Mini PCs Market Research, 2032

The Global Mini PCs Market was valued at $21.1 billion in 2022, and is projected to reach $33 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032.

The rise in demand for Mini PCs is due to their seamless integration with peripherals such as monitors and keyboards, making them an appealing alternative for complete computing solutions. As the need for cutting-edge technological solutions such as AI, IoT, and 5G connection develops, the performance and efficiency of these small devices have skyrocketed. This extraordinary feat of engineering enables them to effortlessly perform a broad range of demanding computing activities, including data processing and machine learning, as well as intensive gaming and immersive VR experiences. As customer preferences move toward tiny and portable computing solutions, the Mini PCs market is expected to develop and innovate throughout the projected period.

Mini PCs, also known as minicomputers or mid-range computers, are a variant of computers that possesses most of the features and capabilities of a large computer but is smaller in physical size. The Mini PCs market is rapidly growing within the expansive computing industry. These compact devices offer desktop-level capabilities in incredibly small sizes. Mini PCs have gained immense popularity due to their unrivaled portability, energy efficiency, and versatility for a multitude of tasks. From sleek stick-shaped designs to small box-like setups, Mini PCs are equipped with powerful impressive hardware such as processors, memory, storage, and various connectivity options. They are utilized in a wide range of fields, including home entertainment, office work, digital signage, industrial automation, and gaming.

Key Takeaways of Mini PCs Market Report

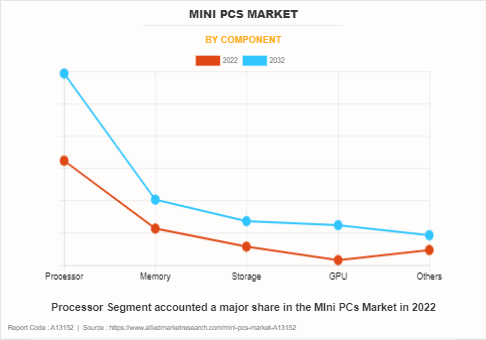

- On the basis of component, the processor segment dominated the Mini PCs Market size in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

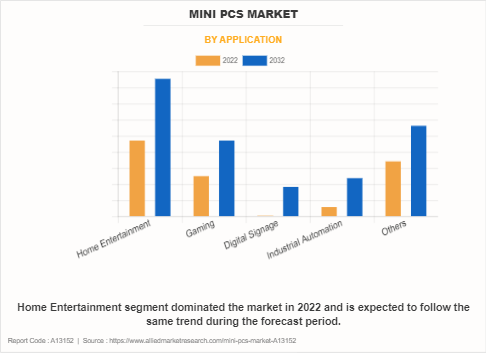

- By application, the home entertainment store segment held the leading position in terms of revenue within the Mini PCs market in 2022. Nonetheless, it is anticipated that the digital signage segment will demonstrate the most rapid Compound Annual Growth Rate (CAGR) throughout the forecast period.

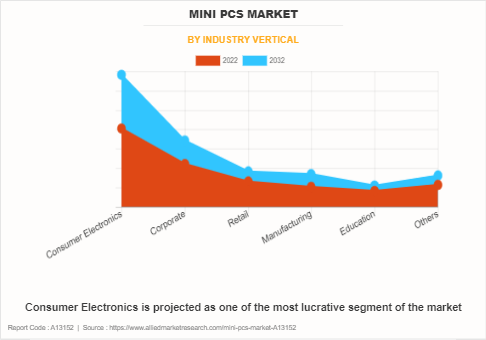

- By end use, the consumer electronics segment exhibited dominance in terms of revenue in 2022 and is projected to maintain this trend by achieving the fastest CAGR during the forecast period.

- Region-wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Segment Overview

The Mini PCs market is segmented into application, component, industry vertical, and region.

By component, the market is divided into processor, memory, storage, GPU, and others. The processor segment accounted for a major share in the market, fueled by impressive advancements in processor technology that delivered higher performance, lower power consumption, and enhanced integrated graphics capabilities. As Mini PCs gain more power and flexibility, they are becoming a must-have for consumers, serving a diverse range of needs from simple computing tasks to entertainment, productivity, and beyond. With the growing need for Mini PCs equipped with speedy processors, the demand continues to soar steadily, as consumers seek devices that can flawlessly handle high-definition media streaming, gaming, and multitasking.

