Merchant Banking Services Market Research, 2032

The global merchant banking services market was valued at $42.1 billion in 2022, and is projected to reach $232.2 billion by 2032, growing at a CAGR of 18.9% from 2023 to 2032.

Merchant banking services aid in maintaining communication with the bank or financial institution regarding the application process and tracking. They also help their clients fill out their paperwork and aid them in obtaining the most money from banks. They also observe all legal requirements set forth by banks or other lending organizations. Services for merchant banking have become more necessary over time. Therefore, in addition to the usual services, merchant banks have begun to offer specialized services like corporate counseling on mergers, employing staff, audits, and tax concerns.

A high rate of adoption by merchant banking services among HNIs and an increase in demand for foreign investments are boosting the growth of the global merchant banking services market. In addition, the increase in the use of digital transformation technology is positively impacting the growth of the merchant banking services market. However, the high cost of merchant banking services and increasing security concerns are hampering the merchant banking services market growth. On the contrary, rising Innovations in the Fintech Industry is expected to offer remunerative opportunities for the expansion of the merchant banking services market during the forecast period.

The merchant banking services market is segmented into End User, Type and Provider.

Segment Review

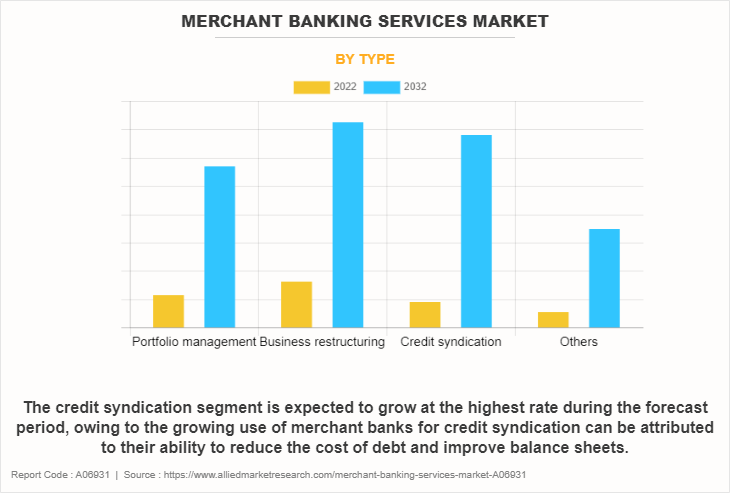

The merchant banking services market is segmented on the basis of type, provider, end user, and region. On the basis of type, the market is categorized into portfolio management, business restructuring, credit syndication and others. On the basis of providers, the market is fragmented into banks, and non-banking institutions. On the basis of the end user, the market is classified into businesses, and individuals. By region, the merchant banking services market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of type, the business restructuring segment holds the highest merchant banking services market size, owing to rising need for business restructuring to improve their operations, reduce costs, and increase efficiency, making them more competitive in the market. However, the credit syndication segment is expected to grow at the highest rate during the forecast period, owing to the growing use of merchant banks for credit syndication can be attributed to their ability to reduce the cost of debt and improve balance sheets.

Region-wise, the merchant banking services market share was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the presence of prominent merchant banking service providers such as the U.S. Capital Advisors LLC; Bank of America Corporation; and JPMorgan Chase & Co across the region is anticipated to fuel the market’s growth. However, Asia-Pacific is expected to witness significant growth during the forecast period. The growth can be attributed to favourable demographics, rising income levels, and growing regional businesses.

