Military Embedded System Market Research, 2031

The global military embedded system market was valued at $1.5 billion in 2021, and is projected to reach $3.3 billion by 2031, growing at a CAGR of 7.9% from 2022 to 2031.

Electronic items or equipment integrated with a computer are known as embedded system. In the majority of military applications, embedded system function as a subsystem within a larger embedded system to carry out a specific task such as electronic warfare, surveillance and many other. Hardware and software are frequently used in embedded system. A fixed system carrying out a specific duty or a programmable system are both examples of embedded system. Networking is a major component of modern military embedded system and their server architecture. Military embedded system' server topologies provide higher-end processing and more input/output choices.

There is no doubt that embedded technology is rapidly changing the capabilities and applications of equipment and electronic system. The modern military embedded system relies on the multicore technology, wireless technology, and cloud computing. The usage of multi-core processors in embedded military system is gaining traction as the technology matures and quad-, hexa-, and even octa cores become the norm for manufacturing military embedded system. Better performance and lower power consumption are offered by multi-core CPUs. Symmetric multiprocessing, a common application in military system, has been found to be quite compatible with multi-core CPUs. These factors are expected to boost the military embedded system market growth.

Embedded system often has to store sensitive data as they frequently need to retrieve or exchange sensitive data. Ensuring the adequate security and wining the customers trust is the major concern for the embedded system manufacturers and designers. These factors are anticipated to hinder the growth of the military embedded system industry share during the forecast period.

Electronics used in military applications have evolved tremendously in the recent years. High dependability, efficiency, and compact size are some of the most critical requirements for electronic equipment and system used in military applications. Since most conventional radar system employs set waveforms, it is easy to recognize, understand, and create defenses against them. On the other hand, modern digitally programmable radars have the capacity to begin producing waveforms that had not yet been observed, making them harder to counter by military forces. system. Therefore, market participants have the chance to create electronic warfare system that react quickly and can detect and block sophisticated sensors.

The industry players are investing a lot of efforts on the military embedded system R&D of smart and unique strategies to sustain embedded system growth in the market. These strategies include mergers & acquisitions, product launches, collaborations, partnerships, and refurbishing of existing technology. On October 11, 2021, General Micro System introduced two 3U OpenVPX ‘single board system’ inspired by MOSA that offer more processing, storage, and input-output than 6U-sized boards twice as big. The X9 SPIDER VPX boards come in conduction- and air-cooled variations and are based on an Intel 11th generation Lake-H 8 core i7 CPU with 64GB of RAM. Both devices were created in accordance with The Open Group Sensor Open System Architecture (SOSATM) technical standard and are intended for deployed military, aerospace.

The key players profiled in this report include Intel Corporation, Mercury System, Inc. Curtiss-Wright Corporation, Advantech Co., Ltd., BAE System, SMART Embedded Computing, SDK Embedded System Ltd., General Dynamics Corporation, Kontron (S&T), and Xilinx Inc.

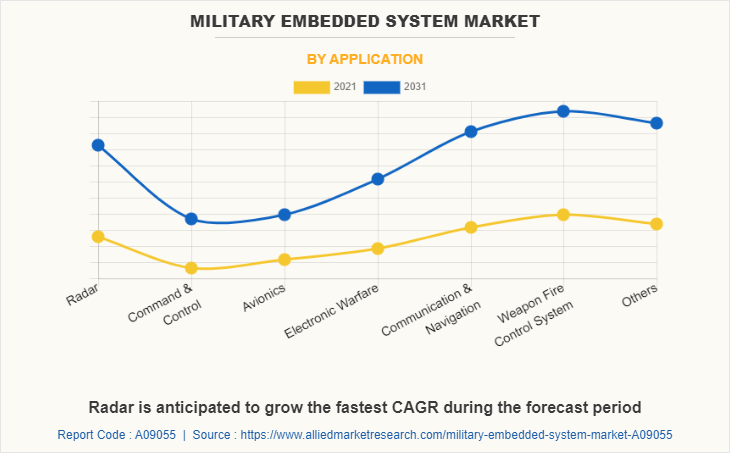

The military embedded system market is segmented on the basis of product type, platform, component, application, and region. By product type, the market is classified into motherboard & computer-on-module (COM), OPEN VPX, VME Bus, Compact-PCI (Board & Serial), and others. By component, the market is classified into hardware and software. By platform, the market is classified into airborne, land, naval, and space. By application, the market is classified into radar, command & control, avionics, electronic warfare, communication & navigation, weapon fire control system, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The military embedded system market is segmented into Product Type, Component, Platform and Application.

