The global military generator market size was valued at $1.3 billion in 2021, and is projected to reach $2 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

A device that transforms mechanical energy into electricity for distribution to military users across power lines is known as an electric generator. In most cases, a spinning shaft provides the mechanical power for an electric generator, which is determined by multiplying the shaft torque by the rotational or angular velocity. There are many ways to generate mechanical power, including gas turbines that burn gas inside the turbine, steam turbines that use the heat from the combustion of fossil fuels or nuclear fission to produce steam, and gasoline and diesel engines. Depending on the features of the mechanical prime mover, the generator's design and speed may differ significantly. In addition, generators provide the electrical power needed for military vehicles, field camps, field hospitals, and training centers.

Technological advancement in diesel generators, the development of small tactical power generators, and the governments around the world increasing their military expenditure are the major factors that propel the market growth. However, stringent emission regulations for diesel engines and alternative backup power equipment are the major factors that hamper the growth of the market. Furthermore, the increasing use of hybrid generators and the rise in the development & adoption of DRASH tent systems are the factors expected to offer growth opportunities during the forecast period.

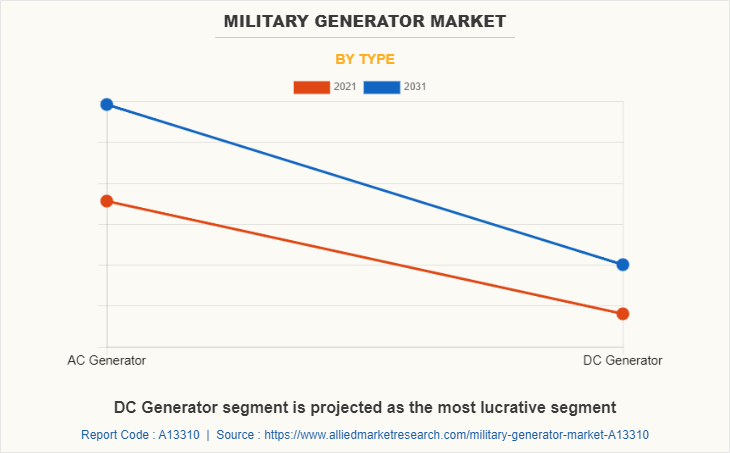

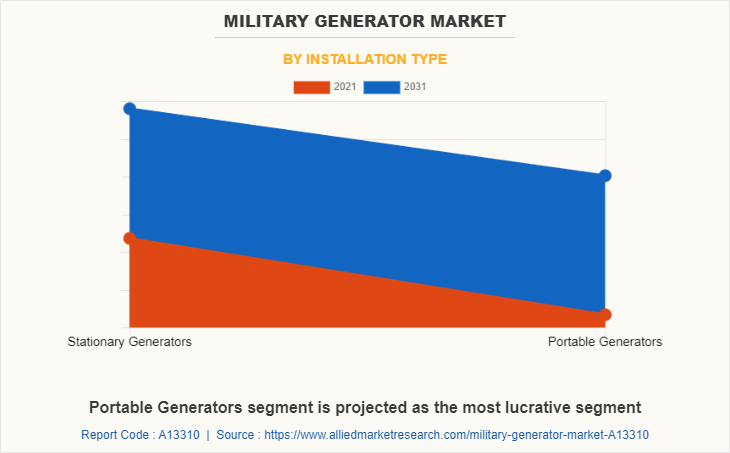

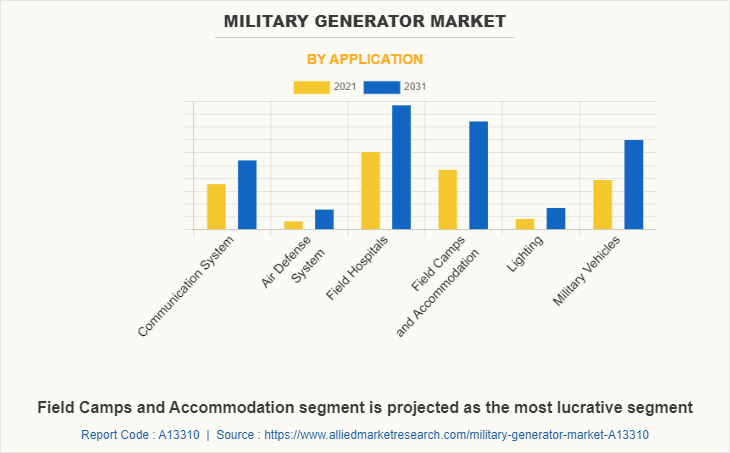

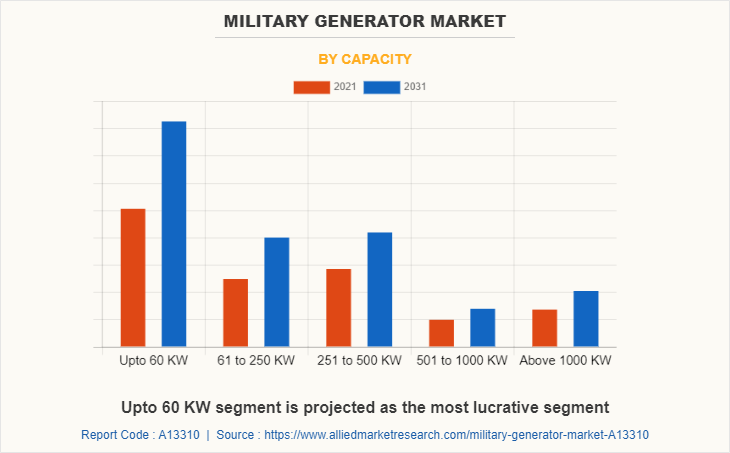

The military generator market is segmented on the basis of type, installation type, application, fuel type, capacity, and region. By type, it is bifurcated into AC Generators and DC Generators. By installation type, it is classified into stationary generators and portable generators. By application, it is categorized into communication system, air defense system, field hospitals, field camps/accommodation, lighting, and military vehicles. By fuel type, it is segregated into diesel, natural gas, and hybrid/others. By capacity, it is divided into up to 60 KW, 61 to 250 KW, 251 to 500 KW, 501 to 1000 KW, and above 1000 KW. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America includes U.S., Canada, and Mexico across which the market has been studied. Communication is one of the important components in the U.S., Canada, and Mexico military sectors as nowadays technological advancements in remote sensing, telecommunications systems, and GPS, prove detrimental for military and intelligence gathering. The defense aviation industry across the U.S. and Canada is highly integrated. Moreover, the implementation of defense protocols is expected to promote the growth of the market over the years. For instance, in December 2020, the US Army developed a portable generator using the X-Engine from Connecticut-based LiquidPiston. This new and potent rotary engine is expected to produce the same amount of power as the Army's present gen-set while being one-fifth the size. Thus, these types of developments are anticipated to drive market growth in the U.S. during the forecast period.

Portable or mobile diesel generators can be moved to any location where a continuous power supply is not available. They are available in a variety of power configurations feasible for several types of military applications. Portable generators are convenient to handle during warfare and when the grid network breaks down. Portable generator sets are offered in a variety of power levels to meet the needs of customers in military applications operations. They can be kept in a soundproof enclosure (canopy) and can be operated automatically.

Moreover, portable low-maintenance generator sets capable of supplying continuous or emergency power are required to ensure the success of defense missions. In addition, portable or mobile power solutions are used to supply power to field hospitals and computer systems on military bases, as well as command and communication vehicles. Investments by armed forces in the development of portable generators are expected to drive the growth of the segment. For instance, in December 2020, LiquidPiston was awarded a Small Business Innovation Research contract by the U.S. Army to develop the X-Engine platform for its small tactical power generators. Moreover, the UK Government is focused on the development and implementation of advanced military generator technologies to protect national assets from adversary threats. The UK defense agencies have acquired modern military generators from commercial firms to heighten the performance of their defense capabilities. Such developments are anticipated to fuel the growth of the military generator market in the country.