The key players that operate in the merchant banking services industry are U.S. Capital advisors LLC, JPMORGAN CHASE & CO., Bank of America Corporation, DBS Bank Ltd., NIBL Ace Capital Limited, MORGAN STANLEY HSBC Bank USA, Citigroup Inc., The Goldman Sachs Group, Inc., and Wells Fargo & Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities

The growing technological advancements across various industries, including the banking and finance industries, are anticipated to drive the merchant banking services market growth over the forecast period. Leveraging technologies such as digital platforms to promote and provide merchant banking services enables market players to reach a broader range of clients and provide them with real-time information and analytics. Furthermore, increasing launches of merchant banking services over digital platforms are also expected to drive the market’s growth. For instance, in April 2023, Greengage, a UK-based digital merchant banking company, announced the launch of e-money accounts services. The company also facilitated GBP and EUR payments and cards targeting SMEs, digital assets firms, and HNWs. Merchant banks assist companies in being listed on stock exchanges, also known as Initial Public Offering (IPO). IPO management responsibilities include conducting due diligence, appointing intermediaries, filing requisite documents, advertising, calculating issue size, and redressal of investor grievances. The recent surge in IPO participation is a direct factor contributing to the growth of merchant banking services. For instance, in August 2021, OYO Hotels and Homes, a SoftBank-backed hospitality company, announced that the company had hired a minimum of 3 merchant banks, including JPMorgan Chase & Co., Kotak Mahindra Capital Company, and Citigroup Inc, to raise USD 1.2 billion by launching its initial public offering (IPO).

Top Impacting Factors

Increase in Demand for Foreign Investments

Foreign investments are an ever-evolving industry, and opportunities emerge regularly. The industry is expected to see new opportunities for international investment as well as new types of alternatives to invest in. In addition, in recent years, it has branched out into an international market, creating new opportunities to use strategies that have already run their course in the U.S. For instance, according to the Investment Trends Monitor report that was published by the United Nations Conference on Trade and Development (UNCTAD) in January 2022, global foreign direct investment (FDI) volumes displayed a strong rebound in 2021. The values climbed to 77% to a predicted $1.65 trillion than $929 billion in 2020 and exceeding their level prior to COVID-19. The increase in investment flows to developing nations is positive. By far, the largest increase was seen in developed nations, with FDI reaching a projected $777 billion in 2021 - three times the abnormally low amount in 2020. Therefore, the growing flow of FDI is beneficial for the growth of the merchant banking services market.

High Rate of Adoption by Merchant Banking Services Among HNIs

The number of High-Net-Worth Individuals (HNWIs) are increasing across the globe owing to better financial management and correct investments. Moreover, given their substantial assets, high-net-worth households require additional services from merchant banking services. Merchant banking services for HNWIs include investment management and tax advice as well as help with trusts and estates and access to hedge funds and private equity firms. Furthermore, around 13% of financial advisor clients fall under the umbrella of high net worth. In addition, HNWIs are in high demand for financial consulting software as more money, more work is required to maintain and preserve those assets. These individuals generally demand personalized services in investment management, estate planning, tax planning, and so on. Such demands are driving the growth of the merchant banking services market.

Restraint

High Cost of Merchant Banking Services

The high expenses connected with merchant banking services make them expensive compared to traditional banking services. Utilizing merchant banks carries several hazards, chief among them the possibility of conflicts of interest, the expense of doing so, and the complexity of such services. Merchant banks typically require significant capital to execute their activities. They may need to deploy substantial funds for underwriting commitments, investments, and financing arrangements. Capital-intensive operations entail costs associated with capital maintenance, liquidity management, and risk management, contributing to the overall cost structure. Hence, the high cost of these services is the primary factor hampering the merchant banking services market growth.

Opportunity

Rising Innovations in the Fintech Industry

BFSI companies are increasing investment in machine learning and AI solutions to transform financial institute’s management for providing enhanced services to the end users and to automate the necessary solutions. In addition, with rising complexity and competition in the BFSI market, the demand for industry-specific solutions increased to meet the goals of the companies and AI-based financial solutions are helping Fintech and other industries to enhance their security and upsurge their revenue opportunity, which is driving the growth of the merchant banking services market. Furthermore, AI and machine learning can assist financial institutes at various stages of risk management process ranging from identifying risk exposure, measuring, and estimating, to assessing its effects.

