Microelectromechanical System (MEMS) Market Outlook – 2031

The global microelectromechanical system (MEMS) market was valued at $76.52 billion in 2021, and is projected to reach $181.04 billion by 2031, growing at a CAGR of 8.7% from 2022 to 2031. Microelectromechanical systems (MEMS) are micrometer-scale devices that integrate electrical and mechanical elements. The micro-electromechanical systems (MEMS) technology includes very small, moving mechanical parts, and the electrical components. This technology is used to fabricate sensors such as accelerometers, gyroscopes, digital compasses, inertial modules, pressure sensors, humidity sensors, and microphones. Impending need of device miniaturization in various electronic devices such as smartphones, wearable devices, medical instruments, and other electronic devices has fueled the growth of the microelectromechanical system (MEMS) market. There is a continuous rise in the demand for these devices owing to a decline in average selling prices and increasing benefits of MEMS devices, such as low cost, less space consumption, and high accuracy. Moreover, these devices are small enough to be soldered directly onto the circuit boards, which reduces the cost of technology.

High adoption in smartphones, thriving portable electronic market, increasing popularity of the Internet of Things (IoT), and robust demand in the automation industry drive the growth of the overall Microelectromechanical System (MEMS) market. Sensor manufacturing companies use MEMS technology to fabricate a wide range of sensors, owing to its low power consumption, small size, and high precision. These manufacturers are developing new MEMS-based sensors for various applications to increase microelectromechanical system (MEMS) industry in distinctive areas as well as globally.

Segment Overview

The microelectromechanical system (MEMS) market is segmented into Type and Application.

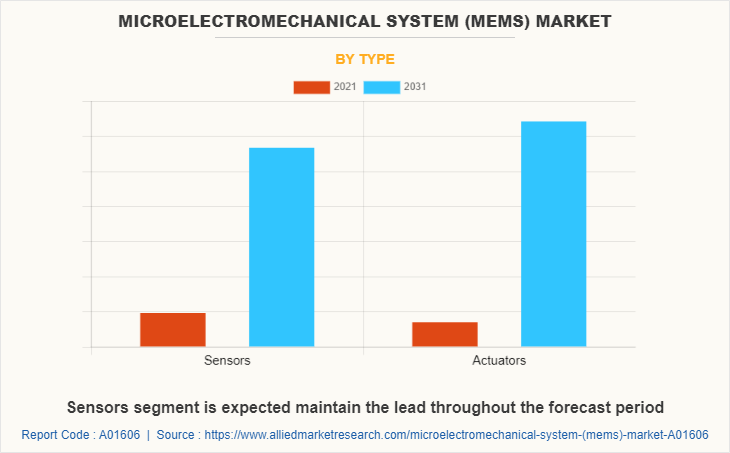

On the basis of type, the market is divided into sensors and actuators. In 2021, the sensors segment dominated the market, in terms of revenue, and is expected to follow the same trend during the forecast period.

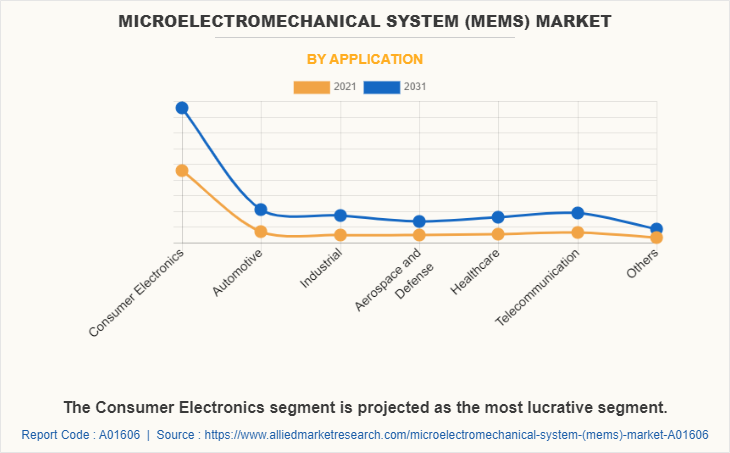

By application, the market is segmented into consumer electronics, automotive, industrial, aerospace & defense, healthcare, telecommunication and others. The consumer electronics segment acquired the largest share in 2021, and is expected to grow at a significant CAGR from 2022 to 2031 for microelectromechanical system (MEMS) market size.

