Mexican Insulated Panels Market Overview:

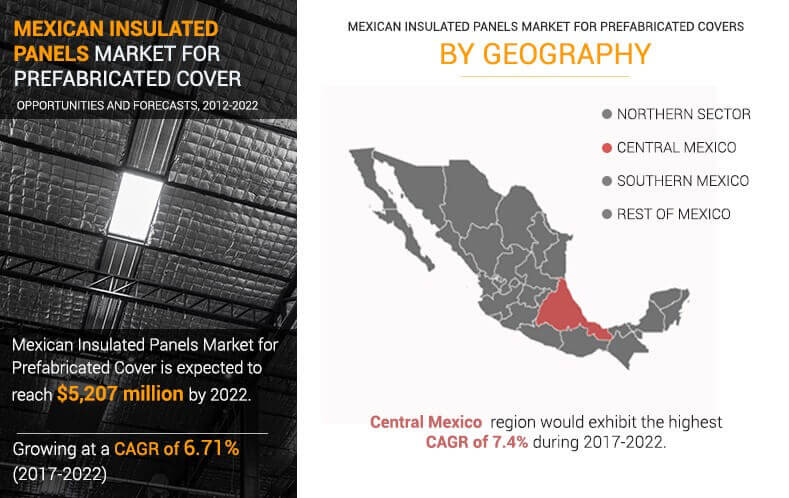

Mexican insulated panels market for prefabricated covers was valued at $3,505 million in 2016, and is projected to reach at $5,207 million by 2022, growing at a CAGR of 6.71% from 2017 to 2022.

Insulated panels are prefabricated insulating structures used in both residential and commercial buildings. Implementation of insulated panels in construction of buildings has led to development of greener and reliable buildings, as they are energy efficient, cost-effective, and structurally strong. These panels are made by sandwiching an insulated foam between two skin materials. The most common type of insulated foam used in insulated panels is polyurethane and polystyrene foam.

The foam insulating material should possess features such as moisture resistant, fire retardant, low density, and chemically inert insulating. Moreover, cold rooms and refrigerator vehicle bodies are the most common applications of insulated panels. Use of insulating panels in buildings offers better energy management, improved durability, economical, faster construction, fire resistant, and acoustical & vibration control.

The major factors that drive the Mexican insulated panels market include rapid urbanization and globalization worldwide. In addition, increase in demand for refrigerated vehicles and cold storage containers, utilized for shipping food, accelerates the demand for insulated panels in the Mexican region. However, vulnerability to pest and susceptibility to moisture restrict the market growth. The eco-friendly nature of insulating panels is expected to present a major opportunity for market growth.

The Mexican insulated panels market for prefabricated covers is segmented on the basis of foam type, skin material, end-user industry, and region. Based on foam type, it is divided into polyurethane foam, polystyrene, and others. The skin materials studied in this report include steel-steel, steel-cardboard, steel-vinyl ester, cardboard-cardboard, and others. By end-user industry, the market is bifurcated into construction and cold storage. Based on region, it is analyzed across northern sector, central Mexico, southern Mexico, and rest of Mexico.

The key players operating in the market are Frigocel Mexicana, S.A. de C.V., Ternium, Metecno, Danica, Marcegaglia SpA, Unypanel SA de CV, Fanosa, S.A. de C.V., Thermopanel, Isocindu S.A. de C.V., and Kingspan Group plc.

Mexican Insulated Panels Market for Prefabricated Covers, by Region

The central Mexico region has witnessed a rapid growth as insulated panels are being frequently used in construction projects in this region. In addition, the central Mexicos rapidly growing economy and culture fuels the insulating panel market in the region. Numerous construction activities are underway in the region, owing to the opening of new restaurants, new commercial & residential buildings, and institutional construction.

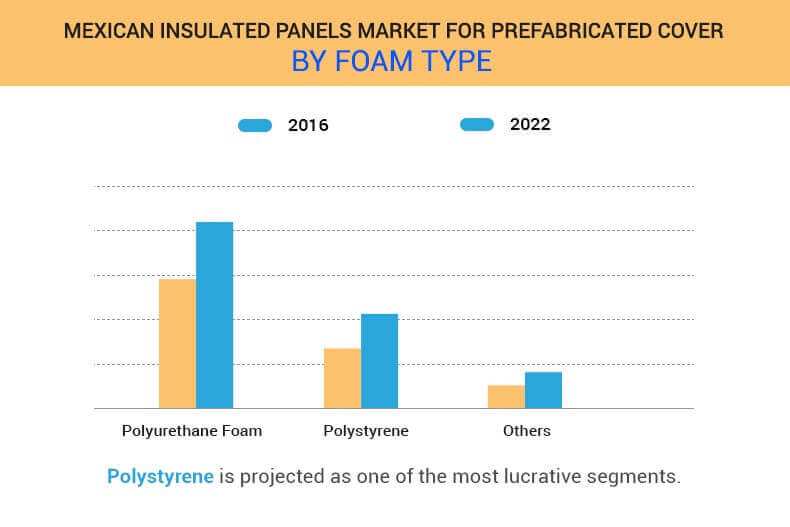

Mexican Insulated Panels Market for Prefabricated Covers, by Foam Type

The polystyrene segment is estimated to be the most lucrative market in the Mexican region due to excellent insulating properties, better moisture and fire resistance, chemical inertness, lightweight nature, and high compressive strength.

