The Middle East unsecured business loans market has been witnessing significant growth during the forecast period, owing to surge in demand for capital that businesses require to sustain and grow their operations. However, risks associated with unsecured loans is one of the key factors restraining the market growth. Moreover, economic fluctuations in the region are restraining the growth of the Middle East unsecured business loans market.

On the contrary, surge in small & medium-sized enterprises (SMEs) is one of the key factors driving the market growth. These businesses lack the collateral needed for secured loans, making unsecured loans a viable option. Furthermore, rise in fintech companies and digital platforms has streamlined the loan application process, driving the market growth.

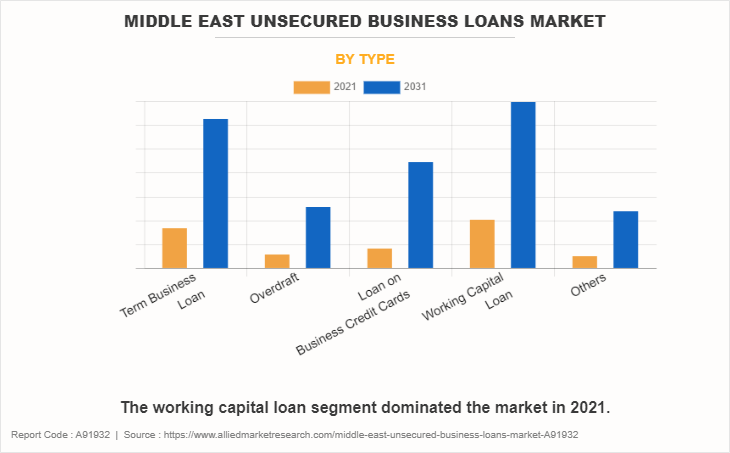

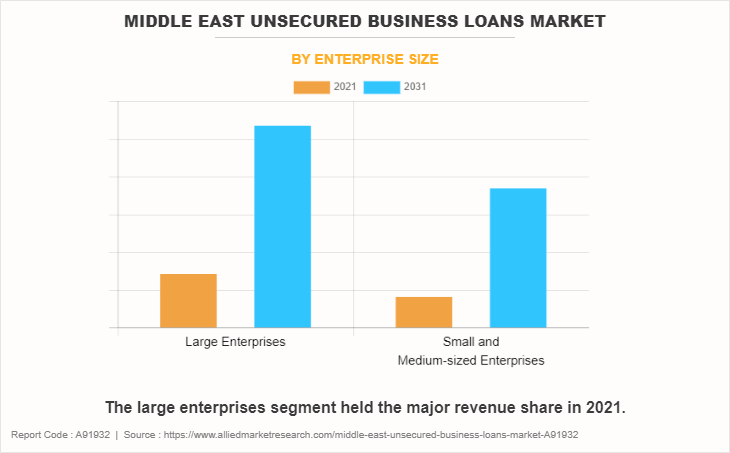

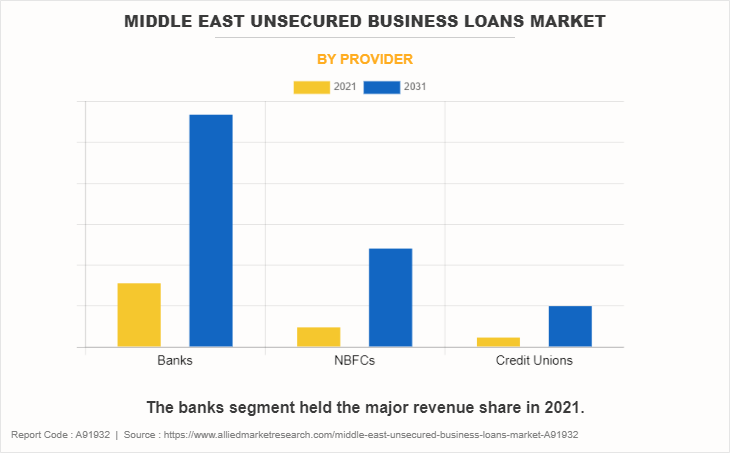

The Middle East unsecured business loans market is segmented into type, enterprise size, and provider. On the basis of type, the market is categorized into term business loan, overdraft, loan on business credit cards, working capital loan, and others. By enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. As per provider, it is fragmented into banks, NBFCs, and credit unions.

In addition, increase in adoption of alternative credit scoring methods is one of the key trends driving the market growth. Moreover, rise in peer-to-peer lending platforms in the Middle East are driving the market growth.

Furthermore, companies are investing in R&D and new product development to provide customized services to the customers. In addition, they are focusing on prioritizing consumer perceptions to offer a seamless and user-friendly experience. Moreover, lenders are concentrating on finding a balance between offering competitive interest rates to attract businesses and mitigating risks associated with unsecured lending. Digital lenders implement dynamic pricing models that assess a borrower's risk profile in real-time, allowing for flexible and competitive pricing.

The Porter's five forces analysis assesses the competitive strength of the players in the Middle East unsecured business loans market. These five forces include the bargaining power of suppliers, the bargaining power of buyers, the threat of new entrants, the threat of substitutes, and competitive rivalry. The bargaining power of suppliers is moderate due to the availability of loan options. The bargaining power of buyers is high, as they have the freedom to explore various lenders and negotiate terms. The threat of new entrants is high due to surge in fintech companies and alternative lending platforms. The threat of substitutes is moderate due to the presence of various financing methods, such as equity investment or crowdfunding. The competitive rivalry is high, as several market players compete for market share.

A SWOT analysis of the Middle East unsecured business loans market includes strengths, weaknesses, opportunities, and threats. The strengths include diversity of loan types, rise in fintech & digital platforms, and increase in focus on inclusive lending. The weaknesses include high risk associated with unsecured loans and economic fluctuations. The opportunities include adoption of alternative credit scoring methods and surge in peer-to-peer lending platforms. The threats include regulatory challenges posed by the growth of non-bank financial institutions, peer-to-peer lending platforms, and intense competitive rivalry.

The key players operating in the Middle East unsecured business loans market include Emirates NBD, Qatar National Bank (QNB), National Commercial Bank (NCB), First Abu Dhabi Bank (FAB), Riyad Bank, Saudi British Bank (SABB), Al Rajhi Bank, Mashreq Bank, Kuwait Finance House (KFH), and Commercial Bank of Dubai (CBD).

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Middle East unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of Middle East unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Middle East unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Middle East Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 73 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | First Abu Dhabi Bank (FAB), Saudi British Bank (SABB), National Commercial Bank (NCB), Qatar National Bank (QNB), Mashreq Bank, Emirates NBD, Kuwait Finance House (KFH), Commercial Bank of Dubai (CBD), Riyad Bank, Al Rajhi Bank |

The Middle East Unsecured Business Loans Market is projected to grow at a CAGR of 15.3% from 2021 to 2031

Emirates NBD, Qatar National Bank (QNB), National Commercial Bank (NCB), First Abu Dhabi Bank (FAB), Riyad Bank, Saudi British Bank (SABB), Al Rajhi Bank, Mashreq Bank, Kuwait Finance House (KFH), and Commercial Bank of Dubai (CBD) are the leading players in Middle East Unsecured Business Loans Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in middle east unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of middle east unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the middle east unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Middle East Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...