Metallized PET Packaging Market Research, 2032

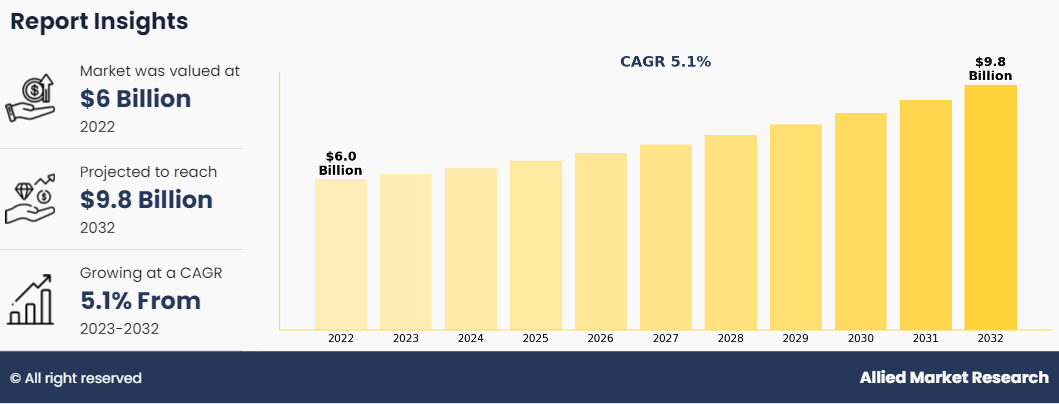

The global metallized pet packaging market size was valued at $6 billion in 2022, and is projected to reach $9.8 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032. Metallized PET packaging is at the forefront of new product packaging solutions, combining practicality, sustainability, and aesthetic appeal. This packaging process involves depositing a thin layer of metal, usually aluminum, over a substrate of polyethylene terephthalate (PET) film. The result is flexible packaging material with a metallic shine, which improves product visibility & shelf appeal while also offering important protective features. At its heart, metallized PET packaging serves two functions: to entice consumers with its visual appeal and to protect the packaged contents. Its glittering luster provides sophistication and elegance to a variety of consumer products, including food & drinks, cosmetics, and medicines. Furthermore, the shiny surface of metallized PET improves brand identification and attracts attention on crowded store shelves, boosting marketing efforts and increase in sales.

Metalized PET packaging provides substantial benefits in terms of product display and brand identity. The metallic aspect of the packaging gives the products a premium and visually appealing style, causing them to stick out on the shelves and capture customer attention. The reflective surface of metallized PET film may be customized using a variety of printing processes, allowing colorful graphics, logos, and product information to be displayed with great clarity and brightness. This branding potential enables manufacturers to produce visually appealing container designs that reinforce brand identification and influence customer purchase decisions. Another element encouraging the use of metallized PET packaging is its versatility & applicability to a variety of product categories. Metallized PET may meet a wide range of packaging needs, including food, drinks, personal care goods, and medicines, while maintaining constant performance and protection. Its versatility enables the fabrication of a variety of package types, such as pouches, bags, wraps, labels, and sleeves, to meet the special requirements of various industries and applications. This adaptability makes packaging operations easier for producers, simplifying manufacturing processes and lowering costs connected with various packaging materials.

However, one of the key restraints for metallized PET packaging is its environmental impact. While PET is recyclable, the metallization process complicates the recycling stream. In addition, the presence of metallic coatings disrupts traditional recycling procedures, making it difficult to properly separate and recover components. As a result, metallized PET packaging frequently ends up in landfills or incineration facilities, leading to environmental deterioration and resource depletion. Furthermore, the use of metallic coatings may reduce PET's biodegradability, compounding concerns about sustainability and waste management. In recent years, there have also been questions raised about the compatibility of metallized PET packaging with rising packaging trends and developments. As the industry advances in sustainable packaging materials and technology, stakeholders are increasingly looking for alternatives to standard metallized films. Biodegradable polymers, bio-based coatings, and compostable packaging solutions are promising alternatives that meet changing customer desires for environmentally sustainable and socially responsible packaging options. As a result, prolonged dependence on metallized PET packaging industry may hamper the shift to more sustainable packaging techniques and attempts to reduce the environmental effect of packaging waste.

On the contrary, advancements in metallization methods, as well as continual innovation in materials science, contribute to the ever-changing environment of metallized PET packaging, providing endless prospects for development. Plasma coating and atomic layer deposition are examples of metallization process innovations that improve metal deposition efficiency and precision, allowing for better control over barrier properties and surface features. Furthermore, R&D into new metal alloys and deposition processes shows promise for improving the performance & sustainability of metallized PET packaging market demand. As technological improvements continue to drive progress in packaging materials and production processes, metallized PET is well-positioned to capitalize on these changes and emerge as a preferred packaging option across several sectors. The variety and practical uses of metallized PET packaging add greatly to its market opportunities. Beyond its principal use in food and beverage packaging, metallized PET has a wide range of uses in industries including healthcare, personal care, and electronics. Its compatibility with numerous printing processes, including as flexography, gravure, and digital printing, increases its versatility and enables the development of detailed patterns and branding features. Further, metallized PET can be laminated with other materials to impart features such as heat seal ability, puncture resistance, or anti-static capabilities, increasing its usefulness in specialized packaging applications. Due to its adaptability, metallized PET packaging can meet a wide range of product categories and packaging requirements, increasing its Metallized PET Packaging Market Growth opportunities.

