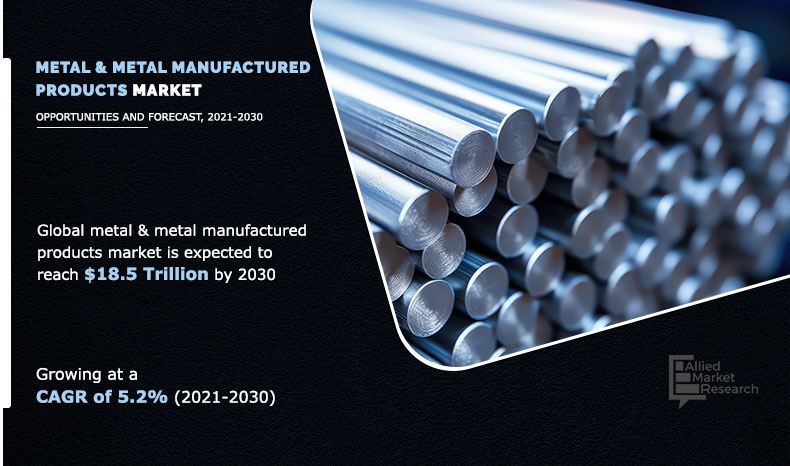

Metal & Metal Manufactured Products Market Outlook - 2030

The global metal & metal manufactured products market size was valued at $11.2 trillion in 2020, and is projected to reach $18.5 trillion by 2030, at a CAGR of 5.2% from 2021 to 2030.

Metal is a reusable and vital resource with great thermal and electrical conductivity, density, and capacity to be deformed without splitting under pressure. Various metals are mined from specific ores in the earth's crust and classified as ferrous or nonferrous based on their iron makeup. Metal fabrication is a process that involves cutting, shaping, or moulding metal material into a finished product. Increase in demand for metal and metal produced products from various end-use industries, such as healthcare, aviation, energy & power, electrical & electronics, and others is expected to drive the market growth during the forecast period.

Furthermore, technical improvements and increase in demand for metals and metal-manufactured items from the automotive industry drive the global market's expansion. Steel, magnesium, and aluminium are popular metals used in the automotive industry because of their low cost and high safety. Government regulations, increase in operational efficiency to reduce operating costs, growing input material costs, and improving output quality are factors that hamper the growth of the market. Growth in the market for metals in emerging economies coupled with large-scale use of recycled metal & related products is expected to provide great opportunities for the metal and metal manufactured products market.

The metal & metal manufactured products market is segmented on the basis of metal type, product type, end-use industry, and region. On the basis of metal type, the metal type market is divided into lithium, magnesium, aluminum, chromium, manganese, iron, cobalt, copper, zinc, molybdenum, silver, and others. On the basis of product type, the market is classified into wires & cables, jewelry & ornaments, bars & rebar, sheets, rolls, pipe fixture & fittings, pipes, molded components, batteries, paints & coatings, and others. On the basis of end-use industry, the market is divided into automotive & transportation, aerospace & defense, marine, consumer goods, electrical & electronics, manufacturing, energy & power, construction, packaging, pharmaceuticals, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in the metal & metal manufactured products market report include, All Metal Sales, Inc., Broder Metals Group, Ltd., China Minmetals Corporation, China Molybdenum Co. Ltd, Hitachi Metals Ltd., Karay Metals Inc., Newmont Corporation, Sierra Metals Inc., Steward Advanced Materials LLC, and Talco Aluminium Company. The global metal & metal manufactured products market report provides in-depth competitive analysis as well as profiles of these major players.

Metal & Metal Manufactured Products Market, by Metal Type

By metal type, the iron segment held a significant share in the metal and metal manufactured products market in 2020. The primary metals used in the manufacturing of metal products are iron and steel.

By Metal Type

Iron is projected as the most lucrative segment.

Metal & Metal Manufactured Products Market, by Product Type

By product type, the others segment is having the highest market share of global metal & metal manufactured products market in 2020. Furthermore, the batteries segment held a significant share in the metal & metal manufactured products market in 2020, growing at a CAGR of 11.7% during the forecast period. The growth of the market is majorly driven by surge in requirement for continuous power supply from critical infrastructures in the wake of COVID-19, increase in demand for plug-in vehicles, rise in need for battery-operated material-handling equipment in industries due to automation, continued development of smart devices, and growing adoption of lithium-ion batteries in the renewable energy sector.

