Milking Robots Market Overview, 2031

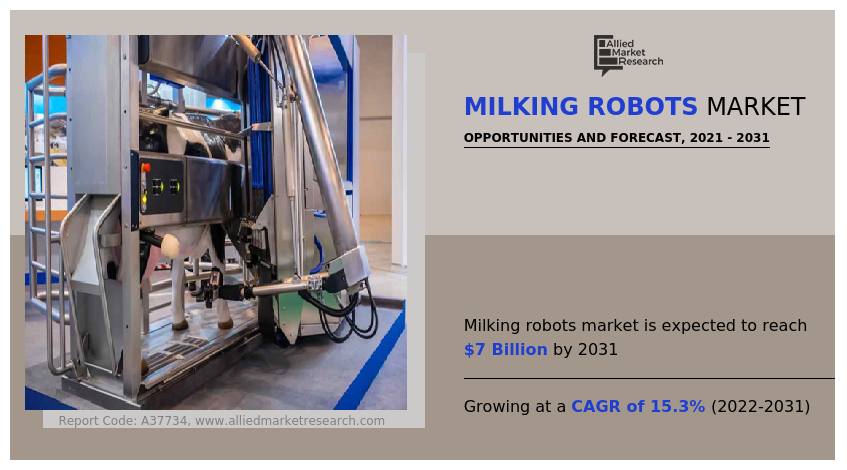

The Global Milking Robots Market was valued at $1.7 billion in 2021, and is projected to reach $7 billion by 2031, growing at a CAGR of 15.3% from 2022 to 2031. Milking robots are made to best meet the farmer's preferences and requirements. Labor and operational costs are expected to rise as a result of rising demand for dairy products and subsequent expansion in dairy farms worldwide.

Milking automation technology, such as milking robots, can dramatically reduce labor costs on dairy farms by improving milk output. Not only do milking robots minimize manual labor, but they also increase the number of times a single cow can be milked, hence boosting the output.

The training provided to the cows at dairy farms has a significant impact on the functionality and usefulness of milking robots. Cows need to adjust to the systems in order to operate more effectively. One of the main things that is anticipated to impede the market is inadequate training. Furthermore, the majority of farm owners worldwide own small to medium-sized farms, and investing heavily in advanced and automated solutions may result in financial losses. This is especially prevalent in emerging economies such as India, Brazil, and China, where farm herd sizes are small and the livestock industry is unorganized.

The milking robots industry players are investing a lot of effort on the research and development of smart and unique strategies to sustain their growth in the market. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. In August 2021, The National Gas Company of Trinidad and Tobago Limited (NGC) inked a Consolidated Gas Supply Contract (CGSC) with Milking Robots Holdings (Trinidad) Limited (MHTL), a part of the Proman family of companies, which is also the largest milking robots producer in the world. The agreement is supposed to upkeep operations at the MHTL Milking robots Complex, which includes one of the world’s most competent producers of low carbon milking robots -- the mega-Milking Robotic M5 plant.

Segment Overview

The milking robots market is segmented into Herd Size, System and Offering.

The global milking robots market is segmented on the basis of system, offering, herd size, and region. By system, the market is sub-segmented into single-stall milking system, multi-stall milking system, and rotary milking system. By offering, the milking robots market is sub-segmented into software, hardware, and services. By herd size, the market is classified into less than 100, between 100 to 1,000, and more than 1,000. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

