The global meeting, incentive, convention, and exhibition (MICE) industry was valued at $598.2 billion in 2022, and is estimated to reach $2,309.4 billion by 2032, registering a CAGR of 11.6% from 2023 to 2032. The MICE industry consists of organizers and suppliers that manage and deliver meetings, conferences, exhibitions, and other related events held to achieve a range of professional, business, cultural, or academic objectives.

The activities of the MICE industry play a key role in the future growth for businesses, cities, destinations, and other covered spectrums. Organizers of MICE events also provide other creative services that include show displays, directional signage, banners, kiosks/exhibit space, event photography, AV/technical production, event marketing & sponsorship management, group air fulfillment, on-site event logistics and staffing, supplier management, virtual meetings, and risk management services.

Increase in presence of corporate industries due to massive growth of business activities, such as client meetings, brand promotions, employee training activities, and others, drives the growth of the global MICE industry. Moreover, rise in government initiatives to promote SMEs and liberalization of market entry to increase FDIs are anticipated to boost the market growth further. Other significant factors that promote the growth of the MICE Industry market are change in lifestyle of business travelers to seek leisure trips, rapid urbanization, and industrial growth. Moreover, infrastructural development and continuous technological advancements fuel the market growth. However, high cost associated with MICE events and uncertain global geopolitical conditions hamper the growth of the market. Factors, such as investments in infrastructural development and technological advancements, are expected to provide lucrative opportunities for the market.

Economic development is one of the key drivers of the MICE industry. A strong and growing economy creates a favorable environment for businesses to thrive, and as a result, the demand for business events such as meetings, conferences, exhibitions, and trade shows is increasing day by day in developing countries such as India, China, among others. This has increased the MICE Industry size. Economic growth leads to increased business activity and trade, which, in turn, leads to an increase in demand for business events.

Global economies have been looking for ways to use young people's potential for entrepreneurship and start-up companies during the last few decades. Moreover, to provide guidance and solutions for the youth, a variety of events and programs, including conferences, seminars, entrepreneurial programs, fora, and others, are arranged which increase the MICE industry share. Various nations plan and fund different initiatives to investigate if students are able to take advantage of unexplored commercial opportunities. Youth are also able to turn their creative business ideas into workable plans owing to an increase in the number of attendances at business seminars and appropriate counseling programs. In addition, the rise in youth interest in conferences, seminars, and career-related events has increased as a result, and this is projected to fuel the demand for events worldwide and boost the expansion of the MICE Industry sector.

Companies may organize meetings and conferences to launch new products, conduct market research, and network with potential partners, suppliers, and customers for MICE Industry growth. Economic development usually results in higher disposable income for individuals and businesses. This means that consumers are more willing and able to spend money on attending events, making it financially viable for organizers to host larger and more elaborate events. Economic growth also often leads to investments in infrastructure development, including convention centers, exhibition halls, and hotels which present higher demand for MICE Industry.

This increases the capacity to host larger and more sophisticated events, which attracts more attendees and exhibitors has increased MICE Industry demand. Economic development is expected to propel the growth of the MICE industry in the upcoming years. Travel & tourism includes leisure tourism, business tourism, medical tourism, and others. The factors that promote the growth of the travel & tourism industry include changes in lifestyle, rise in tourism promotion, increase in accessibility of transport facilities, and others, which are expected to fuel the growth of the MICE industry. Furthermore, technological advancements have given rise to easy access to hotel & transport booking through online portals, which further boost the market growth. Continuous development in the travel & tourism industry and integration of various segments, such as hospitality & infrastructure with government initiatives, accelerate the growth of the global travel & tourism industry, which, in turn, supplements the growth of the MICE industry.

Public and private travel & tourism investment is necessary to support the ongoing growth of the MICE industry. Resulting from greater demand for conventions & meetings and in view of the industry’s potential economic benefits, many destinations around the world have invested heavily in infrastructure development. High investment is made to build structures and facilities to expand capacity and maintain & improve current infrastructure. This has influenced the MICE Industry.

