Microinsurance Market Overview

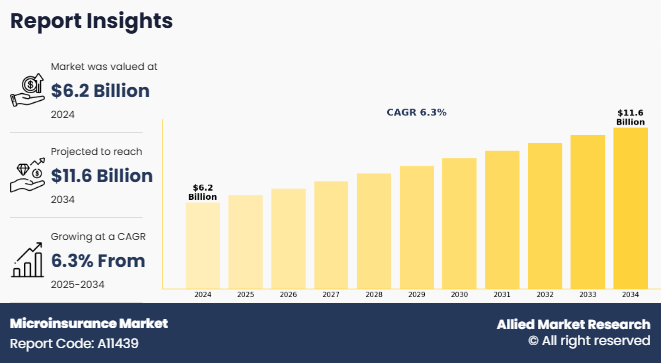

The global microinsurance market size was valued at $6,704.7 million in 2024, and is projected to reach $11.570.5 million by 2034, growing at a CAGR of 6.3% from 2025 to 2034. Rising demand for financial inclusion and insurance awareness, coupled with affordable product needs and supportive government policies, are contributing to the growth of the market.

Market Dynamics & Insights

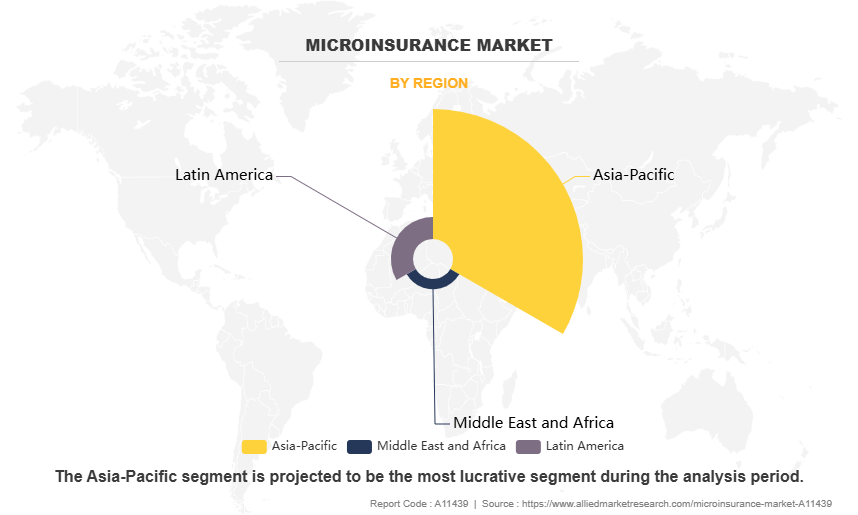

- The microinsurance market industry in Asia-Pacific held the largest share of 75% in 2024.

- By type, the life and accident microinsurance segment dominated the segment in the market, accounting for the revenue share of 52% in 2024.

- By distribution channel, the agents and brokers segment dominated the industry in 2024 and accounted for the largest revenue share of 62%.

- By payment mode, the digital payment segment is the fastest growing segment in the market, growing at a CAGR of 8.6% from 2025 to 2034.

Market Size & Future Outlook

- 2024 Market Size: $6.7 Billion

- 2034 Projected Market Size: $11.5 Billion

- CAGR (2025-2034): 6.3%

- Asia-Pacific: dominated the market in 2024

- Latin America: Fastest growing market

What is Meant by Microinsurance

Microinsurance is insurance designed specifically for low-income individuals and families, offering affordable products and tailored coverage to help them manage financial risks and recover from losses. Microinsurance is specifically intended for the protection of low-income people, with affordable insurance products to help them cope with and recover from financial losses. Life microinsurance, for instance, provides coverage that ensures beneficiaries receive financial support in the event of the policyholder's death, helping families manage funeral costs or other financial burdens. It allows them to access a financial security network that would otherwise be beyond their reach. It offers private coverage for situations such as illness, accidents, fire, theft, or car accidents.

