Milk Bottle Market Research, 2032

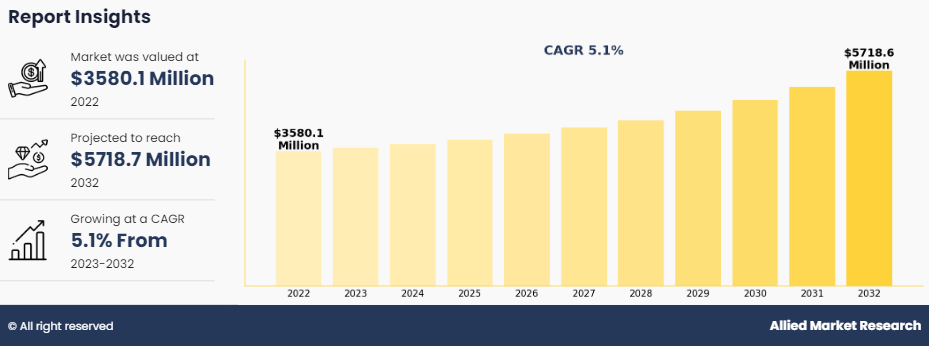

The global milk bottle market was valued at $3580.1 million in 2022, and is projected to reach $5718.7 million by 2032, growing at a CAGR of 5.1% from 2023 to 2032. A milk bottle is a container specifically designed for the packaging, storage, and distribution of milk. Typically made of materials like glass or plastic, it features a narrow neck for easy pouring and a sturdy body to protect the contents. These bottles play a crucial role in preserving the freshness, quality, and nutritional integrity of milk. With an iconic design and varying sizes, milk bottles have been a staple in households and the dairy industry for decades, symbolizing the tradition and practicality associated with the consumption of this essential dairy product.

The continuously expanding global population, along with a rising demand for milk and dairy products, positions the market for steady growth. As dietary habits evolve and nutritional awareness increases, the consumption of milk remains a constant, contributing to the sustained demand for milk bottles. Furthermore, the market benefits from the growing trend towards convenient and on-the-go packaging solutions. Urbanization and hectic lifestyles have intensified the need for practical and easily transportable food & beverage options. In this context, milk bottles serve as a convenient choice, aligning perfectly with the preferences of consumers who seek efficient and portable packaging in their daily lives.

Rising prices for essential raw materials such as plastic and glass pose a significant challenge to the production of milk bottles. Fluctuations in these material costs directly impact manufacturing expenses, potentially squeezing manufacturers' profit margins. The increased production costs may, in turn, lead to a necessity for adjustments in the retail prices of milk bottle market growth. As manufacturers grapple with these challenges, maintaining a delicate balance between cost efficiency and quality becomes imperative, highlighting the intricate relationship between raw material prices, production costs, and consumer pricing in the dynamic milk bottle industry.

Technological advancements have prompted innovation in milk bottle design, revolutionizing the preservation and freshness of dairy products. These advancements go beyond traditional packaging, introducing cutting-edge features to extend the shelf life of milk. One notable example is the integration of vacuum-sealing techniques into milk bottle designs. This innovation involves removing the air from the bottle, creating a vacuum seal that significantly reduces the exposure of milk to oxygen, thereby slowing down the oxidation process. The vacuum-sealing technology serves as a protective barrier, preventing external contaminants from compromising the milk's quality. This method not only enhances the longevity of the milk but also contributes to minimizing food waste by reducing the likelihood of premature spoilage. The vacuum-sealed milk bottles are particularly advantageous for consumers who may not consume milk regularly or prefer to buy in larger quantities. Furthermore, these advancements emphasize a commitment to sustainability, as they align with the goal of reducing the environmental impact associated with food waste. By prolonging the freshness of milk, manufacturers contribute to a more efficient supply chain and provide consumers with a product that maintains its nutritional value for an extended period.

The key players profiled in this report include Longshen Industrial, Huhtamaki, Amcor, Gerresheimer, Tupperware Brands, Maharashtra Industries, MeadWestvaco, Bormioli, Rocco, WWP Direct, and Kadolta Packaging. Partnerships with retailers & distributors and global market expansion are common strategies followed by the major market players. For instance, on October 13, 2023, Abel & Cole launched first refillable plastic milk bottle. This initiative aims to reduce single-use plastic waste by allowing customers to refill the bottle with fresh milk, aligning with the company's commitment toward environmental stewardship.

