Mining Dust Suppression Chemicals Market Research, 2032

The global mining dust suppression chemicals market was valued at $3.9 billion in 2022, and is projected to reach $6.3 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

Mining dust suppression chemicals are specialized chemical formulations or solutions developed to reduce and control the dispersion of dust produced during various mining activities. Mining processes such as drilling, blasting, crushing, transporting, and material handling frequently produce dust as a byproduct. Major hazards to health, safety, and environment of a person may be posed by these flying dust particles. These chemicals function by binding dust particles together, making them heavier and less prone to go airborne, or by creating a barrier to stop dust from escaping into the environment. Mining companies utilize dust suppression chemicals to reduce dust emissions and uphold a secure and environmentally responsible working environment to address these concerns.

The surge in mining activities drives the demand for mining dust suppression chemicals market. According to the International Organizing Committee for the World Mining Congresses, mining production is expected to increase from 11.3 billion metric tons in 2021 to 17.2 billion metric tons in 2022. The significant challenges associated with dust control in mining operations result in a rise in the need for mining dust suppression chemicals. Chemicals used in dust suppression are important to decrease the risks that mining-related dust causes to the environment, human health, and safety. Furthermore, effective dust control is necessary in mining to maintain optimal operational efficiency achievable. An excess of dust may make it difficult to see, exposing workers to the dust produced and decrease in production.

In addition, it could damage equipment, increase maintenance costs, and hinder mining operations. Dust suppression chemicals are utilized, which results in more cost-effective operations to maintain clear visibility and prevent equipment failure due to dust. Chemicals for mining dust suppression are used in a variety of ways, such as surface spraying, dust binders, foams, and dust control systems. These techniques are adaptable for different mining processes and environmental factors, making them a flexible option for dust management in varied mining operations.

Moreover, environmental rules frequently impose severe limitations on the amount of dust that mining operations may emit. These chemicals are necessary as mining companies need to adhere to these legal criteria and secure the required operating permissions. Compliance ensures that mining operations have no detrimental effects on the environment. Owing to these factors, the rise in mining activities boosts the growth of the market.

The expansion of the mining dust suppression chemicals market is influenced by the increase in awareness of health and worker safety concerns within the mining industry. Significant amounts of dust, especially small particulate matter that might be breathed, are produced during mining operations such as drilling, blasting, crushing, and transporting. It is common for this dust to contain hazardous substances such as silica, which, when breathed in over time, can cause serious respiratory conditions such as silicosis.

The concentration of respirable dust in the air is decreased by using dust suppression chemicals to regulate the dispersion of these particles. Inhaling hazardous dust is less expected as a result, protecting the respiratory health of miners. These substances reduce the exposure of miners to airborne pollutants by effectively lowering dust emissions. The incidence of eye, nose, and throat irritation among miners declines in environments with lower dust concentrations. This results in improved productivity and general wellbeing for mining employees.

Dust in the air may make it difficult to see inside mining operations, which is dangerous for both equipment operators and pedestrians. Accidents and injuries may occur from poor visibility. Chemicals used to suppress dust increase visibility by maintaining a low level of dust. As a result, there are safer working environments and fewer accidents. In addition, there is a higher risk of falls, stumbles, and slips when dust settles on stairs, walkways, and other surfaces. Dust suppression chemicals decrease the possibility of accidents and injuries caused by slips and falls by reducing the amount of dust that settles on these surfaces.

Regulated limits of dust exposure at work, especially in mining operations, are strictly regulated in many areas. For the safety of the workforce and to prevent legal and financial repercussions, compliance with these standards is important. Mining businesses comply with these legal standards with dust suppression chemicals, which also ensures worker protection within legal exposure limits. Owing to these factors, the demand for mining dust suppression chemicals increased significantly during the forecast period.

The high maintenance cost of dust suppression equipment restrains the market growth. Equipment used for dust suppression, such as delivery systems, sprayers, and dust control systems, frequently requires a sizable initial investment. Mining companies must set aside funds for the installation and purchase of this equipment. Certain companies, especially smaller mining operations with limited resources, may be discouraged from implementing dust suppression technology due to high upfront costs.

Regular maintenance is required to ensure the proper functioning of dust suppression equipment. This maintenance includes cleansing, examinations, repairs, and the substitution of worn-out parts or elements. These continuous maintenance costs may quickly accumulate, especially for sizable mining operations with sophisticated dust control systems.

The price of replacing parts and professional labor may put a strain on finances of the company. Owing to these factors, the high maintenance cost of dust suppression equipment hinders the growth of the market. Technological advances in mining dust suppression chemicals have enabled the development of more efficient and environment-friendly methods of controlling dust emissions in mining operations. These advancements aim to improve dust management efficiency, reduce environmental impact, and increase worker safety. The development of dust-suppressing chemicals with nanosized particles has been made possible by advances in nanotechnology. These nanoparticles adhere to dust particles more firmly, keeping them from moving airborne. This leads to better dust control with less chemical use.

