Military Drones Market Overview, 2031

The global military drones market size was valued at $11.60 billion in 2021, and is projected to reach $34.34 billion by 2031, growing at a CAGR of 11.7% from 2022 to 2031.Military drones are unmanned aerial aircrafts that perform a range of missions including intelligence, surveillance, remote sensing, target monitoring, and combat. The operators are referred as drone pilot which control these crafts remotely. Military drones are utilized to collect information on enemy movements, scout during firefights, and can be extremely useful in a manhunt. In addition, military drones are effective as they costs less as compared to traditional military weapons and they have become increasingly accurate. Moreover, the most common unmanned aerial system used in combat is the MQ-1 Predator.

United States, holds a prevailing position in the military drones industry and is also known for its continuous historic contributions to aerospace technology. Famous for its huge arsenal of drones, the United States not only equips its armed forces but also supplies these systems to allied countries.The MQ-9 Reaper operated by the US Air Force is a symbol of US military drone expertise, unsurpassed in both intelligence and precision strike capabilities.

In February 2021, the the US Department of Defense recorded the purchase of 48 MQ-9 Reapers, highlighting continued investment in military drone technology.

China, on the other hand has been recognized by the rapid expansion of its defense industry and continuous technological innovation, and has become a alarming competitor in the global military drone industry. Moreover, drones made in China are gaining more traction worldwide because they are affordable and loaded with advanced features.

DJI, a top Chinese drone maker, has a big chunk of the global military drones market and is even trying military drone tech.

The undeniable competition between the United States and China in the field of military drones has driven technological advances, cost efficiencies, and innovative solutions. However, it is not without cooperation. International cooperation and collaborations are prominent. The U.S. and its allies collaborate on drone research, development, and joint exercises. China, too, has forged partnerships with countries seeking affordable drone solutions. Moreover, both nations fiercely compete for global military drones market share. U.S. manufacturers highlight the reliability and battle-proven performance of their drones. In contrast, China positions its drones as cost-effective alternatives.

The military drones industry is a dynamic realm where the U.S. and China hold pivotal roles. Their contributions, competition, and collaborations shape the industry's trajectory. As technology advances and global demand increases, military drones remain critical in modern defense and national security strategies. This industry reflects the ever-changing nature of warfare and underscores the influential roles that drones play in shaping the future of global military operations.

The growth of the global military drones market has propelled, due to upsurge in military spending, and growth in demand for improved surveillance solution. However, high cost of UAV solution is the factor hampering the growth of the market. Furthermore, defense modernization is the factor expected to offer growth opportunities during the forecast period.

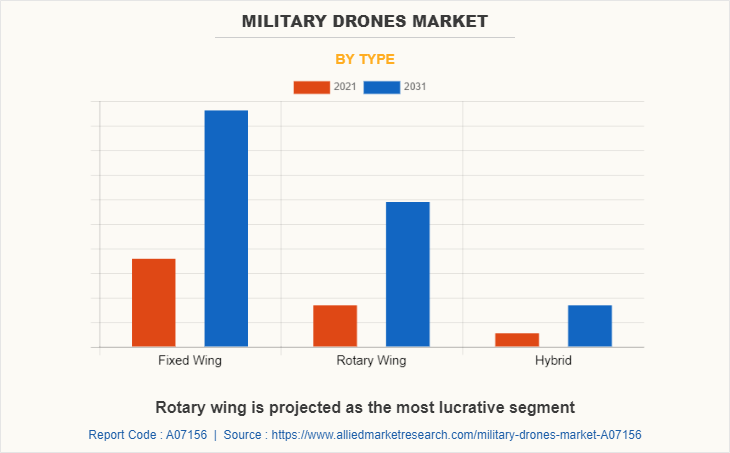

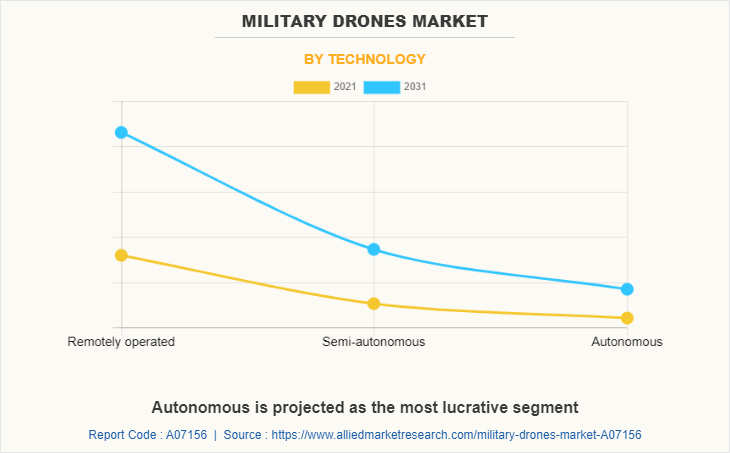

The military drones market is segmented on the basis of type, range, technology, application, and region. By type, it is segmented into fixed-wing, rotary-wing, and hybrid/transitional. By range, it is classified into visual line of sight (VLOS), extended visual line of sight (EVLOS), and beyond line of sight (BLOS). By technology, it is categorized into remotely operated, semi-autonomous, and autonomous. By application, it is fragmented into intelligence, surveillance, reconnaissance, & target acquisition, combat operations, delivery & transportation, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the military drones market report comprise Aeronautics Group, Aerovironment, Inc., Anduril Industries, Animal Dynamics, Asteria Aerospace Ltd., Boeing, Elbit Systems Ltd., General Atomics, Israel Aerospace Industries, Northrop Grumman Corporation, SAAB AB, Shield AI, Teal Drones, Inc., Teledyne FLIR LLC, and Thales Group.

