Merchant Cash Advance Market Research, 2032

The global merchant cash advance market was valued at $17.9 billion in 2023, and is projected to reach $32.7 billion by 2032, growing at a CAGR of 7.2% from 2024 to 2032.

A merchant cash advance (MCA) offers an advance against future sales, based on past debit and credit card sales. The funding provider gets paid back by automatically taking a portion of future credit card sales, usually each business day. Qualified business owners can usually get approved in a day or two, with very less paperwork.

Merchant cash advances provide small businesses with an alternative to other types of small business loans that may be harder to get, such as business lines of credit or traditional bank loans. Business owners receive funds as a lump sum upfront from a merchant cash advance provider and repay the advance from future sales. An MCA can be a funding option for businesses that have high credit card sales volume, need funding quickly, and may not qualify for other small business loans.

Key Takeaways of Merchant Cash Advance Market Report

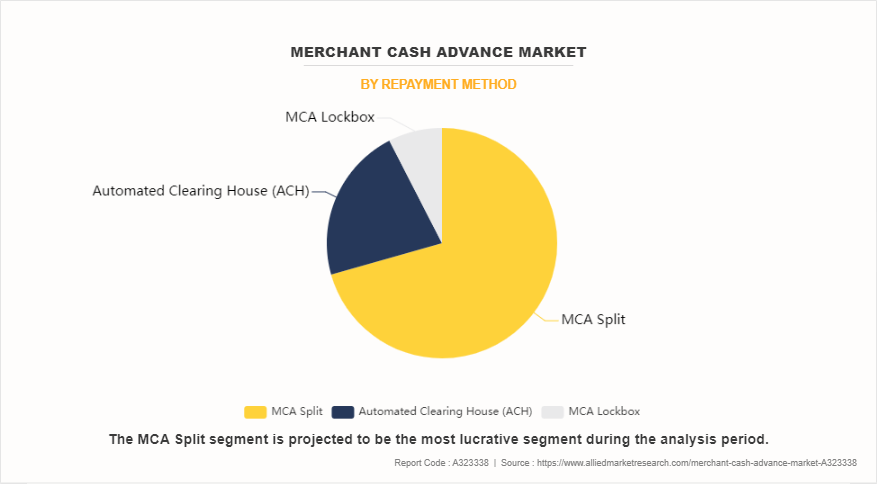

- On the basis of repayment method, the MCA split segment dominated the merchant cash advance market size in terms of revenue in 2023.

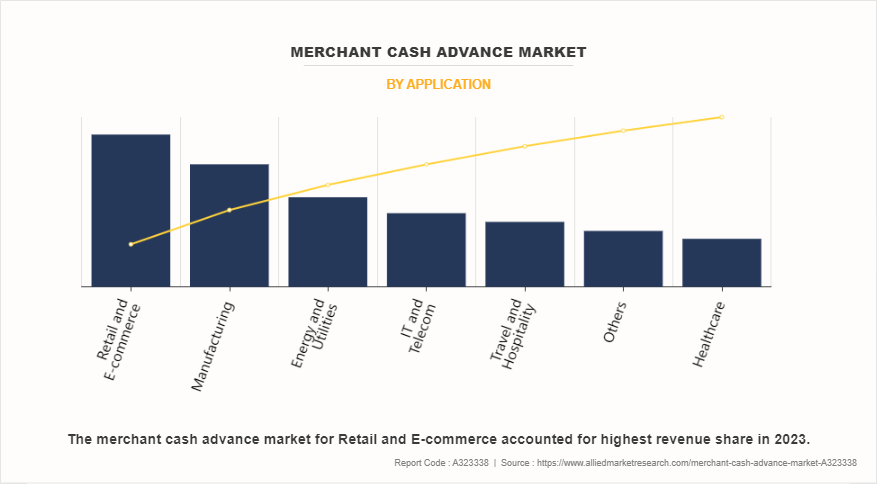

- On the basis of application, the retail and e-commerce segment dominated the market in terms of revenue in 2023.

