Mobility-As-A-Service Market Overview

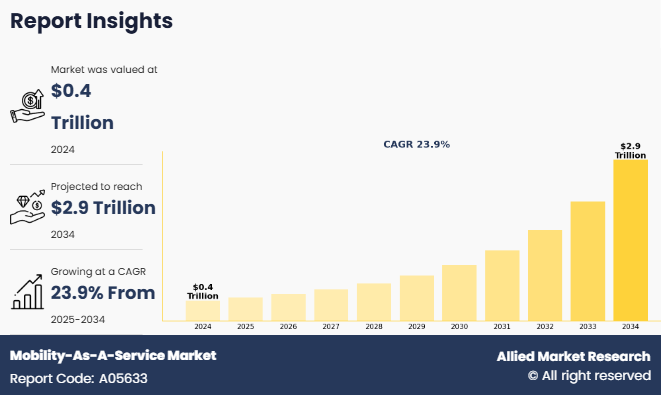

The global mobility-as-a-service industry was valued at $368.5 billion in 2024, and is projected to reach $2900.7 billion by 2034, growing at a CAGR of 23.9% from 2025 to 2034.

The mobility as a service (MaaS) market encompasses platforms, applications, and services that integrate various forms of transport services into a single accessible on-demand mobility solution. This includes ride-hailing, car-sharing, bike-sharing, public transportation, micro-mobility, and others that are all coordinated via a digital interface. The goal of MaaS is to provide seamless, user-centric transportation that reduces reliance on personal vehicles and promotes sustainable urban mobility.

The Global Mobility-as-a-Service Market is segmented into Solution Type, Transportation Type, Service Type, Business Model, Vehicle Type and Payment Type.

The Global Mobility-as-a-Service Market market has witnessed substantial Mobility-as-a-Service Market Growth, driven by rapid urbanization, evolving consumer preferences, environmental concerns, and increasing smartphone and internet penetration. This dynamic market is shaped by government regulations, advancements in connectivity technologies, public-private collaborations, and rising Mobility-as-a-Service Market Demand for convenient, cost-effective transport alternatives. Mobility-as-a-service platforms are majorly designed to offer multimodal travel options through a unified digital interface, enhancing user experience and minimizing urban congestion.

Governments are playing a crucial role in advancing MaaS by embedding it within broader smart city strategies and climate action plans. These public-sector efforts focus on improving infrastructure, encouraging open data standards, and aligning regulatory frameworks to support the integration of services. A notable example is the UK Department for Transport’s launch of the first-ever MaaS Code of Practice in 2023. This pioneering framework sets out best practices for accessibility, data interoperability, safety, privacy, and user-centric design in MaaS platforms. The code ensures that digital mobility services prioritize inclusivity, protect consumer rights, and provide equitable access to all population groups, including the elderly and people with disabilities.

As urban populations grow, cities around the world are grappling with increasing congestion, air pollution, and the inefficiencies of traditional transportation systems. In response, Mobility-as-a-Service (MaaS) has emerged as a transformative solution that integrates multiple modes of transportation—such as public buses, metro trains, ride-hailing, bike-sharing, e-scooters, and car rentals—into a single, user-friendly digital platform. This integrated approach allows users to plan, book, and pay for multimodal journeys seamlessly, offering greater flexibility, cost-efficiency, and convenience compared to owning a private vehicle. MaaS platforms aim to shift user behavior away from personal car ownership toward shared, sustainable mobility, thereby reducing traffic congestion and lowering greenhouse gas emissions.

Furthermore, technology is one of the key drivers of the Mobility-as-a-service industry. Integration of real-time data analytics, cloud computing, IoT, GPS, and AI enables dynamic route planning, efficient fleet management, and personalized service delivery improved transportation and service efficiency. In 2024, several cities in Asia-Pacific, including Tokyo and Singapore, expanded their MaaS infrastructure with AI-powered platforms that recommend optimal travel combinations based on user preferences, traffic data, and environmental impact. Such advancements not only enhance user convenience but also reduce carbon footprints by encouraging mode shifts from private vehicles to shared mobility.