However, countries, such as India, China, Saudi Arabia, the UAE, and others, have witnessed a strong economic growth and notable development in business travel over the years. Thus, these countries focus on infrastructural development of roads, airports, and better hotels to cater to the demand from corporate and government travelers. For instance, Singapore’s Changi Airport Group launched a Master Architect tender for the construction of Terminal 5. This new terminal is projected to consist of a three-runway system. All these factors are expected to provide potential growth opportunities for the MICE Industry market.

SMEs play a crucial role in the development of a country’s economy. These firms offer numerous job opportunities, and thus are one of the significant sectors that help reduce unemployment, even when large enterprises are downsizing. However, certain challenges, such as weak linkage with external market and limited SME financing, restrict the growth of SMEs. To sustain the economy, governments have started taking numerous initiatives. For instance, programs, such as Udayami Helpline, Skill India, District-level Incubation, and Accelerator Program, have been initiated by the Indian Government. SME industrial clustering in Japan, China, and other Asian countries promotes the growth of the SME segment in developing regions. The rise of the SME segment significantly promotes the growth of the MICE industry, as business travelers in this segment frequently travel to seek every small opportunity to expand their market size in this large industry.

Africa is expected to be one of the fastest-growing MICE industries. Government in African countries such as South Africa, Kenya, Nigeria, and Namibia are ramping up the infrastructural and connectivity facilities to mark its presence in the global MICE industry. Nigeria is investing in developing convention centers. The Calabar International Convention Center and the redevelopment of National Arts Theatre in Lagos are the examples that show Nigeria’s attempt to attract MICE tourism in the country. Kenya formed the Kenya National Convention Bureau (KNCB) to develop the MICE industry in Kenya. The KNCB is engaged in marketing, promotion, innovation, and development of the regional and international MICE industry across the country. Therefore, Africa is projected to be one of the popular MICE destinations owing to its marketing and promotional activities that will attract the MICE tourists in the forthcoming years.

Moreover, most of the companies started using these digital platforms for conducting MICE events that also saved significant amount of costs. The growing penetration of online platforms for conducting MICE activities is expected to have a very long-term impact on the MICE industry.

Business travel is costly, and many companies looked at it as an unnecessary expense during the COVID-19 period. Therefore, they are expected to seek the services of online platforms for hosting MICE Industry events in future as well. Furthermore, COVID-19 significantly hampered the global MICE industry and may have a long-term impact.

Moreover, there are visible barriers to the MICE industry's growth due to poor support infrastructure. The growth of business tourism has been hindered by various issues, including inadequate accommodation, poor information dissemination, inadequate training, challenges related to environmental sustainability, limited transportation options, and regulatory obstacles. However, the success of business tourism is contingent upon the active participation and benefit of responsible authorities. Furthermore, isolated and underprivileged areas are the ones that frequently lack adequate lodging options, transportation infrastructure, and basic amenities. When they cannot find reasonably priced, cozy, or safe locations to stay, this makes travelers hesitant. The general standard of the business tourism experience has also been impacted by insufficient access to clean water, hygienic conditions, and medical care.

