The global military and defense sensor market size valued at $8.3 billion in 2021, and is projected to reach $14.4 billion by 2031, growing at a CAGR of 5.8% from 2022 to 2031.

The global military and defense sensors market is witnessing significant growth due to increased procurement of defense systems by military forces globally. Military and defense sensors are a subsystem of a weapon, aircraft, or an electronic device that detects change in its surroundings or scans its environment to gather information. The collected information is then relayed to other electronic systems, normally to a computer processor for processing and analyzing data. Military and defense sensors are used in missiles, combat, aircraft, and radars among a variety of systems for navigation, weapon control, active guidance, target tracking, and environmental awareness. Moreover, sensors such as electro-optical sensors can be used to detect fog, smoke, and dust.

Surge in military modernization programs, increase in demand for armored vehicles, and rise in adoption of unmanned vehicles such as UAVs are the factors that drive the global military sensors market. For instance, in December 2019, Pentagon (U.S. Department of Defense headquarters) & Lockheed Martin signed a contract of $99,000,000 with Raytheon to integrate Raytheon’s next generation electro-optical distributed aperture system (DAS) into all variants of F-35 (an American stealth multirole combat aircraft) over the next two years.

The global military expenditure has seen exponential growth in recent years. According to Stockholm International Peace Research Institute (SIPRI), the global military expenditure has reached $1,981 billion in 2020 with a 2.6% year-on-year increase. The military expenditure accounted for 2.4% of global gross domestic product in 2020. Thus, increase in global military expenditure has augmented the adoption of modern defense systems, including drone defense systems and other technologies. However, the sensors are a costly defense mechanism and requires large capital spending for its integration in a variety of platforms. Conversely, increase in military and defense expenditure globally facilitates the implementation of expensive sensor technology.

Furthermore, advancements of weapons and attacking capabilities worldwide created the demand for modernization and installation of sophisticated defense infrastructure by governments to prevent threats and offensive attacks from foreign countries. Hence, increase in defense expenditure is expected to open new avenues for the growth of the military and defense sensor market.

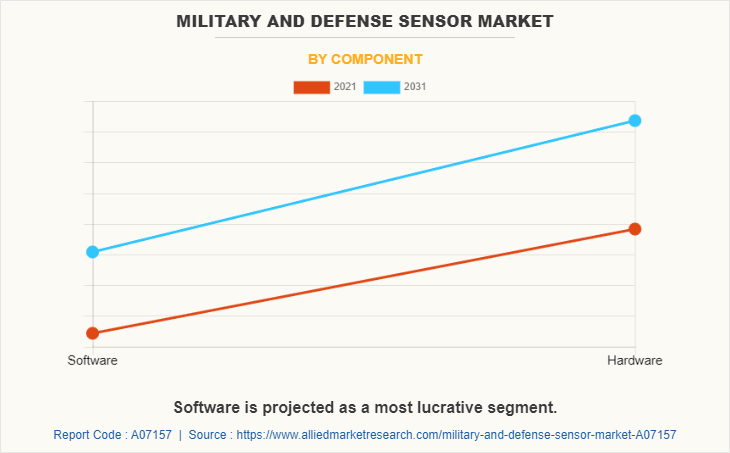

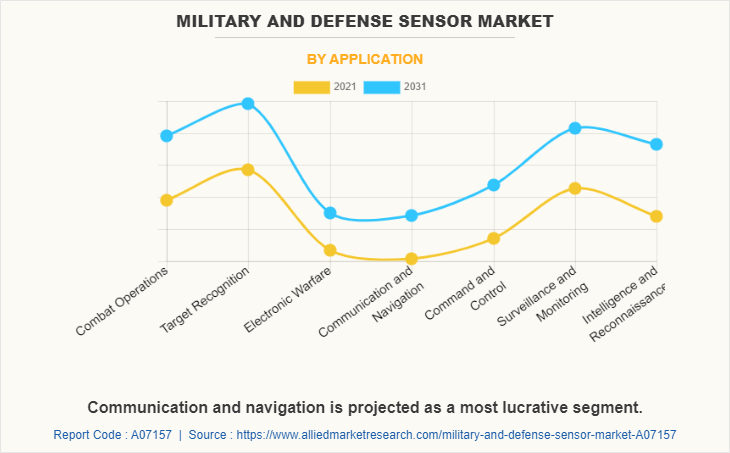

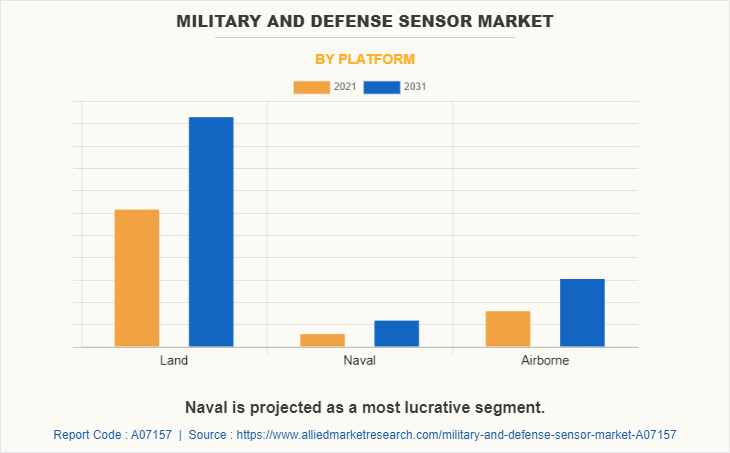

However, policies on development & transfer of weapon systems or related technology may hinder the market growth. On the contrary, development of internet of things (IoT), micro-electro chemical system (miniature mechanical & electronics integrated device), and AI present new pathways in the industry. The military and defense sensor market is segmented on the basis of platform, component, application, and region. By platform, it is divided into land, naval, and airborne.