By application, the mini PCs market insights is bifurcated into home entertainment, gaming, digital signage, industrial automation, and others. The home entertainment segment holds a prime share in the mini PCs market. The trend of streaming services and digital media consumption has made mini PCs a sought-after choice for compact media hubs. These devices allow users to easily stream movies, TV shows, music, and online content straight to their TVs or monitors. And as the demand for versatile and cost-effective home entertainment solutions grows, mini PCs are able to meet these needs efficiently.

By industry vertical, the mini PCs growth projections is segmented into consumer electronics, corporate, retail, manufacturing, education, and others. A significant portion of the mini PCs Market is dominated by consumer electronics. This is due to their essential function of offering compact, efficient, and flexible computing options for personal and household purposes. With the rising demand for affordable, space-saving, and user-friendly devices, consumer electronics are making a substantial contribution to the overall growth of the market.

On the basis of region, the Mini PCs market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of the Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), and Middle East & Africa (UAE, Saudi Arabia, Rest of Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the global mini PCs industry, owing to various factors including the widespread integration of cutting-edge technologies, strong consumer buying power, and the active presence of key players encouraging innovation and market growth.

Competitive Analysis

The mini PCs market share by company include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Technologies Inc., HP Inc., Intel Corporation, Lenovo Group Limited, Elitegroup Computer Systems Co., Ltd., ASRock Inc., and Hasee Computer Co., Ltd. These mini PCs companies have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

Market Dynamics

The rise in remote work and digital transformation

The rise in remote work and digital transformation acts as another significant driving factor for medical electronics, owing to the rise of remote work and the ongoing digital transformation across industries has created a surge in demand for portable and versatile computing solutions like mini-PCs. These devices offer flexibility and mobility, allowing users to work from anywhere while maintaining productivity and connectivity. Further, the surge in technological advancements in hardware components such as processors, memory, and storage, has significantly enhanced the performance and efficiency of Mini PCs.

The surge in the usage of digital signage solutions

The surge in the usage of digital signage solutions is fueling the need for Mini PCs. Companies spanning various sectors are capitalizing on these dynamic displays to improve customer interaction and elevate brand exposure. As the key support system for these networks, Mini PCs provide the necessary processing capabilities to operate high-quality screens and facilitate multimedia content. The widespread adoption of digital signage in retail, hospitality, healthcare, and transportation has led to an increasing demand for Mini PCs to drive these innovative solutions.

More expensive than standard desktops and laptops

Mini PCs, particularly ones with high-end hardware, may be slightly more expensive than standard desktops and laptops, but they provide superior performance and capabilities. This initial cost may be a problem for budget-conscious individuals and enterprises, making price a critical component in their purchasing decisions. This is especially important in markets where cost is a major factor, or during difficult economic times. To be considered a viable choice, tiny PCs must have a higher value than other computing options. Mini PCs Companies and vendors must handle this pricing challenge by establishing competitive pricing strategies, introducing value-added features, and showcasing their distinct advantages to attract potential buyers and promote widespread market acceptance.

Increasing integration of smart home devices and IoT technologies

As smart home ecosystems expand, new opportunities arise for the tiny PC market. With the increasing integration of smart home devices and IoT technologies into daily lives, tiny PCs play an important role as central management hubs for these interconnected devices. Mini PCs facilitate efficient communication and coordination among various smart devices such as thermostats, lighting systems, security cameras, and voice assistants, allowing for seamless automation and personalized experiences in the smart home. Their high computational capabilities enable efficient data processing and analysis from these devices, making them crucial for a truly intelligent and convenient home. Furthermore, as the surge in popularity of smart home technology grows, owing to numerous benefits such as ease, energy savings, and security, so does the need for tiny PCs. This provides a tremendous opportunity for miniature PC producers to adapt to the specialized needs of smart home consumers while also expanding their market presence, hence boosting industry growth.

Recent Developments in Mini PCs Industry

- February 7, 2024: Intel announced the NUC 13 Extreme "Beast Canyon" Mini PC, with 13th Gen Core processors and dedicated graphics, perfect for demanding tasks such as gaming and content creation.