Key Takeaways

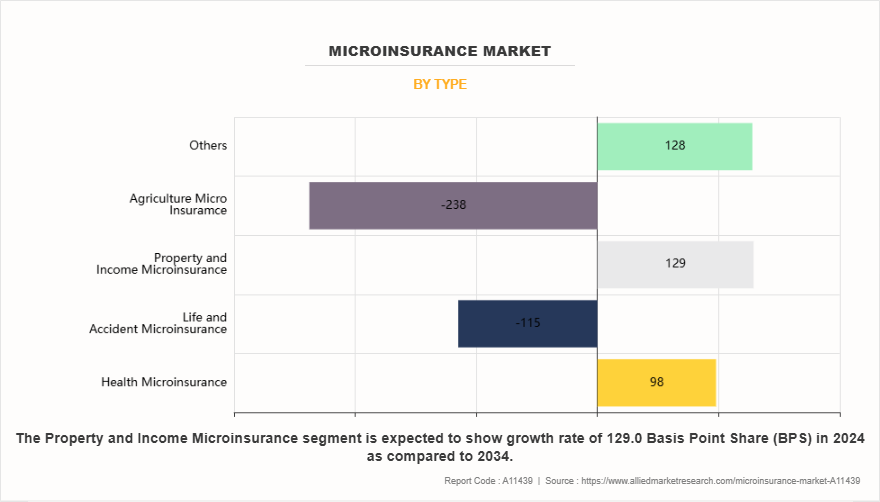

- By Type, the life and accident microinsurance segment held the largest share in the microinsurance market for 2024.

- By Distribution Channel, the agents and brokers segment held the largest share in the microinsurance market for 2024.

- By Payment Mode, the cash segment held the largest share in the microinsurance market for 2024.

- Region-wise, Asia-Pacific held the largest market share in 2024. However, Latin America is expected to witness the highest CAGR during the forecast period.

Factors such as the rise in the demand for financial inclusion and an increase in awareness of insurance benefits, leading to the surge in the demand for affordable insurance products, positively impacted the growth of the microinsurance market. In addition, the government's initiatives and regulatory frameworks in supporting the expansion of microinsurance are expected to fuel the growth during the microinsurance market forecast period. Furthermore, the upsurge in the adoption of digitalization and technology integration in the microinsurance industry is expected to provide remunerative growth opportunities for the microinsurance market in the upcoming years. In addition, a rise in healthcare costs and limited access to quality services in many developing countries have led to an increase in the need for affordable health insurance products, further contributing to microinsurance market growth.

Microinsurance Market Segment Review

The microinsurance market is segmented into distribution channel, type, payment mode, and region. On the basis of distribution channel, the market is segmented into agents and brokers, financial institutes, MNO (Mobile Network Operator), and others. By type, it is classified into health microinsurance, life and accident microinsurance, property and income microinsurance, and agriculture microinsurance. As per payment mode, it is segregated into direct debit and standing order, digital payment, cash, and others. Region-wise, it is analyzed across Asia-Pacific, Latin America, and Middle East and Africa.

On the basis of type, the global microinsurance market share was dominated by the life and accident microinsurance segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the growing demand for life insurance products that cover funeral costs, death benefits, and even healthcare, which is particularly relevant in regions with high rates of poverty and insufficient social safety security. In addition, there is growing emphasis on products that cater to low-income families and individuals, often with coverage for life, health, funeral, and accident coverage. However, the health microinsurance segment is expected to experience the highest growth during the forecast period. This segment is experiencing increasing health needs driven by factors such as rising healthcare costs, aging populations, and the growing prevalence of chronic diseases.

Region wise, Asia-Pacific dominated the market share in 2024 for the microinsurance market. This is due to increase in the adoption of customized products offering a wide range of products, including health, agriculture, property, and life insurance, tailored to meet the diverse needs of low-income populations and shift in preference towards digital microinsurance solutions, driven by increase in mobile technology usage and internet penetration, contributing significantly to the region's microinsurance market growth. However, Latin America is expected to experience the fastest growth during the forecast period. The region is experiencing an increase in the use of mobile phones for premium payments and claims processing, enhancing accessibility and the government subsidies and support in expanding microinsurance coverage, which is expected to provide lucrative growth opportunities for the microinsurance market in the region.

Competition Analysis

The report analyzes the profiles of key players operating in the microinsurance market, are Hollard Insurance, Safaricom, MicroEnsure, HDFC ERGO General Insurance Company Limited, HelloPe Financial Services Pvt Ltd, BIMA MILVIK, Metlife inc (American Life Insurance Company - Nepal), Ahotopa Teledokta, Star Health and Allied Insurance Co Ltd., National Insurance VimoSEWA Cooperative Ltd., Milliman, Inc., Blue Marble Micro Limited, Microserfin, Howden Group Holdings Ltd., and Crest Micro Life Insurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the microinsurance industry.

What are the Recent Developments in the Microinsurance Market

- In September 2024, Howden Group Holdings Ltd. acquired the Microinsurance Catastrophe Risk Organisation (MiCRO) to enhance their support for underserved populations in Guatemala and other Latin American countries. MiCRO specializes in designing and implementing parametric insurance solutions that provide swift payouts based on predefined triggers, such as natural disasters. This acquisition aims to scale access to microinsurance, helping vulnerable communities recover quickly from climate-related events. During the 2024 rainy season, MiCRO's insurance products facilitated over $2 million in payouts to more than 46,000 individuals affected by flooding and landslides in Guatemala.