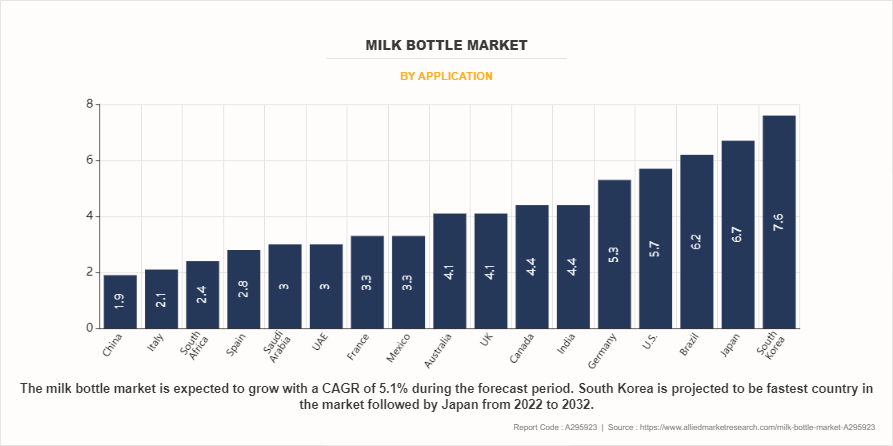

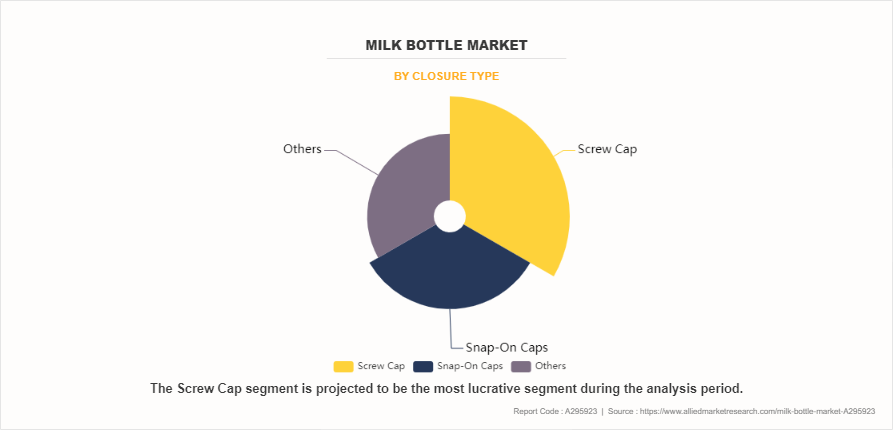

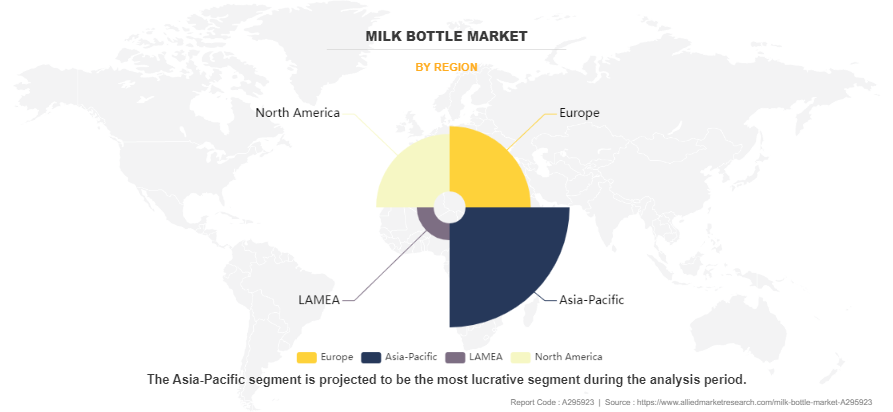

The milk bottle market is segmented on the basis of capacity, application, material closure type, and region. By capacity, the market is bifurcated into below 200 ml, 200 ml to 500 ml, 500 ml to 2000 ml, and above 2000 ml. By application, the market is classified into baby feeding bottle and milk storage bottle. By material used, the market is classified into plastics and glass. By closure type, the market is classified into screw caps, snap-on caps, and others . By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The milk bottle market is segmented into Capacity, Application, Material and Closure Type.

