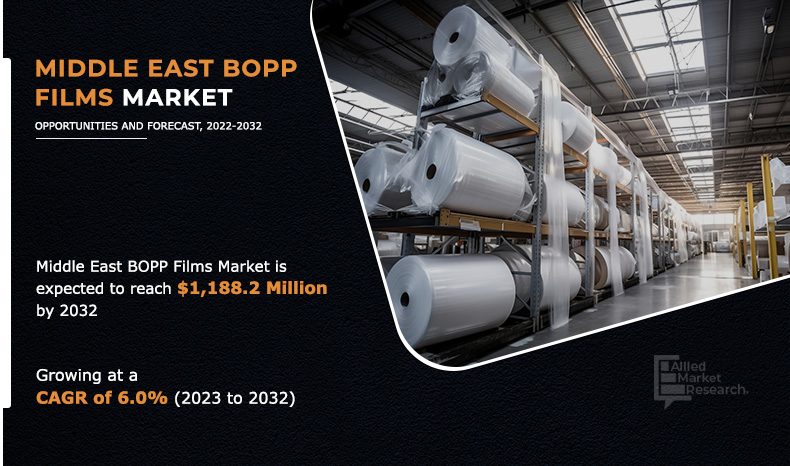

Middle East BOPP Films Market Outlook -2032

The Middle East BOPP Films market was valued at $677.5 million in 2022, and is projected to reach $1,188.2 million by 2032, registering a CAGR of 6.0% from 2023 to 2032.

BOPP (Biaxially Oriented Polypropylene) films are a type of plastic film made from polypropylene (PP) resin. They are one of the most popular packaging materials in use today due to their clarity, strength, barrier properties, and printability. "Biaxially oriented" means that the film has been stretched in two directions, which enhances its mechanical and barrier properties.

BOPP film is produced using a tender frame sequential process. The polypropylene is melted and extruded through a flat die onto a chill roll where it is quenched, then reheated and stretched in the machine direction. After this, it is again stretched in the transverse (perpendicular) direction. This biaxial orientation increases the film strength and sets its shrink properties.

BOPP films are clear and transparent, which makes them ideal for packaging products where visibility is a benefit. BOPP films are mechanically strong, especially in the transverse direction due to the biaxial orientation. In addition, BOPP films are a good barrier to water vapor but have moderate barrier properties to gases such as oxygen. They are often metalized or coated with special layers to improve their barrier properties. They have an excellent print surface, making them suitable for high-quality printing applications.

The demand for BOPP (Biaxially Oriented Polypropylene) films in the Middle East is influenced by a combination of regional specificities and global trends. Cities across the Middle East, especially in GCC countries like the UAE, Qatar, and Saudi Arabia, have been witnessing rapid urbanization and modernization.

This trend has led to a growth in the consumer goods sector, boosting demand for packaging materials, including BOPP films. The retail and fast-moving consumer goods (FMCG) sectors have expanded in the region, with many global brands establishing their presence. The need for high-quality packaging for these products drives the demand for BOPP films.

Increase in demand for BOPP films from the food & beverage industry.

The Middle East has witnessed a rise in the food and beverage sector, particularly packaged foods. BOPP films are extensively used in the packaging of various food products due to their excellent moisture barrier properties. Urbanization has transformed consumer behaviours in the Middle East. There is a growth in preference for convenience food, including ready-to-eat meals and snacks as more people move to cities and lead busier lives, all of which necessitate quality packaging. BOPP films, with their superior protective qualities, ensure that these products remain fresh and are presented attractively on store shelves.

The expansion of the middle-class income group in the region has more disposable income, leading to increased consumption of a broader range of food products. There is a higher demand for packaged goods from both local and international brands, driving the need for BOPP films, as tastes diversify.

The rapid expansion of modern retail spaces, including supermarkets and hypermarkets, in the Middle East has fuelled the demand for aesthetically pleasing and durable packaging. The clarity and printability of BOPP make it a favoured choice for brands aiming to stand out in competitive retail environments. There is a strong emphasis on packaging that ensures product integrity with an increase in awareness about food safety and hygiene. BOPP films offer a robust barrier against contaminants, ensuring that food products remain uncontaminated from production until they reach the consumer.

Availability of raw materials

The Middle East is rich in petrochemical resources, especially oil and gas, which provide primary raw materials to produce polypropylene. This abundance results in competitive raw material costs, creating an advantageous position for BOPP film manufacturers in the region. Polypropylene, a thermoplastic polymer, is derived from propylene monomer, which is a byproduct of oil refining and natural gas processing. Given vast reserves of these hydrocarbons in the Middle East, the region inherently holds a competitive edge in producing propylene at reduced costs.

Countries such as Saudi Arabia, Qatar, and the UAE are among the top holders of proven oil and gas reserves globally. These hydrocarbons are essential feedstocks for various petrochemical derivatives, including propylene, which is the monomer used to produce polypropylene. Given the readily available feedstock, several countries in the Middle East have invested heavily in polypropylene production facilities.

This high production capability aligns perfectly with the requirements for BOPP film manufacturing, ensuring that raw material supply remains consistent. The proximity and abundance of these raw materials mean reduced costs in feedstock procurement. It results in competitive production costs for BOPP films, when coupled with low energy costs in the region, enabling Middle East manufacturers to offer products at competitive prices in both domestic and international markets.

Many Middle East countries, especially those rich in oil and gas, have populations with a high disposable income. This leads to increased consumption of packaged goods, further pushing the demand for BOPP films. The Middle East imports a significant portion of its food, which requires effective packaging to ensure freshness and quality during transit. BOPP films, known for their clarity and barrier properties, are preferred for packaging various food items. There is a push for recyclable packaging solutions in the region with an increase in awareness about environmental concerns. Given that BOPP films are recyclable, they find Favor among businesses looking for sustainable packaging options.