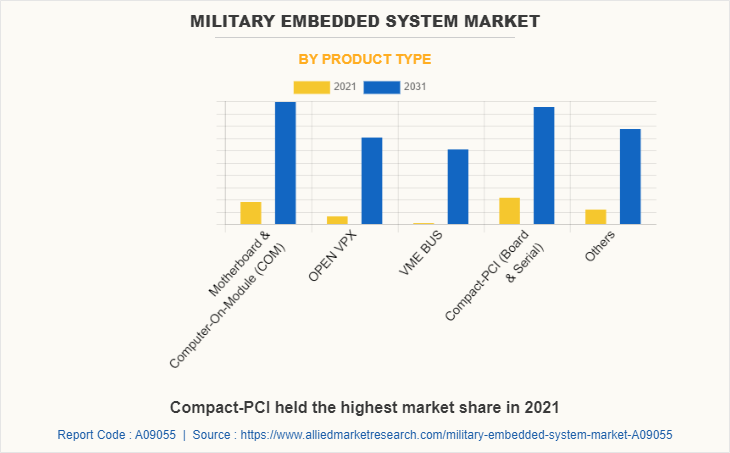

By product type, the Compat- PCI (Board & Serial) dominated the global military embedded system market share in 2021. The industrial standard for modular computer system is called as Compact PCI Serial. It is based on the well-known PICMG 2.0 Compact PCI standard, which communicates among system card components via the parallel PCI bus. On the other hand, Compact PCI offers an architecture that is naturally I/O-oriented and has access to 75 pins across the backplane. The Compact PCI is widely used in military electronics and aerospace system due to its low price, ruggedness and high scalability into different options such as 32bit, 64bit, and others. These factors are anticipated to fuel the growth of the military embedded system market share during the forecast period.

The motherboard & computer-on-module sub-segment exhibits the fastest growth in 2031. Single-board computers are a form of embedded computer system known as a computer-on-module. A full-fledged computer and a microcontroller are combined to create computer-on-module. The concepts of system in package and system on chip have been developed. The main focus of the design is the motherboard and computer-on-module, which are constructed on a single circuit board with input/output controllers, RAM, a computer-on-module, and all other components required to be a functional computer. When low power consumption or small form factors are crucial, a motherboard and computer-on-module solution provides a package computer system for use in small or specialized applications. These are the major factors affecting the military embedded system market size during the forecast period.

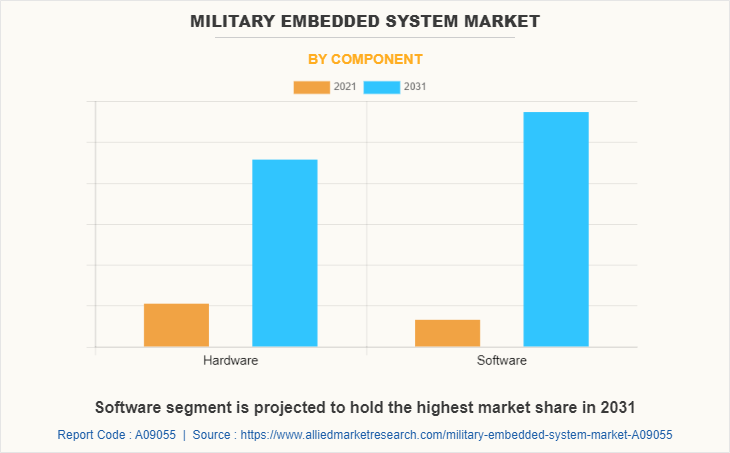

By component, the software sub-segment dominated the global military embedded system market share in 2021. An embedded system is a mix of computer hardware and software that is designed to perform a certain function. Additionally, embedded system may operate as part of a bigger system. The system may be programmable or may only perform certain functions. Embedded System and hardware are managed by the software. The fundamental goal of embedded system software is to manage the operation of a group of hardware components without sacrificing their intended function or efficiency. Software-embedded systems are smaller than conventional computers, which makes them more portable and appropriate for mass production of embedded systems. The use of synthetic instruments (SI) in electronic testing of military system is a significant trend.

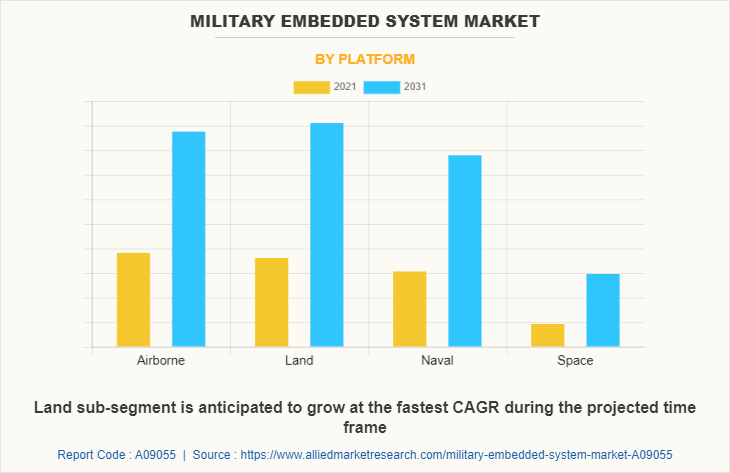

By platform, the land sub-segment dominated the global military embedded system market share in 2021. Development of sophisticated electronic system and mission-critical embedded system and rise in demand for surveillance activities owing to geographical instability contribute toward the expansion of the market. The hostile environment embedded computer system are projected to assist the Army in utilizing commercial off-the-shelf electronics in military ground vehicles.

