Military Antenna Market Research, 2033

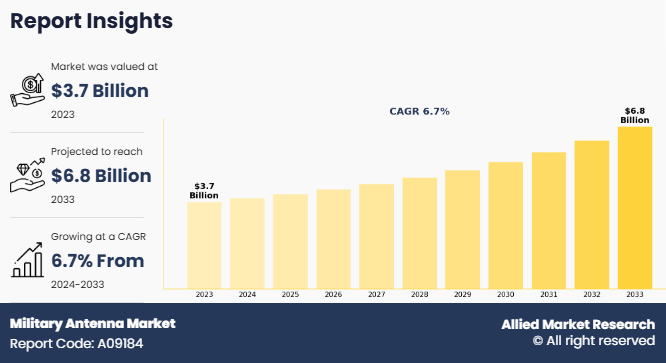

The global Military Antenna Market Size was valued at $3.7 billion in 2023, and is projected to reach $6.8 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Key Takeaways

- The Military Antenna Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global single coated adhesive tapes markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

An antenna is any device that receives and transmits electrical signals. In most cases, industries define these signals as television or radio waves. A military antenna works as a translator that converts radio frequency into alternating current. Military antennas are commonly designed for military, special operations, and government agencies worldwide. It creates a communication bridge among different countries in the world. It is generally used in naval vessels, armored vehicles, military aircraft, armored aircraft, and military ships to provide accurate tracking, better surveillance, and communication.

Currently, air defense systems used by defense forces worldwide use active phased array antennas to provide a detailed image of the area under surveillance. These have led to a rise in the demand for air defense systems across the globe and are expected to drive the military antenna market. For instance, in August 2021, Lockheed Martin Corporation announced the launch of a hybrid antenna for 5G, radar, and remote sensing applications. The new dish was termed Wide Angle ESA Fed Reflector (WAEFR) antenna and was a hybrid of a phased array Electronically Steerable Antenna (ESA) and a parabolic dish. This increased the coverage area by 190% compared to traditional phased array antennas at a much lower cost.

The factors such as the integration of military SATCOM in military communication, increasing use of electronically steered phased array antennas, and increase in demand for land-based communication systems supplement the growth of the military antenna market. However, limited bandwidth for communications and high costs associated with the development and maintenance of infrastructure are the factors expected to hamper the growth of the military antenna market. In addition, the replacement of conventional equipment with technologically advanced equipment and the rise in government expenditure for military applications creates market opportunities for the key players operating in the military antenna industry.

Integration of military SATCOM in military communication

Satellite communication (SATCOM) is key for military operations as it provides beyond line-of-sight communications, which can cover around one-third of the earth on a single satellite. Satellite communications enable an aircraft to communicate via satellite with air traffic control and other ground-based facilities while in the air. It can include voice and ground service. With the arrival of internet protocol (IP)-based applications and new data-hungry cockpits, SATCOM delivers critical safety data as well as improves operational performance for present military aircraft fleets. The potential to enhance safety and efficiency of air travel is exhaustive. As military forces increasingly use space-based assets to fulfil their missions, SATCOM technologies have become vital for communications networks. For instance, in April 2021, Comrod Communication AS. announced the launch of the UHF SATCOM dismounted antenna. It featured a fully ruggedized tripod, to provide a ground deployed remote antenna capability. In addition, it covered the full UFO waveform 292-318 / 243-270 MHz as well as MUOS 300-320 / 360-380 MHz. Moreover, in Europe, the European Union Agency for the Space Programme’s (EUSPA) Government Satellite Communications (GOVSATCOM) initiative is anticipated to accelerate research and innovation in the EU’s Common Security and Defense Policy (CSDP). For instance, in December 2021, Airbus and One Web signed a distribution partner agreement to provide low Earth orbit (LEO) satellite communication services for military and government use to European and UK armed forces, and civil protection and security forces. Hence, the adoption of satellite communication (SATCOM) in military communication avionics is expected to drive the military antenna market.