Upsurge in Military Spending

The global defense expenditure has seen exponential growth in recent years. As per Stockholm International Peace Research Institute (SIPRI), the global military expenditure has reached $1,981 billion in 2020 with a 2.6% year-on-year increase. To modernize the defense forces in order to tackle the rise in threats of wars and other internal conflicts, many nations are continuously increasing their defense spending in order to purchase and manufacture advanced security solutions. The military expenditure accounted for 2.4% of the global gross domestic product (GDP) in 2020. Thus, an increase in global military expenditure has augmented the adoption of simulation and training technology.

Furthermore, advancements of weapons and attacking capabilities worldwide have created the demand for modernization and installation of sophisticated defense infrastructure by governments to be prepared for any unprecedented threats and offensive attacks from foreign countries. Militaries across the globe are investing in the UAV solutions such as drones for effective operations of advanced security systems. Thus, upsurge in military spending is driving the growth of the military drone industry during the forecast period.

Growth in Demand for Improved Surveillance Solution

The growth in threat from terrorism and increase in security concerns across the globe has led to increased government expenditure for UAVs such as drones. Unmanned aerial vehicle solutions have wide range of applications in military & defense sector for the effective observations of the assets and surveillance of the areas for gaining the optimum operational effectiveness.

UAV or drones can carry out stealth operations, function in nights, operate at any location, and are operational efficient to deploy in various operational conditions. Such benefits have led to increase in investments by governments to procure and develop a large number of UAVs globally. For instance, in September 2021, BAE Systems and Malloy Aeronautics have announced plans to explore the development of an all-electric ‘heavy lift’ unmanned air systems (UAS) as a potential new solution to deliver cost-effective, sustainable rapid response capability to military, security and civilian customers. Moreover, the security of key institutions has been greatly enhanced with advanced video surveillance and access control systems. Unmanned Aerial Vehicles are used for tactical planning and surveillance of major events or gatherings in large cities. Such factors are expected to fuel the growth of the global military drones market during the forecast period.

The military drones market is segmented into Type, Range, Technology and Application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military drones market analysis from 2021 to 2031 to identify the prevailing military drones industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global military drones industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Military Drones Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Range |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Northrop Grumman Corporation, Elbit Systems Ltd., AeroVironment, Inc., Anduril Industries, Inc., Animal Dynamics Ltd, Israel Aerospace Industries, Asteria Aerospace Limited, Thales Group, The Boeing Company, Aeronautics Group, Insitu, Shield AI Inc., Saab AB, Aeryon Labs Inc, Teal Drones, Inc. |

Analyst Review

The global military drones market is expected to witness significant growth owing to enhancement in efficiency and operations offered by military drone systems, across a wide range of applications.

Changing geopolitical situations and evaluation in digital technologies & defense budget outlook are expected to spur the adoption of new high-end technologies at security front. Increase in use of robotics, biotechnology, portable unmanned based solutions, and nanotechnology in cloud computing, communication, surveillance, detection, decontamination, and other activities is expected to transform the military outlook across the globe. Furthermore, unmanned vehicles are used in aerial, ground, and underwater for transportation, communication, and other applications. The modernization of defense solution and change in geopolitical situations are creating demand for development of the operational effective unmanned aerial vehicle (UAV). Growth in focus toward product development with effective compatibility with modern military solutions, market participants are need to focus on R&D activities to cater the changing requirements of the military sector.

In order to gain a fair share of the market, major players adopted different strategies, for instance, partnership, product launch, and product development. Among these, product launch is the leading strategy used by prominent players such as Boeing, Elbit Systems Ltd., Northrop Grumman Corporation, SAAB AB, and Thales Group.

The global military drones market was valued at $11.6 billion in 2021 and is projected to reach $34.3 billion in 2031.

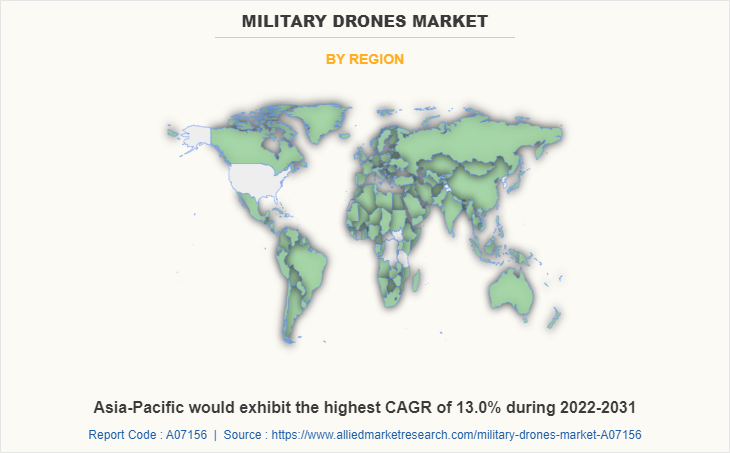

North America is the largest regional market for military drones.

The leading application is Intelligence, surveillance, reconnaissance, and target acquisition

Some leading companies include Boeing, Elbit Systems Ltd., General Atomics, Israel Aerospace Industries, Northrop Grumman Corporation, SAAB AB, and Thales Group.

The upcoming trends in military drones market include greater adoption in transportation & delivery and development of autonomous drones.

Loading Table Of Content...