Micro Fulfillment Market Research, 2031

The global micro fulfillment market size was valued at $2.1 billion in 2021, and is projected to reach $88.3 billion by 2031, growing at a CAGR of 44.8% from 2022 to 2031. Micro fulfilment is strategical placement of small warehouses and distribution facilities in the densely populated areas. This close proximity of the facility to the consumers, enables a quick and cost-effective delivery of the products that were ordered using online channels.

Micro Fulfillment Market Dynamics

The e-commerce sector is growing at an exponential rate, owing to the convenience and large variety of products available on the online channels. The sales in e-commerce sector surged during the COVID-19 pandemic induced lockdowns. This positive impact of COVID-19 on e-commerce sector is expected to continue for the coming years. This increased demand has stressed-out the traditional form of distribution and shipping. Where all the items are stocked in limited number of big warehouses spread across the region, and are directly delivered from there. This method of shipping is proving to be inefficient and less profitable as it requires a high transit time between the warehouses and final delivery location. Therefore, a relatively new concept of keeping the in-demand stocks in small-scale warehouse at multiple densely populated places, is being adopted by the shippers. These small-scale warehouses are known as micro-fulfilment facilities. This concept of small-scale warehousing allows a quick, and profitable delivery. In addition, owing to close proximity to the population, the travel time is less; thus, resulting in less consumption of fuel, making it a sustainable delivery method. Moreover, the micro fulfilment facilities have broadened the scope of e-commerce to include perishable goods such as groceries. Such advantages of micro fulfilment facilities are propelling the growth of the micro fulfillment industry.

Furthermore, rise in urbanization has increased the number of residential complexes in various regions. This positively influences the growth of the micro fulfilment market. Moreover, factors such as increase in internet penetration, and government policies to support the e-commerce sector also play a major role in driving growth of e-commerce industries. This positively influences the micro fulfillment market growth.

In addition, major businesses in the micro fulfilment market offer a wide range of products and services, to meet the needs of the consumers. They constantly innovate their offerings to stay competitive in the micro fulfilment market. For instance, in September 2021, Honeywell International Inc., introduced its latest innovation in shipping industry’s robotic technology. It launched a smart depalletizing robot for the micro fulfilment market. This is anticipated to enable the warehouses and distribution centers automate the manual process. Moreover, major players in the e-commerce industry are partnering with technology companies for the advancement of their micro fulfilment centers with advanced products such as robots, and software.

COVID-19 rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic had halted the production of many components in micro fulfilment market due to lockdown. The economic slowdown initially resulted in reduced spending on various micro fulfilment components. However, COVID-19 has positively affected the e-commerce industry. This prevented the micro fulfilment market from plummeting downwards. In addition, owing to the introduction of various vaccines, the severity of COVID-19 pandemic has significantly reduced. As of mid-2022 the number of COVID-19 cases have diminished significantly. This has led to the full-fledged reopening of micro fulfilment component manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Furthermore, the advancements in technology that have improved the material handling devices and robots, are anticipated to provide lucrative opportunities for the micro fulfilment market growth.