In addition to this, the integration of autonomous vehicles and e-mobility is expected to further accelerate the evolution of Mobility-as-a-service. Autonomous shuttles and robo-taxis are being piloted in several cities as part of broader MaaS initiatives. Additionally, the growing adoption of electric vehicles (EVs) across ride-hailing and car-sharing fleets supports sustainability goals and enhances the attractiveness of MaaS offerings. Some major MaaS providers in world partnered with an EV automaker to introduce an all-electric shared mobility service, setting the stage for future electric MaaS platforms. For instance, in 2025, Uber Technologies, Inc. partnered with May Mobility, Inc., one of the leading autonomous vehicles (AV) technology companies to deploy thousands of AVs on the Uber platform over the next few years, with an initial launch planned for Arlington, Texas, by the end of 2025.

Despite its rapid growth and potential to revolutionize urban transportation, the Mobility as a Service (MaaS) market faces a series of complex challenges that must be addressed to ensure its long-term success and scalability. One of the most pressing issues is the lack of seamless data integration and interoperability among the multitude of service providers involved. As MaaS platforms rely heavily on the aggregation of real-time data from public transit agencies, ride-hailing operators, bike-sharing networks, and other mobility services, inconsistencies in data formats, communication protocols, and system architectures can significantly impede platform performance. Standardizing APIs and enabling interoperable digital systems across providers remains a major hurdle, especially in regions where legacy infrastructure and disparate regulatory frameworks prevail.

Additionally, public transportation systems in many regions are not yet digitally mature enough to fully integrate with MaaS platforms, which creates fragmented user experiences and limits service optimization. Without reliable back-end connectivity and uniform service standards, users may face difficulties in route planning, booking, or making payments—all of which are critical elements of the MaaS value proposition. Furthermore, user adoption is also affected by varying levels of infrastructure development, public trust in digital platforms, and general awareness, especially in developing economies where traditional transportation systems are still dominant.

Segment Overview:

