Military Battery Market Research, 2031

The global military battery market size was valued at $1.6 billion in 2021, and is projected to reach $2.5 billion by 2031, growing at a CAGR of 5% from 2022 to 2031. Military battery is an energy storage device used to power a variety of military electronic equipment as well as ships and submarines. In military & defense sector, batteries are utilized for numerous purposes which includes auxiliary power units, ignition systems, propulsion systems, communication systems, underwater robots, unmanned reconnaissance aircraft, ground vehicles, land warfighter systems, air defense missile systems, and others.

Moreover, military batteries are stronger in terms of performance with longer range, better durability, and higher conductivity as compared to civilian batteries. Furthermore, in case of emergency situation where electricity may fail, these types of batteries act as a backup in such situations.

The growth of the global market is driven by rise in adoption of UAVs & ground vehicles, increase in military expenditure, and surge in use of lithium-ion battery over lead-acid batteries. However, regulations on lithium batteries is the factor hampering the growth of the market. Furthermore, growing markets in southeast Asia, and technological advancements in battery technology are the factors expected to offer growth opportunities during the forecast period.

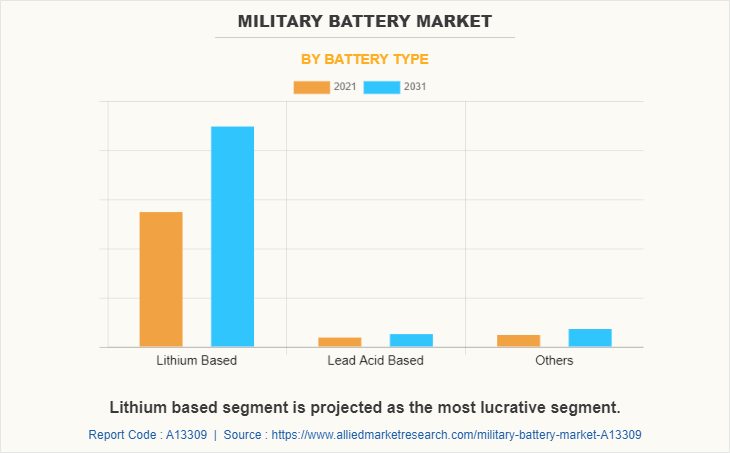

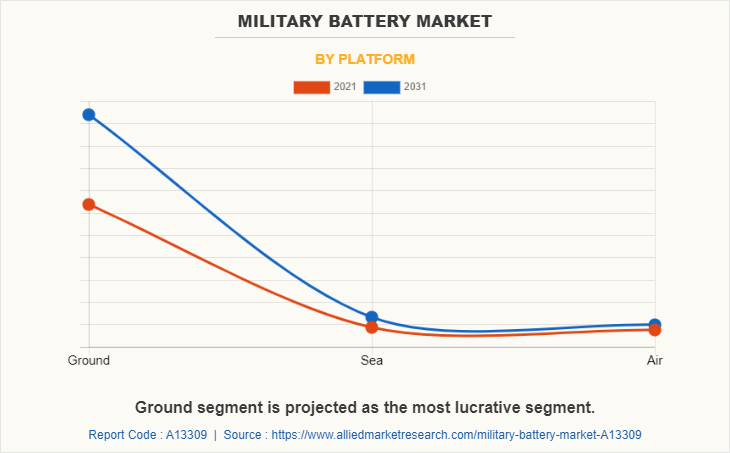

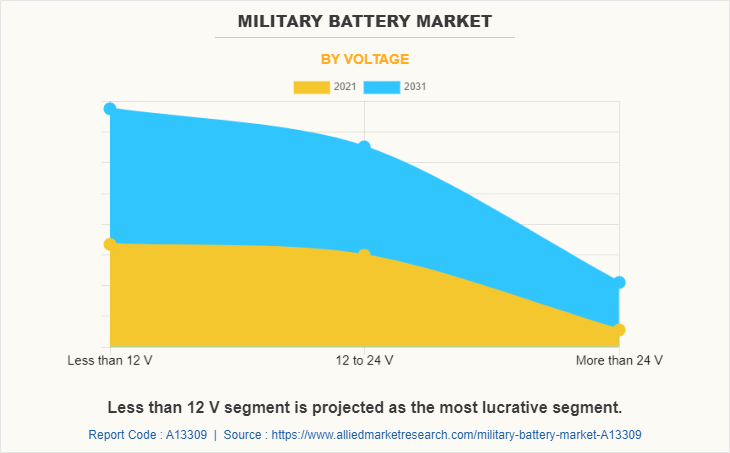

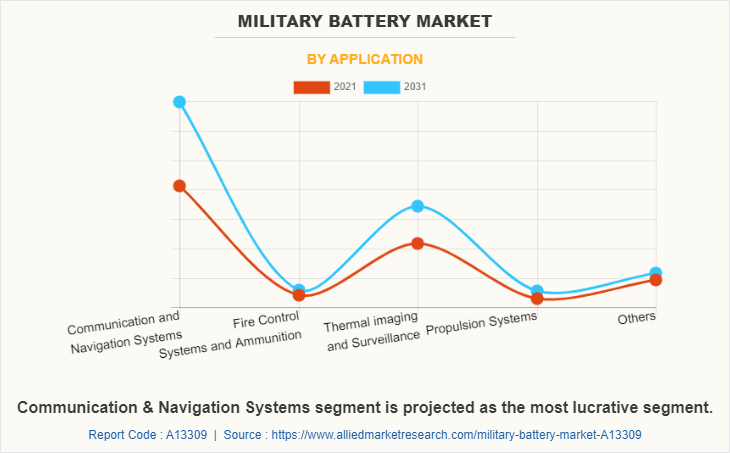

The military battery market is segmented on the basis of battery type, platform, voltage, application, and region. By battery type, it is fragmented into lithium based, lead acid based, and others. By platform, it is categorized into air, ground, and sea. By voltage, it is fragmented into less than 12V, 12 to 24V, and more than 24V. By application, it is classified into communication & navigation systems, fire control systems & ammunition, thermal imaging & surveillance, propulsion systems, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Europe includes countries such as UK, Germany, France, Italy, and rest of Europe. Rest of Europe includes Spain, Netherlands, Sweden, Poland, and others. The Europe military battery market is governed by the presence of numerous companies, such as Epsilor, SubCtech, Saft, and others.

Increased military spending towards the development of defense sector across European countries creates ample opportunities for the growth of military battery market across Europe. For instance, Netherlands government announced $14.26 billion of the defense budget for the financial year 2022, a 5.4% real increase over last year’s defense budget. In addition, the presence of key companies such as Epsilor, SubCtech, Saft and others which are inclined towards developing military batteries leading to the growth of the market across the region.

In UK, several companies are introducing new batteries specifically designed for defense vehicles and robots, fuels the growth of the market across UK during the forecast period. For instance, in September 2021, Epsilor introduced its range of COMBATT 6T Li-ion batteries for defense vehicles and robots at the DESI Exhibition in London. The COMBATT battery line complies with the performance & safety requirements of the new British DEF-STAN 61-021 specification for 6T batteries. In addition, COMBATT 6T batteries have been tested by the British Defence Science and Technology Laboratory, which evaluated them for the upcoming armoured vehicle programs such as the Boxer MIV, Challenger 3 MBT, and Ajax AFV, of the British MoD (Ministry of Defense).