Micro Fulfillment Market Segmantation Overview

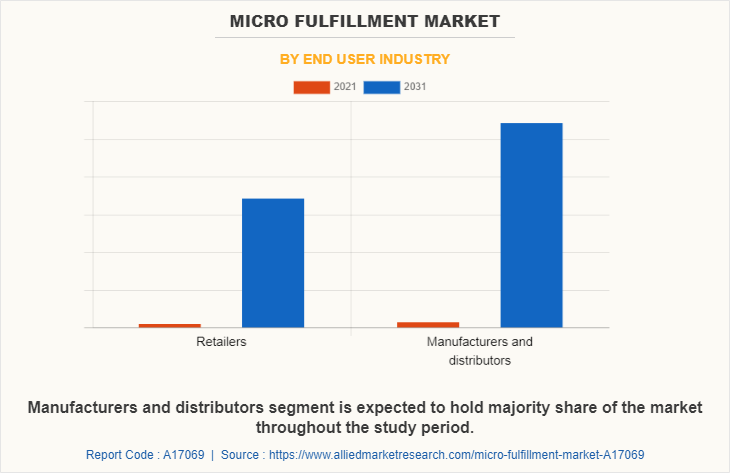

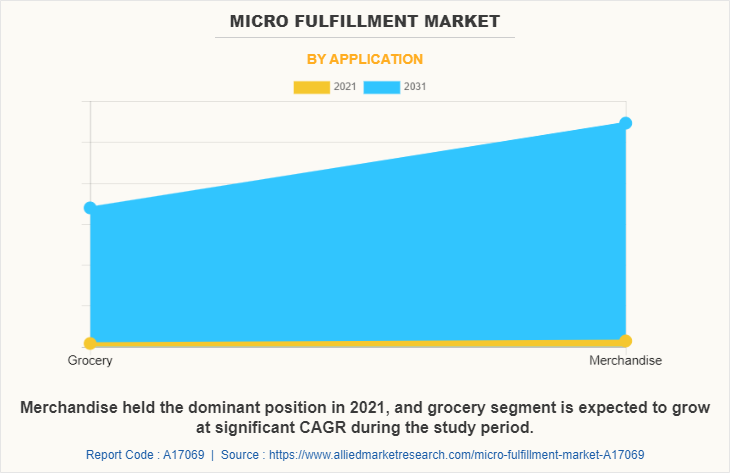

The micro fulfillment market is segmented into End User Industry, Component and Application. On the basis of component, the micro fulfilment market is bifurcated into control systems, and material handling. On the basis of application, the micro fulfilment market is categorized into grocery, and merchandise. On the basis of end-user industry, it is bifurcated into retailers, and manufacturers & distributors. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America held the largest micro fulfillment market share in 2021, accounting for the highest share; whereas, Asia-Pacific is anticipated to grow at a higher CAGR throughout the forecast period. This is attributed to rapid economic growth of the region.

Competition Analysis

Key companies profiled in the micro fulfillment market forecast report include Ahold Delhaize, Alert Innovation, Inc., Bastian Solutions, LLC, Davinci Micro Fulfillment, Flowspace, Fortna Inc., Honeywell International Inc, HÖRMANN Group (HÖRMANN Logistik), Instacart, KION GROUP AG (Dematic), KPI Integrated Solutions, LOCAD, OPEX, PACK & SEND Holdings Pty Ltd, Pacline Overhead Conveyors, Swisslog, and The Kroger Company.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the micro fulfilment market segments, current trends, estimations, and dynamics of the micro fulfillment market analysis from 2021 to 2031 to identify the prevailing micro fulfillment market overview.

The micro fulfilment market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the micro fulfillment market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global micro fulfilment market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the micro fulfilment market players.

The report includes the analysis of the regional as well as global micro fulfillment market trends, key players, market segments, application areas, and market growth strategies.

Micro Fulfillment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 88.3 billion |

| Growth Rate | CAGR of 44.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 295 |

| By End User Industry |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Dematic, HÖRMANN, Davinci Micro Fulfillment, Bastian Solutions, LLC, Instacart, PACK and SEND Holdings Pty Ltd, OPEX, LOCAD, Swisslog, PACLINE OVERHEAD CONVEYORS, Ahold Delhaize, Honeywell International Inc, Flowspace, KPI Integrated Solutions, Fortna Inc., The Kroger Company, Alert Innovation, Inc. |

Analyst Review

The micro fulfilment market has witnessed significant growth in past few years, owing to surge in purchase from online channels. The market is also experiencing growth owing to increased number of residential complexes.

Micro fulfilment facilities offer a highly needed solution to the problems associated with the traditional method of delivery. Traditional method was slow, less profitable, and was negatively affected with human errors. Micro fulfilment facilities being closer to the consumers can quickly deliver perishable as well as non-perishable high demand products. The micro fulfilment facilities are largely free form human errors and are more productive with the wide scale use of automated system. Developed countries such as U.S., and Canada, which already had a highly developed e-commerce sector lead the micro fulfilment market. The respective governments in developing countries have implemented policies to help in the growth of the e-commerce sector. Trustable online payment methods have also positively influenced the market. Moreover, increase in number of residential complexes, fueled by urbanization plays critical role in the development of micro fulfilment market.

Furthermore, the advancements in artificial intelligence, automation, and communication protocols are anticipated to provide lucrative opportunities for the market growth.

Rise in number of grocery delivery startups is a major trend positively influencing the Micro Fulfillment Market.

Micro Fulfillment centers are extensively used for grocery and merchandise delivery applications.

North America is the largest regional market for Micro Fulfillment.

$2,126.0 Million is the estimated industry size of Micro Fulfillment.

Ahold Delhaize, Alert Innovation, Inc., Bastian Solutions, LLC, Davinci Micro Fulfillment, Flowspace and Fortna Inc., are some of the top companies to hold the market share in Micro Fulfillment

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The Micro Fulfillment market is projected to reach $ 88,329.5 million by 2031.

The latest version of the global Micro Fulfillment market report can be obtained on demand from the website.

Loading Table Of Content...