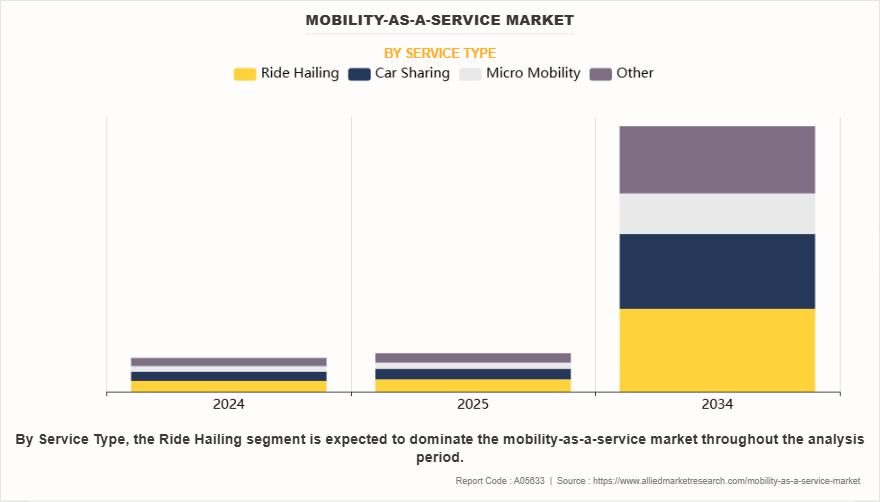

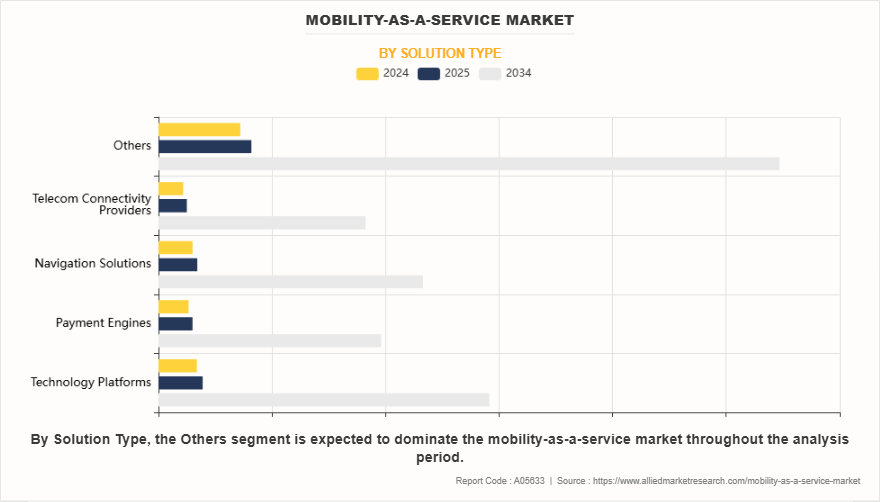

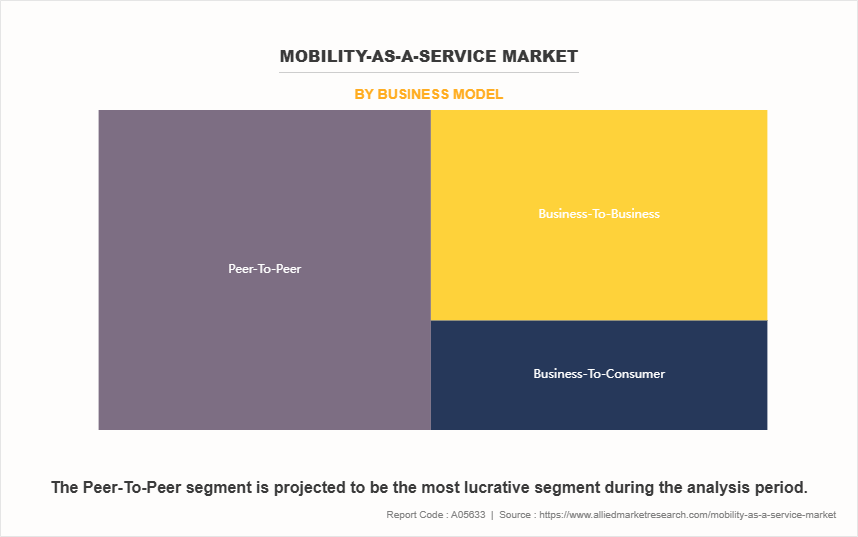

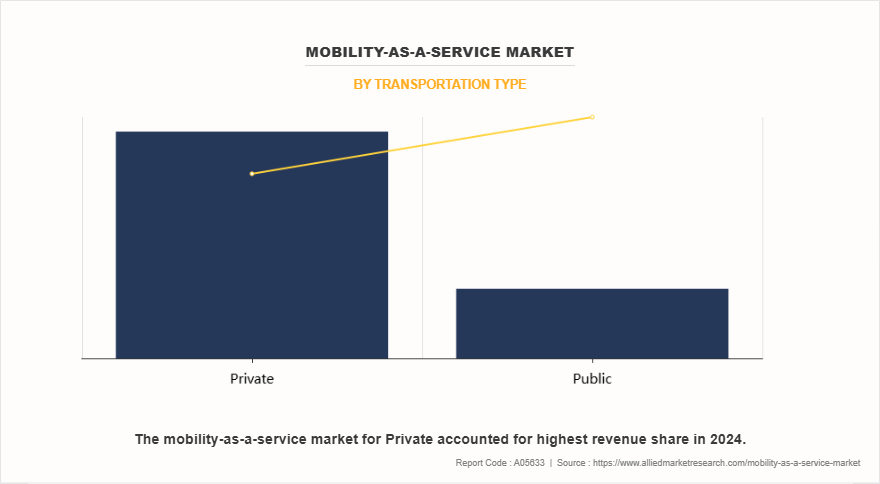

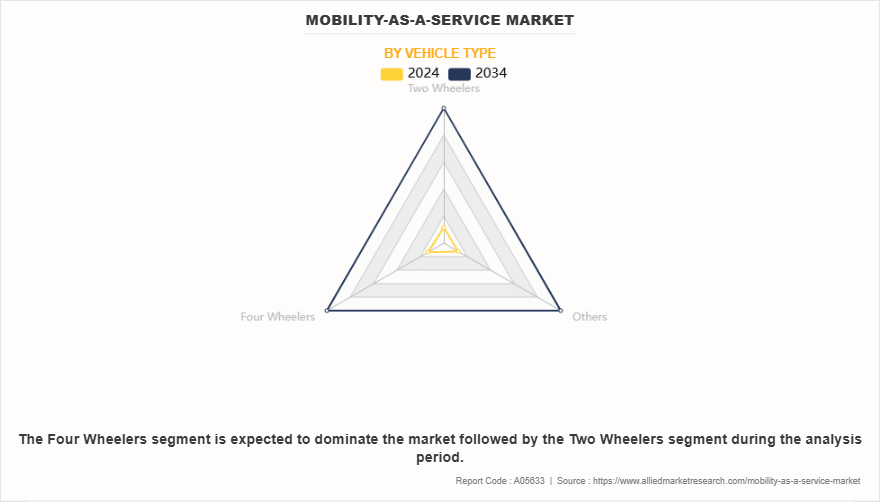

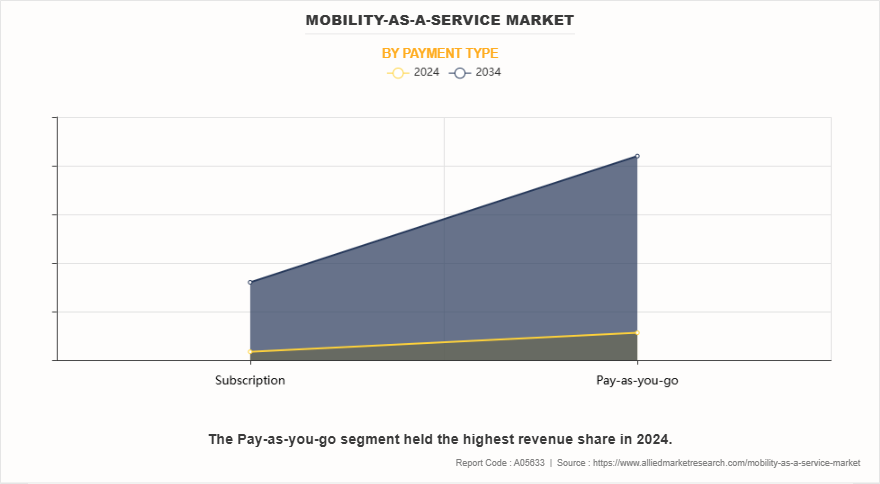

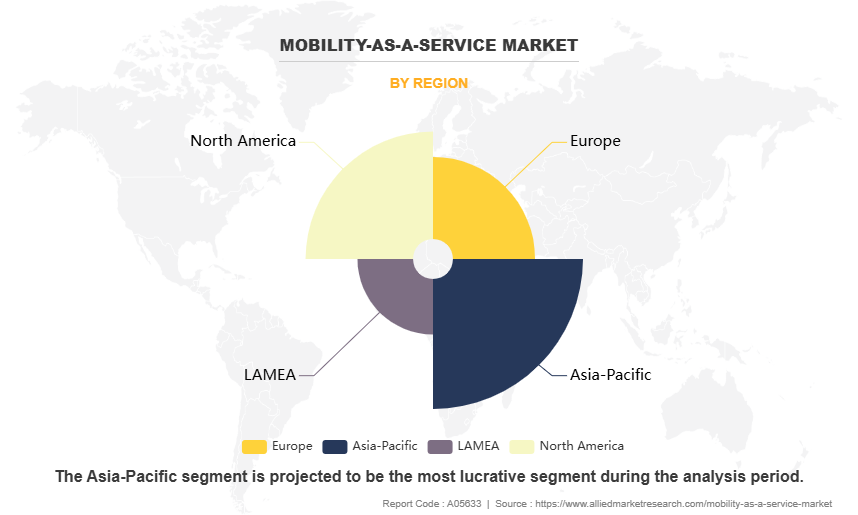

The mobility-as-a-service market is segmented into service type, solution type, business model, transportation type, vehicle type, payment type and region. By service type, the market is bifurcated into ride hailing, car sharing, micro mobility, and other. By solution type, it is classified into technology platforms, payment engines, navigation solutions, telecom connectivity providers, and others. By business model, it is divided into business-to-business, business-to-consumer, peer-to-peer. By transpiration type, it is categorized into public & private. Furthermore, by vehicle type, it is classified into two wheelers, four wheelers, and others. By payment type, it is bifurcated into subscription & pay-as-you-go. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

Based on service type, the ride-hailing segment dominated the global market in the year 2024 and is likely to remain dominant during the Mobility-as-a-Service Market Forecast period. This dominance is attributed to the popularity of on-demand mobility, urban convenience, and low entry barriers for users. As traffic congestion worsens and personal vehicle use declines in many large cities, more people are turning to ride-hailing for convenient, short-distance travel. Moreover, improvements in mobile apps such as better navigation, smarter pricing systems, and more effective driver coordination have made ride-hailing faster, more reliable, and more affordable for users around the world.