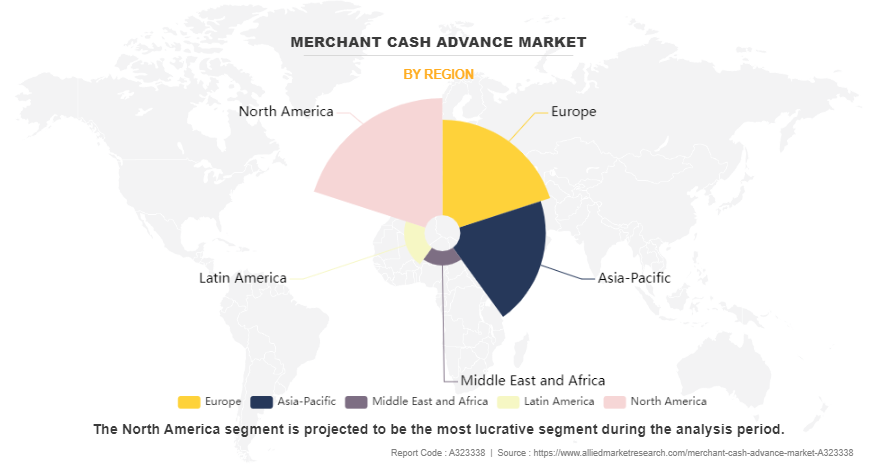

- Region wise, North America region dominated the merchant cash advance market in terms of revenue in 2023. However, the market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The growth of the merchant cash advance industry is influenced by the growing demand for alternative financing. Small businesses often face challenges in securing traditional financing, leading to a high demand for alternative financing options, such as merchant cash advances. Moreover, the growing adoption of digital payments, including credit and debit cards, has led to an increase in the volume of credit card transactions, making merchant cash advances a more viable option for businesses. For instance, in April 2024, Yabx, a leading player in the sustainable financial inclusion space partnered with PayCliq to introduce a revolutionary merchant cash advance service in Nigeria. With approximately 100 million MSMEs in Africa and 42 million in Nigeria alone, consumer payments on the continent are projected to exceed $2.1 trillion by 2025. PayCliq, a business tool specifically designed for businesses across Africa, is set to facilitate seamless payments for merchants, promoting financial inclusion and supporting Nigeria's cashless policy and business accountability.

However, merchant cash advances often come with high costs, including factor rates and fees, which can make them a less attractive option for businesses with tight budgets. Furthermore, many businesses are unaware of merchant cash advances and their benefits, leading to a lack of adoption. These factors hinder the widespread adoption of merchant cash advance services and influence decision-making processes within the market. On the contrary, the increasing use of technology in the financial services industry, such as the use of artificial intelligence and machine learning for underwriting and risk assessment, presents an opportunity for growth in the merchant cash advance market. In addition, the growing demand for short-term financing options, especially among seasonal businesses, presents growth for the merchant cash advance market opportunity.

Market Dynamics

Increasing demand for alternative financing options

The increasing demand for alternative financing options is driving the growth of the merchant cash advance market by catering to small and medium-sized enterprises (SMEs) that struggle to secure traditional bank loans. Merchant cash advances provide these businesses with access to capital that may not be available through conventional lenders, enabling them to manage their cash flow effectively and invest in their growth and expansion plans. This demand for alternative financing options, particularly in the SME sector, is propelling the merchant cash advance market forward, offering businesses a flexible and accessible way to obtain the funds they need to support their operations and development.

High interest rates and fees

The high-interest rates and fees associated with merchant cash advances can limit the merchant cash advance market growth. The implied interest rate for merchant cash advances can be high, with some examples showing implied interest rates of 55% and 50% for a $20,000 advance and a $42,000 advance, respectively. This can make merchant cash advances a more expensive financing option compared to traditional bank loans. In addition, the lack of regulation in the merchant cash advance market can potentially expose businesses to high retrieval rates and unfavorable terms.

