Mini Excavators Market Overview

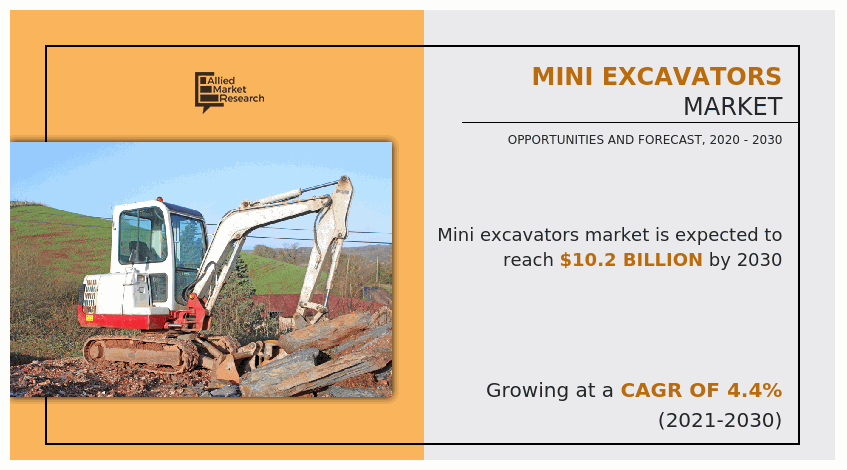

The global mini excavators market size was valued at $6.6 billion in 2020, and is projected to reach $10.2 billion by 2030, growing at a CAGR of 4.4% from 2021 to 2030. This is driven by rising construction activity in developed nations and the launch of advanced, user-friendly models. Key industry players have expanded operations globally to strengthen their market presence and capitalize on increasing demand for compact, efficient construction equipment.

Market Dynamics & Insights

- The mini excavators industry in Asia-Pacific held a significant share of over 45.6% in 2020.

- The mini excavators industry in U.S. is expected to grow significantly at a CAGR of 4.3% from 2021 to 2030

- By type, track segment is one of the dominating segments in the market and accounted for the revenue share of over 80.1% in 2020.

- By end-user, landscaping and construction segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $6.6 Billion

- 2030 Projected Market Size: $10.2 Billion

- CAGR (2021-2030): 4.4%

- Asia-Pacific: Largest market in 2020

- Asia-Pacific: Fastest growing market

What is Meant by Mini Excavators

Mini excavators are construction equipment equipped with dipper, boom, or bucket installed on a movable platform based on application requirement. These excavators provide assistance in performing landscaping, excavating, demolishing, picking & placing, material handling, constructing activities, and others. In addition, mini excavator aids in completion of labor-intensive tasks or the works earlier performed using heavy construction equipment.

Excavators are predominantly used in construction as well as agriculture sector for various applications. However, a large excavator is not always optimal to performing small scale task. Whereas, by using mini excavators, these tasks can be performed easily and at lower cost, which is anticipated to boost the demand for mini excavators. Further, rise in demand for mini excavators, owing to rise in construction sector is projected to propel growth of the global mini excavator market. On the other hand, rise in world population has significantly increased demand in the agriculture sector, thereby; positively influencing mini excavators market growth. Furthermore, the availability of a wide range of mini excavator in various lifting capacities makes it suitable for use in various small-scale applications. Thus, mini excavators are extensively used for excavating small trenches, pits, handling lighter loads, maintaining land surface, and others. The development of advanced battery technologies has helped to ease the process of owning and operating mini excavator. In addition, integration of cameras and other spatial sensors have fueled the development of new generation of mini excavators, which puts lesser burden on the operator.