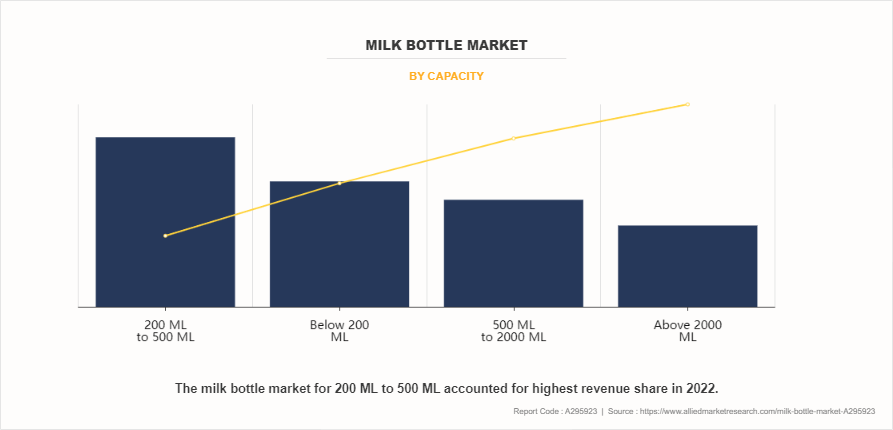

By capacity, the 200 ml to 500 ml sub-segment dominated the global milk bottle market share in 2022. Urbanization has resulted in a transformation of lifestyles and consumption habits., resulting in a higher demand for compact and efficient packaging. The 200 ml to 500 ml milk bottles are ideal for urban inhabitants who have limited storage space and choose packaging that complements their urban lifestyle. The smaller size is ideal for refrigerator storage and fits easily into refrigerators usually seen in urban houses. Innovations such as resealable caps, ergonomic designs, and lightweight yet robust materials lead to an improved user experience, attracting consumers who value both functionality and priorities in their packaging choices. Smaller milk bottles can be less expensive to manufacture than bigger containers. The reduced material needs, along with the capacity to create larger numbers owing to smaller sizes, frequently result in cheaper manufacturing costs per unit. This cost savings may be passed on to customers, making smaller Milk Bottle industry a more economically viable alternative for both producers and consumers.

By application, the milk storage bottle sub-segment dominated the global milk bottle market share in 2022. Milk storage bottles greatly decrease the environmental effect of packaging. Glass bottles, in particular, are noted for their recyclability and durability, which help to promote a circular economy. By using reusable materials, the dairy sector may reduce waste and contribute to overall environmental conservation. Milk bottles, particularly those made of better insulating materials, can help to maintain the product's freshness and shelf life. These bottles provide superior protection against external influences like light and air, allowing the milk's nutritious content and flavor to be preserved for a longer time. While the initial cost of establishing a milk storage bottle may be higher, the long-term benefits result in cost savings for consumers. Milk storage bottles allow companies to showcase their creativity and customize their brand. Companies can employ bottle design and labelling to identify their products in a crowded market. This not only increases brand visibility, but it also promotes a distinct identity that connects with customers.

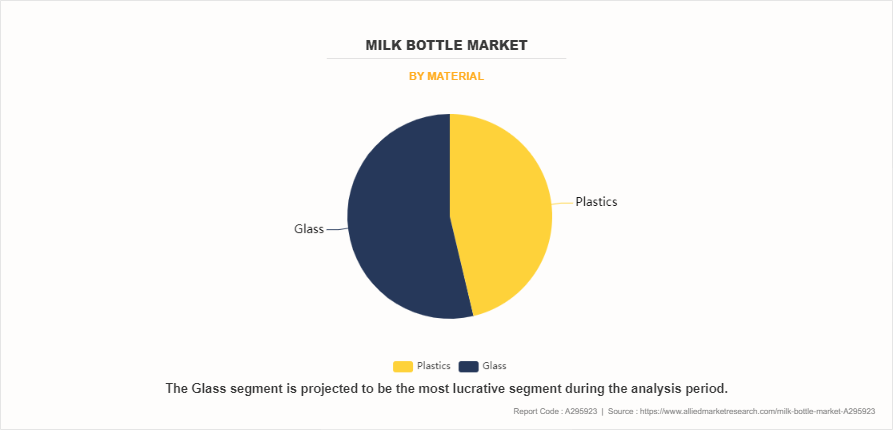

By material, the glass sub-segment dominated the global milk bottle market share in 2022. Glass is impermeable and non-reactive, due to which the milk is not affected by external odors or flavors. This feature helps to retain the freshness and natural flavor of the milk, giving customers a better taste experience. Glass milk bottles are noted for their strength and lifespan. Unlike some plastic containers, which deteriorate over time, glass bottles may be reused repeatedly without losing structural integrity. This lifespan increases the economic and environmental benefits of glass packing. Glass is recyclable, which means it may be recycled again without losing quality. The closed-loop glass recycling technology helps to build a circular economy in which resources are reused and waste is reduced. This is consistent with worldwide efforts to reduce the environmental impact of packaging materials. Glass milk bottles come in a traditional and timeless design that appeals to consumers seeking a high-quality and authentic product. The visual attractiveness of glass packaging helps to build a favorable brand image by differentiating items on shop shelves and attracting consumers looking for a more refined and sophisticated option.

