 2033 to identify the prevailing medical insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical insurance market trends, key players, market segments, application areas, and market growth strategies.

Medical Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.4 trillion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 407 |

| By Age Group |

|

| By Distribution Channel |

|

| By Claim Type |

|

| By Region |

|

Analyst Review

The medical insurance market is rapidly evolving as a crucial component of the global healthcare landscape. The medical insurance market growth is driven by factors, such as rise in healthcare costs, increase in awareness about health insurance, and advancements in technology. Medical insurance provides financial protection against medical expenses, making it essential for individuals and businesses to mitigate the financial risks associated with healthcare. The market has witnessed transformative changes due to technological advancements and shift in consumer expectations, reshaping how insurance providers deliver services and engage with customers, which is expected to drive medical insurance market during the forecast period.

In addition, the integration of advanced technologies, such as Artificial Intelligence (AI), telemedicine, and blockchain, has revolutionized the medical insurance industry. AI is particularly influential, automating claims processing, enhancing risk assessment, and improving customer service through predictive analytics and machine learning. These innovations reduce operational costs, minimize fraud, and allow insurers to offer personalized policies tailored to individual health profiles. Moreover, telemedicine is another critical technology impacting the medical insurance market. It enables policyholders to access healthcare services remotely, increasing convenience and reducing the need for in-person consultations. Insurance providers incorporate telehealth services into their coverage plans, expanding access to healthcare and improving patient outcomes.

Furthermore, factors such as increasing prevalence of chronic diseases, rising healthcare costs, and expanding health coverage initiatives provide an opportunity for market growth. The government programs aimed at expanding access to health coverage and subsidies create favorable conditions for medical insurance market growth.

Medical insurance is a type of policy that covers the cost of healthcare services, including doctor visits, hospital stays, medications, surgeries, and preventive care, protecting individuals from high medical expenses.

The base year is 2023 in the medical insurance market.

The forecast period for the medical insurance market is 2024 to 2033.

The total market value of the medical insurance market is $1.7 trillion in 2023.

The market value of the medical insurance market in 2033 is $4.4 trillion.

Loading Table Of Content...

Loading Research Methodology...