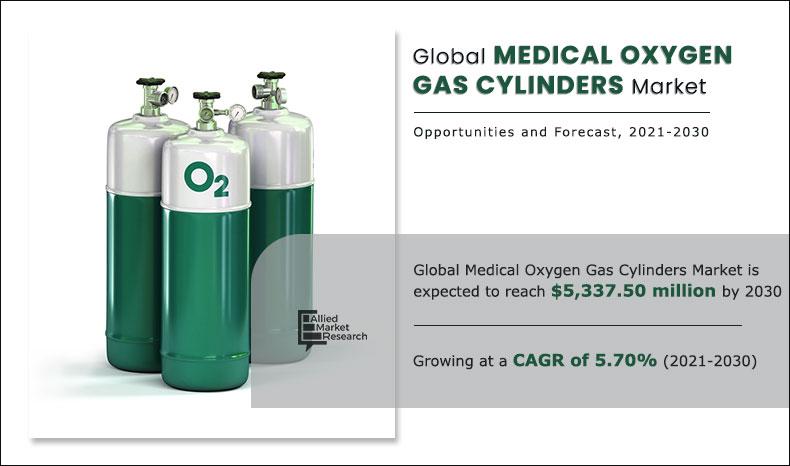

The global medical oxygen gas cylinders market size was valued at $2,971.40 million in 2020, and is estimated to reach $5,337.50 million by 2030, growing at a CAGR of 5.70% from 2021 to 2030.

Medical oxygen gas cylinders are often used by medical care workers for therapeutic and diagnostic purposes. Medical oxygen gas systems, for example, oxygen concentrators and compressed oxygen gas cylinders are considerably utilized in homecare settings, and are normally chosen by old patients who experience challenges in mobility, and rely upon a steady oxygen supply.

Some common chronic medical illnesses, such as chronic obstructive pulmonary disease (COPD), emphysema, and chronic bronchitis, which are common long-term effects of smoking, necessitate oxygen treatment or supplemental oxygen to provide adequate oxygen levels. Furthermore, many types of oxygen systems are used to deliver a controlled amount of oxygen to patients. Additionally, medical oxygen gas is high purity oxygen that is created for usage in the human body and is used for clinical therapies.

Furthermore, rising prevalence of COVID-19 cases across the globe and growing cases of chronic diseases are also supplementing the market growth. Optimal medical infrastructure utilization became a high priority for Governments worldwide during the COVID-19 pandemic. Furthermore, special attention is drawn to both the import and local manufacture of medical oxygen gas to ensure its uninterrupted supply to designated COVID-hospitals identified by the local administration. For example; as per Worldometer; As of April 27th, 2021; there are 19,172,322 active cases of COVID-19 across the globe. Thus, oxygen gas cylinders are required for the increasing demand from medical clinics, home care settings and many others. Medical oxygen gas cylinders are available in various sizes relying on the requirement. In hospitals, oxygen gas treatment is executed on the patients for the therapy of chronic health issue to improve energy levels, rest and a superior quality life of patients. Oxygen is generally utilized in medical clinics for the therapy of various intense and chronic diseases. Theses clinical oxygen chambers are generally utilized in the ambulance to manage emergency circumstances. The medical oxygen gas cylinders have huge need for the patients facing different infections like asthma, disease, and others.

Increase in daily exposure to environmental pollution is driving the market. Additionally, increase in population susceptible to indoor air pollutants as well as increase in population of active smokers is also responsible for propelling the growth of the market. However, high cost of the oxygen cylinders and stringent regulatory procedures are hampering the growth of the market. Furthermore, high growth potential in emerging market and increase in geriatric population will create a lucrative growth opportunity for the oxygen gas cylinder market in the forecasted years.

By Technology

Continuous Flow segment holds the dominant position in 2020 and would continue to maintain the lead over the forecast period.

Oxygen Gas Cylinder Market Segmentation

The global medical oxygen gas cylinders market is segmented into technology, product, end user and region. By technology, the market is categorized into pulse flow and continuous flow. By product, the market is bifurcated into portable and fixed. By end user, it is divided into hospital and home healthcare.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

Fixed segment is projected as one of the most lucrative segments.

Segment Review

Depending on technology, the continuous flow segment dominated the market in 2020, and is expected to continue this trend throughout the forecast period This is attributed to the rise in lifestyle habits like smoking & consumption of alcohol and increase in the geriatric population are expected to boost the market growth. On the product, the fixed segment dominated the market in 2020, and is expected to continue this trend throughout the forecast period. This is attributed to the increasing instances of chronic diseases like cardiovascular diseases, respiratory diseases, and gastrointestinal disorders.

By End User

Hospital segment holds the dominant position in 2020 and would continue to maintain the lead over the forecast period.