By closure type, the screw caps sub-segment dominated the global milk bottle market share in 2022. Screw caps form an airtight closure, preserving the fragrance and flavor of the milk. Screw caps, unlike conventional closures, prevent odors from permeating the milk, resulting in a more delightful and consistent customer experience. Screw caps' user-friendly shape makes them ideal for usage by people of all ages. The danger of spilling is greatly decreased, making it easier to pour and seal the milk bottle. This benefit is especially appreciated by customers who value hassle-free use in their everyday routines. Screw caps offer flexibility in packaging design, enabling various customization options. This adaptability allows dairy producers to differentiate their products through branding, label design, and cap color selection. This branding potential not only draws customers, but also helps to build brand familiarity and loyalty. Screw caps frequently have tamper-evident features like a breakable ring or a visible seal. These characteristics provide buyers a visible indication that the goods were not tampered with during shipping or storage. This additional degree of protection increases consumer trust and confidence in the product.

By region, Asia-Pacific dominated the global milk bottle market size in 2022. Economic growth and rising disposable incomes in several Asia-Pacific countries have given people more money to spend on high-quality food goods. As people become more sensitive about the quality and safety of the products they eat, there is a rising desire for packaged dairy products, which drives up demand for milk bottles. The development of cold chain infrastructure in Asia-Pacific has been critical to the dairy industry expansion. Refrigerated transport and storage facilities guarantee that dairy goods, particularly milk bottles, may be delivered effectively without sacrificing quality, further contributing the growth of milk bottle market forecast period. Milk bottles offer plenty of space for branding and marketing campaigns. Dairy firms in Asia-Pacific may use appealing package designs to increase brand exposure and communicate product benefits to customers. Creative packaging can influence purchase decisions, which increases brand loyalty. Milk bottle makers in the region are investing in R&D to provide new packaging options. This includes easy-open caps, ergonomic designs, and materials that extend the shelf life of dairy products. Customization possibilities appeal to a wide range of client preferences while also helping to increase market competition.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the milk bottle market analysis from 2022 to 2032 to identify the prevailing milk bottle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the milk bottle market demand segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global milk bottle market trends, key players, market segments, application areas, and market growth strategies.

Milk Bottle Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5718.7 million |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Capacity |

|

| By Application |

|

| By Material |

|

| By Closure Type |

|

| By Region |

|

| Key Market Players | Maharashtra Industries, tupperware brands, meadwestvaco, WWP Direct, Longshen Industrial, Kadolta Packaging, gerresheimer, bormioli rocco, Amcor, Huhtamaki |

The global milk bottle market is propelled by increasing dairy consumption, changing dietary habits, and advancements in packaging technology. In addition, the market is driven by growth in technological advancements and smart bottles.

The major growth strategies adopted by the milk bottle market players are partnerships with retailers & distributors and global market expansion.

North America will provide more business opportunities for the global milk bottle market in the future.

Longshen Industrial, Huhtamaki, Amcor, Gerresheimer, Tupperware Brands, Maharashtra Industries, MeadWestvaco, Bormioli, Rocco, WWP Direct, and Kadolta Packaging are the major players in the milk bottle market.

The 200 ml to 500 ml sub-segment of the capacity segment acquired the maximum share of the global milk bottle market in 2022.

Retail consumers are the major customers in the global milk bottle market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global milk bottle market from 2022 to 2032 to determine the prevailing opportunities.

The increasing demand for eco-friendly packaging and sustainable practices is expected to drive the adoption of milk bottles, particularly in the food & beverage industry. Consumers' growing preference for reusable and recyclable packaging aligns with the resurgence of milk bottles.

Smart and connected bottles, rise in innovative materials and designs of milk bottle, and surge in demand for nutritional integration to drive the global milk bottle market.

Loading Table Of Content...

Loading Research Methodology...