The global military aircraft communication avionics market was valued at $23.9 billion in 2020, and is projected to reach $35.0 billion by 2030, growing at a CAGR of 4.05% from 2021 to 2030.

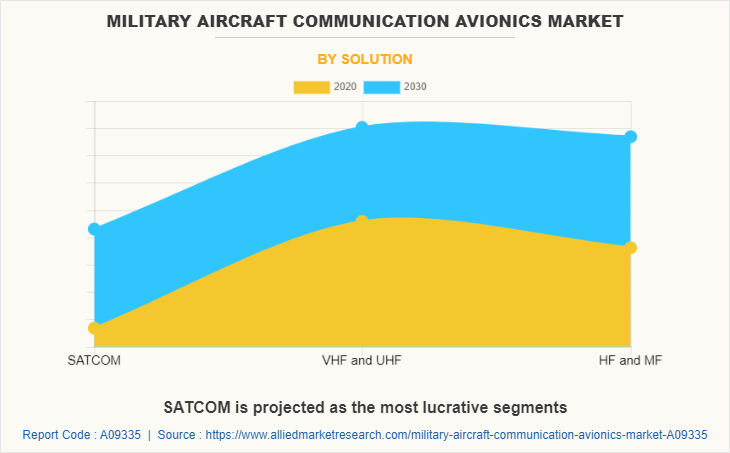

Military aircraft communication avionics can be identified as electronics and communication systems that are integrated into military aircraft. Aircraft communication avionics are used to perform air to air and air to ground communication. The form of communication can be in terms of data transfer or voice-over communications. Rise in dependency on communications and data analysis for a range of critical operations has increased demand for effective communication channels with minimum lag. Conventionally radio communication with high frequency (HF), very high frequency (VHF), and ultra-high frequency (UHF) are used for military aircraft communication, however, with the advent of satellite communication (SATCOM) technologies, new business horizons have been forecasted. Defense organizations across the globe are inclined toward integrating their military aircraft communication avionics system with SATCOM technologies as they provide notable beyond visual line of sight (BVLOS) communication capabilities on a much more secure source.

The military aircraft communication avionics market is segmented into Aircraft Type, Component, Sales Channel and Solution.

Factors such as a rise in geopolitical conflicts across the globe, increase in defense budgets, and demand to modernize communication avionics of existing aircraft fleet to support growth of the military aircraft communication avionics market during the forecast period. Countries such as Russia, China, India, and Japan have increased their defense budget by 2.9%, 4.7%, 0.9%, and 7.3%, respectively in 2021, as compared to previous years. Rise in impact of global economies and electronic component supply chain at the global level has been enormous. Degrading global trade relations and restrictions placed by several nations over others have generated demand to diversify the supply chain at the regional level in the military communication avionics industry to ensure a continuous supply of critical components. Shortage in supply of electronics chips also impact the military aircraft communication avionics market. Rise in demand for consumer electronics induced by chips, coupled with trade restrictions due to COVID-19 has generated a global shortage of electronic chips. Hence, to address rise in market challenges, defense bodies are engaged in long-term agreements with companies, mitigating short-term challenges. For instance, Finland entered into an agreement with Lockheed Martin to acquire 64 F-35A Block 4 fighter aircraft along with weapons, communication systems, and required training. The program is expected to last till 2030 and the weapons procurement will be done by 2035, depending upon the availability of funds.

