Mobile Crane Market Overview

The global mobile crane market size was valued at $14.4 billion in 2021, and is projected to reach $24.5 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031. This is fueled by increased investments in construction and infrastructure projects across both developed and developing countries. The introduction of advanced, easy-to-operate mobile cranes has further boosted demand. To capitalize on market opportunities, several key players are actively expanding their operations and global footprint, aiming to strengthen their competitive position and meet the growing needs of various industries worldwide.

Market Dynamics & Insights

- The mobile crane industry in Asia-Pacific held a significant share of over 48.8% in 2021.

- The mobile crane industry in India is expected to grow significantly at a CAGR of 6.5% from 2022 to 2031

- By boom type, telescopic boom segment is one of the dominating segments in the market and accounted for the revenue share of over 71.4% in 2021.

- By end-user, utilities segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2021 Market Size: $14.4 Billion

- 2031 Projected Market Size: $24.5 Billion

- CAGR (2022-2031): 5.3%

- Asia-Pacific: Largest market in 2021

- LAMEA: Fastest growing market

What is Meant by Mobile Crane

A crane is a heavy machine used for handling, lifting, and moving light and heavy loads. A mobile crane performs all the tasks of a crane, with an added feature of horizontal mobility. With different types of carriers, mobile crane can mobilize itself on any type of terrain. In addition, mobile cranes are equipped with different types of booms that enable it to perform various material lifting tasks.

North America and Asia-Pacific regions spend heavily on infrastructure projects, such as roads, tunnels, railways, bridges, and metros, owing to increase in demand for efficient public transport. The manufacturing sector, which uses compact mobile cranes for material handling, is also witnessing a notable growth. In other regions, such as Africa, Europe, Middle East, and Latin America, the building and infrastructure construction sectors are witnessing a significant boom. Mobile cranes are extensively used on construction sites for lifting heavy loads, therefore; growth of the construction industry is anticipated to positively impact the mobile cranes market. Furthermore, mobile cranes have mobility in various types of terrains, such as mountainous, lose soil, and dense forests. This, increasing the usage of mobile cranes for various activities. In addition, various public-private partnerships (PPP) are being formed in countries globally, such as Mexico, India, China, Canada, and Japan for speeding up construction projects. This has led to significant inflow of money and resources towards the infrastructural development. Therefore, it is anticipated to positively influence the mobile crane market growth.

Moreover, various market players now offer cranes with longer telescopic booms that can operate at a considerably higher speed. Furthermore, incorporation of hybrid power mode technology, enables the mobile cranes to operate on oil as well as electricity.. This, is anticipated to enhance the usability of mobile cranes, thereby, positively influencing the market.

Major players in the industry have focused on development of high-performance and heavy lifting mobile cranes. For instance, in February 2021, Manitex Valla, an Italy-based manufacturer of mobile cranes, launched V110 R Electric Mobile Crane, which is a battery-operated and remote-controlled mobile crane. This equipment features a front wheel drive and a lifting capacity of up to 11 tones to a service height of 10.4 meters. Furthermore, in December 2021, XCMG, a Chinese manufacturer of mobile cranes, launched XCMG XCT25 EV, the world’s first truck crane with hybrid technology. It is a 25-ton capacity hybrid crane, which can easily switch to different operating modes that are, hybrid, pure electricity, pure oil, and plug-in.

The novel coronavirus rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted the production of many components of mobile cranes due to lockdown. The economic slowdown initially resulted in reduced spending on mobile cranes by the construction sector. However, owing to the introduction of various vaccines, the severity of COVID-19 pandemic has significantly reduced. As of mid-2022, the number of COVID-19 cases have diminished significantly. This has led to the full-fledged reopening of mobile cranes manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Furthermore, the aftermarket support for the mobile crane industry has advanced significantly. Various companies such as Manitowoc, Liebherr, and others are developing technologies for diagnosing and predicting issues in cranes systems and scheduling maintenance. In addition, companies such as VerveTronics offers various Internet of Things (IOT) solutions for preventive and predictive maintenance technology for the mobile cranes. These systems can be integrated or retrofitted in the existing cranes. Such advancement in aftermarket is expected to incredibly enhance the service life of mobile cranes. Thereby, driving the growth of the mobile crane market.