An increase in the adoption of modern and advanced air defense systems to counter illegal operations is expected to accelerate the growth of the military generators market during the forecast period. European nations are increasingly adopting modern defense systems for increased protection and defense capabilities against the rising instances of illegal activities, which is expected to drive the demand for military generators in the region.

Further, the rise in defense expenditure in Asia-Pacific to tackle growing terrorism and regional disputes in countries such as India, Afghanistan, and China promote the growth of the adoption of military generators across the region. Moreover, a surge in defense expenditure across Asia-Pacific augments the procurement of advanced military generator systems. For instance, in 2020, the defense expenditure of major Asia-Pacific countries, including South Korea, India, China, and Japan grew by 4.9%, 2.1%, 1.9%, and 1.2%, respectively. Furthermore, the surge in defense budget is anticipated to act as the key driving force of the military generator market during the forecast time period.

Some leading companies profiled in the report comprise Caterpillar CMCA Group of Companies, Cummins Inc., Fischer Panda, HDT Global, KOHLER SDMO, Leonardo DRS, SFC Energy AG, The Dewey Electronics Corporation, and Rolls-Royce plc. The leading companies have adopted strategies such as product launch and contract to strengthen their market position.

Technological advancement in military generator

Improved fuel economy has been continuing to be the most notable modern breakthrough in diesel generator technology. Diesel-powered engines, as has always been the case, have been more readily adopted by the general population. Diesel is frequently overlooked by regular gasoline usage due to the ongoing wrangling over fuel economy. Diesel generators have a huge customer base in a variety of industries, particularly those that require fuel economy for large-load transportation, backup power supply, and major agricultural operations. Moreover, there have been numerous attempts and breakthroughs to enhance the overall efficiency of the diesel generators. The ignition of power within the generator is formed from the mixture of oxygen and fuel. This mixture eventually creates enough energy to start the engine. For instance, Cummins Inc. initiated the HSK78G natural gas generator series, which offers innovative gas technologies and a scope of advanced capabilities. The new HSK78 series offers a total package of gas generator capabilities and innovative gas technology for prime and peaking power applications. The HSK78G generator series has been designed from the skid up, providing reliable power no matter how extreme the fuel source or operating conditions.

Development of small tactical power generators

Military power and energy demands are expanding at an exponential rate, yet present generators use outdated technology, making them enormously large and heavy, as well as less fuel efficient than they could be. The Small Tactical Power Generators run on readily available military fuels such as JP8, jet fuel, or diesel. To boost the mobility of army systems, small, compact, efficient power is required. The Army can use the small tactical power generator platform for a wide range of warfighter demands, from camp support to communications systems to computerized weaponry. For instance, in December 2020, LiquidPiston, Inc. (LPI), developer of advanced rotary diesel and multi-fuel internal combustion engines, announced the award of a Small Business Innovation Research (SBIR) contract with the U.S. Army to develop the X-Engine platform to power Small Tactical Generators ranging from 2-5 kW.

An increase in the development of small tactical power generators to create breakthrough energy technologies that greatly minimize the logistical strain on the warfighter is expected to drive the growth of the market. The focus of this initiative is on small and portable generators that are generally on the front lines of a fight and used for backup telecommunications, remote power, homeland security, first responders, and marine power. Small tactical generators benefit the warfighter by offering increased system efficiency, mobility, reliability, and maintainability.

Stringent emission regulations for diesel engines

Alarming rise in air pollution caused due to diesel generators acts as a major restraint of the market. This has resulted in severe health and environmental problems, which hampers the growth of the market. Air pollutants released from diesel generators include oxides of nitrogen, carbon monoxide, hydrocarbons, and particulate matter. These air pollutants severely impact human health, causing diseases such as stroke, heart disease, lung cancer, and asthma. To cope with environmental pollution, some regulations have been imposed on diesel generator emissions such as central pollution control board & Ministry of Environment and Forests Emission standards for new gensets with up to 800 kW –GSR (Generator Set Regulations) 771E, GSR 535E, 232E, and 489E (India); EPA emission standard for Emergency Standby Diesel Generator Sets; Paris Agreement COP 21 for greenhouse gas reduction –Targets 2021-2030; and Kyoto Protocol 1998 COP 3. Such regulations create a burden on the application of diesel engine generators that are anticipated to hinder the growth of the market.

