Micro Irrigation Systems Market Overview:

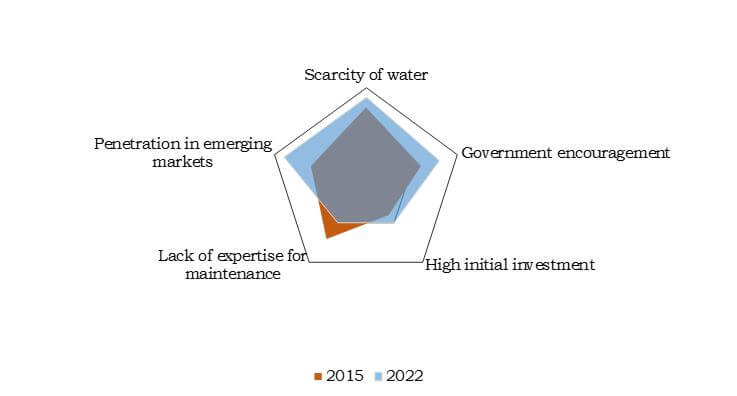

Micro Irrigation Systems Market is expected to garner $8,321 million by 2022, registering a CAGR of 16.6% during the forecast period 2016 - 2022. Irrigation involves provision of water to dry land for crop cultivation. The micro-irrigation process supplies water at frequent intervals above and below the soils surface. Micro-irrigation systems are generally low- or medium-pressure systems that deliver water in the form of sprinkles, spray, mist, drip, and jet. Due to rise in concerns of water scarcity, micro irrigation systems prove to be an innovative and efficient solution as compared to the conventional irrigation practices. The two major factors that drive the micro-irrigation systems market are an increase in the demand for food and agriculture products and a rise in water supply & storage problem.

The high initial investment and high maintenance cost of the micro-irrigation system act as the hindrance to the growth of the market. A micro-irrigation system is not a feasible option for the farmer with less area of cultivation. However, an increase in the investment from the companies is expected to reduce the impact of these restraints. Various companies develop cost-effective equipment for this market. The micro-irrigation market faces challenges from the high cost of equipment and narrow level of commercialization in the developing economies.

The report incorporates the study of micro-irrigation systems, and focuses on the various growth prospects and restraints in the market. The study highlights Porters five forces analysis for the market that comprises of the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market. The study also depicts the value chain analysis for the world micro-irrigation systems market.

Segment Overview:

The micro-irrigation systems market is segmented on the basis of product type, crop type, application, and geography. The segmentation done under product type is sprinkler irrigation and drip irrigation. In 2015, the sprinkler irrigation systems contributed the highest revenue in the market, globally. However, the drip irrigation systems are anticipated to exhibit the fastest growth during the forecast period 2016 - 2022.

Based on crop type, the market is sub-segmented into plantation crops, field crops, orchard crops, and others. The orchard crop type segment garnered the highest revenue share in 2015 and is expected to exhibit the same during the forecast period. However, the plantation crop type is projected to have the fastest growth during the forecast period.

Based on applications, the market is segmented into small farming, large & corporate farming, government, and others. Among the application segments, small farming dominated the market in terms of expenditure, in 2015, and is projected to continue its dominance throughout the forecast period.

The geographical regions considered in the report are North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific currently constitutes the highest market share in the world micro irrigation systems market on account of massive irrigated areas and adoption of micro irrigation systems across the hilly terrains.

Scarcity of Water

Water is depleting to a greater extent and needs to be utilized optimally. Among the agricultural, industrial, and personal use sectors, the agricultural sector is the predominant consumer of water, globally. Micro-irrigation helps to avoid wastage of water, by using water in the form of spray, mist, drip, and other forms. Thus, micro-irrigation systems enhance productivity and reduce virtual water requirement in the agricultural sector. Hence, the impact of scarcity of water is remarkable at present; however, it is expected to increase during the forecast period owing to the depleting resources, environmental conditions, and increasing population.

Government Encouragement

Government plays a prime role in helping farmers for installing micro-irrigation systems, by providing subsidies to the small-scale farmers. Many regional government provide electricity free-of-cost to the farmers. Farmers in the developing countries are encouraged to adopt micro-irrigation systems to increase productivity through optimum water usage. Government encouragement drives the market, notably, and it is expected to have a strong impact on the market during the forecast period.

High Initial Investment

The installation of micro-irrigation systems requires high initial costs, as expensive components are used in the system. This restrains the growth of the world micro-irrigation systems market. The rise in prices of components and systems is also expected to increase the impact of the high initial investment on the market. Thus, currently, high initial investment has a notable impact on the market, which is expected to increase during the forecast period.

Key Benefits

- The study comprises of an analytical depiction of the world micro irrigation systems market with the trends of current and future scenarios to depict the investment pockets in the market.

- The report determines the overall attractiveness and understands the profitable trends to gain a stronger coverage in the market.

- The report throws light on information regarding key drivers, restraints, and opportunities with impact analysis.

- The current market here is quantitatively analyzed and forecast for the years 2014-2022, which is provided to highlight the financial status of the market.

- Porters five forces model analysis of the industry illustrates the potency of the buyers and suppliers participating in the market.

- The value chain analysis in the report provides a clear understanding of the roles of stakeholders involved in the value chain.

Micro Irrigation Systems Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Crop Type |

|

| By Application |

|

| By Geography |

|

| Key Market Players | Rain Bird Corporation, Valmont Industries, Inc., Rivulis Irrigation Ltd., Jain Irrigation Systems Ltd., Lindsay Corporation, The Toro Company, Nelson Irrigation Corporation, Hunter Industries, T-L Irrigation Co., Netafim Ltd. |

Analyst Review

The world micro irrigation systems market is expected to witness a remarkable growth due to the technological advancements and increase in awareness during the forecast period. The demand for easy system functionalities has further propelled this growth particularly in the rural sector. Moreover, adoption in emerging economies and growth in greenhouse vegetable production are the expected growth perspectives for the market. The market growth is restricted by factors such as high initial investments and lack of expertise for maintenance.

Micro irrigation systems have been increasingly employed in Asia-Pacific, followed by LAMEA, North America, and Europe. The highest market share of the market in Asia-Pacific is attributed to the increasing adoption in China and India.

Among drip and sprinkler irrigation system, sprinkler irrigation is leading the market due to ease of automation and wider irrigation area coverage by such systems. Besides this, the crop type orchard crops have dominated the market owing to decreased labor costs, and increased efficiency. Small farming application have dominated other applications of micro irrigation systems owing to massive farmlands under this sub-segment.

Manufacturers in the market focus on product innovation with exceptional product offerings to lead in the market. Jain Irrigation Systems Ltd., Netafim Ltd., and The Toro Company are the leading market players, occupying prominent revenue-share. These players adopt R&D, product launch, and acquisition as their key strategies to sustain in the market.

Loading Table Of Content...