Increasing use of electronically steered phased array antennas

Steered phased antennas are a type of antenna array that comes with the feature of electronic steering to change the direction and shape of radiated signals, without any physical movement of the antenna. The phase difference between the radiated signals from each antenna in the array is responsible for this electronic steering. Thus, military platforms adopted communication on-the-move (COTM) solutions for commercial vehicles, military vehicles, trains, and boats, which has led to the greater use of electronically steered phased antennas (ESPA). For instance, in January 2021, L3Harris Technologies developed a Multi-Band Multi-Mission (MBMM) phased array ground antenna system and integrated it with the Space Force’s Satellite Communication Network system in order to demonstrate multiple simultaneous satellite contacts. Also, in 2019, the US Air Force Space and Missile Systems Center (SMC), in partnership with the Pentagon’s Defense Innovation Unit, awarded a contract to Atlas Space Operations (US) to prototype an electronically steered antenna array to support the Air Force’s multi-band, multi-mission requirements. Therefore, the increasing use of electronically steered phased array antennas for military communication systems is expected to drive the military antenna market.

High costs associated with the development and maintenance of infrastructure

The high cost of developing and maintaining earth station infrastructure is one of the major factors hindering the market growth. Most of the required components are typically custom-made or purchased from expensive commercial off-the-shelf suppliers (COTS). Additionally, designing, developing, and building an antenna and its components requires hours of work by trained personnel. The skill level required is itself a barrier to entry, requiring significant investment in the R&D, manufacturing, system integration, and assembly stages of the value chain for these systems.

Satellite communications services are used in advanced defense systems, and system failures are undesirable. These services must be accurate, reliable, durable, energy-efficient, and have a wide detection range. Companies in this market need to develop highly functional and efficient ground facilities to maintain leadership and remain competitive. Owing all such factors associated with high cost for the development and maintenance of infrastructure hinders the military antenna market growth.

Replacement of conventional equipment with technologically advanced equipment

The necessity for upgrading conventional military equipment has increased as warfare and battlefield management have changed. Modernization of defense systems is required to stay up with technological advancements on the battlefield, and this requirement is projected to propel the market forward. The goal of modernization is to improve quality, close the capability gap, and lower total costs. There has been an increase in major contracts between major defense corporations and the U.S. government for military system upgrades and such as tactical radar systems, traveling wave antennas, loop antennas, moveable tactics, light weapons, upgraded antennas, and other items. For instance, in September 2021, Southwest Antennas awarded an Indefinite Quantity Indefinite Delivery (IDIQ) contract worth $4.9 million from a major U.S. Federal Law Enforcement agency. Southwest Antennas supplied high-performance antennas, accessory products, and engineering services to support and upgrade existing communication technology along with the deployment of new systems to be used by federal law enforcement officers. Thus, upgrading conventional military equipment with technologically advanced equipment is expected to create lucrative opportunity for the military antenna market during the forecast period.

