Minimally Invasive Glaucoma Surgery (MIGS) Devices Market Overview:

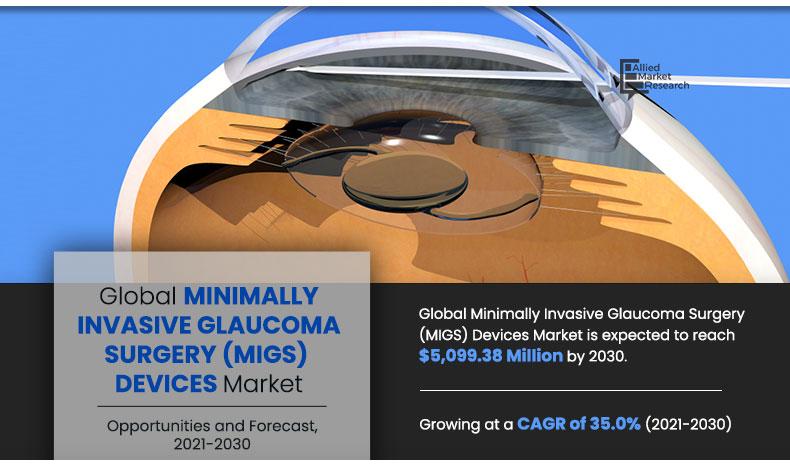

The minimally invasive glaucoma surgery (MIGS) devices market size generated $298.75 million in 2020 and is projected to reach $5,099.38 million by 2030, growing at a CAGR of 35.0% from 2021 to 2030.Minimally invasive glaucoma surgery devices offer an ab interno approach that spares medication, and conjunctival invasion for the treatment of patients suffering from glaucoma. MIGS devices such as stents, shunts, micro implants, and others are utilized for the treatment of patients with mild-to-moderate glaucoma. Rise in preference for MIGS devices over traditional glaucoma surgical devices has been witnessed over the years, as the former devices are safer, and effective compared to traditional devices. In addition, rise in focus of market players in the development of stents specifically for minimally invasive glaucoma surgeries that can reduce intraocular pressure (IOP) effectively supplements the market growth. Moreover, surge in prevalence of glaucoma, rise in geriatric population prone to varied ophthalmic diseases including glaucoma, and change in demographics globally fuel the growth of the minimally invasive glaucoma surgery (MIGS) devices market.

Rise in geriatric population along with increase in prevalence of glaucoma around the world, surge in the demand for combined glaucoma and cataract surgeries and increase in focus of key players in the development of MIGS stents drives the market growth. Moreover, in 2019, AbbVie acquired Allergan plc for eye care products include xen, durysta, ozurdex, and refresh/optive. Regional players are eyeing for their spot in the minimal invasive glaucoma surgery device market with these successful advancements. Thus, increase in adoption of MIGS devices boosts the growth of the market. However, reimbursement barriers regarding MIGS devices and dearth of skilled professionals hamper the market growth. In addition, rapid transition from glaucoma medications to minimally invasive glaucoma surgeries are opportunistic for the minimally invasive glaucoma surgery (MIGS) devices market growth.

COVID-19 impact on the MIGS devices market

Coronavirus (COVID-19) was discovered in December 2019 in Hubei province of Wuhan city in China. The disease is caused by a virus, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted from humans to humans.

After its discovery in Wuhan, the disease rapidly spread to other parts of the globe. Moreover, this virus causes various symptoms in patients, which range from common symptoms to serious symptoms. For instance, common symptoms include fever, dry cough, and fatigue. However, serious symptoms include difficulty in breathing or shortness of breath, chest pain or pressure, and loss of speech or movement. Furthermore, the virus has high potential of lethality in geriatric population. On March 11, 2020, the World Health Organization made an assessment that COVID-19 can be characterized as pandemic. In addition, there are only a few vaccines that received emergency approvals for COVID-19 treatment or prevention. Thus, social distancing is observed as the most important measure to stop the spread of this disease. Furthermore, to maintain social distancing, various countries across the world have adopted nationwide lockdowns.

The COVID-19 pandemic is an unprecedented global public health challenge and is anticipated to have a negative impact on the minimally invasive glaucoma surgery (MIGS) devices market. Glaucoma specialists prefer trabeculectomy procedure for glaucoma surgery. The most commonly performed MIGS procedure was the iStent inject followed by XEN and Preserflo, in minimally invasive glaucoma surgery (MIGS) before the COVID-19 pandemic. Although trabeculectomy remains the most commonly performed established glaucoma surgery, it is being performed with reduced frequency during the COVID-19 pandemic due to the decrease in number of postoperative visits and procedures required.

Minimally Invasive Glaucoma Surgery (Migs) Devices Market Segmentation

The minimally invasive glaucoma surgery (MIGS) devices market is segmented on the basis of surgery, target, product, end user, and region. By surgery, the market is bifurcated into glaucoma in conjunction with cataract and standalone glaucoma. By target, the market is divided into trabecular meshwork, suprachoroidal space, and others. By product, the market is classified into MIGS stents, MIGS shunts, and other. By end user, the market is categorized into eye hospitals, ophthalmology clinics, and ambulatory surgical centers. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment review

By surgery type, the market is categorized into glaucoma in conjunction with cataract and standalone glaucoma. The standalone glaucoma segment dominated the market in 2020 and is anticipated to remain dominant during the forecast period. Key factors, such as increase in geriatric population is prone to glaucoma such as mild to moderate glaucoma conditions, primary angle-closure glaucoma, and secondary angle-closure glaucoma, which is set to drive the growth of the minimally invasive glaucoma surgery (MIGS) devices market.

