Microcellular Polyurethane Foam Market Outlook - 2026

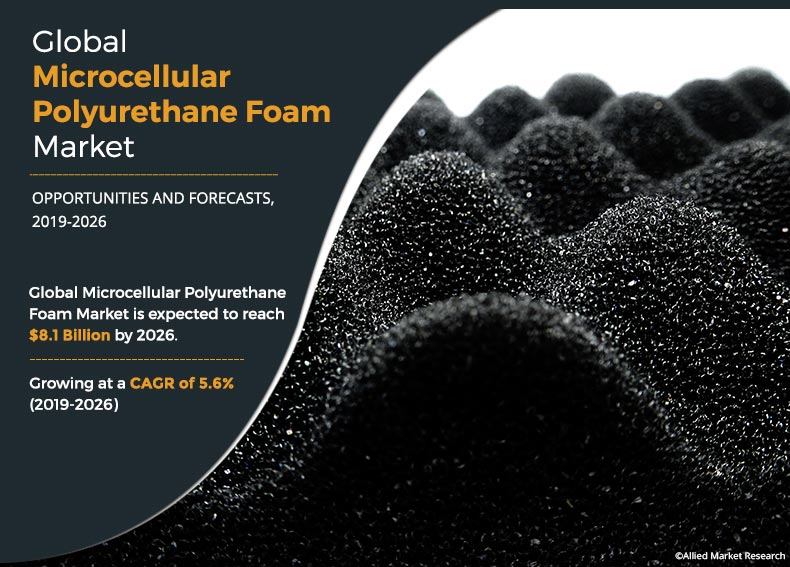

Microcellular polyurethane foam market accounted for revenue of $5.2 billion in 2018 and is anticipated to generate $8.1 billion by 2026. The microcellular polyurethane foam market is projected to experience growth at a CAGR of 5.6% from 2019 to 2026.

Microcellular polyurethane foam is flexible, open cell, and closed cell urethane foam that is very economical possess excellent resistance to compression set. The foam has good cushioning, sealing, and vibration control due to very low compression properties. Also, the open cell structure allows gas and vapors to pass through the material. It can also be formulated to form an integral skin, as it is mechanically mixed, and hence the cell size is more uniform. Automotive application accounts for the largest share of the global microcellular polyurethane foam market due to its use in cushioning as well as in bodies of the car, where their insulation properties provide protection against heat and noise of the engine. Microcellular polyurethane foam is used in electrical potting compounds, seals & gaskets, automotive bushings, durable elastomeric wheels & tires, hard plastic parts, and carpet underlay.

The factors that drive the growth of microcellular polyurethane foam market application areas such as automotive, aerospace, and construction industries. The use of microcellular foams in several parts of auto vehicles, aircrafts, medical, and in insulation in housing constructions have led to increase in demand for such foam. Moreover, increase in consumer spending in emerging economies also drive the growth of microcellular polyurethane foam market. However, volatile raw material prices hamper the microcellular polyurethane foam market growth as fluctuations in the prices influences the process of production. Moreover, environmental impact related to raw materials used are strictly regulated by many governing bodies with goal to reduce carbon footprint. This limits the global microcellular polyurethane foam market growth.

The microcellular polyurethane foam market is segmented based on type, application, and region. Based on type, the market is bifurcated into high density foam and low-density foam. Based on application, the market is divided into automotive, building & construction, electronics, medical, aerospace and others. Based on region, the microcellular polyurethane foam market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

The key players in microcellular polyurethane foam industry are BASF SE, Dow Inc., SAINT-GOBAIN, Huntsman Corporation, Evonik Industries, INOAC Corporation, Rogers Corporation, Rubberlite Inc., Mearthane Products Corporation, and Kuraray Co., Ltd. The key players adopted several strategies such as acquisition to sustain the intense competition in the microcellular polyurethane foam market.

Based on type, the segment is divided into high density and low density foam. Low density foam segment is further divided into semi-rigid and others. Low density foam dominates the microcellular polyurethane foam market share while high density foam is expected to grow at faster pace. In low density foam, others type is dominating the market hold while the semi-rigid foam is expected to grow at faster pace. The high density foam market is expected to grow at higher pace owing to the layering benefits.

By Type

Low Density Foam is projected as the most lucrative segment.

Based on application, the market is segmented into automotive, building & construction, medical, electronics, aerospace, and others. Microcellular polyurethane foams can be found in armrests & headrests, seats, cushioning properties to reduce stress and fatigue while driving. Automotive segment is leading the market with largest share and is also expected to grow at higher pace. The building & construction segment follows the automotive segment owing to the increased use of such foams in insulation, freezing, cooling and so on.

By Application

Automotive is projected as the most lucrative segment.

Based on the region, North America is expected to be the fastest growing region in the microcellular polyurethane foam market owing to the presence of major corporation in the region. U.S. dominates the market in the North America region and is expected to grow at higher pace. Asia-Pacific has the highest market share owing to the increased investments in the emerging economies in the microcellular polyurethane foam industry. China dominates the Asia-Pacific microcellular polyurethane foam market followed by Japan. India is expected to experience growth in the region owing to increased investments in the market.

By Region

North America is projected as the most lucrative market.

Key Benefits for Microcellular Polyurethane Foam Market:

- The report provides an in-depth analysis of the forecast along with the current and future microcellular polyurethane foam market trends

- This report highlights the key drivers, opportunities, and restraints of the microcellular polyurethane foam market along with the impact analyses during the forecast period

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the microcellular polyurethane foam industry for strategy building

- A comprehensive analysis of the factors that drive and restrain the growth of microcellular polyurethane foam market.

- The qualitative data in this report aims on market dynamics, trends, and developments for microcellular polyurethane foam market.

- The microcellular polyurethane foam market size is provided in terms of volume and revenue

Microcellular Polyurethane Foam Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Saint Gobain S.A., Dow Inc., Kuraray, Evonik Group, BASF SE, Mearthane Products Corporation, INOAC Corporation, Huntsman Corporation, Rubberlite Inc., Rogers Corporation |

Analyst Review

The microcellular polyurethane foam market is anticipated to grow at a considerable rate during the forecast period. This is attributed to the rise in demand for such foam from developing economies owing to an increase in investment in the automotive, building & construction sectors, medical, electronics, power, manufacturing, mining and so on. Along with the rise in demand from developing economies, the developed regions such as North America also contributed dominantly to the market owing to the presence of key players. The technological advancements in the automotive and aerospace industries for continuous efforts to reduce the weight of vehicle and aircraft have surged the adoption of microcellular polyurethane foam. The microcellular polyurethane foam market will grow at steady pace as they are widely being adapted in the industry for benefits such as cushioning purposes, insulation properties, protection against heat and noise and light-weighting. Low density foam dominates the market share but the rise in demand for high density foam is expected to surge as they can be used freely for layering. However, the market will experience restrain owing to volatile raw material process and several strict rules and regulations from governing bodies on part of the raw materials being used.

Loading Table Of Content...