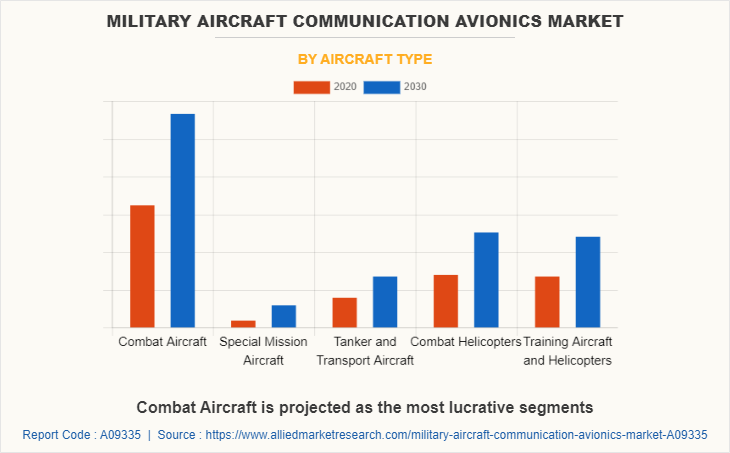

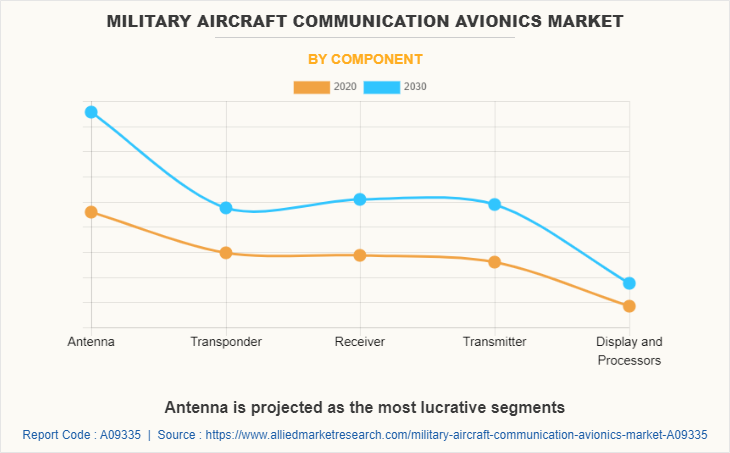

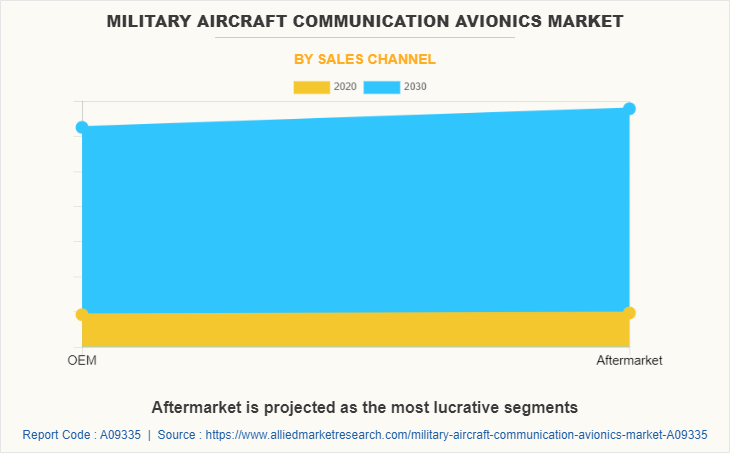

The global military aircraft communication avionics market is segmented into aircraft type, component, sales channel, solution, and region. By aircraft type, it is categorized into combat aircraft, special mission aircraft, tanker & transport aircraft, combat helicopters, and training aircraft & helicopters. Depending on component, it is fragmented into antenna, transponder, receiver, transmitter, and display & processors. By sales channel, it is divided into original equipment manufacturer (OEM), and aftermarket. The solution segment is divided into satellite communication (SATCOM), very high frequency & ultra-high frequency (VHF & UHF), and high frequency & medium frequency (HF & MF). Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Companies have adopted product development and product launch as their key development strategies in the military aircraft communication avionics industry. Moreover, collaborations and acquisitions are expected to enable leading players to enhance their product portfolios and expand into different regions. The Key players operating in the military aircraft communication avionics market are Appareo, Aspen Avionics, Avidyne Corporation, BAE System, Boeing, Cobham Limited, Honeywell International Inc., L3Harris Technologies Inc, Raytheon Technologies Corporation, and Thales Group.