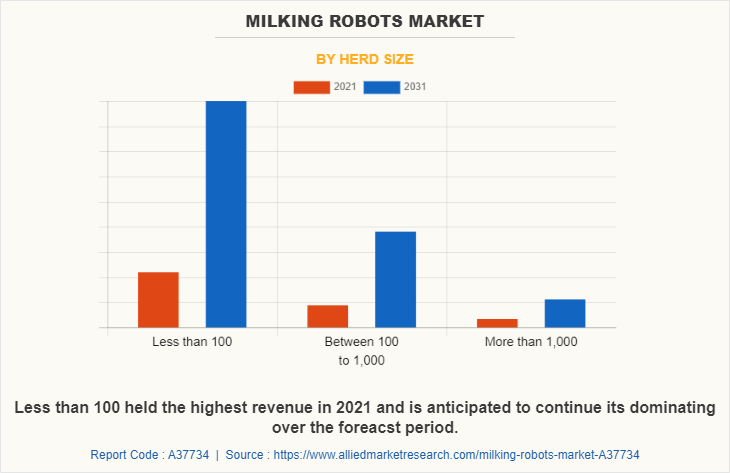

By herd size, the less than 100 sub-segment dominated the global milking robots market share in 2021. Robotic milking system are widely used by dairy farm proprietors with herd sizes of between 100 and 1,000 cows because they make it possible to milk several cows at once, increasing milk production. Multi-stall automatic milking is preferred by farms with herds of 100 to 1,000 cows. In such units, a single robot arm can milk up to 500 cows at once and can serve two or more stalls, making it easier and more convenient for farms with bigger herds.

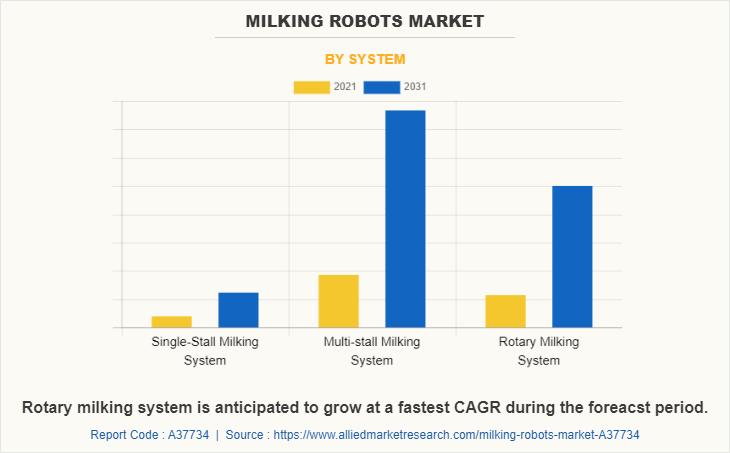

By system, the multi-stall milking system sub-segment dominated the market in 2021. Multi-stall models accounted for roughly 44% of the worldwide market share. Due to rising demand for milk and milk products, significant investment in farming technology, and expensive on-farm labor costs, the market is anticipated to witness significant growth. Rising average herd size and technological advancement are expected to drive substantial growth in milking robots adoption in these areas. These are predicted to be the major factors affecting the milking robots market size during the milking robots market forecast.

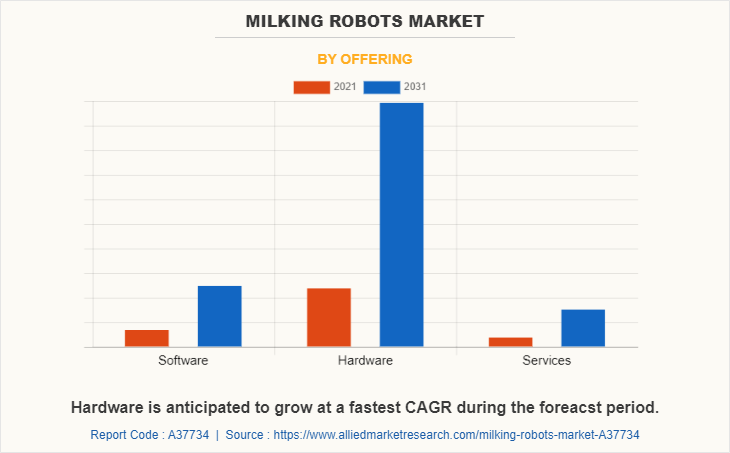

By offering, the hardware sub-segment dominated the global milking robots market share in 2021. The milking robot was developed to improve the efficiency and productivity of the milking process. Because robot suppliers wished to keep the data to themselves, it used to be a stand-alone system. However, most robots have become compatible with a wide range of other technologies and devices over the years, and data flows between systems are being encouraged, which is a positive development. Integrating AMS technology with other systems and sensor technology improves cow health and welfare while allowing farmers to respond faster and make better, more informed choices.