By application, the weapon fire control system sub-segment dominated the global military embedded system market share in 2021. A full weapon system is typically comprised of the fire control system, fire system, and delivery system. The firing control system is one of them and is a crucial component of the weapon system's which act as "nervous system" and "vision" for weapon fire control system as well as a key representation of the weapon system's high level of sophistication. The primary weapon system is the fire control system, which typically consists of servo system, target tracking system, fire control controllers, and ballistic meteorological monitoring equipment. Large firms are also focusing on developing weapons that are connected to fire control systems. These factors are anticipated to propel the weapon fire control system in the near future.

By region, North America dominated the global market in 2021 and is projected to remain the fastest-growing exhibit during the forecast period. North America is a prominent region for technologically innovative applications. The U.S. exhibits a significant investment potential in embedded system technology as a technologically advanced nation. The market expansion in this region was facilitated by increased investments in integrated military capabilities and next-generation communication technology. Increased investments in military hardware and capabilities, as well as the adoption of network-centric infrastructure contribute toward the market growth. The U.S. and Canada are the two largest countries in North America. The U.S. dominates the market for military embedded system in North America.

Impact of COVID-19

- The COVID-19 pandemic has had a severe detrimental impact on economies all around the world as well as on the manufacturing of embedded system, subsystem, and components for the military

- R&D in the processor manufacturing business has been negatively impacted, due to the global travel limitations implemented by nations to contain the COVID-19 pandemic

- Sales of military embedded system are directly proportional to the demand from end-use industries namely defense forces, aerospace, governments, and others. However, the demand for military embedded system in defense industry was greatly affected owing to import-export restrictions, closed borders, and supply chain disruptions due to the outbreak of the COVID-19 pandemic.

- Economic slowdown has affected the modernization of defense forces across the world as majority of government funding were diverted towards healthcare sector owing to rapid spread of the COVID-19 virus, impacting the market growth

Key Benefits for Stakeholders

- This report provides an analysis of the military embedded system market forecast, segments, current trends, estimations, and dynamics of the military embedded system market analysis from 2021 to 2031 to identify the prevailing military embedded system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the military embedded system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global military embedded system market trends, key players, market segments, application areas, and market growth strategies.

Military Embedded System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.3 billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 378 |

| By Product Type |

|

| By Component |

|

| By Platform |

|

| By Application |

|

| By Region |

|

| Key Market Players | Xilinx Inc., General Micro Systems, Curtiss-Wright Corporation, Kontron AG, BAE Systems, Microsemi Corporation, Abaco Systems, Telephonics Corporation, Radisys Corporation, Intel Corporation |

Analyst Review

Increase in demand for defense forces modernization is the key factor projected to drive the growth of the global military embedded system market during the forecast period. In addition, the overall hardware costs related to embedded systems have decreased as a result of numerous advancements in integrated circuit and processor technology. Modern servers that focus on networks are increasingly being used, particularly in military applications. Over the past few years, there has been significant developments in military electronics such as modern warfare, systems, and advancement in wireless technology, and many more which is expected to drive the growth of the market during the forecast period. However, high initial investments, requirement of highly skilled workers, and data security associated with military embedded systems are the key factors expected to hamper the market growth during the forecast period. On the contrary, increased demand for use of multi-core technologies, commercially available hardware, and increased acceptance of electronic warfare systems are projected to contribute toward the market growth in the upcoming years.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, Europe, and LAMEA. Rapid urbanization of defense forces is one of the key factors responsible for leading position of North America and Asia-Pacific in the global military embedded system market.

The diverse applications of military embedded system across defense, aerospace, government, and other sectors is the major market driver. In addition, the embedded systems market is experiencing growth due to surge in demand for specialized military systems. The factors driving the global military embedded system software market growth include the rise in multi-core technology use of, rise in demand for commercial off-the-shelf hardware, and rise in adoption of electronic warfare systems.

Software sub-segment of the component segment acquired the maximum share of the global military embedded system market in 2021.

Rise in application of electronic warfare systems and application of cloud, IoT, and artificial intelligence in military embedded system is anticipated to boost the growth of the military embedded system market in the upcoming years.

Asia-Pacific will provide more business opportunities for the global military embedded system market in future.

Intel Corporation, Mercury Systems, Inc. Curtiss-Wright Corporation, Advantech Co., Ltd., BAE Systems, SMART Embedded Computing, SDK Embedded Systems Ltd., General Dynamics Corporation, Kontron (S&T), and Xilinx Inc. are the major players in the military embedded system market.

The major growth strategies adopted by military embedded system market players are product development and innovation.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global military embedded system market from 2021 to 2031 to determine the prevailing opportunities.

Defense forces and governments are the major customers in the global military embedded system market.

Loading Table Of Content...