Mining Equipment Market Overview

The Global Mining Equipment Market size was valued at $122.3 billion in 2020, and is projected to reach $200.9 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. Diverse industry sectors are heavily investing in mining equipment, driving strong market growth. Increased investments by domestic players are boosting demand for crushers, trucks, loaders, and diggers to enhance precision, reduce labor costs, and optimize operations. Surface mining equipment is projected to grow rapidly, supported by construction and mining deployments.

Market Dynamics & Insights

- The mining equipment industry in Asia-Pacific held a significant share of over 58.9% in 2020.

- The mining equipment industry in Germany is expected to grow significantly at a CAGR of 3.7% from 2023 to 2032

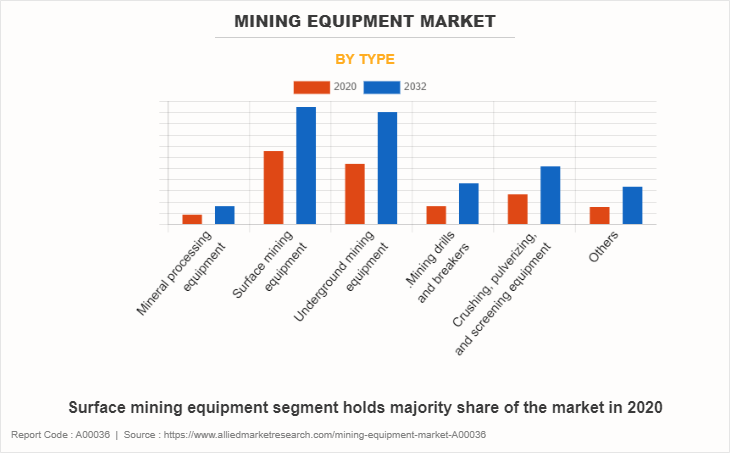

- By type, surface mining equipment segment is one of the dominating segments in the market and accounted for the revenue share of over 30.6% in 2020.

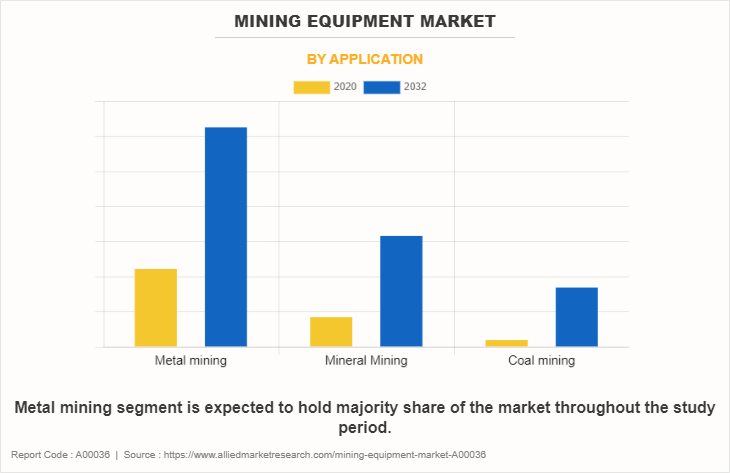

- By application, metal mining segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $122.3 Billion

- 2030 Projected Market Size: $200.9 Billion

- CAGR (2023-2032): 4.1%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant by Mining Equipment

Mining equipment are used for extraction of geological materials, such as copper, nickel, cobalt, gold, silver, lead, zinc, iron, diamond, platinum, and others, from the surface or under the earth.

These equipment or machines perform digging, drilling, and loading activities in the mining industry. Caterpillar, Komatsu, Liebherr-International AG, and Metso Corporation are some of the leading key players of the mining equipment industry.

Market Dynamics

In mining equipment industry, the major products includes mining drills and tools, earth movers, crushing equipment and machines, feeding & conveying equipment, and others. Metals and minerals are extracted from the ground with the help of computerized remote-control equipment, high-technology operations, and complex machinery. Mining activity may vary according to the type of metals and minerals to be extracted from the earth.

There are basically two types of mining processes, that is, surface mining and underground mining, each mining process involves different machineries as per applications. Apart from digging, there are other activities such as milling, smelting, refining, and others.

The mining equipment market size is increasing due to rise in mining activities for extraction of metals and minerals from the ground, to deal with growing demand for metals and mineral commodities. Furthermore, adoption of various technologies such as automation and IoT is reducing labor cost and operational time associated with mining activities, this in turn is expected to increase the demand for innovative mining equipment.