Moreover, the key players profiled in this report include Polyplex Corporation, Ester Industries, Toray Plastics, Sumilon Industries, Cosmo Films, Terphane (Tredegar Corporation), Vacmet India Ltd, Gaylord Packers, Hangzhou Hengxin(Jinxin) Filming Packaging, and Alpha Industry Company. Product launches and strategic partnership are common strategies followed by major market players. For instance, 2 August 2023, CamVac Ltd, a prominent global supplier of metallized and transparent barrier films and laminates launched a product Camfoil which acts as a multi-layered metallized laminate.

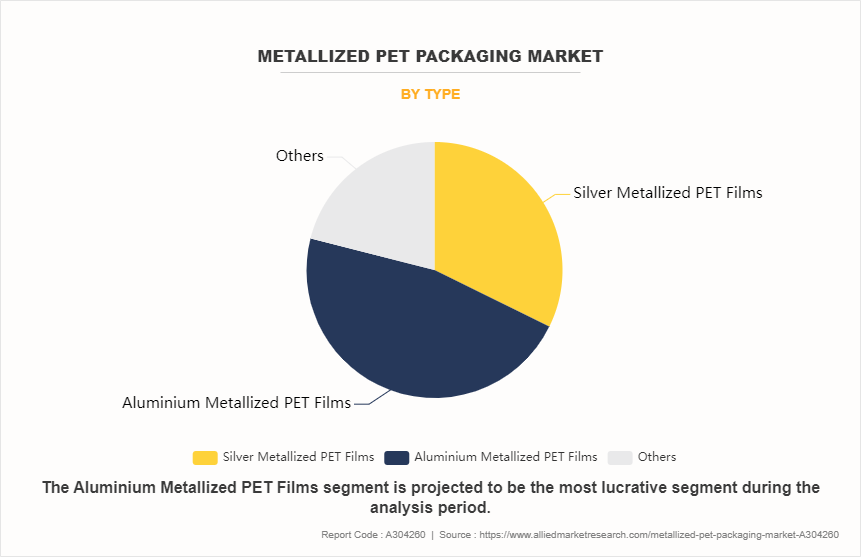

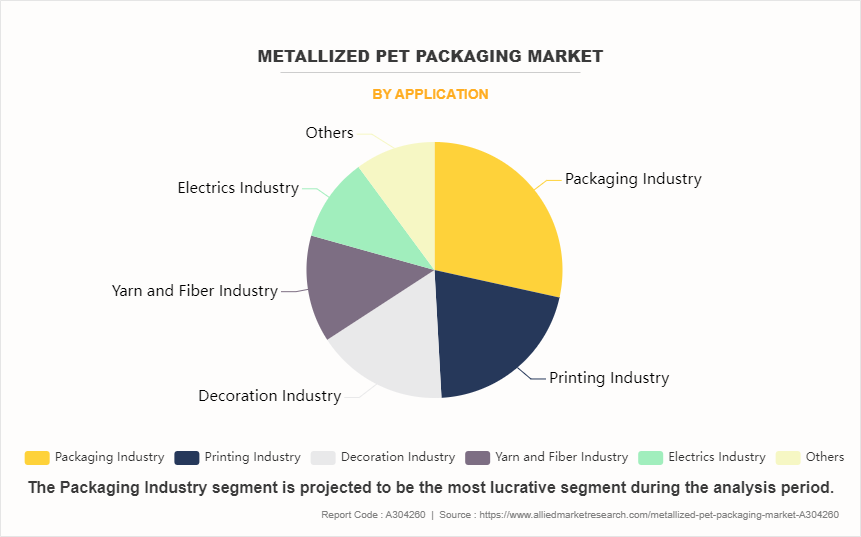

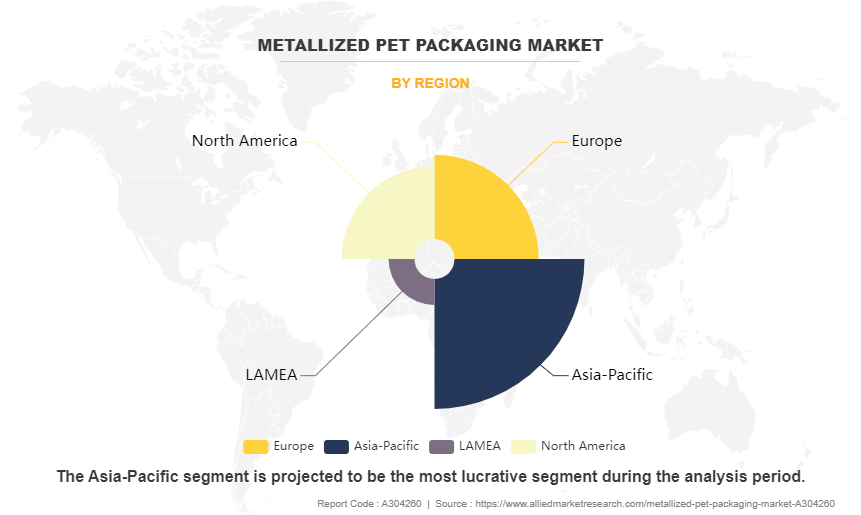

Furthermore, the metallized PET packaging market statistics is segmented into type, application, and region. On the basis of type, the market is segregated into silver metallized PET films, aluminum metallized PET films, and others. Based on the application, the market is classified into packaging industry, printing industry, decoration industry, yarn & fiber industry, electrics industry, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The metallized pet packaging market is segmented into Type and Application.

By type, the aluminum metallized PET films sub-segment dominated the global metallized PET packaging market share in 2022. The metallized PET packaging market is experiencing growth, propelled by the demand for aluminum metallized PET films. These films find application across various segments such as food, beverages, and pharmaceuticals due to their superior barrier properties, extended shelf life, and aesthetic appeal. In addition, the driving factors include increase in preference for lightweight, sustainable packaging solutions, coupled with rise in consumption of packaged goods globally. Moreover, technological advancements in metallization processes enhance film performance, thereby boosting the market adoption. This trend is expected to persist as industries continue to prioritize efficient, eco-friendly packaging solutions. All these factors are projected to fuel market growth during the forecast period.

Based on the application, the packaging industry sub-segment dominated the global metallized PET packaging market share in 2022. The metallized PET packaging market within the broader packaging industry is anticipated to experience growth driven by several key factors. Upsurge in demand for lightweight, sustainable packaging solutions, coupled with PET's excellent barrier properties and aesthetic appeal, has propelled its adoption across various sectors. In addition, rise in emphasis on product differentiation and brand enhancement fuels the demand for metallized PET packaging market forecast, particularly in the food & beverage industry. Furthermore, technological advancements in metallization processes and recyclability features contribute to the market expansion. Overall, the metallized PET segment is poised for continuous growth, catering to evolving consumer preferences and industry demands.