Growth in environmental concerns has made industries turn toward sustainable and recyclable packaging materials. BOPP films are recyclable and hence have gained traction. Companies seek to showcase their commitment to sustainability, and using recyclable materials like BOPP can be a part of that strategy. The push for a circular economy, where materials are reused or recycled drives the demand for BOPP films.

The availability of various alternative packaging materials such as PLA (Polylactic Acid), which is a biodegradable polymer derived from renewable resources such corn starch or sugarcane. Bioplastics might be preferred over traditional plastics such as BOPP as industries seek sustainable alternatives. This hinders the demand for BOPP films.

The Middle East BOPP films market is segmented into type, end-use industry, and countries. On the basis of type, the market is divided into laminated BOPP film, industrial BOPP film, metallized BOPP film, packaging BOPP film, label BOPP film and others. On the basis of end-use industry, it is segregated into food, beverage, pharmaceutical and medical, industrial and others. Countries covered in the report are Saudi Arabia, GCC countries and Rest of Middle East.

Middle East BOPP Films Market, by Type

By type, packaging BOPP film segment dominated the Middle East BOPP Films market in 2022. The Middle East is experiencing a surge in demand for Biaxially Oriented Polypropylene (BOPP) film for packaging applications. This growth is driven by the region's expanding food and beverage industry, e-commerce, and consumer goods sectors, all of which rely heavily on BOPP film for its excellent barrier properties, durability, and aesthetic appeal. With increased consumer awareness of packaging quality and sustainability, BOPP film manufacturers in the Middle East are poised for substantial growth as they cater to these evolving market needs.

By Type

Metalized BOPP Film is projected as the fastest-growing segment.

Middle East BOPP Films Market, by End-Use Industry

Based on end-use industry, food segment dominated the Middle East BOPP Films market in 2022. The Middle East's food industry is witnessing a surge in demand for Biaxially Oriented Polypropylene (BOPP) film, owing to its exceptional packaging properties. BOPP film's moisture resistance, transparency, and shelf-life extension capabilities make it an ideal choice for packaging food products, ensuring their freshness and quality while meeting the region's growing appetite for packaged and processed foods.

By End-use Industry

Pharmaceutical and Medical is projected as the fastest-growing segment.

Middle East BOPP Films Market, by Country

Based on country, the Rest of Middle East dominated the Middle East BOPP Films market in 2022. The growing packaging industry, increased consumer awareness of product quality, and sustainability concerns are key factors fueling this demand. BOPP films offer excellent barrier properties, transparency, and printability, making them a preferred choice for various packaging needs in the Middle East region.

The key players operating in the Middle East BOPP Films market Rowad, Gulf Packaging Industries Limited Ltd., Qingdao Kingchuan Packaging, COPACK Company, Flex Films, Taghleef Industries, Polyplex, POLIBAK, Jindal Films and Cosmo Films.

By Countries

Saudi Arabia is projected as the fastest-growing country.

Key Benefits For Stakeholders

- The report includes in-depth analysis of different segments and provides market estimations between 2022 and 2032.

- A comprehensive analysis of the factors that drive and restrict the growth of the Middle East BOPP Films market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and forecast are based on factors impacting the Middle East BOPP Films market growth, in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current Middle East BOPP Films market trends and future estimations from 2022 to 2032, which help identify the prevailing market opportunities.

Middle East BOPP Films Market Report Highlights

| Aspects | Details |

| By Type |

|

| By end-use Industry |

|

| By Key Market Players |

|

Analyst Review

According to the insights of the CXOs of leading companies, The Middle East, being rich in oil and gas, is a significant hub for petrochemical industries. This abundance offers competitive raw material prices, which can be a competitive advantage in BOPP film production.

The rise in consumption of packaged goods, driven by urbanization, a growth in middle-class income groups, and changes in lifestyle, has increased the demand for BOPP films in the region. Political instability in certain parts of the Middle East poses risks to supply chains and operations. The region faces intense competition from established BOPP players in Southeast Asia and Europe.

The region has seen an increase in intra-regional trade agreements, which can benefit businesses operating in multiple Middle East countries. Investing in R&D to innovate and produce high-quality films is expected to be essential to stay ahead of competitors. The BOPP industry in the Middle East is expected to position itself as a leader by adopting eco-friendly practices, using renewable energy, and innovating in sustainable product offerings with a global shift towards sustainability.

ncrease in demand for BOPP films from the food & beverage industry is the key factor boosting the Middle East BOPP Films market growth

The Middle East BOPP films market attained $677.5 million in 2022 and is projected to reach $1,188.2 million by 2032, growing at a CAGR of 6% from 2023 to 2032.

The key players operating in the Middle East BOPP Films market include Rowad, Gulf Packaging Industries Limited Ltd., Qingdao Kingchuan Packaging, COPACK Company, Flex Films, Taghleef Industries, Polyplex, POLIBAK, Jindal Films and Cosmo Films.

Availability of raw materials is the main drivers of Middle East BOPP Films market

The Middle East BOPP films market is segmented into type, end-use industry, and countries. On the basis of type, the market is divided into laminated BOPP film, industrial BOPP film, metallized BOPP film, packaging BOPP film, label BOPP film and others. On the basis of end-use industry, it is segregated into food, beverage, pharmaceutical and medical, industrial and others. Countries covered in the report are Saudi Arabia, GCC countries and Rest of Middle East.

Growth in environmental concern is the restraint factor of Middle East BOPP Films market

Packaging BOPP film is the dominating segment based on type

Loading Table Of Content...