Polymer-based dust suppression chemicals cover dust particles with a robust, flexible coating to keep them from becoming airborne. Particularly in difficult mining conditions, these binders are quite effective. Furthermore, the development of precise chemical delivery systems is a result of advanced technology. These devices make sure that dust-suppressing chemicals are sprayed in the proper amounts and places, increasing their effectiveness while reducing waste. Many manufacturers have offered their products that are modified to function effectively.

For instance, Alumichem provides DUST-AWAY, which is a liquid dust binder, based on calcium magnesium acetate (CMA). It is safe and easy to use, and its unique non-corrosive features make it compatible with any surface or metal, including galvanized metal. DUST-AWAY is not only an eco-friendly dust binding product. It is also an eco-friendly and effective alternative to conventional road salt. The spray pattern and chemical application rate may be adjusted by smart sprayers with sensors and automation technology in response to current conditions.

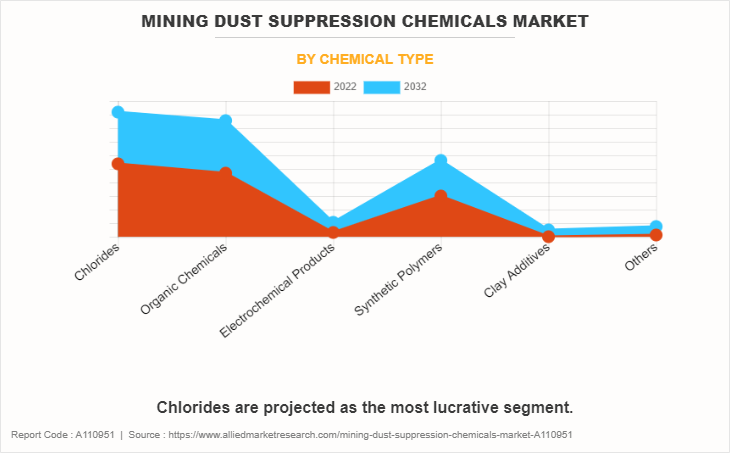

One may prevent overspray and ensure that dust-suppression chemicals are sprayed effectively by performing this. Owing to these factors, the technological advancements in mining dust suppression chemicals presented an excellent growth opportunity for the market. The mining dust suppression chemicals market is segmented on the basis of chemical type, application, and region. On the basis of chemical type, the market is classified into chlorides, organic chemicals, electrochemical products, synthetic polymers, clay additives, and others.

The chloride segment is divided into calcium chloride, magnesium chloride, and sodium chloride. The organic chemicals segment is broadly bifurcated into non-petroleum-based chemicals and petroleum-based chemicals. The non-petroleum-based chemicals are further divided into lignosulfonate, tall oil, vegetable oil derivatives, and others. The petroleum-based chemicals are segmented into asphalt, organic solvents, oil and tar, and others. The electrochemical products segment is segregated into enzymes, ionic solutions, sulfonated oils, and others.

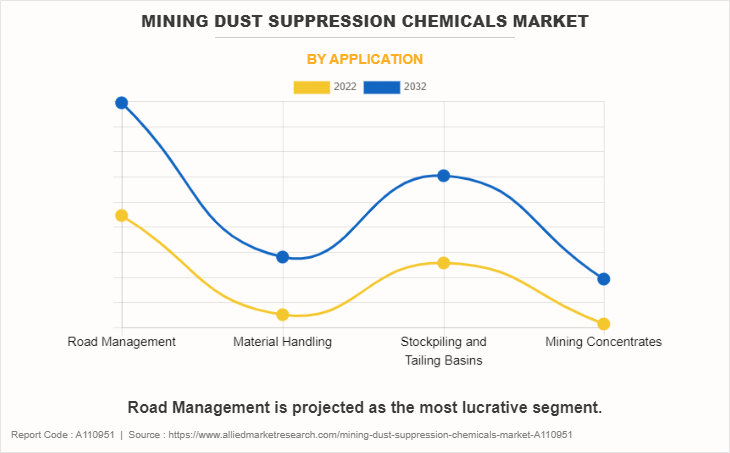

The synthetic polymers segment is divided into polyvinyl acetate, vinyl acrylic emulsions, and others. The clay additives segment is classified into bentonites, montmorillonite, and others. On the basis of application, the market is segregated into road management, material handling, stockpiling and tailing basins, and mining concentrates. The road management segment is classified into chlorides, lignin derivatives, asphalt derivatives, polymers, and others. The material handling segment is divided into antioxidant binders, foam suppression chemicals, wetting agents, and others. The stockpiling and tailing basins segment is segregated into chlorides, clay additives, polymers, tackifiers, and others. The mining concentrates segment is divided into dust suppression chemicals type. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global mining dust suppression chemicals market are Alumichem, Borregaard AS, Carroll Technologies Group, Dow, Ecolab, Envirofluid, Global Road Technology International Holdings (HK) Limited, Quaker Chemical Corporation, Solenis, and Veolia. These players have adopted business expansion, partnership, and product launch as their key strategies to increase their market shares.

