Microcellular Plastics Market Research, 2031

The global microcellular plastics market size was valued at $47.6 billion in 2021, and is projected to reach $93.0 billion by 2031, growing at a CAGR of 7.1% from 2022 to 2031.

Report Key Highlighters:

- The study covers four regions and nearly 20 countries. The segment analysis of each region and country in terms of value ($million) and volume (kilotons) during the forecast period 2021-2031 is covered in the microcellular plastics market report.

- The microcellular plastics market is highly fragmented, with numerous players including Armacell, BASF SE, Formosa Plastics Corporation, INEOS, INOAC CORPORATION, LAVERGNE, Inc., RTP Company, SABIC, TotalEnergies, and Trinseo.

Microcellular plastics are chemically refined polymers that are widely utilized in the food, healthcare, and polymer composite industries to reduce material waste and maintain valuable mechanical qualities. Microcellular plastics are thermoplastic polymers with a high number of tiny bubbles and cell densities. Instead of using chlorofluorocarbons, hydrocarbons, or other potentially hazardous chemical blowing agents, microcellular plastics have played a great role in everyday life in the form of extended foam plastic which gives high-impact strength in the products.

These plastics are a versatile and durable solution for structural loaded applications, with a more environmentally responsible approach. They provide an unique combination of material and processing properties, enhancing efficiency throughout the manufacturing process and elevating the life-cycle performance. Microcellular plastics provide 100% recycled material as well as environmental sustainability which is available in 3D-shaped or double-curved sandwich panels.

Microcellular plastics are considered safe for food packaging in a solid-state microcellular plastic as PVC is a versatile material with numerous applications, including window frames, drainage pipe, water service pipe, medical devices, blood storage bags, cable and wire insulation, resilient flooring, roofing membranes, stationary, automotive interiors and seat coverings, fashion and footwear, packaging, cling film, credit cards, vinyl records, synthetic leather, and other coated fabrics. Microcellular polymers provide strength and weather resistance, making them ideal for building products.

Increase in demand for microcellular plastics in the food packaging and building & construction, and other industries drives the growth of the microcellular plastics market.

Microcellular plastics are extensively used in food packaging to manufacture coffee can lids, bread bags, six-pack soda can rings, and grocery store fruit and vegetable bags. It helps to prevent goods from harm, ensures food safety, and extends food freshness. Polyethylene terephthalate (PET) has excellent flexibility and resilience, allowing it to be used in very lightweight packaging, conserving raw materials and natural resources in food and beverages. PET has superior barrier properties, which protect it from the outside environment.

Further, microcellular plastics are utilized in materials such as polyvinyl chloride for building and construction items such as pipes, cables, window profiles, flooring, and roofing, giving construction materials safety and cost-effectiveness while also helping to decrease environmental impacts. In building and construction, it is resistant to weathering, chemical rotting, corrosion, shock, and abrasion. According to Federal Statistical Office, in May 2021, the construction of 32,384 dwellings was permitted in Germany, an increase of 8.7% compared to April 2021 when polyvinyl chloride as microcellular plastic is gaining popularity in the building and construction industry.

Microcellular plastics such as polystyrene is used as insulation material in buildings and construction which reduces energy consumption in buildings and construction by blocking heat transmission through the encasement. Microcellular plastics are gaining popularity in expanded polystyrene which is widely used in walls, roofs, and floors, where its compressive strength can be tailored for specific systems, such as beam and block construction, underfloor heating systems, and below concrete floor slabs.

According to China's Five-Year Plan unveiled in January 2022, the construction industry is estimated to register a growth rate of 6% in 2022. Prefabricated parts, which are either partially or wholly manufactured and transported to construction sites for assembly including microcellular plastics, may account for over 30% of the new construction in the country.

Microcellular plastics are used in automobile and transportation, aircraft, and others. Polystyrene (solid and foam) is used to make many car parts, including knobs, instrument panels, trim, energy-absorbing door panels, and sound-dampening foam. Polyvinyl chloride (PVC) contributes significantly to the quality, safety, and cost-effectiveness of contemporary road vehicles even while lowering their environmental impact.

PVC microcellular polymers are employed in passenger compartment sections such as the dashboard, door panels, seats, and armrests. PVC-coated fabrics are frequently employed in life-saving car airbags, and the material's fire-retardant characteristics add to the overall safety of a vehicle. Furthermore, microcellular plastic is utilized on the outside of aircraft for items including fuel tank coverings, landing gear hubcaps, and pylon fairings.

