Mixer Grinder Market Research, 2031

The global Mixer Grinder Market Size was valued at $12.70 billion in 2021, and is projected to reach $18.18 billion by 2031, growing at a CAGR of 3.7% from 2022 to 2031.Mixer grinder are electric kitchen appliances that are used for mixing food, dough, and batters. They can also be used for shredding, mashing, and tossing. Mixer grinder consist of a stand and a head, where the head contains the mixing mechanism to which various types of mixing apparatuses can be attached.

There is rapid increase in the number of residential consumers who are developing interest in baking and cooling different types of foods and deserts at home. This increase in interest helps in increasing the sale of mixer grinder. During the COVID-19 pandemic, lockdowns forced everyone to stay at home and consumes started pursuing their various hobbies. Some of the most popular ones were cooking and baking. New recipes and guides were being circulated online as trends and many consumers were eagerly pursuing those trends. Most foods that people were cooking required extensive mixing and dough making, which is a difficult process if done by hand. Attributed to such difficulties, consumers started purchasing mixers grinder to make such processes easier and more efficient, which led to an increase in sale of mixer grinder.

Rise in business-related travel and increase in number of food joints such as hotels & restaurants fuel the Mixer Grinder Market Growth because of commercial end users. According to the National Restaurant Association’s Restaurant Performance Index, the U.S. restaurant industry was valued around $860 billion in 2019 with over 1 million restaurants operating in the U.S., which acts as a key growth driver of the mixer grinder market. There are numerous counterfeit brands in the global market. The emergence of several local manufacturers has impacted and shaped the consumer buying behavior owing to the price sensitivity and affordability among the consumers in several underdeveloped economies. Thus, counterfeit brands are generally prevalent in such economies where customers are highly price-sensitive.

Many countries across the world, especially in Asia-Pacific and LAMEA, are in various stages of development. People in these regions mainly belong to the middle-income category. However, as their countries are progressing, their lifestyles are improving as well. There is a lot of migration to urban areas, and the rural areas are also slowly developing. The standard of living of the people in these regions is increasing rapidly. They are getting increased exposure to different parts of the world and are learning about technologies and trends in developed countries..