In Germany, key players operating in the market are introducing new batteries ideal for remotely operated vehicles (ROV) and autonomous underwater vehicle (AUV) in the market, boosts the growth of the military battery market in Germany. For instance, in April 2021, SubCtech GmbH, specialist in marine technology, marine research and offshore technology, introduced a new generation of battery solution namely, “PowerPack 416”. The Powerpack 416 is available in voltage ranges between 14 volts and 600 volts and provides an output of 7 kWh per SmartPowerBlock module- scalable up to approx. 100 kWh per battery canister. It is ideal for remotely operated vehicles (ROV) and autonomous underwater vehicle (AUV).

In France, companies are launching new batteries which are specifically designed for use in military armored vehicles and autonomous ground vehicles (AGV) in the market, which in turn is boosting the growth of the military battery market in France. For instance, in May 2022, Epsilor, unveiled its NATO 6T Li-ion rechargeable battery at Eurosatory 2022 in Paris. The NATO 6T Li-ion rechargeable battery meets the safety requirements of MIL-PRF-32565C. in addition, the NATO 6T battery is equipped with a smart battery management system and is an ideal solution for military armored vehicles and autonomous ground vehicles (AGV). Moreover, the battery offers over 1200 charge and discharge cycles and can serve for approximately ten years with no need for maintenance or replacement.

European countries, such as Russia, Spain, Switzerland, the Netherlands, Norway, Denmark, Sweden, Belgium, Luxemburg, Finland, and others are also among the major contributors to the rest of Europe military battery market. The presence of military battery manufacturers, such as Saft, has supplemented the growth of the market across the region.

For instance, in 2019, Saft developed a new Xcelion 6T Type 1-A battery for military ground vehicles, defense systems and microgrids. Moreover, increased government spending towards enhancing the defense sector of European countries and strengthening them against unknown threats creates an increased demand for advanced weapons technology to be present. This increased demand creates a wider scope for the growth of the market across the region.

Prominent players profiled in the military battery market report include Bren-Tronics, Inc., Cell-Con, Inc., Denchi Group Limited, EaglePicher Technologies, LLC, Eco-bat Technologies Limited, Enersys, Exide Technologies, LLC, Lincad Limited, Saft, and Ultralife Corporation.

Rise In Adoption Of Uavs And Ground Vehicles

The growth in threat from terrorism and increase in security concerns across the globe has led to increased government expenditure for Unmanned aerial vehicle (UAVs) and ground vehicles. Unmanned aerial vehicle solutions have wide range of applications in military & defense sector for the effective observations of the assets and surveillance of the areas for gaining the optimum operational effectiveness.