Microcellular plastic has several benefits in a traditional aircraft materials, including lightweight, high strength, and durability. It is composed of heat-resistant, non-corrosive polymers that may be machined to replace metal fasteners and screws. However, the availability of alternatives is predicted to hinder the market growth of microcellular plastics.

Nevertheless, increase in consumption of packaged food associated with polystyrene is expected to provide sufficient development prospects for the microcellular plastics market in the future years. Expanded polystyrene (EPS) is an excellent insulator with consistent thermal performance across a wide temperature range in microcellular plastics. It is also used in a variety of applications such as packaging, buoyancy, panel cores, bean bags, and civil engineering.

Microcellular polystyrene is a smoother material that is generally used for meat, produce, bakery, deli, and egg carton packaging. Molded polystyrene is used to create a more solid material for items such as disposable cups and lids, dairy product containers, and salad bar and vegetable containers in food and drinks.

Further, polystyrene packaging helps in minimizing the damage and risk to the sender. Polystyrene materials ensure the quality and safety of the products in food packaging. The Styrofoam form of Polystyrene is commonly used to make plates, bowls, insulated cups, trays, and a wide range of packaging materials.

Mondi introduced new packaging options for the food market, including microcellular polystyrene, in April 2022 at Anuga FoodTec in Cologne, Germany. Products composed of two trays offer recyclable solutions to fresh food producers and can help to reduce food waste. PerFORMing Monoloop and Mono-Formable‐¯offer high-barrier food protection, demonstrating the vital role that packaging plays throughout the distribution network.

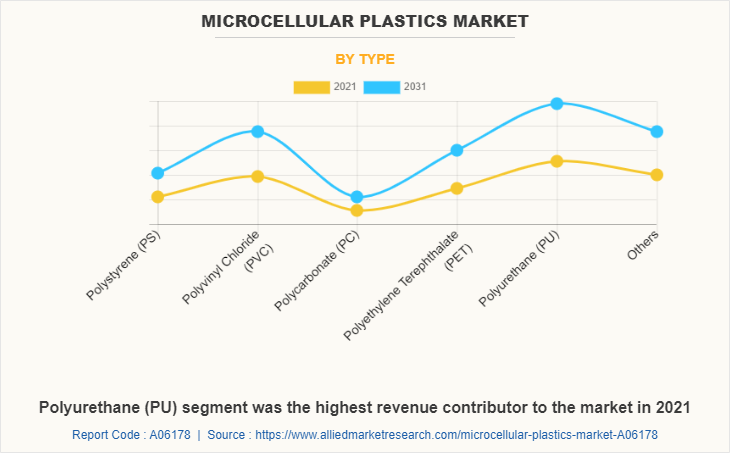

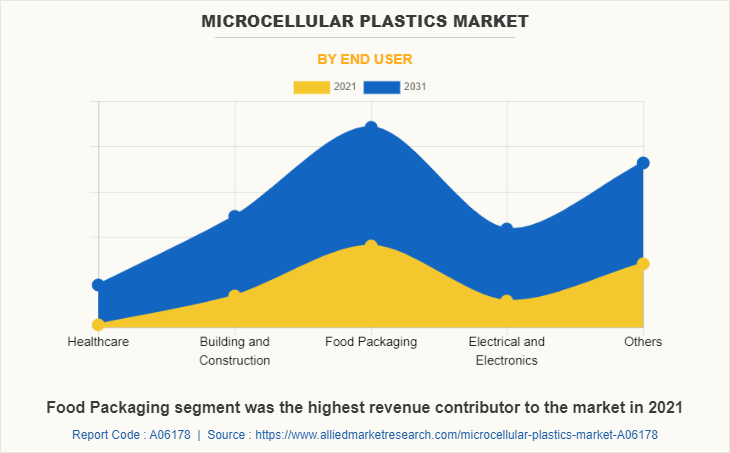

The microcellular plastics market is segmented into type, end-use industry, and region. On the basis of type, the market is categorized into polystyrene, polyvinyl chloride, polycarbonate, polyethylene terephthalate and others. On the basis of end-use industry, it is categorized into healthcare, building & construction, food packaging, electrical & electronics, and others. Region wise, the microcellular plastics market share is studied across North America, Europe, Asia-Pacific, and LAMEA.

