Medical Professional Liability Insurance Market Research, 2031

The global medical professional liability insurance market was valued at $12.5 billion in 2021, and is projected to reach $33.7 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Medical professional liability insurance is a type of insurance designed to protect medical professionals' finances against legal fees and compensation claims made by patients in the event of a legal dispute. A particular contractual duty known as indemnity requires one party to make up the damage suffered by the party who was wronged. The purpose of medical liability insurance or malpractice insurance is to cover the extent of monetary loss brought on by unintended mistakes and omissions made by the physician, insured qualified and nonqualified workers, and staff. In addition, it pays for the costs associated with self-representation in court.

Surge in improving claim management services via advanced software allows insurance companies to efficiently speed up the customer’s payment lifecycle and reduce fraudulent claim settlement activities. In addition, increase in instances of accidents and surge in awareness of medical professional liability insurance are some of the factors propelling the medical professional liability insurance market growth. However, increase in insurance premium cost and lack of knowledge about coverages included in medical professional liability insurance policy are some of the major factors limiting the medical professional liability insurance market. On the contrary, the surge in reliance on medical equipment for patient’s diagnosis by doctors can risk the diagnosis owing to faulty equipment, which is expected to boost the demand for medical professional liability insurance. Furthermore, increasing cases of suing for wrong treatments is anticipated to drive the medical professional liability insurance market in upcoming years.

The report focuses on growth prospects, restraints, and trends of the medical professional liability insurance market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the medical professional liability insurance market outlook.

The medical professional liability insurance market is segmented into Type, Claim Type, Coverage, Application and Distribution Channel.

Segment Review

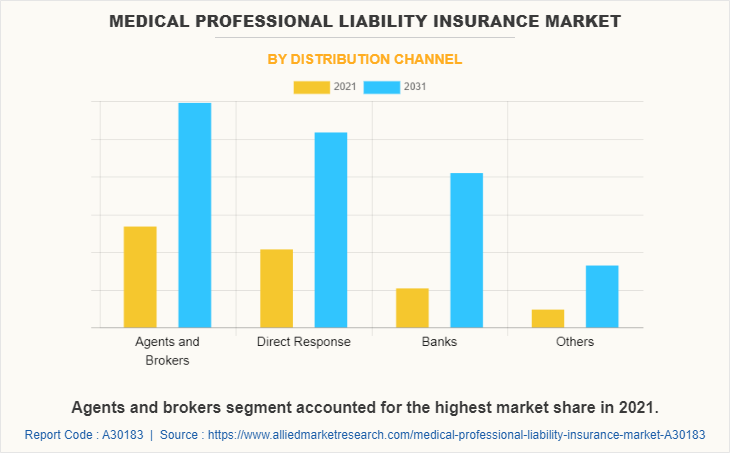

The medical professional liability insurance market analysis is segmented into type, claim type, coverage, application, distribution channel, and region. By type, the market is differentiated into occurrence-based policies and claims-based policies. The claim type is segmented into misdiagnosis or delayed diagnosis, childbirth injuries, medication errors, surgical errors and others. By coverage, the market is segmented into up to US$1 million, US$1 million to US$5 million, and US$5 million to US$20 million and above US$20 million. Depending on application, it is fragmented into individual and commercial. The commercial is further segmented into private hospital and public hospital. Private hospital is further segregated into large hospital and small and medium-sized hospital. The distribution channel segment is segregated into agents & brokers, direct response, banks and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By distribution channel, agents & brokers segment accounted for the highest share in medical professional liability insurance market size. This is attributed to the fact that physicians and hospitals prefer agents & brokers to acquire the insurance coverage as they have little understanding of medical professional liability insurance appropriate plans.

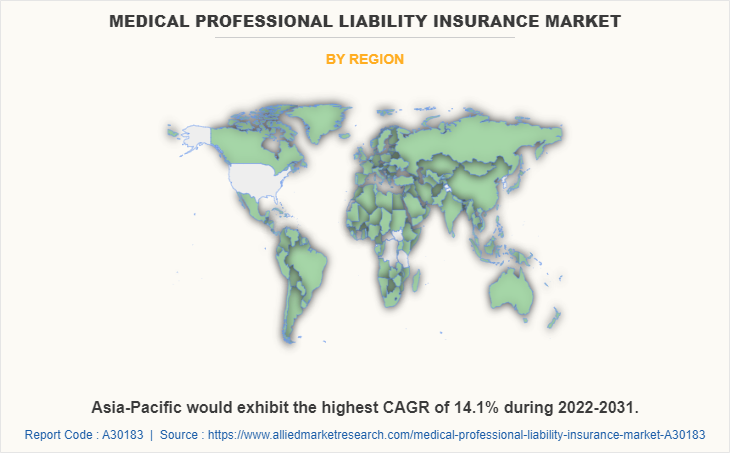

By region, Asia-Pacific is expected to grow at the highest CAGR during the forecast period in medical professional liability insurance market share. This is attributed to increase in number of medical mistakes during operation & surgeries across the Asian countries owing to factors like incorrect time, omission error, staff shortages and incorrect doses.