UAVs can carry out stealth operations, function in nights, operate at any location, and are operational efficient to deploy in various operational conditions. Such benefits have led to increase in investments by governments to procure and develop a large number of UAVs globally. Moreover, countries such as the U.S. and the UK are investing in military vehicles and UAVs for combat, surveillance and intelligence missions. The increasing adoption of UAVs and ground vehicles by defense forces will drive the market for military batteries.

Rise In Military Expenditure

Leading countries such as the U.S., Russia, China, Saudi Arabia, and India are strengthening the defense sectors by investing huge amounts in the procurement and development of advanced military systems. In addition, due to the rise in concern for border security and terrorism, the emerging economies across the globe are modernizing their conventional defense equipment and systems to tackle the enemy.

For instance, according to Stockholm International Peace Research Institute (SIPRI), military spending by the U.S amounted to a total of $801 billion in 2021 and the U.S. military burden decreased from 3.7% of GDP in 2020 to 3.5% in 2021. Moreover, military spending of China was $293 billion in 2021, a 4.7% increase compared with 2020.

Furthermore, in defense, military batteries have their application in communication equipment, fire control systems, propulsion systems, auxiliary power units, navigation systems, and others. Military batteries are used to power radio communication equipment, radar communications, night vision devices, air defense missile systems, and other field devices.

Military batteries are also used in several ground vehicles and unmanned aerial vehicles. Thus, countries across the globe are procuring weapon systems, UAVs and other defense equipment along with their battery systems for their robust defense system. This in turn, fuels the demand for military batteries.

Increase In Use Of Lithium-ion Battery Over Lead-acid Batteries

Currently, lead-acid batteries are most widely used in defense sector for various applications such as engine start–stop, propulsion systems, and others due to its cost-effective nature. Furthermore, these batteries are widely available in a variety of off-the-shelf pack sizes with little concern for supply. However, these batteries have shorter service life and require regular maintenance to keep them running properly. Moreover, lead-acid batteries can lead to problems such as electrolyte leakage and creation of hazardous gases during cycling.

In recent years, the use of lightweight & high-power density lithium-ion batteries for defense application has increased significantly, as it provides highest electrochemical potential, i.e., it can generate higher battery voltage than the other batteries. Lithium-ion batteries have extremely low resistance, allowing for much faster charging with minimal losses.

Moreover, these batteries are much lighter, hold a charge better, and can withstand more charge/discharge cycles than lead-acid batteries. Owing to these advantages of lithium ion over lead acid batteries, lithium-ion batteries are getting widely adopted in defense sector, which is expected to fuel the growth of the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military battery market analysis from 2021 to 2031 to identify the prevailing military battery market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the military battery market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global military battery market trends, key players, market segments, application areas, and market growth strategies.

Military Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.5 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 253 |

| By Battery Type |

|

| By Platform |

|

| By Voltage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cell-Con, Inc., EaglePicher Technologies, LLC, Denchi Group Limited, Saft, Exide Technologies, LLC, Bren-Tronics, Inc., ENERSYS, Ultralife Corporation, Ecobat Technologies Limited, Lincad Limited |

Analyst Review

The global military battery market is expected to witness growth due to rise in adoption of UAVs & ground vehicles and rise in military expenditure.

In several countries, the increase in adoption of UAVs and ground vehicles by defense forces has been observed. Owing to which, numerous military battery manufacturers have started to develop batteries for use in unmanned vehicles, which in turn is boosting the growth of the market. For instance, in 2020, Bren-Tronics delivered the first 2-B fully MIL-PRF-32565B compliant 6T battery to the U.S. Army’s Combat Capabilities Development Command (CCDC) Ground Vehicle System Center (GVSC). The Bren-Tronics MIL-PRF-32565B compliant 6T battery is a 24 V battery and will be used in unmanned vehicles, communication systems, weapon systems, and others.

Moreover, to gain a fair share of the market, major players adopted different strategies, for instance, product launch, acquisition, and contract. Among these, contract is the leading strategy used by prominent players such as Bren-Tronics, Inc., EaglePicher Technologies, LLC, Lincad Limited, and Ultralife Corporation.

The military battery market was valued at $1,582.2 million in 2021, and is projected to reach $2,537.9 million by 2031, registering a CAGR of 5.0%.

The military battery market to register a CAGR of 5.0%.

North America region accounted for the military battery market share.

The growth of the global military battery market is driven by rise in adoption of UAVs & ground vehicles, increase in military expenditure, and surge in use of lithium-ion battery over lead-acid batteries.

Key players operating in the global military battery market include Bren-Tronics, Inc., Cell-Con, Inc., Denchi Group Limited, EaglePicher Technologies, LLC, Eco-bat Technologies Limited, Enersys, Exide Technologies, LLC, Lincad Limited, Saft, and Ultralife Corporation.

Loading Table Of Content...