- In March 2025, Blue Marble Micro Limited launched the Blue Marble Impact Reinsurance Facility, a global initiative designed to expand parametric climate insurance coverage for underserved communities across Latin America, Africa, and Asia. This facility, backed by Zurich Insurance and a consortium of global reinsurers, aims to close the protection gap for communities vulnerable to climate shocks by offering trigger-based parametric coverage for risks such as cyclones, drought, excess rainfall, extreme temperatures, hurricanes, and storm.

- In August 2024, Milliman, Inc. launched a new platform called Milliman Connect, designed to unify data and systems for group and worksite insurers. This platform aims to streamline operations, enhance data integration, and improve overall efficiency for insurers. By leveraging advanced technology, Milliman Connect helps insurers manage their data more effectively, leading to better decision-making and improved service delivery for their clients.

What are the Top Impacting Factors in Microinsurance Market

Driver

Increasing demand for financial inclusion

The increase in the demand for financial inclusion is a significant driver of the microinsurance market. Microinsurance offers affordable insurance products tailored to low-income individuals who might not have access to traditional insurance. By providing financial security, microinsurance helps people in low-income or rural areas by offering affordable coverage, reducing their financial risks from events like health emergencies or natural disasters. In addition, microinsurance boosts economic stability by encouraging savings and investment for future emergencies. It helps low-income families stay financially secure during illness, death, or disasters, preventing them from falling into deeper poverty and supporting overall economic resilience. Moreover, the surge in the partnerships between governments, NGOs, and providers has led to more effective and widespread access to microinsurance, helping to reach more people in need, improve financial security, and reduce poverty. These factors are expected to contribute to the growth of the microinsurance market.

Moreover, microinsurance promotes inclusive Insurance by providing affordable coverage in rural areas where traditional insurance is limited. It empowers vulnerable groups, like low-income individuals, women, and marginalized communities, by giving them access to financial services that help improve their economic well-being and future planning. In addition, the growing demand for microinsurance in regions prone to natural disasters like floods, droughts, or hurricanes enables affected populations to rebuild their lives more quickly, reducing the long-term economic impact on communities, augments the growth of the mircoinsurance market. For instance, in September 2024, The Reserve Bank of Fiji (RBF) scaled up its parametric micro-insurance efforts through a new partnership with SUN Insurance, Tower Insurance, and the InsuResilience Solutions Fund (ISF). This initiative aimed to enhance financial resilience among vulnerable communities in Fiji by making parametric insurance more affordable for low-and-middle-income households and micro, small, and medium enterprises (MSMEs). This partnership focuses on developing tailored insurance products, enhancing local capacities, and building a sustainable insurance market, thus contributing to microinsurance market growth.

Restraints

Limited long-term commitment

The major challenge for the growth of the microinsurance market is the limited long-term commitment from both insurers and policyholders. Low-income individuals often face financial instability, making it difficult for them to commit to long-term policies, as their priorities shift frequently due to changing life circumstances. Microinsurance products are often perceived as offering less coverage and fewer benefits than traditional insurance, which can make customers doubt their value over time. This makes them less likely to renew or remain engaged with the product. In addtion, microinsurance policies are often short-term and need to be renewed frequently. This creates a relationship between the insurer and the customer that focuses on individual transactions rather than building a long-lasting connection. As a result, customers may leave or not renew their policies often, making it difficult for insurers to keep their business stable and profitable in the long run. Moreover, the lack of long-term commitment significantly weakens the stability of the risk pool, making it more challenging to manage liabilities effectively. This instability leads to increased uncertainty and financial strain on the system. Additionally, lack of trust and a limited understanding of the benefits associated with microinsurance serve as barriers to ongoing participation. This reluctance to engage not only hampers customer retention but also negatively impacts the overall sustainability and success of the microinsurance market. To address these challenges, microinsurance models need to develop strategies that increase value by offering more benefits or making the product more useful, build trust, and encourage long-lasting customer relationships.

Opportunity

Digitalization and technology integration

The increase in digitalization and technology integration presents a significant microinsurance market opportunity to expand its reach, enhance accessibility, and improve efficiency in service delivery. The surge in the adoption of digital platforms has led to quick and seamless onboarding with features like online registration, e-signatures, and easy payment methods, allowing customers to instantly access microinsurance products without long wait times. In addition, through digital platforms, insurers can offer tailored products such as micro-health insurance or crop insurance for farmers, improving financial protection against health-related and environmental risks. Furthermore, rise in use of digital tools such as IoT devices like weather sensors, agricultural sensors help insurers to enhance risk assessment and monitoring capabilities, resulting in more accurate pricing and improved underwriting models, offers remunerative opportunities for the growth of the microinsurance market.