Based on solution type, others platforms accounted for the largest market share in 2024 and are projected to lead during the Mobility-as-a-Service Market Forecast period. These platforms serve as the backbone for real-time trip planning, seamless booking, and integrated payments, and are pivotal in enabling MaaS ecosystems. Furthermore, heavy investment in AI, machine learning, and predictive analytics is enhancing user experience and system efficiency.

Based on business model, the peer-to-peer model held the highest market share, owing to the widespread adoption of mobile-based MaaS apps by individuals. However, the B2B segment is expected to witness the fastest growth, driven by rising enterprise demand for managed mobility solutions, particularly in urban office zones and industrial clusters.

Based on transportation type, the private transportation segment led the market due to its foundational role in multimodal networks. Various integrating services like buses, metros, and trams into digital MaaS platforms ensures widespread accessibility, affordability, and consistent daily usage. Public transit is often the most reliable and cost-effective option for urban commuters, making it a critical element in city-wide mobility planning. Its high capacity and established infrastructure make it ideal for integration with other mobility services, enabling seamless journey planning and supporting efforts to reduce traffic congestion, lower emissions, and promote sustainable urban transport solutions.

Based on vehicle type, four-wheelers held the dominant position in 2024, largely due to the prevalence of cars in ride-hailing and car-sharing services. However, two-wheelers are expected to witness substantial growth, particularly in densely populated cities with narrow roads where the adoption of e-scooters and e-bikes is rapidly increasing.