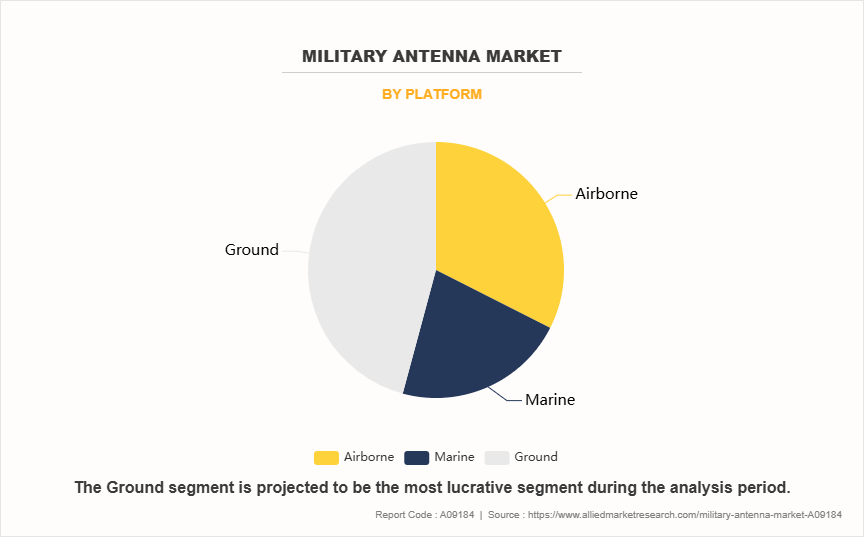

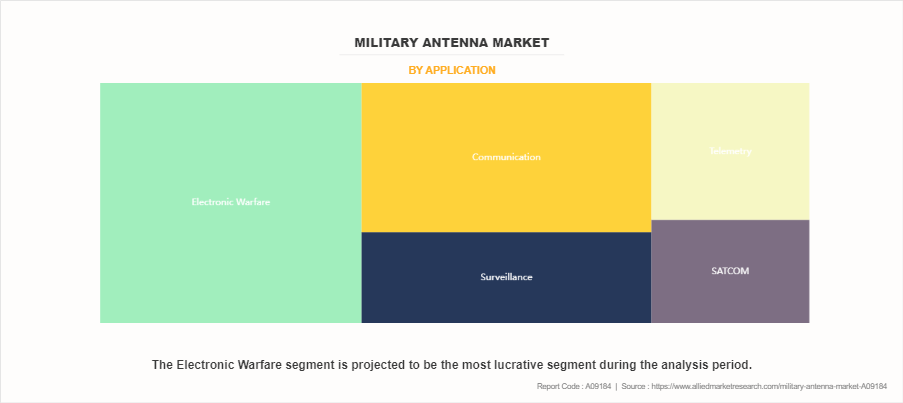

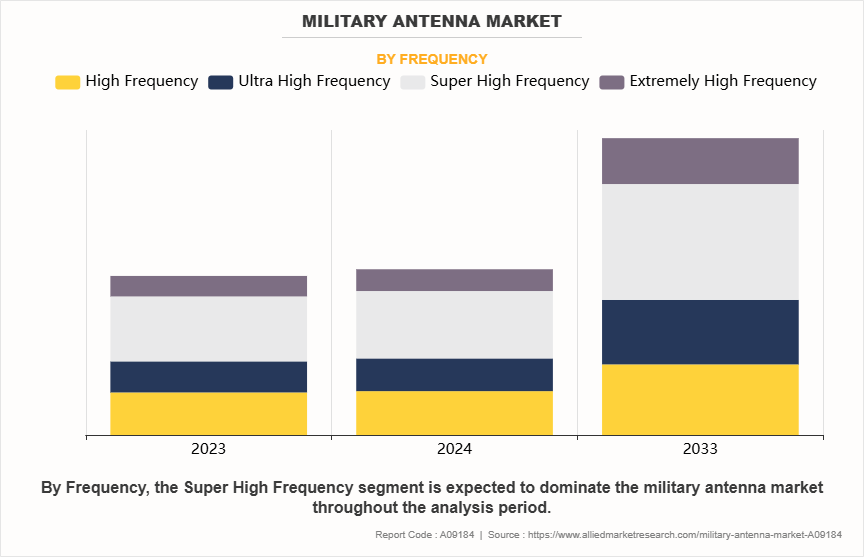

The military antenna market is segmented into platform, application, frequency, end-use, and region. By platform, the market is divided into airborne, marine, and ground. By application, it is fragmented into communication, surveillance, SATCOM, electronic warfare, and telemetry. By frequency, it is categorized into high frequency, ultra-high frequency, super high frequency, and extremely high frequency. By end-use, it is further classified into OEM and aftermarket. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Platform

Based on the platform, the Airborne segment held the highest Military Antenna Market Share in 2023, accounting for more than two-fifths of the global market revenue and is estimated to maintain its leadership status throughout the forecast period. However, Marine segment is projected to manifest the highest CAGR of 7.6% from 2024 to 2033.