Acquisition of new aircraft by major countries

Rise in geopolitical conflicts and race for acquisition of arms among major nations to establish global dominance has led to increase in their defense budget allocations, which supports aircraft acquisition activities. Nations across the globe are also undergoing research and development programs to modify their existing aircraft communication capabilities and extend their serviceable lifespan. For instance, in December 2021, Lockheed Martin received a contract worth $847 million from the U.S. Navy. According to the contract, the company is expected to provide long lead modification components for production of 105 F-35 joint strike aircraft.

Integration of SATCOM in military communication avionics

Satellite communication (SATCOM) is key for military operations as it provides beyond line-of-sight communications, which can cover around one-third of the earth on a single satellite. Satellite communications enable an aircraft to communicate via satellite with air traffic control and other ground-based facilities while in the air. It can include voice and ground service. With the arrival of internet protocol (IP)-based applications and new data-hungry cockpits, SATCOM delivers critical safety data as well as improves operational performance for present military aircraft fleets. The potential to enhance safety and efficiency of air travel is exhaustive. As military forces increasingly use space-based assets to fulfil their missions, SATCOM technologies have become vital for communications networks

In December 2019, the inception of the United States Space Force (USSF) has proved to be a turning in the global military satellite communications. With an annual budget of more than $17 billion, USSF is slowly becoming a central engine for enhancing military assets in space. While developed countries such as France already have a Space Force established before the U.S., the space fairing nations such as India and China are also trying to amplify their space applications for military. While considering the global acceleration of SATCOM in the military domain, New Space has been one of the crucial sectors to make space more accessible to military agencies. As the world progresses toward a nexus of challenges from a variety of issues, development of SATCOM is expected to be crucial for military agencies.

Integration of web 3.0 and advent of web 4.0 in military aircraft communication avionics

Access to high-speed internet connectivity has become a basic need of military organizations across the globe. Hence, to cater to the rising demand from military organizations to have better internet and communication, private companies and corporate players along with government bodies are engaged in exploring business opportunities within the sphere of web 3.0 and web 4.0. Web 3.0 can be defined as third generation internet services that focus on machine-based understanding of data to provide information driven agile solutions. Web 4.0 can be defined as a symbiotic web, allowing humans and machines to act in state of symbiosis, allowing to build more powerful solutions such as mind controlled interfaces. Artificial Intelligence (AI) and machine learning (ML) is capable of providing suggestions of critical decisions based on data driven approach can be considered in web 3.0 whereas active human machine interactions and carrying out manned and unmanned operations together can be considered as the advent of web 4.0.

Advancements and integration of such technologies pose a demand for comprehensive military aircraft communication avionics systems, which augment the business potential.

