MENA Small Cell 5G Network Market Insights:

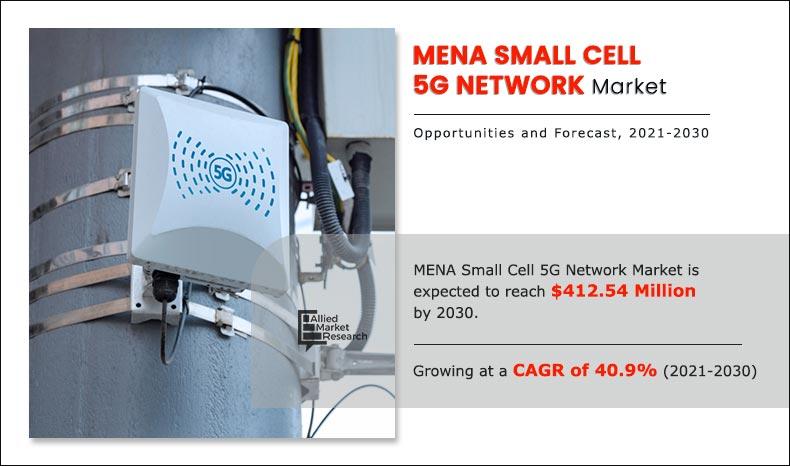

The MENA small cell 5G network market was valued at USD 13.42 million in 2020 and is projected to reach USD 412.54 million by 2030, registering a CAGR of 40.9%. Saudi Arabia was the highest revenue contributor with $3.37 million in 2020, and is estimated to reach $73.31 million by 2030, registering a CAGR of 36.0%.

Surge in investment in 5G infrastructure coupled with increase in funding for high-speed networks among numerous countries across the globe is expected to drive the MENA small cell 5G network market growth. The emergence of Citizens Broadband Radio Service (CBRS) band & Internet of Things (IoT) and rise in preference for ultra-reliable, low-latency communications significantly contribute toward the growth of the global market. However, concerns regarding small cell backhaul and small cell deployment challenges is expected to hamper the market growth.

In 2020, the solutions segment dominated the MENA small cell 5G network market. Small cell 5G solutions are widely used to integrate various technological aspects of a network device. Thus, increase has been witnessed in the demand for small cell 5G solution, owing to its ability to converge various hyperdense network architectures into advance scalable architectures. This, in turn, is expected to drive the adoption of small cell solutions.

However, the services segment is expected to witness highest growth rate during the forecast period. Most of the industry verticals opt for all-in-one package solutions for any need in the transformations of services. Hence, rise in digital transformation has proliferated the adoption of small cell 5G network across diverse industry verticals, owing to its ability to increase capacity in operator networks across an array of locations and addresses. This is a major factor supporting the segment growth at a significant rate.

Saudi Arabia dominated the overall MENA small cell 5G network market in 2020. Rising trend of 5G network expansion in the Saudi Arabia fuels growth of the market. For instance, in July 2020, Saudi Arabian carrier Zain KSA announced the expansion of its 5G network to cover all the Kingdom’s regions. Zain launched commercial 5G operations in Saudi Arabia in October 2019. In the initial deployment phase, the company deployed 2,000 towers that covered an area of more than 20 cities across Saudi Arabia.

By Country

Saudi Arabia is projected as one of the most significant country

The report focuses on the growth prospects, restraints, and MENA small cell 5G network market analysis. The study provides Porter’s five forces analysis of the MENA small cell 5G network industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the MENA small cell 5G network market trends.

Segment Review:

The MENA small cell 5G network market is segmented into component, radio technology, frequency band, cell type, application, end user, and region. On the basis of component, the market is bifurcated into solution and services. Depending on radio technology, it is categorized into standalone and non-standalone. By frequency band, it is classified into low band, mid band, and millimeter wave. As per cell type, it is segregated into femtocells, picocells, and microcells. The applications covered in the study include indoor application and outdoor application. According to end user, the market is differentiated into residential, commercial, industrial, smart city, transportation & logistics, government & defense, and others. Country wise, it is analyzed across UAE, Saudi Arabia, Kuwait, Qatar, Turkey, Oman, Jordan, Morocco, Egypt, and Rest of MENA.

By Component

Services segment is projected as one of the most lucrative segments.

Top Impacting Factors:

Upsurge in inclination toward remote working culture and online education adoption across the globe due to the outbreak of the COVID-19 pandemic, increase in network densification, rise in mobile data traffic, emergence of Citizens Broadband Radio Service (CBRS) band, surge in investment in 5G infrastructure by numerous countries, emergence of Internet of Things (IoT), and rise in preference for ultra-reliable, low-latency communications significantly impact the growth of the market.