By chemical type, the chlorides segment held the largest market share in 2022. One of the primary drivers is the escalating global mining activities, resulting in an increased need for effective dust control measures. The demand for robust dust suppression solutions has intensified, propelling the utilization of chloride-based compounds with mining operations expanding into diverse environments, including arid regions.

By application, the road management segment held the largest market share in 2022. One of the primary drivers behind the adoption of dust suppression chemicals is the heightened awareness of the health and environmental hazards associated with airborne dust particles. Mining operations are under pressure to mitigate their dust emissions as communities and regulatory bodies demand cleaner air quality. This has led to a significant increase in the use of dust suppression chemicals to address these concerns and maintain a socially responsible image.

By region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is one of the fastest-growing regions in the world. The Asia-Pacific region has witnessed a significant surge in the use of mining dust suppression chemicals, driven by several factors. One of the primary drivers is the rapid expansion of mining activities across the region to meet the increase in demand for minerals and resources. The generation of airborne dust becomes a major concern due to its adverse impact on air quality, worker health, and the environment as mining operations intensify. Mining companies have increasingly adopted dust suppression chemicals to mitigate dust emissions to address these concerns.

Key Developmental Strategies Undertaken By Key Players:

In November 2022, Global Road Technology International Holdings (HK) Limited uses its modern dust control technology to help combat the spread of crystalline silica dust across mining sites. Its ACTIVATE product line is made to work together to limit the spread of particulate pollutants. GRT: 12X targets the dust produced by exploration drilling, and the drills themselves are utilized to saturate the fine dust produced by drilling and stop it.

The second prong is GRT: DC Binder, a polymeric additive that prevents hazardous airborne dust from being generated from the heaps of fine Drill Cuttings (DC) by forming a solid surface crust that binds the hazardous dust particles in place. These two measures may reduce the spread of hazardous material and safeguard workers when used together. This expansion is anticipated to increase the demand for mining dust suppression chemicals market.

In June 2022, Alumichem partnered with Photocat, that is expected to take over the de-icing and dust suppression product CMA. Calcium magnesium acetate (CMA) is a highly effective and sustainable de-icer and dust suppressant. This partnership is expected to expand the growth of the mining dust suppression chemicals market.

In February 2022, Global Road Technology International Holdings (HK) Limited launched a new range of dust control products to establish themselves as industry leaders in reducing the dust pollution caused by mining activity in Australia. Phase one comprises the use of GRT 12X, a solution designed to reduce drilling-related dust produced during blasting and exploration.

Drill water is super-activated to saturate and capture the dangerously tiny dust that drilling may produce, preventing it from becoming an airborne hazard. The GRT: DC Binder, the second product included in this offering, is a polymeric additive that prevents dangerous airborne dust from being produced from piles of fine drill cuttings (DC) by hardening the surface and binding the dangerous dust particles present. This product launch is expected to increase the demand for mining dust suppression chemicals, leading to the growth of the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mining dust suppression chemicals market analysis from 2022 to 2032 to identify the prevailing mining dust suppression chemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mining dust suppression chemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mining dust suppression chemicals market trends, key players, market segments, application areas, and market growth strategies.

Mining Dust Suppression Chemicals Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.3 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 371 |

| By Chemical Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Carroll Technologies Group, Ecolab, Alumichem, Quaker Chemical Corporation, Global Road Technology International Holdings (HK) Limited, Veolia, Envirofluid, Dow, Solenis, Borregaard AS |

Analyst Review

According to the opinions of various CXOs of leading companies, dust suppression chemicals are used in mining operations to manage and limit the production, spread, and negative effects of dust particles. Different techniques, such as spraying, dust binding, and surface treatment, are employed for applying these chemicals depending on the specific mining operation and its unique needs. These chemicals function by either aggregating dust particles, which makes them denser and less prone to go airborne, or by forming a barrier to stop dust from spreading into the environment.

The wide usage of mining dust suppression chemicals in the mining industry drives the market growth. Dust suppression chemicals are extremely important in reducing the hazards to the environment, human health, and safety posed by mining-related dust. In addition, the rise in awareness regarding workers safety and surge in the construction of rails and ports boost the growth of the mining dust suppression chemicals market. However, high maintenance cost of dust suppression equipment hampers market growth. Rise in technological advancements to produce effective dust suppression chemicals and rise in environment concerns due to the mine dust created a lucrative growth opportunity for the mining dust suppression chemicals market.

Manufacturers are continually innovating to develop new and more effective dust suppression chemicals. Research and development efforts focus on creating products that offer improved dust control performance while addressing environmental concerns.

Road Management application is the potential customers of Mining Dust Suppression Chemicals Market industry.

Asia-Pacific region will provide more business opportunities for Mining Dust Suppression Chemicals market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Alumichem, Borregaard AS, Carroll Technologies Group, Dow, Ecolab, Envirofluid, Global Road Technology International Holdings (HK) Limited, Quaker Chemical Corporation, Solenis, and Veolia are the top players in Mining Dust Suppression Chemicals market.

Loading Table Of Content...

Loading Research Methodology...