The growing popularity of microcellular plastic in windows and pipes is the preferred choice in Asia-Pacific in renovation or in new buildings which are affordable, energy saving and 100% recyclable. According to China’s National Bureau of Statistics, in 2020, the construction industry in China generated an additional value of approximately $1.08 (CNY 7.3) trillion. Thus, the increase in demand from building and construction, food packaging, and others is expected to boost the growth of the microcellular plastics industry in the region during the forecast period.

Microcellular polyurethane plastics are lightweight and focus on reducing the weight of products, especially in the automotive and aerospace industries, microcellular polyurethane plastics are increasingly being used as a lightweight alternative to traditional materials such as metals and other plastics.

According to Balance Money, US military spending in the aerospace industry, including polyurethane plastics, will total $934 billion from October 2020 to September 2021. Military spending is the second-largest item in the federal budget after Social Security.

Microcellular polyurethane plastics are also increasingly being used in biomedical applications, such as tissue engineering and drug delivery systems. These materials can be designed to have specific mechanical and chemical properties, making them ideal for use in medical implants and devices.

Food Packaging segment was the highest revenue contributor to the market in 2021. Polypropylene (PP) is commonly used in food packaging to make yogurt containers, maple syrup containers, cream cheese containers, and sour cream containers, as well as prescription drug bottles. In April 2022, at Anuga FoodTec in Cologne, Germany, Mondi introduced fresh microcellular plastic packaging options for the food sector. Fresh food providers with recyclable choices help reduce food waste. PerFORMing Monoloop and Mono-Formable Polypropylene provides a high-barrier food protection, emphasizing the critical function that packaging plays throughout the production process of food packaging.

High-density polyethylene (HDPE) is one of the most widely used microcellular plastics in food and beverages. This semi-translucent, lightweight plastic bag resists temperature fluctuations, water, and vapor. It also has high tensile strength and has been authorized by the FDA for food handling purposes. This plastic bag is typically found at food shops, convenience stores, delis, and restaurants.

Key Players & Strategies:

Major players operating in the global microcellular plastics market include Armacell, BASF SE, Formosa Plastics Corporation, INEOS, INOAC CORPORATION, LAVERGNE, Inc., RTP Company, SABIC, TotalEnergies, and Trinseo. These players adopted several growth strategies to strengthen their position in the market. For instance, in 2022, INEOS launched a lineup of commercially available sustainable polystyrene products. The new products provide customers with a choice to select the best fit for their application. INEOS polystyrene portfolio includes general purpose polystyrene (GPPS) resins and high impact polystyrene (HIPS) resins. This product launch is projected to increase the growth of the microcellular plastics market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the microcellular plastics market analysis from 2021 to 2031 to identify the prevailing microcellular plastics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the microcellular plastics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global microcellular plastics market trends, key players, market segments, application areas, and market growth strategies.

Microcellular Plastics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 93 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Armacell, INOAC CORPORATION, BASF SE, Trinseo, SABIC, Formosa Plastics Corporation, INEOS, LAVERGNE, Inc., RTP company, TotalEnergies SE |

| Other Key Market Players | microgreen Polymers, ABC Group, Horizon Plastics, Gracious Living Innovations, |

Analyst Review

According to the opinions of various CXOs of leading companies, the microcellular plastics market is driven by increasing demand for microcellular plastics in the building & construction industry. Microcellular plastics are utilized in materials such as polyvinyl chloride for building and construction items in pipes, cables, window profiles, flooring, and roofing, which gives construction materials safety and cost-effectiveness while also helping to decrease environmental impacts. However, the availability of substitutes is expected to restrain industry expansion.

The global microcellular plastics market was valued at $47.6 billion in 2021, and is projected to reach $93 billion by 2031, growing at a CAGR of 7.1% from 2022 to 2031.

Increase in demand for microcellular plastics in food packaging and building & construction industries drives the growth of the microcellular plastics market.

Food packaging is the leading application of Microcellular Plastics Market.

Asia-Pacific is the largest regional market for Microcellular Plastics.

Major players operating in the global microcellular plastics market include Armacell, BASF SE, Formosa Plastics Corporation, INEOS, INOAC CORPORATION, LAVERGNE, Inc., RTP Company, SABIC, TotalEnergies, and Trinseo.

Loading Table Of Content...