Based on payment type, the pay-as-you-go segment dominated the market in 2024, supported by flexibility and low-commitment options that attract casual users. Subscription models are rapidly gaining popularity, especially among regular commuters and corporations seeking predictable pricing and convenience.

Based on region, the Asia-pacific region dominated the global market in the year 2024 and is likely to remain dominant during the forecast period. This dominance is attributed to strong policy support, early adoption of integrated transport platforms, and a mature public transportation infrastructure. Asia‐‘Pacific cities like Singapore, Seoul, Tokyo, Hong-Kong, and Shanghai are global leaders in MaaS innovation, driven by proactive public‐‘private collaborations, smart city policies, and environmental regulations promoting shared mobility.

Key Market Players:

The key players included in the mobility as-a-service market analysis are Siemens, Lyft, Inc., Moovit Inc., Via Transportation, Inc., Cubic Transportation Systems, Inc., FOD Mobility UK Ltd., Flowbird Group, Uber Technologies Inc., SkedGo, Worldwide Mobility.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the Mobility-as-a-Service Market Size, market segments, Mobility-as-a-Service Market Trends, Mobility-as-a-Service Market Share, estimations, and dynamics of the Global Mobility-as-a-Service Market analysis from 2024 to 2034 to identify the prevailing mobility-as-a-service market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the mobility-as-a-service market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as Mobility-as-a-Service Industry trends, Mobility-as-a-Service Market Size, key players, market segments, application areas, and market growth strategies.