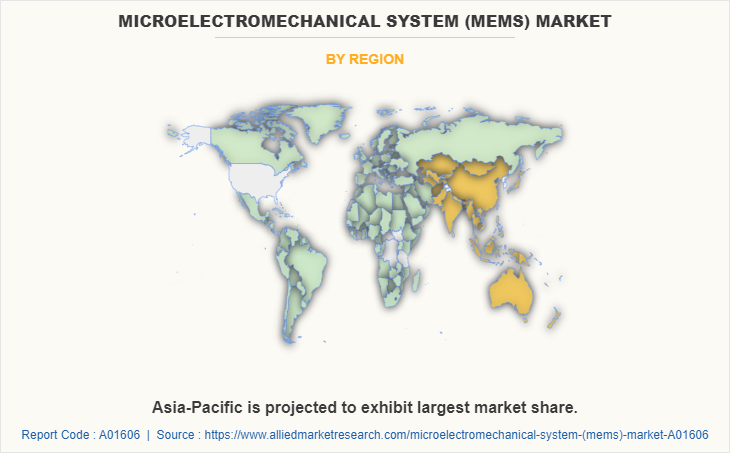

Region-wise, the microelectromechanical (MEMS) market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific remains a significant participant in the microelectromechanical (MEMS) market. Major organizations and government institutions in the country are intensely putting resources into technology to grab microelectromechanical (MEMS) market opportunity.

The notable factors positively affecting the microelectromechanical system (MEMS) market include growth in trend of smart consumer electronics, emerging trends in automotive industry and increase in popularity of IoT. However, lack of standardized fabrication process of microelectromechanical devices and incorporation of sensor in devices, which incurs extra value and reduces life of device hampers the market growth. This factor is expected to slow down the market growth. Moreover, emerging trends toward autonomous vehicles and increase in adoption of smart wearables and innovative application in biomedical sector offers huge market opportunities by 2031.

Competitive analysis and profiles of the major microelectromechanical system (MEMS) market players such as Analog Devices Inc., Broadcom Inc, DENSO CORPORATION, HP Development Company, L.P., Knowles Electronics, LLC, NXP Semiconductors, Panasonic Corporation, Robert Bosch GmbH, STMicroelectronics and Texas Instruments Incorporated.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the microelectromechanical system (mems) market analysis from 2021 to 2031 to identify the prevailingmicroelectromechanical system (MEMS) market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen supplier-buyer network of microelectromechanical system (MEMS) market growth.

In-depth analysis of the microelectromechanical system (MEMS) market outlook assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and microelectromechanical system (MEMS) market share.

The current microelectromechanical system (MEMS) market forecast is quantitatively analyzed to benchmark the financial competency.

The report includes the analysis of the regional as well as global microelectromechanical system (mems) market trends, key players, market segments, application areas, and market growth strategies.

Microelectromechanical System (MEMS) Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NXP Semiconductors, Robert Bosch GmbH, Texas Instruments Inc., Analog Devices Inc., Panasonic Corporation, Broadcom Inc., Knowles Electronics, LLC, STMicroelectronics, DENSO CORPORATION, HP Development Company, L.P. |

Analyst Review

According to the insights of the CXOs of leading companies, the microelectromechanical devices is expected to leverage high potential for the industrial, commercial and infrastructure industry verticals in 2031. The current business scenario is witnessing an increase in the demand for MEMS technology, particularly in the developing regions such as China, India, and others, due to an increase in consumer electronics and smart wearable devices. Companies in this industry are adopting various innovative techniques such as mergers and acquisition activities, to strengthen their business position in the competitive matrix.

The global microelectromechanical system (MEMS) market is expected to witness high growth rate during the forecast period, owing to increased usage in smartphones, major growth in portable electronic market and increase in popularity of Internet of Things (IoT), and robust demand in automation industry. Further, emerging trend of wearable devices, connected cars, smart watches, connected homes, and others are expected to offer new opportunities for market growth.

The MEMS industry displays fair degree of consolidation, with top five industry participants occupying a significant market share. Robert Bosch, STMicroelectronics, and Texas Instruments are few of the leading companies in this industry. Other key players in the industry include Denso Corporation, STMicroelectronics, and Analog devices, Inc.

the upcoming trends of Microelectromechanical System (MEMS) Market is in 5G, audio, motion, olfactometry, and imaging.

Consumer electronics is the leading application of Microelectromechanical System (MEMS) Market.

Asia-Pacific is the largest regional market for Microelectromechanical System (MEMS).

The estimated industry size of Microelectromechanical System (MEMS) is $76.52 billion in 2021.

Texas Instruments Incorporated, Analog Devices Inc., Robert Bosch GmbH, STMicroelectronics and Panasonic Corporation re the top companies to hold the market share in Microelectromechanical System (MEMS).

Loading Table Of Content...