By Product Type

Others is projected as the most lucrative segment.

Metal & Metal Manufactured Products Market, by End-Use Industry

By end-use industry, others segment is having the highest market share of global metal & metal manufactured products market in 2020. Moreover, the electrical and electronics segment held a significant share in the metal & metal manufactured products market in 2020, growing at a CAGR of 13.9% during the forecast period. The rapid pace of innovations in electronics technology stimulates consistent demand for newer and faster electrical and electronics products. Technological development is a key for attracting both, consumers and business users for either replacing or upgrading the older products with advanced versions.

By End-use Industry

Others is projected as the most lucrative segment.

Metal & Metal Manufactured Products Market, by Region

By region, Asia-Pacific is projected to grow at the highest CAGR from 2020 to 2030. Asia-Pacific was the largest region in the metal manufacturing market in 2020, accounting for around 48.1% of the market. This was mainly due to the large manufacturing industry in the region, especially for automobiles, telecom, machinery, and transportation.

By Region

Asia Pacific holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key Benefits for Stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the metal & metal manufactured products market industry for strategy building.

- It outlines the current metal & metal manufactured products market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, & metal & metal manufactured products market opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact of COVID-19 on Global Metal & Metal Manufactured Products Market

- Some of the major economies suffering from the COVID-19 crisis include, Germany, France, Italy, Spain, the UK, and Norway. Many industries were shut down due to lack of raw material availability and disruptions in the supply chain, owing to the COVID-19 outbreak. The global lockdown suspended marine and industrial activities, which resulted in decline in demand for metal & metal manufactured products.

- Increase in demand–supply gap, price volatility, and change in government policy are expected to affect the growth of various end-use industries. In terms of its immediate and long-term effect on industry and consumers, the COVID-19 pandemic has outpaced any headwind ever encountered. The global economy of metal & metal manufactured products industries experiences a significant slowdown due to constraints of the COVID-19 pandemic on the economic activity.

- The growth is mainly due to companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges.

Metal & Metal Manufactured Products Market Report Highlights

| Aspects | Details |

| By Metal Type |

|

| By Product Type |

|

| By End-Use Industry |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Pipe fixtures & fittings and electrical & electronics are the most lucrative metal manufactured products in the global metal & metal manufactured products market, followed by bars, jewelry & ornaments, molded components, wires & cables, and others. Significant demand for pipe fixtures & fittings in various industries and infrastructural development in emerging as well as developed economies are expected to drive its demand in the global metal & metal manufactured products market. FDA, REACH, and other regulatory bodies have stated a ban on lead piping system for water supply, resulting in the renewal of water systems in different regions, which further increases the demand for pipe fixtures & fittings.

Electrical & electronics is another key metal manufactured products, which possess high market potential for investment owing to increase in demand for electrical & electronic devices in different applications. Metals are widely utilized in various end-user industries of electrical & electronic application, such as appliances, power generation & transmission, solar power, telecommunications links, consumer electronics, and others.

The growth of the global metal & metal manufactured products market is majorly driven by an increase in demand from various end-use sectors, such as healthcare, aviation, energy & power, electrical & electronics and others.

Trends in construction are the principal determinants of demand for structural metal products and hence due to growing construction activities in APAC, the metal, and metal manufactured products in this region is expected to grow.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Asia-Pacific region will provide more business opportunities for Metal & Metal Manufactured Products Market in coming years

End use industry segment holds the maximum share of the metal & metal manufactured products market

All Metal Sales, Inc., Broder Metals Group, Ltd., China Minmetals Corporation, China Molybdenum Co. Ltd, Hitachi Metals Ltd., Karay Metals Inc., Newmont Corporation, Sierra Metals Inc. are the top players in metal & metal manufactured products market.

Wires & cables, jewelry & ornaments, electrical & electronics, bars, sheets, rolls, pipe fixture & fittings industry are the potential customers of metal & metal manufactured products industry.

The global metal & metal manufactured products market was valued at $18.5 Trillion by 2030

Loading Table Of Content...