Increasing demand for secure and convenient payment methods

The integration of merchant cash advances with digital payment platforms offers lucrative growth opportunities for the merchant cash advance market. The digital payment platforms can provide real-time data on sales and revenue, enabling merchant cash advance providers to offer more tailored and flexible repayment options to businesses. By integrating with digital payment platforms, merchant cash advance providers can also streamline the application and approval process for businesses, making it faster and more convenient to access capital. This can help drive business growth by providing businesses with the funds they need to invest in their operations, expand their product or service offerings, and take advantage of new market opportunities.

Segment Review

The merchant cash advance market is segmented into repayment method, application, and region. On the basis of repayment method, the market is categorized into MCA split, automated clearing house (ACH), and MCA lockbox. As per application, the market is differentiated into IT and telecom, healthcare, manufacturing, retail and e-commerce, travel and hospitality, energy and utilities, and others. Region wise, it is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By repayment method, the MCA split segment acquired a major merchant cash advance market share in 2023. This is attributed to the fact that this method of repayment where a fixed percentage of daily credit card sales is automatically remitted to the lender, makes it a convenient and flexible option for businesses with fluctuating sales. Furthermore, the growing demand for alternative financing options among small and medium-sized enterprises (SMEs) is driving the growth of the MCA split segment. SMEs often face challenges in securing traditional bank loans, making merchant cash advances an attractive alternative. However, the automated clearing house (ACH) segment is expected to be the fastest-growing segment in the merchant cash advance market forecast period. This method involves the automatic withdrawal of funds from a borrower's bank account to fulfill the repayment obligation. It offers convenience and reliability for lenders by ensuring timely repayments without relying on the borrower's manual initiation of payments. Moreover, it provides a structured and automated repayment process, reducing the risk of missed or delayed payments. This method is often favored by MCA providers as it offers a predictable and consistent collection of repayments, enhancing cash flow predictability and reducing administrative burdens associated with manual payment collections.

By application, the retail and e-commerce segment acquired a major share in merchant cash advance market in 2023. Retail and e-commerce businesses often turn to MCAs to navigate fluctuations in cash flow, capitalize on inventory procurement opportunities, or invest in marketing campaigns to bolster sales. The ability to obtain funding swiftly, often without the stringent requirements of traditional loans, makes MCAs an attractive choice for businesses in this sector, allowing them to adapt rapidly to market changes and seize growth opportunities. However, the IT and telecom segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the increasing demand for alternative financing options, the growth of small and medium-sized enterprises (SMEs), and the increasing use of technology in the financial services industry. The merchant cash advance market provides a flexible financing option for SMEs in the IT and telecom sector, which often face challenges in securing traditional financing options.

Region-wise, North America dominated the merchant cash advance market in 2023. This is attributed to the increasing number of retailers seeking out short-term credit facilities to help cover short-term credit needs, as well as the capital markets tightening and banks becoming increasingly interested in alternative sources of income. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the growing demand for alternative financing options and the growth of small and medium-sized enterprises (SMEs), as well as the increasing use of technology in the financial services industry.

Competition Analysis

Competitive analysis and profiles of the major players in the merchant cash advance market include CAN Capital, Inc., Fundbox, Kalamata Capital Group, Lendio, Libertas Funding, LLC, National Business Capital, OnDeck, Perfect Alliance Capital, Rapid Finance, and Reliant Funding. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Recent Developments in the Merchant Cash Advance Industry

- In April 2024, Yabx, a leading player in the sustainable financial inclusion space, partnered with PayCliq to introduce a revolutionary merchant cash advance market service in Nigeria. With approximately 100 million MSMEs in Africa and 42 million in Nigeria alone, consumer payments on the continent are projected to exceed $2.1 trillion by 2025. PayCliq, a business tool specifically designed for businesses across Africa, is set to facilitate seamless payments for merchants, promoting financial inclusion and supporting Nigeria's cashless policy and business accountability.