The factors that further affected the market include concerns regarding small cell backhaul and small cell deployment challenges are expected to hamper the market growth during the forecast period. However, each of these factors is anticipated to have a definite impact on the growth of the MENA small cell 5G network industry.

By Radio Technology

Standalone segment is projected as one of the most lucrative segments.

Increase in investment in 5G infrastructure by numerous countries

5G deployment is more advanced in countries such as the UAE, Saudi Arabia, Kuwait, and Qatar, which is driving the growth of the market. Ongoing trend among the telecom operators in these countries enhanced its infrastructure and customer experiences. This fuels the growth of the 5G small cell network market. For instance, in May 2021, STC Kuwait, the Kuwait telecommunications company announced the commercial launch of its 5G Stand Alone (5G SA) services. In addition, telecom operator claimed the widest scale 5G deployment coverage on sub-3GHz and 2.1GHz bands among the mobile service providers in the MENA region. Moreover, the operator has strengthened its infrastructure with the deployment of a Business Support System.

Rise in mobile data traffic

Mobile data traffic is internet content transferred to various mobile consumer electronics such as smartphones and tablets. Continuous increase in mobile data traffic across the world is driving the growth of the market. Global mobile traffic is expected to increase with a factor of 5, accounting 136EB per month by 2024. In addition, by 2024, 5G networks are expected to carry nearly one-third of the mobile data traffic, globally. Thus, owing to notable rise in mobile data traffic, the demand for technically advanced telecommunication network is likely to increase considerably.

Key Benefits for Stakeholders:

- This study includes the MENA small cell 5G network market share analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and MENA small cell 5G network market opportunity.

- The MENA small cell 5G network market size is quantitatively analyzed from 2020 to 2030 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in MENA small cell 5G network market forecast.

MENA Small Cell 5G Network Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Radio Technology |

|

| By Frequency Band |

|

| By Cell Type |

|

| By Applications |

|

| By End User |

|

| By Country |

|

| Key Market Players | Cisco Systems Inc., Casa Systems, AT&T Inc., Nokia, COMBA Telecom Systems Holdings Ltd, ZTE Corporation, Corning Incorporated, Huawei Technologies Co Ltd, NEC Corporation |

Analyst Review

Top level executives are inclining toward wireless infrastructure, which is positively impacting the market growth. Mobile network operators are including small cells as a key component of their strategy for 5G network rollouts, as they are important for delivering reliable and consistent experiences for their subscribers. This is primarily due to better spectral efficiency, more reliable coverage, and improved overall network performance & capacity provided by 5G small cell, creating an opportunity to lower cost-per-bit. The adoption of small cells in this pre-5G/LTE-Advanced Pro (LTE-A Pro) transition is increasing, as it provides increased data capacity and helps service providers to eliminate expensive rooftop systems and installation or rental costs, which reduce the overall cost. In addition, it helps improve the performance of mobile handsets. For instance, if the phone is closer to a small cell base station, it transmits at lower power levels, which effectively consumes less battery power of the cell phone and substantially increases its battery life.

The MENA small cell 5G network market is moderately concentrated, and companies are focusing on leveraging new technologies for offering advanced small cell 5G network solutions to cater to the evolving end-user requirements. Key players have adopted various growth strategies to enhance and develop their product portfolio, garner maximum market share, and increase their market penetration. Furthermore, constant need has been witnessed for technological advancements in communication networks to adjust with the increasing mobile data traffic management demand due to which the adoption of small cell 5G network is expected to increase in the upcoming years.

In the current business scenario, substantial rise has been experienced in the usage of small cell 5G network solutions across Middle East. This is attributed to the fact that large population in this region has created an extensive pool of mobile subscribers for telecom companies. Moreover, the region is one of the prominent contributors to the total number of mobile subscribers across the globe, and is expected to add more subscribers to its network in the upcoming years.

Moreover, ongoing transition to the fifth generation wireless networks or 5G in the UAE primarily drives the growth of the market. For instance. Etisalat, the UAE’s leading telecom operator is actively upgrading its infrastructure and network to be ready to provide the service as soon as the 5G mobile handsets are available in UAE. Along with the faster data upload and download speeds, 5G will be essential to facilitate the ‘Internet of Things’. However, the key enabler to 5G technology is the rising usage of low-power antennas known as ‘small cells’ and distributed antenna systems (DAS). Hence, this factor boosts growth of the 5G small cell market in the country.

Furthermore, continuously increase in mobile data traffic is positively impacting the small cell 5G network market growth. According to the Cisco Visual Networking Index (VNI) Global Mobile Data Traffic Forecast, Mobile data traffic is expected to grow at a CAGR of 46% from 2018 to 2022, reaching 77.5 Exabyte’s per month by 2022. In addition, the study states that by 2022, a 5G connection will generate 2.6 times more traffic than the average 4G connection.

Loading Table Of Content...