Scarcity of semiconductors

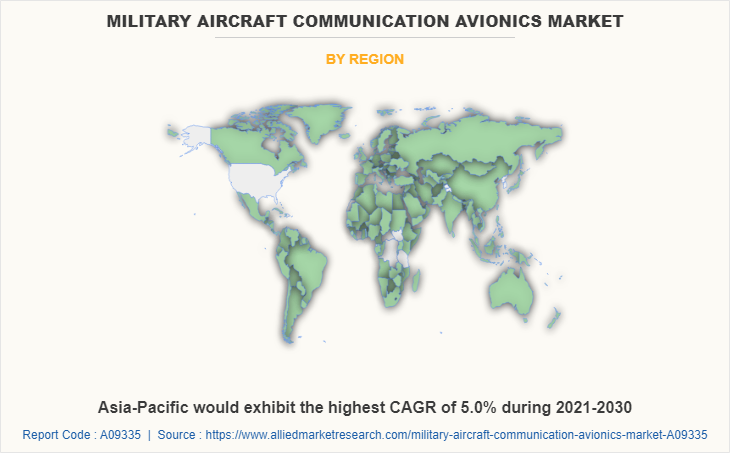

Semiconductors play a vital role in defining business opportunities within the military aircraft communication avionics market. With increase in demand for satellite communication and data driven operations, the need of electronics chips and semiconductors within the military aircraft production industry has increased over past years. Sudden rise in demand for consumer electronics on commercial front in 2020, followed by global trade and travel restrictions, owing to the COVID-19 pandemic led to a global scarcity of semiconductors, impacting manufacturing operations of military aircraft communication avionics systems. Asia-Pacific is the largest chip manufacturer, catering more than 70% of the total market share. Degrading trade and geopolitical relation between the U.S. and China is disrupting global supply chain of the semiconductors industry, impacting manufacturing side of the military aircraft communication market. Shortage in electronic chips, resulting in delayed deliveries, increased manufacturing time and rise in overhead costs are among the primary concerns challenging business opportunism.

KEY BENEFITS FOR STAKEHOLDERS

- This study presents the analytical depiction of the global military aircraft communication avionics market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall military aircraft communication avionics market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global military aircraft communication avionics market with a detailed impact analysis.

- The current military aircraft communication avionics market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Military aircraft communication avionics Market Report Highlights

| Aspects | Details |

| By Aircraft Type |

|

| By Component |

|

| By Sales Channel |

|

| By Solution |

|

| By Region |

|

| Key Market Players | Boeing, BAE System, Cobham Limited, Raytheon Technologies, Honeywell International Inc., Avidyne Corporation, L3Harris Technologies, Thales group, Aspen Avionics, Appareo |

Analyst Review

The military aircraft communication avionics market is expected to undergo a major shift in the coming years. Rise in requirement to modernize military aircraft fleet with latest communication avionics, along with the acquisition of new aircraft to strengthen existing fleet to support business potential in the coming years. For instance, as of 2021, the U.S. ordered 2,387 combat aircraft, 77 special mission aircraft, 207 tankers and transport aircraft, 1,224 combat helicopters, and 516 training aircraft & helicopters. Adoption of commercial off-the-shelf (COTS) components within the military aircraft communication avionics market is generating notable market competitiveness. Initiatives are taken by major industry players such as Honeywell to provide ruggedized COTS components, capable of matching the performance of indigenous military avionics components and are shifting the market dynamics. The primary benefits of using COTS components include reduction in costs, diversification of supply chain, flexibility in meeting design challenges, and ability to meet size, weight, price, and cost (SWaP-C) requirements. Introduction of modified COTS (MOTS) where companies manufacture a customized COTS part to meet specific military-grade requirements such as processing capabilities and ruggedization to support market competitiveness.

Design optimization through adoption of size, weight, price, and cost (SWaP-C) concept and reduction of manufacturing cost through integration of additive manufacturing processes, along with long-term service agreements has reduced the overall cost of acquisition. Such initiatives by major industry players are expected to provide new business horizons to the military aircraft communication avionics market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. Asia-Pacific is expected to maintain its lead during the forecast period, owing to the increasing military expenditure in India and China, followed by initiatives taken by these countries to develop indigenous manufacturing capabilities within the aerospace and defense vertical.

Integration of new technologies such as AI/ML, helping aircraft pilots improve their decision-making, and the advent of web 4.0 to support business growth.

Air-to-ground communication and air to air communication across military platforms are among the primary application of the military aircraft communication avionics market.

Asia-Pacific is the largest regional market for military aircraft communication avionics market

The estimated industry size of the military aircraft avionics market as of 2020 was 23,869.5 million

The Key players operating in the military aircraft communication avionics market are Appareo, Aspen Avionics, Avidyne Corporation, BAE System, Boeing, Cobham Limited, Honeywell International Inc., L3Harris Technologies Inc, Raytheon Technologies Corporation, and Thales Group.

Loading Table Of Content...