Major players in the mini excavators industry have focused on development of high-performance battery powered mini excavators. For instance, in April 2022, Hitachi Construction Machinery Tierra Co., Ltd., a leading provider of construction machinery launched a 5-tonne class ‘ZX55U-6EB’ battery-powered mini excavator in Europe. It is based on a short rear-end swing design mini excavator, which allows efficient operation even in confined spaces. The owners of this machine can expect reduced maintenance costs and downtime, compared to diesel-powered excavators. Key players offer mini excavators that are operator friendly. These excavators have features that make it easy for the operator to stay comfortably in the cabin of excavators. For instance, in November 2020, J C Bamford Excavators Ltd. a manufacturer of industrial equipment launched a fully glazed cab on the 19C-1E platform. It is an industry first for the electric mini excavator sector. It is equipped with an electric heater to provide instant heat to demist windows and warm the cab working environment for the operator.

The novel coronavirus has rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic has halted the production of many components of mini excavators due to lockdown. The economic slowdown initially resulted in reduced spending on mini excavator from commercial and non-commercial users. Furthermore, the number of COVID-19 cases is expected to reduce in the near future as the vaccine for COVID-19 is introduced in the market. This has led to the reopening of mini excavators manufacturing companies at their full-scale capacities, which is expected to help the market to recover by the start of 2022. After COVID-19 infection cases begin to decline, mini excavator manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Furthermore, the increased investments on infrastructure projects such as road construction, by the governments across the globe have surged the demand for mini excavators.

Mini Excavators Market Segment Overview

The mini excavator market is segmented on the basis of type, size, end user, and region. By type, the market is categorized into wheeled and track mini excavator. On the basis of size, it is categorized into less than 4 tons and 4 tons to 10 tons. On the basis on end user, the market is categorized into landscaping & construction and agriculture. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia Pacific dominated the market in 2020, accounting for the largest mini excavators market share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to rise in spending on construction activities by government and non-government entities.

Competition Analysis

Key companies profiled in the mini excavator market report include AB Volvo, Caterpillar, Inc., Doosan Infracore Co. Ltd., Deere & Company, Hitachi, Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators, Ltd., Kobe Steel, Ltd., Komatsu, Ltd., Takeuchi Mfg. Co., Ltd., and other players.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mini excavators market analysis from 2020 to 2030 to identify the prevailing mini excavators market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mini excavators market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- The global mini excavators market forecast analysis from 2021 to 2030 is included in this report.

- The report includes the analysis of the regional as well as global mini excavators market trends, key players, market segments, application areas, and market growth strategies.

Mini Excavators Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Operating Weight |

|

| By End User |

|

| By Region |

|

| Key Market Players | Doosan Infracore Co. Ltd., Takeuchi Mfg. Co., Ltd., Caterpillar Inc., Hyundai Construction Equipment Co. Ltd., Kobe Steel, Ltd., Hitachi, Ltd., Deere & Company, AB Volvo, Komatsu Ltd., J C Bamford Excavators Ltd. |

Analyst Review

The mini excavators market has witnessed significant growth in past few years owing to surge in spending on construction activities.

Asia-Pacific is expected to provide attractive opportunities for mini excavators due to rapid urbanization and development of the construction industry. Moreover, infrastructure development in South Asia, the Middle East, and Africa is expected to drive the market growth in coming years. In addition, rise in awareness about versatile benefits of mini excavators across different industry verticals such as landscaping, construction, and agriculture is expected to fuel adoption of this equipment in materials handling and lifting applications. Furthermore, rise in urbanization has surged the demand for commercial and residential construction projects, thereby, positively influencing the growth of the mini excavator market. However, dearth of skilled workforce and technicians is anticipated to hamper growth of the global mini excavator market.

Moreover, standardization of mini excavators and incorporation of latest battery technology along with use of latest camera and spatial sensors in mini excavators are anticipated to provide lucrative opportunities for the mini excavator market

Tracked mini excavators are being extensively used for various construction and landscaping activities.

Asia-Pacific is the largest regional market for mini excavators.

$6,550.5 million is the estimated market size of mini excavators in 2020.

AB Volvo, Caterpillar, Inc., Doosan Infracore Co. Ltd, Deere & Company, Hitachi, Ltd. and Hyundai Construction Equipment Co., Ltd. are some of the top companies to hold major market share in mini excavators market.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...