By region, Europe dominated the global milking robots market overview market in 2021 and is projected to remain the dominating sub-segment during the forecast period. Growing demand of dairy product and subsequent increase in number of dairy farms in Europe is expected to drive the milking robots market growth in this region. A rise in livestock rearing operations has resulted from the region's expanding population and the ensuing rise in demand for milk and dairy products, opening up possibilities for the adoption of automated milking techniques like milking robots. Additionally, it is anticipated that the demand for milking automation solutions will increase as a result of the fast urbanization and economic growth in nations like the UK, Germany, and Spain as well as the rising demand for automatic milker and other dairy products.

Competitive Analysis

The key players profiled in this report include Afimilk Ltd., BouMatic Robotics, Dairymaster, DeLaval (Tetra Laval), Fullwood Ltd., GEA Group AG, Lely Industries N.V., Read Industrial Ltd., System Happel and Waikato Milking Systems NZ LP.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the milking robots market segments, current trends, estimations, and dynamics of the milking robots market analysis from 2021 to 2031 to identify the prevailing milking robots market opportunities.

- The milking robots market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the milking robots market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global milking robots market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the milking robots market players.

- The report includes the analysis of the regional as well as global milking robots market trends, key players, market segments, application areas, and market growth strategies.

Milking Robots Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7 billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Herd Size |

|

| By System |

|

| By Offering |

|

| By Region |

|

| Key Market Players | Fullwood Packo, Milkomax Solutions laitières, DAIRYMASTER, BouMatic, GEA Group Aktiengesellschaft, DeLaval, Hokofarm Group, Waikato Milking Systems NZ LP., AktivPuls GmbH, Lely |

Analyst Review

The nutritional qualities of milk and milk products are the primary factors driving the growth of the global market for milking robots. Furthermore, the growing number of dairy businesses and rising demand from the food and beverage industries are propelling market growth. This, along with an increase in demand for quality and quantity milk, as well as the high cost of labor, is encouraging the deployment of robots for operational purposes, consequently stimulating market expansion.

Some market restraint factors include dairy farmers learning how to handle minor repairs, some parts are expensive to replace if their warranties have expired, and these include lasers that locate the cows' teats and hydraulic arms that move in and out from underneath cows. The final manual labor tasks remaining in the milking process were cleaning and inspecting the teats and attaching the milking equipment (milking cups) to the teats; it is a complex task that requires accurate detection; the tasks have been successfully automated in the voluntary milking system (VMS), or the automatic milking system (AMS).

Milk manufacturing is time-consuming. Labor and operational costs are expected to rise as a result of increased demand for milk products and subsequent expansion in dairy farms globally. Milking automation technology, such as milking robots, can drastically decrease labor expenses on dairy farms by improving milk output. Milking robots not only reduce manual labor, but also increase the number of times a single cow can be milked, increasing production.

Among the analyzed regions, Europe is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, North America, and LAMEA. The high number of dairy farms and rising milk demand in these countries are driving up sales of milking robots in Europe are the key factors responsible for leading position of Europe and Asia-Pacific in the global milking robots market.

A rise in livestock rearing operations has resulted from the Asia Pacific region's expanding population and the ensuing rise in demand for milk and dairy products, opening up possibilities for the adoption of automated milking techniques like milking robots.

The major growth strategies adopted by milking robots market players are investment and agreement.

Europe will provide more business opportunities for the global milking robots market in future.

Awareness about monitoring system for dairy cows, identification and tracking of dairy cows using sensor technology, and behavior monitoring and control of livestock on dairy farms are expected to drive demand for sensing and monitoring solutions for dairy farming during the forecast period.

Agriculture industry are the major the major customers in the global milking robots market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global milking robots market from 2021 to 2031 to determine the prevailing opportunities.

Hardware sub-segment of the end-use industry acquired the maximum share of the global milking robots market in 2021.

Afimilk Ltd., BouMatic Robotics, Dairymaster, DeLaval (Tetra Laval), Fullwood Ltd., GEA Group AG, Lely Industries N.V., Read Industrial Ltd., System Happel and Waikato Milking Systems NZ LP. are the major players in the milking robots market.

Loading Table Of Content...

Loading Research Methodology...