By Application

Based on application, the Electronic Warfare segment held the highest market share in 2023, accounting for about four fifths of the global Intermodal freight transportation market revenue and is estimated to maintain its leadership status throughout the Military Antenna Market Forecastperiod. However, Telemetry segment is projected to manifest the highest CAGR of 7.7% from 2024 to 2033.

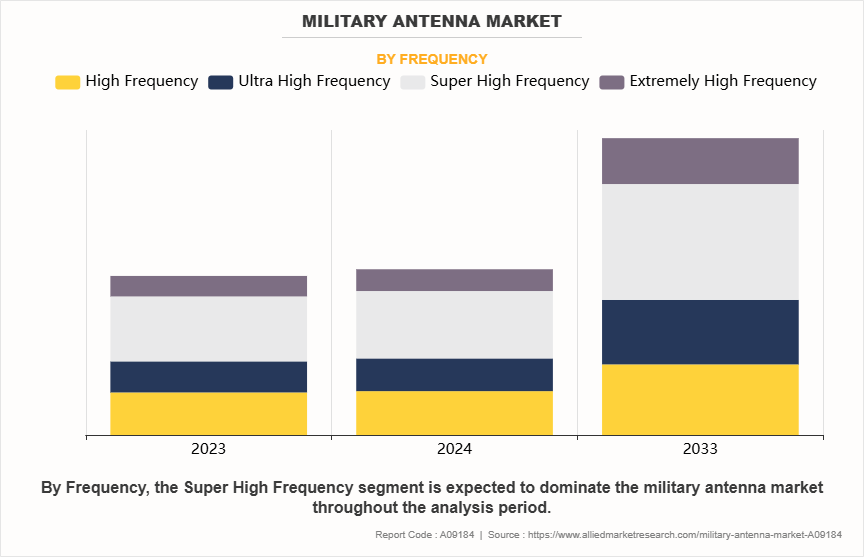

By Frequency

Based on frequency, the Super High Frequency segment held the highest market share in 2023, accounting for about four fifths of the global Intermodal freight transportation market revenue and is estimated to maintain its leadership status throughout the forecast period. However, the Extremely High Frequency segment is projected to manifest the highest CAGR of 8.6% from 2024 to 2033.

By End Use

Based on end use, the OEM segment held the highest market share in 2023, accounting for about four fifths of the global Intermodal freight transportation market revenue and is estimated to maintain its leadership status throughout the forecast period. However, the Aftermarket segment is projected to manifest the highest CAGR of 7.5% from 2024 to 2033.

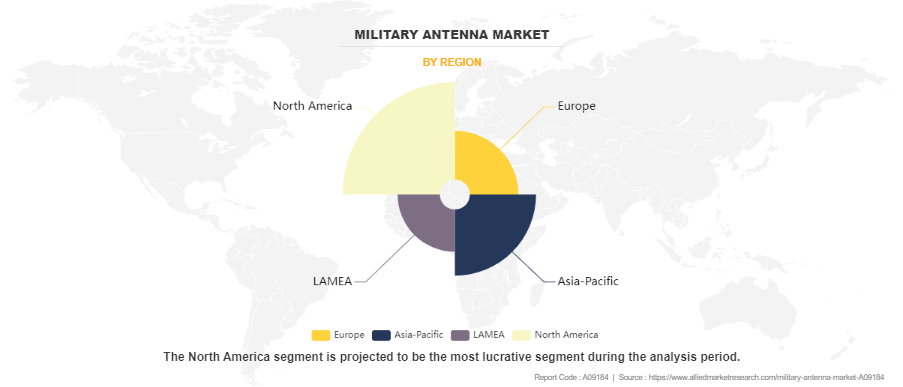

By Region

The North America region held the highest market share in 2023, accounting for two-fifth of the global market revenue and is estimated to maintain its leadership status throughout the forecast period. However, the Asia-Pacific segment is projected to manifest the highest CAGR of 8.4% from 2024 to 2033.