By Surgery

The glaucoma in conjunction with cataract segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By target, the market is divided into trabecular meshwork, suprachoroidal space, and others. The trabecular meshwork segment is anticipated to depict significant growth during the forecast period due to ineffective drug delivery witnessed in the glaucoma medication which has propelled the transition of glaucoma treatment from medication to minimally invasive glaucoma surgery (MIGS) devices, thereby augmenting the market growth.

By product, the market is divided into MIGS stents, MIGS shunts and other. The MIGS segment is anticipated to exhibit significant growth during the forecast period. Increase in demand for surgical devices in emerging countries and rise in geriatric population is expected to boost the growth of these segments during the forecast period.

By Product

The MIGS stents segment spearheaded the market in 2020 and will continue to maintain its supremacy over the forecast period.

By end user, the market is divided into eye hospitals, ophthalmology clinics, and outpatient surgical centers. The eye hospitals segment is anticipated to depict significant growth during the forecast period and is expected to exhibit a lucrative CAGR during the forecast period. Introduction of advanced surgical devices, shorter waiting time, cost efficiency, and rising awareness about MIGS surgery and treatment devices are expected to boost the segment growth during the forecast period.

By region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific is anticipated to depict significant growth during the forecast period. Increase in demand for surgical devices in emerging countries is expected to boost the growth of these segments during the forecast period.

By Region

North America dominated the market in 2020, whereas the market in Asia-Pacific is likely to witness the fastest market growth during the forecast period.

The key players operating in the global minimally invasive glaucoma surgery devices market include AbbVie Inc., Asico LLC., Glaukos Corporation, iSTAR Medical SA, Ivantis Inc., Lumenis Ltd., Ziemer Ophthalmic Systems AG, Novartis International AG, Santen Pharmaceutical Co. Ltd., and Carl Zeiss Meditec AG.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the minimally invasive glaucoma surgery (MIGS) devices market, and the current trends and future estimations to elucidate the imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing minimally invasive glaucoma surgery (MIGS) devices market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the minimally invasive glaucoma surgery (MIGS) devices market.

Minimally Invasive Glaucoma Surgery (MIGS) Devices Market Report Highlights

| Aspects | Details |

| By Surgery |

|

| By Target |

|

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | LUMENIS LTD., NOVARTIS INTERNATIONAL AG (ALCON INC.), ABBVIE INC. (ALLERGAN), GLAUKOS CORPORATION, ZIEMER OPHTHALMIC SYSTEMS AG, SANTEN PHARMACEUTICAL CO. LTD., IVANTIS INC., ASICO LLC, CARL ZEISS MEDITEC AG, ISTAR MEDICAL SA |

Analyst Review

This section provides various opinions of the top-level CXOs in the minimally invasive glaucoma surgery (MIGS) devices market. In accordance with several interviews conducted, the utilization of minimally invasive glaucoma surgery (MIGS) devices for surgical treatment of glaucoma is expected to increase due to rise in development of new MIGS devices across the globe. North America is projected to be the highest revenue contributor, whereas Asia-Pacific is expected to offer lucrative opportunities to the key players in this market.

According to the perspectives of CXOs of leading companies in the market, rise in burden of geriatric population that is susceptible to glaucoma, increase in demand for surgeries combining glaucoma, and cataract, and surge in geriatric population susceptible to glaucoma boost the market growth. However, unfavorable reimbursement for minimally invasive glaucoma surgery devices, and dearth of skilled professionals are anticipated to hamper the market growth. Glaucoma in conjunction with cataract segment dominates the global MIGS market in 2020 and is anticipated to maintain this dominance throughout the forecast period as these MIGS devices are highly utilized in these surgeries. Several market players are focused toward developing minimally invasive glaucoma surgery (MIGS) devices that can be ideal for the lowering of intraocular pressure including mini shunts, stents, and micro-implants. According to the CXOs, majority of the manufacturers and distributors have focused on expanding their presence in emerging economies.

Yes, global minimally invasive glaucoma surgery (MIGS) devices companies are profiled in the report

The top companies that hold the market share in global minimally invasive glaucoma surgery (MIGS) devices market are AbbVie Inc., Asico LLC., Glaukos Corporation, iSTAR Medical SA, Ivantis Inc., Lumenis Ltd., Ziemer Ophthalmic Systems AG, Novartis International AG, Santen Pharmaceutical Co. Ltd., Carl Zeiss Meditec AG.

The key trends in the global minimally invasive glaucoma surgery (MIGS) devices market are reducing intraocular pressure (IOP) effectivel and increase in geriatric population is prone to glaucoma such as mild to moderate glaucoma conditions, primary angle-closure glaucoma, and secondary angle-closure glaucoma, which is set to drive the growth of this market .

The market value of global minimally invasive glaucoma surgery (MIGS) devices market will reach $5,099.38 million by 2030

The forecast period in the report is from 2021 to 2030

The total market value of global minimally invasive glaucoma surgery (MIGS) devices market was $298.75 million in 2020

The base year for the report is 2020

Loading Table Of Content...