Key players operating in the global medical professional liability insurance market include Allianz, Aviva, AXA, Berkshire Hathaway Specialty Insurance, Chubb, Cigna, CoverWallet, Coverys, Liberty Mutual Group, MagMutual LLC, MCIC Vermont, ProAssurance Corporation, The Doctors Company, The Hartford, Zurich, The Travelers Indemnity Company, and CNA. These players have adopted various strategies to increase their market penetration and strengthen their position in the medical professional liability insurance industry.

Top Impacting Factors

Medical professional liability insurance avoids extra costs for doctors

Medical professional liability insurance ensures that the doctors/physicians does not have to incur any cost for the damages caused by them out of their own pocket. For instance, if an uninsured doctor/physician causes any mistake during an operation, the damages caused to the other person has to be paid for all the damage caused, medical bills, and any other cost. However, medical professional liability insurance saves the out-of-pocket cost for the insured and pays for all the damages caused to the other person, without causing any financial risk to the insured. Thus, medical professional liability insurance saves the insured from incurring any additional cost and provides financial stability. Therefore, this factor is fueling the growth of the market.

Increasing demand for medical professional liability insurance

Medical professional liability insurance providers have immense potential to expand products and services in the market. Companies include third-party medical professional liability coverage, comprehensive coverage, bodily & property damage, and medical coverage in order to provide better services to the doctors and medical practitioners. Thus, insurers are expected to have lucrative opportunities to innovate and expand their offerings by including specific coverage. Furthermore, this coverage is provided in a combination or bundled offerings, thus making it convenient for consumers to choose specific requirements from the plans. In addition, the doctors are increasingly adopting the medical professional liability insurance plan to protect themselves from malpractice claims. Moreover, the increasing awareness among people about laws and legal frameworks against crimes by doctors is urging doctors to adopt the coverage. Thus, increasing demand for medical professional liability insurance is fueling the growth of the market.

Medical professional liability decreases risks for doctors

Medical professional liability insurance provides ample amount of advantages for doctors, which help to stay protected from various types of risks. It protects the insured’s business if injuries are caused to the other person due to their mistakes or fatalities in operation. In addition, it safeguards the insured for an offense like wrongful entry, false arrest, and slander. Further, it covers their legal liability for various offenses, which can arise if the insured company’s marketing division violates someone’s copyright rules. Moreover, if damages are filed against the insured, or if they are sued by any third party, the medical professional liability insurance policy covers the investigation and attorney expenses, medical expenses in case of injury. Furthermore, the policy not only protects them against unexpected losses but also ensures a safe future for their business. Therefore, this factor drives the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical professional liability insurance market forecast from 2022 to 2031 to identify prevailing medical professional liability insurance market opportunity.

- In addition to the market research, important drivers, restraints, and opportunities are covered as well.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical professional liability insurance market segmentation assists in determining the prevailing market opportunities.

- According to their contribution to global market revenue, the major countries in each region are mapped.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical professional liability insurance market trends, key players, market segments, application areas, and market growth strategies.

Medical Professional Liability Insurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Claim Type |

|

| By Coverage |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | CoverWallet, Zurich, MCIC Vermont, Berkshire Hathaway Specialty Insurance, ProAssurance Corporation, Liberty Mutual Group, MagMutual LLC, Chubb, Coverys, The Doctors Company, AXA, Allianz, Aviva, Cigna, The Travelers Indemnity Company, The Hartford, CNA |

Analyst Review

Medical professional liability insurance significantly protects doctors and physicians from unexpected accidents and false claims. In addition, it reduces out of pocket costs for the insured. Without coverage, the insured have to pay out of pocket to cover claims, which can put their business at financial risk. Furthermore, rise in cases of medical equipment related accidents is expected to provide major lucrative opportunities for the growth of the liability insurance market

During the pandemic, adoption of digitalized solutions for medical professional liability insurance policies has benefited the demand for the insurance, considering the accessibility and convenience for customers. Moreover, technological advancements such as automated claim underwriting and claims processing in the field of insurance are anticipated to boost the adoption of medical professional liability insurance among doctors.

The medical professional liability insurance market is segmented with the presence of regional vendors such as Allianz, Aviva, AXA, Berkshire Hathaway Specialty Insurance, Chubb, Cigna, CoverWallet, Coverys, Liberty Mutual Group, MagMutual LLC, MCIC Vermont, ProAssurance Corporation, The Doctors Company, The Hartford, Zurich, The Travelers Indemnity Company, and CNA. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnerships to reduce supply and demand gaps. With increase in awareness & demand for medical professional liability insurance across the globe, major players have collaborated on their product portfolio to provide differentiated and innovative products.

The medical professional liability insurance market is estimated to grow at a CAGR of 10.8% from 2022 to 2031.

The medical professional liability insurance market is projected to reach $33.70 billion by 2031.

Avoiding of extra costs for doctors, increased demand for medical professional liability insurance and the fact that medical professional liability decreases risk for doctors majorly contribute toward the growth of the market.

The key players profiled in the report include Allianz, Aviva, AXA, Berkshire Hathaway Specialty Insurance, Chubb, Cigna, CoverWallet, Coverys, Liberty Mutual Group, MagMutual LLC, MCIC Vermont, ProAssurance Corporation, The Doctors Company, The Hartford, Zurich, The Travelers Indemnity Company, and CNA

The key growth strategies of medical professional liability insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...