The leading Military Antenna Market Players operating in the military antenna market are Alaris Holdings, Amphenol Corporation, Antcom, Antenna Products Corporation, AVL Technologies, Inc., Barker & Williamson, Cobham Aerospace Communications, Comrod Communication AS., Eylex Pty Ltd., Hascall-Denke, L3Harris Technologies, Inc., Lockheed Martin Corporation, M.T.I Wireless Edge Ltd., Mobile Mark, Inc., Raytheon Technologies Corporation, Rohde & Schwarz, and Southwest Antennas.

Key Benefits For Stakeholders

- This Military Antenna Market Report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military antenna market analysis from 2023 to 2033 to identify the prevailing military antenna market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the military antenna market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global military antenna market trends, key players, market segments, application areas, and market growth strategies.

Military Antenna Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.8 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Frequency |

|

| By End-Use |

|

| By Platform |

|

| By Application |

|

| By Region |

|

| Key Market Players | Comrod Communication AS, Lockheed Martin Corporation, Alaris Holdings Limited, Cobham Limited, Amphenol Corporation, Barker & Williamson, Eylex Pty Ltd., Mobile Mark, Inc., Antenna Products Corporation, Southwest Antennas, Antcom, RTX, AVL Technologies, Rohde & Schwarz, L3Harris Technologies, Inc., Hascall-Denke, MTI Wireless Edge |

Analyst Review

This section provides the opinions of various top-level CXOs in the global military antenna market. The increase in demand for modern battle equipment, rise in technological advancements, and surge in demand for high-frequency military aircraft drive the growth of the military antenna market. Many countries are now focusing on modernization to improve the equipment quality and offer more advanced technologies to their country forces. For instance, in January 2021, Thales announced that it had been awarded its third delivery order from the U.S. Army to provide the AN/PRC-148D Improved Multiband Inter/Intra Team Radio (IMBITR). This latest award brings the total IMBITR radio orders to more than 6,000. Similarly, Canada also has plans to invest significantly in the procurement of portable communication systems in the coming years.

Furthermore, the military antenna market is expected to grow at a significant rate in the coming years, owing to the adoption of various electronic systems for communication, intelligence, surveillance & reconnaissance (ISR), and command and control in the defense industry. Also, military forces are increasingly using space-based assets such as SATCOM technologies to fulfill their missions. For instance, in April 2021, Comrod Communication AS. announced the launch of the UHF SATCOM dismounted antenna. It featured a fully ruggedized tripod to provide a ground-deployed remote antenna capability. In addition, it covered the full UFO waveform 292-318 / 243-270 MHz as well as MUOS 300-320 / 360-380 MHz.

The market growth is supplemented by factors such as the integration of military SATCOM in military communication, increasing use of electronically steered phased array antennas, and increase in demand for land-based communication systems supplement the growth of the military antenna market. However, limited bandwidth for communications and high costs associated with the development and maintenance of infrastructure are the factors expected to hamper the growth of the military antenna market.

In addition, the replacement of conventional equipment with technologically advanced equipment and the rise in government expenditure for military applications creates market opportunities for the key players operating in the military antenna market.

Among the analyzed regions, North America is the highest revenue contributor, followed by Asia-Pacific, Europe, and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to lead during the forecast period due to the rising military shipbuilding activities in countries such as Japan, China, South Korea, and India and growing awareness about technological advancements.

The military antenna market was valued at $3,650.6 million in 2023 and is estimated to reach $6,812.8 million by 2033, exhibiting a CAGR of 6.7% from 2024 to 2033.

The military antenna market is product type, and region. 2024-2033 would be the forecast period in the market report.

The Ground segment held the largest market share in 2022 and is expected to grow at the fastest rate during the forecast period. Euro 58.3 billion is the market value of the military antenna market in 2022.

The military antenna market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Military antenna market report.

The top companies that hold the market share are Alaris Holdings Limited, Amphenol Corporation, Antcom, Antenna Products Corporation, AVL Technologies, Barker & Williamson, Cobham Limited, and Comrod Communication AS.

Loading Table Of Content...

Loading Research Methodology...