- January 3, 2024: Get smart with the new NUC 13 series! Intel unveiled its latest lineup of Mini PCs equipped with 13th Gen Core processors for improved performance and AI enhancements, making them ideal for everyday tasks and productivity workflows.

- February 14, 2024: The ThinkCentre M70q Gen 3 arrives! Lenovo brought power and efficiency to compact desktops with their new Mini PC featuring 13th Gen Intel Core processors with smoother multitasking and enhanced security features in Mini PC Windows 11.

- February 10, 2024: Dell raises the bar! Dell‐™s new OptiPlex Micro PCs include 13th Gen Intel Core processors, delivering significant performance gains for everyday tasks and professional applications. Get ready for faster workflows and a lag-free experience.

- December 12, 2023: Expanding horizons Dell introduced new OptiPlex Micro models specifically designed for the education and healthcare sectors. With enhanced durability and manageability features, these Mini PCs cater to specialized needs for learning environments and medical institutions.

- February 2, 2024: Security meets power! HP launched the EliteDesk Mini G9 series with 13th Gen Intel Core processors and robust security features, making them ideal for businesses focused on data protection and performance.

- February 13, 2024: Gamers rejoice! ASUS unleashed the upgraded ROG Strix G13 Mini Gaming PC featuring the latest AMD Ryzen processors and improved cooling for smooth and powerful Mini Gaming PC experiences in a compact form factor.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mini PCs market analysis from 2022 to 2032 to identify the prevailing mini PCs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and mini PCs manufacturer to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mini PCs market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global mini PCs market size by country.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mini PCs market trends, mini PCs manufacturer, mini PCs market statistics, market segments, application areas, and market growth strategies.

Mini PCs Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 33 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Application |

|

| By Component |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Apple Inc. (US), Acer Inc., Elitegroup Computer Systems, HP INC., Hasee Computer, Lenovo Group Limited, Intel Corporation, ASRock Inc, ASUSTeK Computer Inc., Dell Technologies Inc. |

Analyst Review

The Mini PCs Market is expected to significant growth within the electronics and computer hardware sectors, driven by factors such as the increase in adoption of remote work setups, digital transformation initiatives, and the need for compact computing solutions. The market is witnessing a surge in demand across various regions, including developed economies such as the U.S., the UK, and Japan, as well as emerging markets such as China, India, and Brazil.

Market Landscape:

- The Mini PCs Market is projected to $21,141.6 million in 2022, showing a CAGR of 4.5% during the forecast period.

- The consumer electronics vertical is expected to dominate the Mini PCs industry during the forecast period.

- The Asia-Pacific region is anticipated to witness the fastest growth in the Mini PCs Market from 2023 to 2032 due to increase in adoption of consumer electronics and rise in disposable income of consumers

Key Drivers:

- The proliferation of cloud computing and the Internet of Things (IoT) ecosystem is fueling the demand for Mini PCs for edge computing applications.

- Challenges such as rising component costs and supply chain disruptions may pose constraints to market growth.

Technological Advancements:

- Ongoing evolution in Mini PC technology includes advancements in processor performance, graphics capabilities, and connectivity options.

- Increasing trend towards remote work and digital learning is creating new opportunities for Mini PC vendors to address the growing demand for portable and versatile computing solutions.

Strategies:

- Market participants are introducing Mini PCs with enhanced features such as higher processing power, improved energy efficiency, and compact form factors.

- Product innovation and strategic collaborations are key strategies adopted by industry players to maintain competitiveness and capture market share.

Leading manufacturers are launching new product lines with upgraded processors, expanded memory and storage options, and enhanced connectivity features to meet evolving consumer and business needs. Collaborations with software developers and ecosystem partners are facilitating the development of tailored Mini PC solutions for specific use cases such as gaming, digital signage, and industrial automation.

Rise of Compact Gaming Mini PCs and the integration of AI and IoT Capabilities in mini PCs are the upcoming trends of mini PCs market in the world.

Home Entertainment is the leading application of mini PCs market.

North America is the largest region for mini PCs

In 2022, $21.14 billion is the estimated size of mini PCs

include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Technologies Inc., HP Inc., Intel Corporation, Lenovo Group Limited, Elitegroup Computer Systems Co., Ltd., ASRock Inc., and Hasee Computer Co., Ltd. are the top companies to hold the market share in mini PCs

Loading Table Of Content...

Loading Research Methodology...