Increasing use of hybrid generators

Hybrid generators are new-age generators that combine traditional generator sets with another controllable electric source in order to generate a fuel-efficient, noise-reduced, and environment-friendly source of power supply. The controllable source may comprise a fuel cell or another device that generates electricity from a non-electrical power source such as a hydroelectric generator, wind turbine generator, and solar-powered power source. The batteries in hybrid gensets are charged by renewable power sources such as solar, wind, and hydro along with the fuel generators during their operation. The power supply is given from the charge stored in the batteries itself, thus eliminating the need for fuel generators to be operating continuously.

In addition, a hybrid generator uses traditional fuel generators (diesel, petrol, and LPG) with renewable sources of power such as wind turbines, gas turbine generators, and a solar-powered power source. Hybrid gensets ensure an uninterrupted power supply, when a power outage occurs, the generator system detects it and automatically begins to supply power to the connected system. Owing to such features, military forces look for new hybrid technology, which can more efficiently power command posts and division tactical operation centers. For instance, in December 2022, an IDE HEPS Tactical Hybrid Generator was successfully deployed to the final phase of the British Army’s AWE22 Sustain & Protect experimentation. Through Marshall Land Systems and IDE teaming, the focus is on to provide warfighters the organic means to generate, store, manage, and distribute electrical power to increase the tempo, mass, autonomy, and protection, through advanced hybrid power technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military generator market analysis from 2021 to 2031 to identify the prevailing military generator market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the military generator market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global military generator market trends, key players, market segments, application areas, and market growth strategies.

Military Generator Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Type |

|

| By Installation type |

|

| By Application |

|

| By Fuel Type |

|

| By Capacity |

|

| By Region |

|

| Key Market Players | Fischer Panda, HDT Global, SFC Energy AG, CMCA Group of Companies, Cummins, Inc., The Dewey Electronics Corporation, Leonardo DRS, KOHLER SDMO, Caterpillar, Rolls-Royce plc |

Analyst Review

The global military generator market is expected to witness growth during the forecast period owing to rise in the development and adoption of DRASH tents systems. The Deployable Rapid Assembly Shelter (DRASH) tent is a portable, lightweight military tent that can be used as a geodesic shelter. The DRASH tent may also connect to other shelters to rapidly & efficiently build, command, and control medical, life support, or surgical facilities. In addition, DRASH is known for its ability to combine a number of items into a complete system solution. This is accomplished by combining housing, lighting, mobility, power distribution, heating, cooling, and command and control equipment into a single package. It is expanding its popularity by incorporating energy-efficient products into its already comprehensive line of equipment. This is expected to drive the growth of the market.

Moreover, governments of countries such as Russia, the U.S., China, India, and others are increasing investment in armed forces to establish dominance on the battlefield. In April 2022, according to Stockholm International Peace Research Institute (SIPRI), total global military expenditure increased by 0.7% in real terms in 2021, to reach $2113 billion. The five largest spenders in 2021 were the U. S., China, India, the UK, and Russia, together accounting for 62% of expenditure. Moreover, total global military expenditure rose to $1981 billion in 2020, an increase of 2.6 percent from 2019. In addition, the rise in terrorist activities & civil activities in several regions and the surge in international conflicts force countries to enhance their military strengths through advancements in weapons capabilities, which increases the demand for weapons power supply. These government activities are expected to drive the market during the forecast period.

The global military generator market was valued at $1.3 billion in 2021 and is projected to reach $2.0 billion by 2031, registering a CAGR of 4.7% from 2022 to 2031.

Some leading companies profiled in the report comprise Caterpillar CMCA Group of Companies, Cummins Inc., Fischer Panda, HDT Global, KOHLER SDMO, Leonardo DRS, SFC Energy AG, The Dewey Electronics Corporation, and Rolls-Royce plc.

Field hospitals is the leading application of military generator market.

North America is the largest regional market for military generator

Increase in use of hybrid generators and rise in development and adoption of DRASH tents systems are the upcoming trends of military generator market.

Loading Table Of Content...