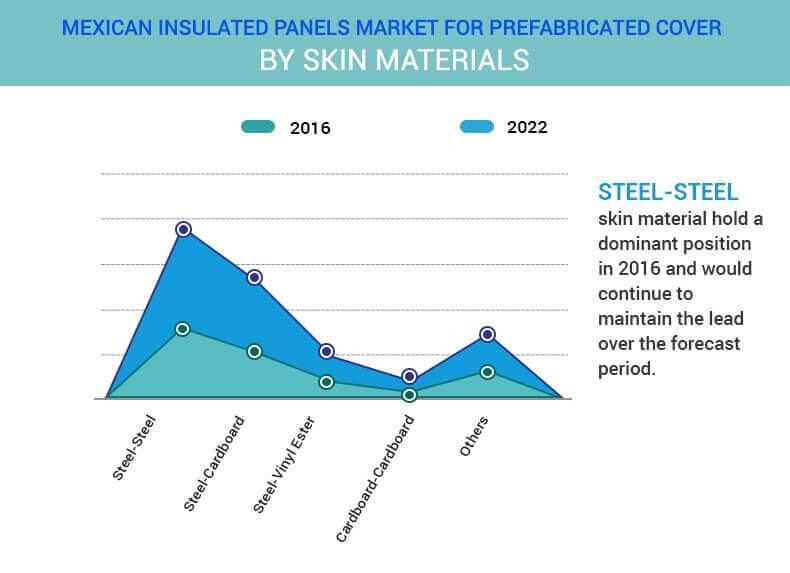

Mexican Insulated Panels Market for Prefabricated Covers, by Skin Material

Steel-steel skin material dominates the Mexican insulated panels market for prefabricated covers. The lightweight of the insulating panels improves construction efficiency and shipping cost. Furthermore, high strength of the steel-steel insulating panels increases its life span, and does not require any internal steel framework.

Key Benefits for Mexican Insulated Panels Market:

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current trends and future scenario of the market from 2017 to 2022 to understand the prevailing opportunities and potential investment pockets.

- Major countries in each region have been mapped according to their individual revenue contribution to the global/regional market.

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study.

- The profiles of key players along with their key strategic developments are enlisted in the report.

Mexican Insulated Panels Market Report Highlights

| Aspects | Details |

| By Foam Type |

|

| By Skin Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | KINGSPAN GROUP PLC, ISOPAN SPA (LEGAL NAME IN SPANISH: ISOCINDU S.A. DE C.V.), FRIGOCEL SA DE CV, TERNIUM S.A., THERMOPANEL, DANICA CORPORATION A/S, INDUSTRIAS UNYPANEL SA DE CV, MARCEGAGLIA SPA, FANOSA, METECNO SPA |

Analyst Review

Insulated panels are advanced building materials that are engineered to provide energy-efficient homes and commercial buildings. These insulated panels are developed by sandwiching a rigid insulation foam between two panels. The outer skin of the insulated panels is made from steel, cardboard, polymers, and other suitable material. Use of insulated panels for the construction of buildings has led to development of greener and reliable buildings, as they are energy efficient, cost effective, and structurally strong. The rigid foam insulating material plays a vital role in the performance of the insulated panels. Polyurethane and polystyrene foam are the most common types of foam materials used in the manufacturing of insulated panels. The market share of polyurethane foam in 2016 is high as compared to polystyrene foam, but the growth rate of polystyrene foam is higher than polyurethane foam, as the price of polystyrene foam is lower than polyurethane foam. Furthermore, cold rooms and refrigerators vehicles body are one of the most common application of insulated panels. Insulated panels are used in cold storage as they offer high thermal efficiency, eco-friendliness, fire retardance, and moisture resistance. Rapid industrialization in the Mexican region has spurred the demand for cold storage for frozen poultry & meat, ice-cream & dairy products, frozen fruits & vegetables and chemical storage.

Heavy investment in infrastructure and commercial construction projects by MNCs in Mexico has led to rapid industrialization. The major commercial construction projects include malls, residential, and office buildings. The use of insulating panels in the construction of malls is a part of the green building initiative taken up by the Mexican government to reduce the carbon footprint.

In central Mexico, the immigrant population accounts a major proportion of the rapidly growing economy and culture. Numerous construction activities are underway in the region, owing to the opening of new restaurants, new commercial & residential buildings, and institutional construction. This rapid growth in urban population has led to a high demand for insulated panels in construction and cold storage in restaurants and supermarkets.

Loading Table Of Content...