By region, Asia-Pacific dominated the global metallized PET packaging market in 2022. The Asia-Pacific metallized PET packaging market is being propelled by several key driving factors. The region's increasing focus on sustainable packaging solutions in response to environmental concerns drives the demand for metallized PET, known for its recyclability and lightweight nature. In addition, surge in demand for convenience and ready-to-eat food products fuels the adoption of metallized PET packaging in the food industry. Moreover, advancements in metallization technologies and the versatility of PET as a packaging material contribute to the market growth. Overall, these factors converge to boost the expansion of the metallized PET packaging market in Asia-Pacific.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the metallized pet packaging market analysis from 2022 to 2032 to identify the prevailing metallized pet packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the metallized pet packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global metallized pet packaging market trends, key players, market segments, application areas, and market growth strategies.

Metallized PET Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.8 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 299 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sumilon Industries, Cosmo Films, Ester Industries Limited, Gaylord Packers, Alpha Industry Company, Terphane (Tredegar Corporation), Polyplex Corporation, Toray Plastics, Hangzhou Hengxin(Jinxin) Filming Packaging, Vacmet India Ltd |

The metallized PET packaging market size is expected to grow due to increase in demand for extended shelf life globally. In addition, the market is driven by growth in technological advancements in PET packaging.

The major growth strategies adopted by the metallized PET packaging market players are product launches and partnership agreements.

Asia-Pacific will provide more business opportunities for the global metallized PET packaging market in the future.

Polyplex Corporation, Ester Industries, Toray Plastics, Sumilon Industries, Cosmo Films, Terphane (Tredegar Corporation), Vacmet India Ltd, Gaylord Packers, Hangzhou Hengxin(Jinxin) Filming Packaging, and Alpha Industry Company are the major players in the metallized PET packaging market.

The aluminum metallized PET films metallized PET packaging sub-segment of the type segment acquired the maximum share of the global metallized PET packaging market in 2022.

The Food & Beverage Industry are the major customers in the global metallized PET packaging market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global metallized PET packaging market from 2022 to 2032 to determine the prevailing opportunities.

Food Packaging is expected to experience a growth in adoption, as metallized PET packaging is widely used in the food industry for various applications such as pouches, bags, wrappers, and labels.

Smart packaging and track-and-trace technologies, rise in advanced barrier solutions of metallized PET packaging, and surge in demand for innovative design and branding industry fuel the global metallized PET packaging market.

Loading Table Of Content...

Loading Research Methodology...