In addition, growing consumption of natural resources, such as coal, diamond, and uranium, and increasing need for mineral fertilizers to improve agricultural yield supplements are major factors expected to increase the demand for the global mining equipment market. However, stringent government regulations such as environmental concerns, safety standards, emission norms, and import regulations are expected to hinder the growth of the global market.

Increase in usage of coal for heating and electricity generation and rise in construction of roads and railway tracks through hilly areas are expected to fuel the demand for mining activities in emerging countries such as India, China, and others. Moreover, robotic machines and drilling technology minimize human intervention, thereby increasing workplace safety. These factors are also expected to propel the growth of the global mining equipment market. However, increase in prices of raw materials is anticipated to restrain the global mining equipment market growth.

Stationary mining equipment at a surface generally perform processing, hauling, and other service functions. Stationary equipment and structures such as conveyor systems, water reclamation systems, feeders, bins, and hoppers are common for most surface mining operations. Many companies operating in this market offer their solutions in the stationary equipment category. For instance, Austria-based SBM Mineral Processing GmbH deals in stationary mineral processing equipment and conveying plants for processing of natural stone.

Mining excavation on an open surface or operated from the surface is termed as surface mining. Nearly 60% of all the U.S. electricity is generated from coal and uranium. According to the National Mining Association, the U.S. needs nearly 40,000 pounds of newly mined material and approximately 3.4 tons of coal each year. Further, adoption of new technologies has increased the demand for mining equipment to help development of the mining and construction sector. Surge in population drives the infrastructure development related projects for end users, especially in developing countries such as Brazil, China, India, and the Middle East, which, in turn, leads to development of the mining equipment industry.

The applications of automation systems such as AHS in open-pit mines targets to provide cost reduction advantage to mining operations. Thus, is expected to drive growth of the mining equipment market in the field of surface mining.

Articulated dump truck is a type of heavy equipment used to transport heaps over rough terrain and sometimes on public roads. The dumping mechanism is usually hydraulically powered so as to avoid compression problems that can at times be faced, while using pneumatic systems. Engine of an articulated dump truck can either be diesel-powered or gasoline-powered and is normally a large internal combustion (IC) engine irrespective of the type of fuel used.

Prominent vendors such as Caterpillar, Komatsu, and Volvo CE deal in advanced articulated dump trucks to stimulate their market growth. For instance, articulated trucks by Caterpillar offers features such as automotive style comfort, simple operation, combined service points, and extended service intervals, thereby, letting users/miners to focus on work expending less time and capital on servicing.

Crawler dozers are continuous tracked earthmoving equipment attached with front-mounted blades to push or move huge amount of materials, which includes sand, soil, and stones. A riper is attached behind a crawler dozer to break and loosen solid material. In addition, they have engines in the range of 45 to 700 horsepower or above.

Some of the major players that offer crawler dozers for mining application include,

Komatsu and Caterpillar. For instance, Komatsu offers crawler dozers with operating weights ranging from 8 to 108 tons and merge a comfortable environment for operator with modern bulldozer technology, thereby providing exceptional performance throughout the entire working cycle.

Mining dozers are continuous tracked heavy equipment machinery used to push large volume of materials such as quarries, sand, and soil. Major players such as Sandvik and Caterpillar offer technologically-advanced products to the market. For instance, LZ101LE battery-powered dozer from Sandvik AB is designed for low-seam operations. These dozers enhance underground working atmosphere by eradicating coverage to hazardous emissions. In addition, the machine is ideal for tabular ore bodies, such as chrome and platinum mines. The dozer features a push capacity of up to 4 tons.

Surge in demand for noiseless rock. breakers in economies such as China, India, and Africa is expected to propel the market growth. For instance, Volvo Construction Equipment offers a low-noise hydraulic breaker, which handles breaking and trenching operations in mining and quarrying. This equipment controls vibration and noise generated by hydraulic breakers. In addition, it reduces noise made while striking by covering the whole breaker with a special damper. Moreover, technical advancements in breakers offer lucrative growth opportunities for the market growth.

Mining Equipment Market Segment Overview

For example, Sandvik offers hydraulic breakers. It has automatic feature function system that provides efficient and economical operation. All such factors are anticipated to lead to development of the market. The mining equipment market is segmented on the basis of equipment type, application, and region.

By Type,

The mining equipment market share is analyzed as mineral processing equipment, surface mining equipment, underground mining equipment, mining drills & breakers, crushing, pulverizing, & screening equipment, and others. The surface mining equipment segment held the highest market share in 2020 of the global mining equipment market.