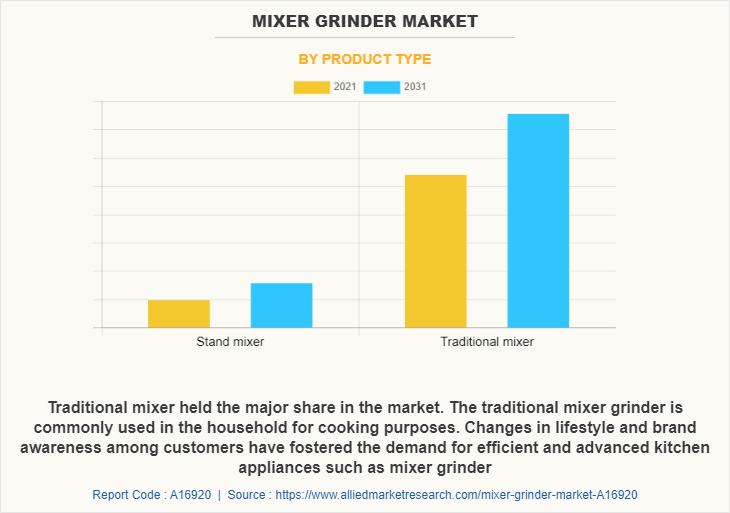

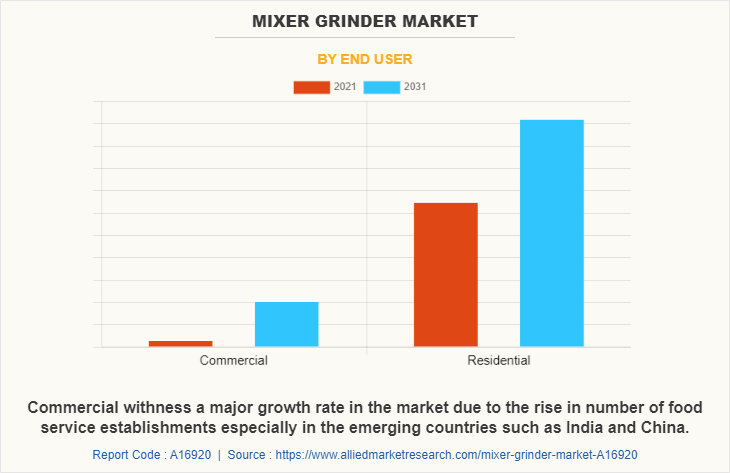

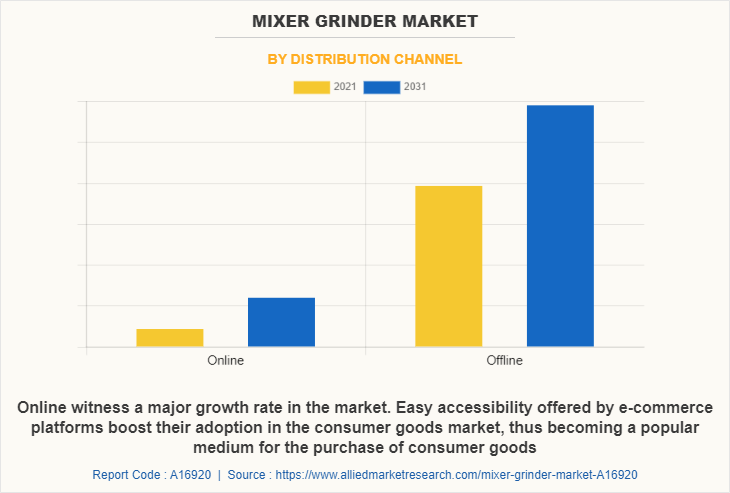

The global mixer grinder market is segmented on the basis of product type, end user, distribution channel, and region. Based on type, the market is bifurcated into stand mixer and traditional mixer. Based on end user, the market is divided into residential and commercial. Based on distribution channel, the market is classified into online and offline. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, Italy, Spain, Russia, Belgium, Slovenia and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Malaysia, Indonesia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, United Arab Emirates, Iran, Saudi Arabia, Syrian Arab Republic, and the rest of LAMEA).

Based on the product type, the traditional mixer held the major share in the market. High spending capability of consumers due to increased disposable income has driven the companies to introduce enhanced electric mixer grinder in the market to cater to the increase in requirements of the consumers. Companies are investing in R&D to introduce innovative range of mixer grinder.

Based on the end user, residential segment held the major share in the market in 2021 and is likely to remain same throughout the Mixer Grinder Market Forecast period. There is an increase in the demand for mixer grinder among the household end users owing to changes in lifestyle and increase in disposable income. The market is witnessing a rise in trend of modular kitchens among household consumers. Customers are opting for advanced and sophisticated built-in kitchen appliances, to enhance the aesthetic value of the kitchen. Further, the launch of technology driven kitchen appliances is encouraging consumers to transform their basic kitchen into a smart kitchen.

Based on the distribution channel, the offline segment gain a major traction in the market. It offers a wide range of white goods, especially categorized and organized in large shelves. These products are placed on shelves as per their category with placards displaying the details and price of these products. The offline stores usually span over a large area and display a wide range of brands in one particular store. It offers availability of various brands at one place. In addition, these stores are located near residential areas for convenience and easy accessibility.

Region wise, North America held the major mixer grinder market share in 2021.Innovations in stand mixers, such as built-in weighing scales, multiple mixing presets, and large number of mixing attachment for different types of mixing, are increasing the popularity of these mixers. The engaged stakeholders are also implementing certain unique designs in the mixer grinder, which is helping in increasing the adoption of these mixers.

The key players profiled in the Mixer Grinder Industry include are Bajaj Group, BOSCH, Crompton greaves consumer electricals limited, De’Longhi Appliances S.r.l, Electrolux AB, Galanz Enterprise Group, Group SEB, Havells India Ltd., Kenstar, LG Electronics Ltd., Morphy Richards, Newell Brands, Panasonic Corporation, Samsung Electronics, and Whirlpool Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mixer grinder market analysis from 2021 to 2031 to identify the prevailing mixer grinder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mixer grinder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mixer grinder market trends, key players, market segments, application areas, and market growth strategies.

Mixer Grinder Market Report Highlights

| Aspects | Details |

| By Product type |

|

| By End user |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Galanz Enterprise Group, De’Longhi Appliances S.r.l, Crompton Greaves, Kenstar, HAVELLS GLOBAL LIMITED, Bajaj, Whirlpool Corporation, BOSCH, NEWELL BRANDS, Morphy Richards, ELECTROLUX AB, GROUP SEB, Panasonic Corporation, Samsung Electronics, LG Electronics |

Analyst Review

According to the CXOs of leading companies, the past few years have witnessed rapid increase in the adoption and sales of mixer grinder. This can be attributed to an increase in hobbies such as baking and cooking. Increasing standards of living, increasing disposable incomes, and extensive advertisements and marketing of these kinds of products in developing countries are leading to further proliferation of the market.

According to the CXOs of leading companies, the past few years have witnessed rapid increase in the adoption and sales of mixer grinder. This can be attributed to an increase in hobbies such as baking and cooking. Increasing standards of living, increasing disposable incomes, and extensive advertisements and marketing of these kinds of products in developing countries are leading to further proliferation of the market.

Smart kitchen appliance in spite of being a growing market is expected to experience slow growth rate. Companies need to address the rapidly changing technological needs to excel in the market. Growth strategies such as collaborations or acquisitions are anticipated to help the operating companies to sustain in the competitive market.

number of residential consumers that are developing interest in baking and cooking, Improvised aesthetic trend, and Increasing interest in domestic baking and cooking is leading to greater adoption of stand mixers are the upcoming trends of Mixer Grinder Market in the world.

Residential is the leading end user of Mixer Grinder Market.

North America region is the largest regional market for Mixer Grinder.

The global mixer grinder market was valued at $12,704.9 million in 2021, and is projected to reach $18,182.5 million by 2031, registering a CAGR of 3.7% from 2022 to 2031

The top key players profiled in the report include are Bajaj Group, BOSCH, Crompton greaves consumer electricals limited, De’Longhi Appliances S.r.l, Electrolux AB, Galanz Enterprise Group, Group SEB, Havells India Ltd., Kenstar, LG Electronics Ltd., Morphy Richards, Newell Brands, Panasonic Corporation, Samsung Electronics, and Whirlpool Corporation

Loading Table Of Content...