- In August 2023, Global fintech SumUp made a push into merchant financing with the launch of SumUp Cash Advance, and it raised a US$100m credit facility to help support the rollout. The cash advances are based on merchants’ payment history and are repaid via payment acceptance through SumUp’s card readers.

- In July 2023, YouLend partnered with Paysafe, a leading payments platform, to launch a market-leading financing solution to a targeted segment of their U.S. customers and enhance their relationship with their merchants. Although Paysafe was already providing its customers with a comprehensive payment solution on a global scale, the company sought to address additional issues for its merchant base.

- In December 2021, Fintech firm iwoca, which claims to be one of Europe’s largest small business lenders, announced the expansion of its merchant cash advance market product to all small businesses “accepting card payments in the UK”.

- In September 2021, iwoca, one of Europe’s largest small business lenders, launched its industry-first cash advance product on Funding Xchange for small business online sellers. Iwoca became the first lender in the UK using open banking to offer fully automated revenue-based repayments to e-commerce businesses with a business bank account on the marketplace.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the merchant cash advance market analysis from 2024 to 2032 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the merchant cash advance market outlook.

- In-depth analysis of the merchant cash advance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as merchant cash advance market trends, key players, market segments, application areas, and market growth strategies.

Merchant Cash Advance Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2032 |

| Report Pages | 265 |

| By Repayment Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | CAN Capital, Inc., National Business Capital, Lendio, Kalamata Capital Group, Rapid Finance, OnDeck, Perfect Alliance Capital, Libertas Funding, LLC, Fundbox, Reliant Funding |

Analyst Review

Technology is playing a critical role in transforming merchant cash advance (MCA) offerings. Advanced analytics and artificial intelligence (AI) are being used to better personalize financial solutions per business demands. Furthermore, the need for transparency and accountability is becoming the new norm. Future MCA agreements are expected to be even simpler, with no hidden costs and clear repayment terms. This will allow one to make more informed decisions, ensuring that the financing option they select is precisely aligned with their business goals and cash flow requirements.

Key players in the merchant cash advance market adopt partnership, acquisition, and product launch as their key development strategies to sustain their growth in the market. For instance, in November 2021, Amazon launched a new financing solution, a merchant cash advance, provided by Parafin, a U.S.-based provider of growth capital for sellers. This secure financing option ties payment on the cash advance to a portion of sellers’ future sales for a fixed capital fee and provides eligible Amazon sellers with easy and quick access to capital when they need it, paired with flexible payment plans. With this program, sellers can access capital in a matter of days with transparent and capped rates, no fixed term, no personal guarantee, no credit checks or excessive paperwork, and no late fees. Therefore, such strategies adopted by key players propel the growth of the merchant cash advance market.

The key players in the merchant cash advance market include CAN Capital, Inc., Fundbox, Kalamata Capital Group, Lendio, Libertas Funding, LLC, National Business Capital, OnDeck, Perfect Alliance Capital, Rapid Finance, and Reliant Funding. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the merchant cash advance market.

The size of the global merchant cash advance market was valued at $17,886.16 million in 2023 and is projected to reach $32,658.23 million by 2032.

The key players operating in the global merchant cash advance market include CAN Capital, Inc., Fundbox, Kalamata Capital Group, Lendio, Libertas Funding, LLC, National Business Capital, OnDeck, Perfect Alliance Capital, Rapid Finance, and Reliant Funding.

North America is the largest regional market for Merchant Cash Advance.

Partnership and product launch are the key strategies opted by the operating companies in this market.

The merchant cash advance market is segmented into repayment method and application. On the basis of repayment method, the market is categorized into MCA split, automated clearing house (ACH), and MCA lockbox. As per application, the market is differentiated into IT and telecom, healthcare, manufacturing, retail and e-commerce, travel and hospitality, energy and utilities, and others.

Loading Table Of Content...

Loading Research Methodology...