North America was the largest shareholder in the global medical oxygen gas cylinders market in 2020, owing to rising prevalence of COVID-19 cases and surge in the geriatric population in this region followed by Europe. According to the U.S. Centers for Disease Control and Prevention, the U.S. has need of more than seven billion respirators in the long run to combat a worst-case spread of a severe respiratory outbreak such as COVID-19 which can be fulfilled by medical devices like oxygen cylinders, are the major factors driving the growth of the global medical oxygen gas cylinders market in North America. However, Asia-Pacific is anticipated to register the highest CAGR during the forecast period, due to rapidly increasing the prevalence of chronic diseases, infectious diseases and cardiovascular diseases as well as surge in need for oxygen cylinders in this region due higher population, development in health care infrastructure, and rise in the number of hospitals equipped with advanced medical facilities boost the medical oxygen gas cylinders market growth in this region.

By Region

Asia-Pacific region would exhibit the highest CAGR of 7.60% during 2021-2030

Some of the major companies that operate in the global medical oxygen gas cylinders market are Koninklijke Philips N.V., Invacare Corporation, Nidek Medical Products, Inc., Inogen, Inc., Messe Düsseldorf GmbH, ResMed, DeVilbiss Healthcare LLC, Airgas Inc, Messer Group GmbH, OrientMEd International.

Key Benefits For Stakeholders

- This report provides an extensive analysis of the current and emerging market trends and dynamics in the global medical oxygen gas cylinders market to identify the prevailing opportunities.

- This study presents the competitive landscape of the global medical oxygen gas cylinders market to predict the competitive environment across geographies.

- Comprehensive analysis of factors that drive and restrict the medical oxygen gas cylinders market growth is provided.

- Region- & country-wise analysis is provided to understand the medical oxygen gas cylinders market trends and dynamics

Key Market Segments

By Technology

- Pulse Flow

- Continuous Flow

By Product

- Portable

- Fixed

By End Users

- Hospital

- Home Healthcare

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Market Players

- Koninklijke Philips N.V.

- Invacare Corporation

- Nidek Medical Products, Inc.

- Inogen, Inc.

- Messe Düsseldorf GmbH

- ResMed

- DeVilbiss Healthcare LLC

- Airgas Inc

- Messer Group GmbH

- OrientMEd International.

Medical Oxygen Gas Cylinders Market Report Highlights

| Aspects | Details |

| By TECHNOLOGY |

|

| By PRODUCT |

|

| By END USER |

|

| By Region |

|

| Key Market Players | RESMED INC., NIDEK MEDICAL PRODUCTS, INC, INVACARE CORPORATION, MESSE DÜSSELDORF GMBH, .INOGEN, INC., AIRGAS, AN AIR LIQUIDE COMPANY, KONINKLIJKE PHILIPS N.V., MESSER GROUP GMBH, ORIENTMED INTERNATIONAL FZE, DEVILBISS HEALTHCARE |

Analyst Review

According to the perspective of CXOs of leading companies, the global medical oxygen gas cylinders market gained prominence in 2020, and is expected to witness a significant rise in the future. This is attributed to increase in prevalence of chronic diseases, increase in FDA approvals for medical gas equipment, rise in geriatric population, and increase in insistence for home healthcare setting. Furthermore, medical oxygen gas cylinders are often required by healthcare personnel for treatment and diagnostic purposes. These are the factors that reinforce growth of the market. However, high cost of medical oxygen gas cylinders is expected to hamper the market growth. Many significant key players across the globe are planning to expand their production capacities and delivery services to meet rising demand due to the pandemic, which is expected to offer high growth opportunities to key players. Another key factor expected to drive demand for these products is rise in prevalence of chronic diseases, infectious diseases, and cardiovascular diseases and rapid increase in aging population globally. In addition, improvement of healthcare infrastructure in emerging countries further supplement the market growth.

The total market value of medical oxygen gas cylinders marketis $2,971.40 million in 2020.

The forcast period for medical oxygen gas cylinders marketis 2021 to 2030

The market value of medical oxygen gas cylinders marketin 2030 is $5,337.50 million.

The base year is 2020 in mental health market

Top companies such as Airgas, Koninklijke Philips N.V., ResMed Inc., Messer Group GmbH, and Invacare Corporation held a high market position in 2020. These key players held a high market postion owing to the strong geographical foothold in different regions.

In technology segment continuous flow is the most influencing segment. This is attributed to rise in burden of COVID-19, increase in target population, and launch of cost-effective medical oxygen gas cylinders are the major growth factors that propel the market. Moreover, rise in number of chronic diseases is also anticipated to drive the medical oxygen gas cylinders market growth.

Daily exposure to environmental pollution, increase in population susceptible to indoor air pollutants, and increase in population of active smokers drive growth of the global medical oxygen gas cylinders market. However, stringent regulatory procedures and high cost are expected to hamper the market growth.

Asia-Pacific is anticipated to register highest CAGR during the forecast period, owing to rapidly increasing prevalence of chronic diseases, infectious diseases, and cardiovascular diseases as well as surge in need for oxygen cylinders in this region due to higher population, development in health care infrastructure, and rise in number of hospital equipped with advanced medical facilities.

Medical oxygen gas cylinders consist of high pressurized oxygen used for various medical purposes. In addition, to cater to the varying requirements of end users, medical oxygen gas cylinders are available in various formats and sizes

pulse flow and continuous flow

Loading Table Of Content...