Moreover, the upsurge in the use of blockchain technology providing transparency and security in insurance transactions, allowing customers to track claims and premiums in real-time, reducing fraud and boosting customer confidence, offers new avenues for the growth of the microinsurance market. In addition, the increase in use of smart contracts on blockchain enables insurers to automate and enforce policies based on pre-set conditions, minimizing human error and speeding up claims processing. Furthermore, the integration of advanced technology helps insurers to create innovative models like pay-as-you-go insurance, where customers only pay for coverage when they need it, making insurance more flexible and affordable. For instance, in December 2024, Bboxx partnered with RADIANT YACU and launched Bboxx Protect, a microinsurance product offering affordable and comprehensive coverage for electric motorbike (EV) riders in Rwanda. This PAYGo (pay-as-you-go) model provides insurance at over 40% lower than the average market rate, saving riders up to 44% annually. Bboxx Protect aims to increase insurance accessibility and affordability, addressing Rwanda‐™s low insurance penetration and encouraging the transition from traditional internal combustion engine bikes to EVs. This partnership is expected to drive significant growth in the microinsurance market by addressing the needs of underserved population.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the microinsurance market segments, current trends, estimations, and dynamics of the microinsurance market analysis from 2024 to 2034 to identify the prevailing microinsurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the microinsurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution in the global microinsurance market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global microinsurance market trends, key players, market segments, application areas, and market growth strategies.

Microinsurance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 11.6 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Type |

|

| By Distribution Channel |

|

| By Payment Mode |

|

| By Region |

|

| Key Market Players | HelloPe Financial Services Pvt Ltd, Blue Marble Micro Limited, National Insurance VimoSEWA Cooperative Ltd., BIMA MILVIK, Howden Group Holdings Ltd., HDFC ERGO General Insurance Company Limited, Star Health and Allied Insurance Co Ltd, Safaricom PLC, Crest Micro Life Insurance, Microserfin, Milliman, Inc., Metlife Inc (American Life Insurance Company - Nepal), MicroEnsure, Ahotopa Teledokta, Hollard Insurance |

Analyst Review

The microinsurance market is experiencing significant growth, fueled by increasing consumer awareness of affordable risk protection and the rising need for financial security among underserved populations. Microinsurance offers a cost-effective alternative to traditional insurance products, providing accessible coverage for low-income individuals and families who may not have the financial means for conventional insurance. In addition, the expansion of mobile technology and digital platforms has boosted the adoption of microinsurance, allowing for simplified policy enrollment, payment, and claims processing. This ease of access, coupled with the growing demand for health, life, and asset protection, is expected to drive the market growth, particularly in emerging markets where insurance penetration remains low.

Furthermore, the technological advancements in mobile technology and digital platforms are driving the growth of the microinsurance market. Microinsurance products are now integrated with mobile apps and digital wallets, allowing easy access to policies, payments, and claims through smartphones. These innovations are appealing to those who value convenience and digital-first solutions in their financial and insurance decisions. In addition, the increase in use of AI and data analytics enhances risk assessment and pricing, making microinsurance more personalized and accessible. Furthermore, partnerships between fintech startups and traditional insurers are opening new avenues for delivering especially in emerging markets. These advancements present significant opportunities for insurers to tap into the growing demand for flexible, low-cost insurance solutions.

Moreover, government policies and regulations aimed at promoting financial inclusion and expanding access to affordable insurance are also driving the growth of the microinsurance market. In many regions, governments are encouraging the use of microinsurance to protect low-income populations, particularly in the areas of health, life, and agricultural insurance. Initiatives such as subsidies and tax incentives for insurers that offer microinsurance products are further accelerating adoption. However, challenges persist, particularly around regulatory compliance, fraud prevention, and ensuring transparent claims processing. Protecting consumers' personal data and ensuring fair pricing models are critical concerns for the industry. Despite these challenges, the microinsurance market is expected to continue growing, as more consumers and businesses seek affordable risk protection solutions, particularly in emerging markets where insurance penetration remains low.

The microinsurance market is expected to witness notable growth due to a rise in demand for financial inclusion and an increase in awareness of insurance benefits.

The microinsurance market is projected to reach $11,570.5 million by 2034.

The microinsurance market is estimated to grow at a CAGR of 6.3% from 2025 to 2034.

The key growth strategies of microinsurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

The key players profiled in the report include Hollard Insurance, Safaricom, MicroEnsure, HDFC ERGO General Insurance Company Limited, HelloPe Financial Services Pvt Ltd, BIMA MILVIK, Metlife inc (American Life Insurance Company - Nepal), Ahotopa Teledokta, Star Health and Allied Insurance Co Ltd., National Insurance VimoSEWA Cooperative Ltd., Milliman, Inc., Blue Marble Micro Limited, Microserfin, Howden Group Holdings Ltd., and Crest Micro Life Insurance.

Loading Table Of Content...

Loading Research Methodology...