Mobile Crane Market Segment Overview

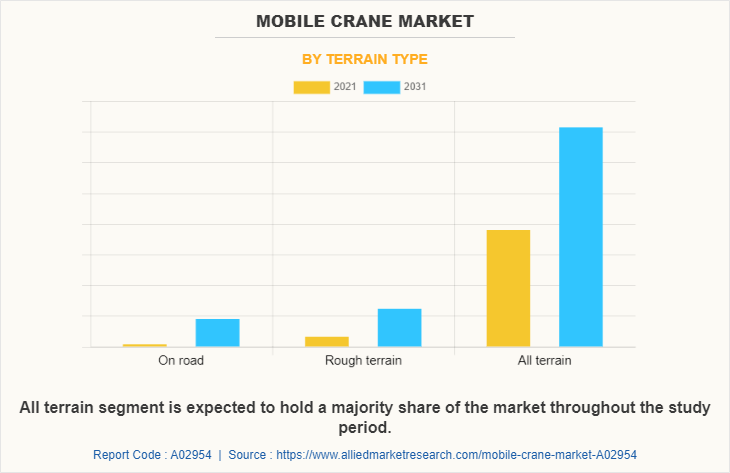

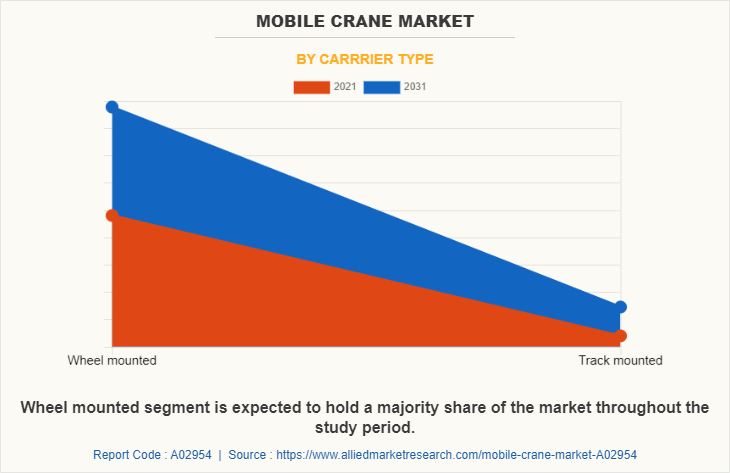

The mobile crane market is segmented into Terrain Type, End User Industry, Boom Type and Carrrier Type. By boom type, the mobile crane market is bifurcated into lattice boom and telescopic boom. According to carrier type, the market is categorized into wheel mounted and track mounted. By terrain type, the market is segmented into on-road, rough terrain, and all-terrain. By end-user industry, the market is classified into construction, manufacturing, and utilities. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market in 2021, accounting for the highest mobile crane market share, and is anticipated to maintain this trend during the forecast period. This is attributed to increase in spending on infrastructural development and investment in manufacturing industry from public and private entities.

Competition Analysis

Key companies profiled in the mobile crane market forecast report include, Altec Inc., Cargotec Corporation, Liebherr International AG, Manitowoc Company Inc., SANY Heavy Industry Co. Ltd., Tadano Ltd., Terex Corporation, Xuzhou Construction Machinery Group Co. Ltd. (XCMG), Zoomlion Heavy Industry Science and Technology Co. Ltd., and Kobelco Construction Machinery Co., Ltd.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile crane market analysis from 2021 to 2031 to identify the prevailing mobile crane market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobile crane market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mobile crane market trends, key players, market segments, application areas, and market growth strategies.

Mobile Crane Market Report Highlights

| Aspects | Details |

| By Terrain Type |

|

| By End User Industry |

|

| By Boom Type |

|

| By Carrrier Type |

|

| By Region |

|

| Key Market Players | Manitowoc Company, Inc., Tadano Ltd., Terex Corporation, Kobelco Construction Machinery Co., Ltd., Liebherr-International AG, SANY Heavy Industry Co. Ltd., Altec, Inc., cargotec corporation, Xuzhou Construction Machinery Group Co., Ltd., Zoomlion Heavy Industry Science and Technology Co., Ltd. |

Analyst Review

The mobile crane market has witnessed significant growth in past few years, owing to surge in investments on infrastructure and construction projects.

The rise in urbanization globally, especially in Asia-Pacific has fueled the demand for various infrastructure projects, such as, roads, bridges, railways, tunnels, and others. In addition, construction activities have also witnessed an up-trend. The medium income countries, such as India, China, Vietnam, South Korea, and others have fueled the demand for low- and high-rise buildings. Such factors are anticipated to drive the demand for mobile cranes during the forecast period. Furthermore, the manufacturing sector is witnessing a rise in Europe and Asia-Pacific regions. Mobile cranes are extensively used for heavy load handling in the manufacturing sector, especially, for the manufacturing of heavy objects such as, cars, industrial machineries, steel, and others.

In addition, incorporation of latest battery technology along with advanced telescopic booms is expected to play a pivotal role in the development of autonomous mobile and highly functional mobile cranes. Such advanced mobile cranes require minimal operator input, and are expected to complete the task at much less time. Thereby, providing saving high cost of operation. Such advancements are anticipated to provide lucrative opportunities for the growth for the market.

Development of more durable and efficient mobile cranes is a major upcoming trend in the market.

Mobile cranes are extensively used in construction, manufacturing and logistics sector for handling heavy loads.

Asia-Pacific is the largest regional market for Mobile Crane.

$14,357.7 Million is the estimated industry size of Mobile Crane.

Altec Inc., Cargotec Corporation, Liebherr International AG, Manitowoc Company Inc., Sany Heavy Industry Co. Ltd., Tadano Ltd. and Terex Corporation are some of the are the top companies to hold the market share in Mobile Crane.

Based on boom type, the telescopic boom holds the maximum market share of the Mobile Cranel market in 2021.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The product launch is key growth strategy of Mobile Crane industry players.

Loading Table Of Content...