Moreover, increasing investments in AI and machine learning offer the potential to transform the area of automation for time-consuming, mundane processes, and offering a far more streamlined and personalized customer experience, which is enhancing the growth of the merchant banking services market. In addition, companies operating in merchant banking services are adopting AI driven technologies to sustain their position in the market. For instance, in December 2021, Wells Fargo launched Vantage system, a new digital banking platform for Commercial Banking and Corporate & Investment Banking clients. This feature provides enhanced features to drive a more personalized experience through artificial intelligence (AI) and machine learning (ML) that meet the financial needs of businesses in any stage of growth, which in turn is expected to provide lucrative opportunity for the growth of the merchant banking services market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the merchant banking services market analysis from 2023 to 2032 to identify the prevailing merchant banking services market outlook.

- Merchant banking services market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the merchant banking services market segmentation assists to determine the prevailing merchant banking services market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global merchant banking services market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global merchant banking services market trends, key players, market segments, application areas, and merchant banking services market growth strategies.

Merchant Banking Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 232.2 billion |

| Growth Rate | CAGR of 18.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By End User |

|

| By Type |

|

| By Provider |

|

| By Region |

|

| Key Market Players | The Goldman Sachs Group, Inc., JPMORGAN CHASE & CO., Wells Fargo & Company, U.S. Capital Advisors LLC, MORGAN STANLEY, Citigroup Inc., HSBC Bank USA, NIBL Ace Capital Limited, BANK OF AMERICA CORPORATION, DBS Bank Ltd. |

Analyst Review

Merchant banking is a financial service provider that offers a wide range of services such as underwriting, issuing of securities, asset management, portfolio management, and advisory services. Merchant banks provide specialized services to large corporations, high net worth individuals, and institutional investors. The areas covered under merchant bank services include equity underwriting, portfolio management, and credit application processing received from financial institutions. The increasing demand for personal & business banking services, such as portfolio management and payment processing services, is anticipated to fuel the market’s growth over the forecast period.

The global merchant banking services market is expected to register high growth. The growth can be attributed to a specialized delegated workforce covering diverse parts of capital markets. Moreover, investment firms deal with high-value transactions and have economies of scale since they manage large sums of money. Thus, the increase in adoption of merchant banking services, owing to their high reliability and low latency networks is one of the most significant factors driving the growth of the market. With surge in demand for mobile money, various companies have established alliances to increase their capabilities. For instance, in December 2022, HSBC partnered with Extend, a virtual card and spend management platform. With this partnership, HSBC would provide Extend solutions to its commercial card customer across the U.S. to help companies control expenses with the management of virtual cards.

In addition, with further growth in investment across the world and the rise in demand for merchant banking services, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in April 2023, DBS Bank India announced the launch of ’digiPortfolio’, on its digibank platform. The platform utilizes both technology and human involvement to build a group of investment options organized by Morningstar that identify the risk preferences of various investors. The digiPortfolio is a simple, one-stop solution for customers to invest money with ready-made baskets of mutual funds. DBS Bank aims to rectify the customer experience and make it more smooth by utilizing AI, data, and innovative technologies.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, March 2023, HSBC UK Bank plc, a UK ring-fenced subsidiary of HSBC Holdings plc acquired Silicon Valley Bank UK Limited, a subsidiary of Silicon Valley Bank. The acquisition creates sense for its business across the UK. The company solidifies its commercial banking franchise and improves its capacity to serve advanced and emerging firms, consisting of technology and life-science areas across the UK and the world

The Merchant banking services market is estimated to grow at a CAGR of 18.9% from 2023 to 2032.

The Merchant banking services market is projected to reach $ 232,190.96 million by 2032.

Asia-Pacific is the largest regional market for Merchant Banking Services during the forecast period.

The estimated industry size of Merchant Banking Services is $ 232,190.96 million by 2032.

U.S. Capital advisors LLC, JPMORGAN CHASE & CO., Bank of America Corporation, DBS Bank Ltd., NIBL Ace Capital Limited, MORGAN STANLEY, HSBC Bank USA, Citigroup Inc., The Goldman Sachs Group, Inc., and Wells Fargo & Company

Loading Table Of Content...

Loading Research Methodology...