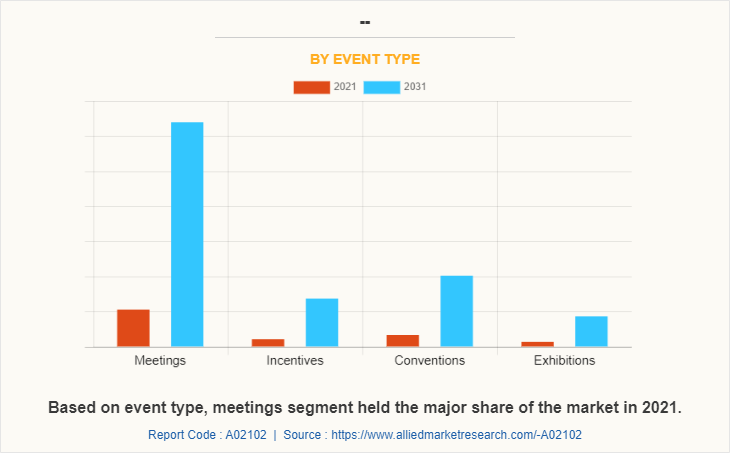

The MICE industry is segmented into event type and region. By event type, it is divided into meeting, incentive, convention, and exhibition. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa. The report highlights the drivers, restraints, opportunities, and growth strategies adopted by the key players to understand the dynamics and potential of the market. Key players operating in the global MICE industry are also profiled to provide a competitive landscape of the market.

By event type, the meetings segment Of MICE Industry accounted for more than 60% of the market share, in terms of revenue, in 2022 owing to the recent trend of organizing hybrid meetings, which involve the use of social media and meeting apps. Hybrid meeting solutions connect speakers and attendees with online audiences in a virtual way. Meeting attendance can range from ten to thousands of people. Meeting times vary depending on the meeting type. Thus affecting the MICE Industry.

Region-wise, Europe was the largest market in 2022 and held the highest market share of 41.0%. Europe region dominated the global MICE industry in 2022and is expected to sustain its dominance during the MICE Industry forecast period. On a positive note, Europe has been extremely successful in winning conferences of international associations with over half of its top cities and countries selected as destinations for international association conferences. UK and Germany are the top investing pockets for the MICE industry in Europe. Moreover, the market is witnessing growth due to increase in the trend of online booking.

The players in the MICE industry have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the market and create MICE Industry opportunities. Some of the key players profiled in the MICE industry analysis include Maritz, BI Worldwide, Ltd., ITA Group, Inc, One10, LLC, Meetings and Incentives Worldwide, Inc. (M&IW), Creative Group, Inc., ACCESS Destination Service, 360 Destination Group, CSI DMC, Carlson Wagonlit Travel, IBTM, BCD Group, Cievents, ATPI Ltd, Conference Care Ltd, the Freeman Company, and the Interpublic Group of Companies, Inc.

Key benefits to stakeholders

- The study provides an in-depth analysis of the market with current and future trends to elucidate the imminent investment pockets.

- Information regarding key drivers, restraints, and opportunities along with their impact analysis on the market is provided in the report.

- Porter's five forces analysis illustrates the potency of buyers and suppliers operating in the industry.

- A quantitative analysis of the MICE industry from 2022 to 2032 is provided to determine the market potential.

MICE Industry, by Type Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.1 trillion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 110 |

| By Event Type |

|

| By Region |

|

| Key Market Players | CWT, FCM Travel, Maritz, CSI DMC, The Interpublic Group of Companies, Inc., ITA Group, One10, LLC, ATPI Ltd., BI WORLDWIDE, Meetings and Incentives Worldwide, Inc, ACCESS Destination Services, The Freeman Company, LLC, Creative Group, Inc., 360 Destination Group, IBTM World, Conference Care Ltd., BCD Group International BV |

Analyst Review

According to the CXOs of the top global companies, the MICE industry garners high revenue in the travel industry. It provides easy and convenient methods for organizing events and helps choose the right destination, which is the basis of a successful event.

The hotel and transportation industries are directly involved in the MICE industry. These industries may benefit from MICE business by offering their services and facilities to the planner and attendees of MICE events. Hotels are the main suppliers of MICE and are the main beneficiaries as well. According to top CXOs across the globe, business travelers who attend MICE events spend over 65% of their money on hotels for rooms and hotel dining while 15% is spent on other restaurants outside the hotel.

Around 10% is spent on shopping and another 10% on local transportation. In addition, the high penetration of the internet & technology in densely populated countries supports the growth of business travel, which indirectly supports the growth of the global MICE industry. Therefore, development in the MICE industry majorly drives economic growth, regional cooperation, and intellectual development.

Loading Table Of Content...

Loading Research Methodology...