Mobility-As-A-Service Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2900.7 billion |

| Growth Rate | CAGR of 23.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 422 |

| By Solution Type |

|

| By Transportation Type |

|

| By Service Type |

|

| By Business Model |

|

| By Vehicle Type |

|

| By Payment Type |

|

| By Region |

|

| Key Market Players | World Wide Mobility, Lyft, Inc., Cubic Transportation Systems, Inc. , Siemens, Flowbird Group, Via Transportation, Inc., SkedGo, FOD Mobility UK Ltd., Moovit Inc., Uber Technologies Inc. |

Analyst Review

The Mobility-as-a-Service (MaaS) market is experiencing steady growth, driven by urbanization, increased demand for seamless transportation, and the global push for sustainable mobility solutions. Governments, city planners, and transportation authorities across the world are prioritizing integrated mobility platforms, leading to sustained investments in digital infrastructure and smart transit solutions. Key drivers of the market include rising urban populations, growing smartphone penetration, and advancements in digital payment systems, real-time data analytics, and geolocation technologies.

A significant trend shaping the market is the shift toward multimodal, user-centric transportation ecosystems. Major cities are increasingly adopting MaaS platforms that combine public transit, ridesharing, bike rentals, car-sharing, and micro-mobility services into a single, unified digital interface. The integration of technology such as AI-powered routing, predictive analytics, and personalized travel recommendations is enhancing commuter convenience and operational efficiency. Additionally, rising focus on eco-friendly travel is also boosting the incorporation of electric and low-emission vehicles into MaaS offerings that align with global carbon neutrality goals.

Furthermore, regulatory support remains a key market influencer, with municipalities and national governments introducing policies that encourage modal integration, open data standards, and sustainable urban mobility. Various initiatives taken by government and public sector authorities, such as congestion pricing, low-emission zones, and mobility credits are also accelerating MaaS adoption. In addition to this, collaboration with private players plays a pivotal role in bridging technological gaps, fostering innovation, and enabling scalability of MaaS platforms in both developed and developing regions.

Despite growth opportunities, the market faces several challenges also, such as fragmented transportation networks and data interoperability issues. The implementation of MaaS requires coordinated collaboration among various stakeholders, including public transit agencies, private mobility providers, and technology vendors. Additionally, data privacy concerns and cybersecurity risks pose significant barriers, particularly as platforms handle sensitive user information and mobility patterns. Addressing these concerns requires robust data governance frameworks and transparent user consent mechanisms.

Regional market dynamics vary, with Asia-Pacific leading MaaS adoption due to progressive urban mobility policies, strong digital infrastructure, and high public transit usage. Countries such as China, India, and Singapore have emerged as frontrunners in MaaS deployment. North America is also witnessing steady progress, driven by smart city initiatives and growing consumer preference for digital mobility solutions. Meanwhile, the Middle East and Latin America are also showing growing interest in MaaS, driven by infrastructure development and the need for efficient, sustainable urban transport systems.

Upcoming trends in the global Mobility-as-a-Service market include AI-driven route optimization, subscription-based models, electric and autonomous vehicle integration, public-private partnerships, real-time data platforms, and a growing focus on sustainable urban mobility.

The leading application of Mobility-as-a-Service (MaaS) is daily urban commuting, where integrated platforms combine public transit, ride-hailing, and micro-mobility options to provide seamless, cost-efficient, and sustainable travel solutions.

The largest regional market for Mobility-as-a-Service (MaaS) is Asia-pacific.

The estimated industry size of Mobility-As-A-Service is 0.4 trillion.

Siemens, Lyft, Inc., Moovit Inc., Via Transportation, Inc., Cubic Transportation Systems, Inc., FOD Mobility UK Ltd., Flowbird Group, Uber Technologies Inc., SkedGo, Worldwide Mobility are the top companies that hold the market share in mobility-as-service market.

Loading Table Of Content...

Loading Research Methodology...