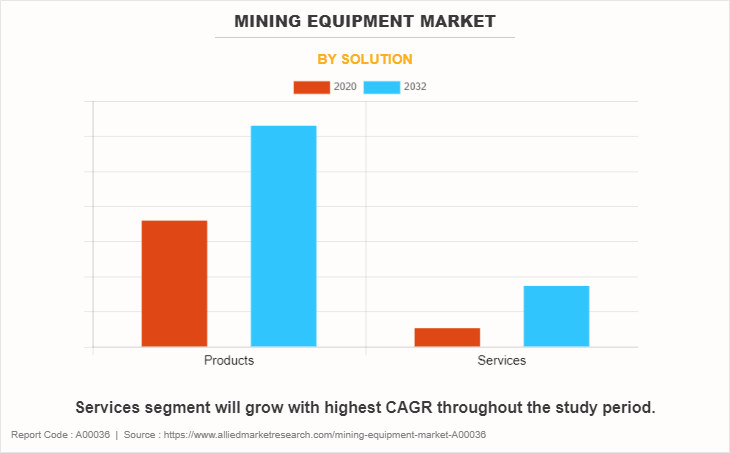

By Solution,

It is segmented into products and services. The products segment accounted for the largest share in 2020, the services segment is projected to maintain its lead position during the forecast period.

By Application,

It is segmented into metal mining, mineral mining, and coal mining. The metal mining segment held the highest market share in 2020 and is estimated to maintain its leadership status throughout the forecast period.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. LAMEA is anticipated to be the largest market for mining equipment during the forecast period. It is the most productive region as compared to others with diverse industry verticals significantly investing in mining equipment. Moreover, various domestic players are investing in the mining sector, which is anticipated to boost demand for mining equipment such as crushers, trucks, loaders, diggers, and others to complete operations with reduced labor cost and high precision of work within optimized time.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging global mining equipment market trends and dynamics.

- In-depth mining equipment market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive mining equipment market opportunity analysis of all the countries is also provided in the report.

- The global mining equipment market forecast analysis from 2020 to 2032 is included in the report.

- The key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry.

Mining Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 200.9 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2020 - 2032 |

| Report Pages | 264 |

| By Type |

|

| By APPLICATION |

|

| By SOLUTION |

|

| By Region |

|

| Key Market Players | Deere & Company, Atlas Copco AB, AB Volvo, Caterpillar Inc., Sandvik AB, KOMATSU Ltd, Hitachi, Ltd, Doosan Corporation, Liebherr-International AG, Metso Corporation |

Analyst Review

The mining equipment market has witnessed a notable growth in past few years. Developing countries such as India, China, and Australia have witnessed increase in demand in the mining equipment market. The demand for precious metals such as gold, silver, copper, titanium, and bauxite is an important factor that boosts growth of the global mining equipment market. Moreover, rise in demand for technologically advanced mining equipment, such as remote monitoring mining equipment, propels the market to expand in developed regions. Mining drills & breakers is the fastest growing segment, followed by crushing, pulverizing, & screening equipment.

Leading companies in the mining equipment market such as Caterpillar Inc.; Komatsu Ltd.; Joy Global Inc. Inc. Sandvik; and Hitachi Co. Ltd have witnessed a significant growth in past few years. Innovative products, such as remote-controlled mining equipment, launched by these players have increased their overall consumer base. Moreover, other players operating in the market such as AB Volvo, Doosan Group; Atlas Copco, and Liebherr Group are expected to strengthen their product line with higher technological products to cater to the increase in requirements of consumers. Players operating in the mining equipment market focus on development and launch of high-quality products, depending on needs and preferences of consumers to keep up with recent technological advancements. Moreover, innovative marketing and positioning strategies of players have helped to increase the overall market size.

Rise in demand for technologically advanced mining equipment and growth in need for mineral fertilizers are the upcoming trends of Mining Equipment Market in the world

The metal mining, mineral mining, and coal mining are the leading application of Mining Equipment Market

Asia-Pacific is the largest regional market for Mining Equipment

The estimated industry size of Mining Equipment in 2020 is 122,274.0 million

AB Volvo, Caterpillar Inc., Deere & Company, Doosan Corporation, Epiroc AB, Hitachi, Ltd., Komatsu Ltd., Liebherr-International AG, Metso Corporation, and Sandvik AB

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By type, the surface mining equipment segment held the highest market share in 2020 of the global mining equipment market revenue

The base year considered in the Mining Equipment market report is 2022.

Loading Table Of Content...

Loading Research Methodology...