Many governments and organizations are applied the policies on development and transfer of weapon systems or related technologies which are anticipated to hamper the global military and defense sensor market during the forecast period. Furthermore, according to the United Nation organization, to avoid responsibility being diffused under section 2.1.1, an effective counter-IED (improvised explosive device) campaign sometimes involves cooperation from multiple government departments, directed by a ministry or department with the necessary resources and authority. The development of defined coordinating mechanisms, the creation of such a national coordinating entity, and effective inter-agency cooperation through a network of designated focal points within pertinent national authorities can all significantly enhance the coherence of cross-government counter-IED operations. carrying out urgent intelligence-driven counter-IED operations against terrorists’ image from Adobe Stock It typically takes close coordination between the State's intelligence agencies, law enforcement, and specialized military support agencies to stop terrorists from obtaining weapons and using IEDs. To facilitate the exchange of information and intelligence amongst those entities that require it, solid and dependable procedures must be put in place. Thus, these various regulations by organizations and governments are expected to limit the market growth during the forecast period.

The increase in instances of political, economic, or social upheaval among countries or regions has led to rise in domestic and intercontinental tensions across the world. Governments around the world have increased defense expenditure to defend the growing territorial and intercountry instability which is evident from the $1,981 billion defense spending in 2020 a 2.6% rise in global defense expenditure from 2019. The surge in hostile instances worldwide have fueled the demand for autonomous security and surveillance systems. The huge demand for autonomous security and surveillance systems has promoted defense organizations to adopt sensors for enhancing their defense capabilities. The drone manufacturing companies are developing innovative solutions to provide advanced surveillance and security capabilities to monitor and protect the assets of an organization. For instance, in May 2021, Asylon, Inc. and Boston Dynamics announced a partnership for integrating unmanned ground vehicle (UGV), Spot, into the Asylon DroneCore Robotic Perimeter Security platform.

The coupling of ground and air unmanned platforms enhances the observation and security automation capabilities of the platform. The increase in demand for autonomous security and surveillance systems encourages the development of ingenious drone solutions by drone manufacturers. The heightened autonomous surveillance and security capabilities are the factors propelling the adoption of drones globally and drives the growth of the military and defense sensor market during the forecast period.

The military and defense sensor market is segmented into Application, Platform and Component.By component, it is classified into software, and hardware. By application, it is categorized into combat operations, target recognition, electronic warfare, communication and navigation, command and control, surveillance and monitoring, and intelligence and reconnaissance. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in the military and defense sensor market share include Thales Group, BAE Systems plc., Raytheon Company, Curtiss-Wright Corporation, Honeywell International Inc., Esterline Technologies Corporation, Kongsberg Gruppen ASA, TE Connectivity Ltd., Lockheed Martin Corporation, and Rockwest Solutions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the military and defense sensor market analysis from 2021 to 2031 to identify the prevailing military and defense sensor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the military and defense sensor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global military and defense sensor market trends, key players, market segments, application areas, and market growth strategies.

Military and Defense Sensor Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14.4 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 261 |

| By Application |

|

| By Platform |

|

| By Component |

|

| By Region |

|

| Key Market Players | TE Connectivity Ltd., KONGSBERG, Raytheon Technologies Corporation, Honeywell International Inc., Transdigm Group, Inc., Lockheed Martin Corporation, Curtiss-Wright Corporation, Rock West Solutions, Thales Group, BAE Systems plc |

Analyst Review

the military and defense sensor market is projected to witness moderate-to-high growth rate, owing to growth in defense budget in many countries, and rising conflicts between countries. Companies in this industry are adopting various innovative techniques to provide defense forces with advanced and innovative feature offerings.

The military and defense sensor market are driven by emerging applications of radar in remote sensing, rise in defense expenditure globally, and rise in adoption of sensors in wearable devices. For instance, in 2019, U.S. Defense Advanced Research Projects Agency (DARPA) awarded Lockheed Martin a $12,300,000 contract to develop a long range, long duration, and payload capable unmanned underwater vehicle (UUV). Moreover, unmanned vehicles (UVs) or drones utilize state-of-art sensors such as ultrasonic fuel flow sensor, capacitive fuel level sensor, and light detection and ranging (LiDAR) sensors.

However, incorporation of sensors in devices incurs extra value and reduces life of device, and policies on development and transfer of weapon system or related technology are anticipated to restrict the market growth. Moreover, surge in military modernization programs, and high demand for autonomous security and surveillance systems are expected to create lucrative opportunities in near future for the military and defense sensors market.

Among the analyzed regions, North America is expected to account for the highest revenue in the global market in 2021. However, Europe is expected to grow at a higher rate, predicting lucrative opportunities for the key players operating in the military and defense sensor market.

The military and defense sensor market valued for $8,267.30 million in 2021 and is estimated to reach $14,437.20 million by 2031, exhibiting a CAGR of 5.79% from 2022 to 2031.

Thales Group, BAE Systems plc., Raytheon Company, Curtiss-Wright Corporation, Honeywell International Inc., Esterline Technologies Corporation, Kongsberg Gruppen ASA, TE Connectivity Ltd., Lockheed Martin Corporation, and Rockwest Solutions are some of the significant businesses profiled in the military and defense sensor market share.

In Platform type land-based segment is the leading application of military and defense sensor market,

North America is the largest regional market for military and defense sensor market.

Factors such as emerging applications of radar in remote sensing, rise in defense expenditure globally, and rise in adoption of sensors in wearable devices drive the growth of the military and defense sensor market.

Loading Table Of Content...