Modular Construction Market Research, 2031

The Global Modular Construction Market was valued at $131.1 billion in 2021, and is projected to reach $234.7 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031. Modular construction is a process in which an off-site construction of a building is completed, using the same design, standards, and materials. The construction of the buildings is done in a modules format, which is then put together on site. The modular construction creates fewer site disturbances and generates less waste as compared to traditional construction. In addition, the disassembling of modular buildings can be achieved easily, and can be refurbished and relocated for new modular homes, thus minimizing the demand for raw materials and the need for energy to construct new buildings.

Market Dynamics

Modular construction is utilized for permanent or temporary facilities such as military housing, classrooms, classrooms, construction camps, and industrial facilities. Moreover, modular houses and buildings are used in remote areas where conventional construction is not possible. Furthermore, modular construction finds its major application in healthcare facilities, churches, fast food restaurants, and commercial offices. In addition, it is gaining increased popularity, owing to its benefits such as ability to serve remote locations, low waste generation, environmentally friendly construction process, enhanced flexibility, high quality, and increased market acceptance.

The growth of the global modular construction market is driven by increase in urbanization & industrialization in developing countries. In addition, upsurge in population is anticipated to have a significant impact on the growth of the market to cater to the increasing needs of consumers. Furthermore, rise in demand for jobs, housing, energy, clean water, food, transportation infrastructure, and social services leads to higher adoption of cost-effective modular construction technologies to ensure uniform quality.

However, lack of reliability on modular construction in earthquake-prone regions considerably hampers the growth of modular construction market. In addition, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Construction activities were halted or restricted. This led to decline in market. Conversely, industries are gradually resuming their regular construction and services. This is expected to lead to re-initiation of modular construction companies at their full-scale capacities, that helped the market to recover by end of 2021.

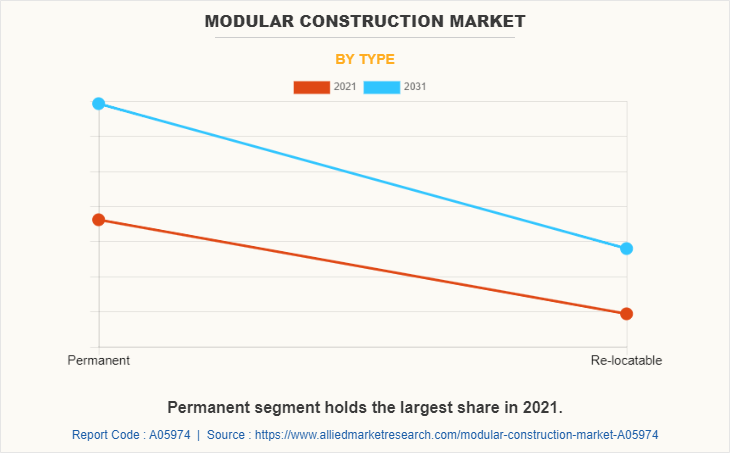

By Type:

The modular construction market is divided into permanent and re-locatable. In 2021, permanent segment registered the highest revenue and re-locatable segment is expected to grow at a significant CAGR, owing to greater flexibility re-locatable building offers. Permanent modular houses are inexpensive and simple to build. Moreover, these houses are available in a wide range of designs and patterns. Some popular houses based on shape include duplex and multistory apartments. These houses are aesthetically built with the use of CorTen steel with anticorrosive paint coating. Moreover, there is a surge in demand for customized and DIY construction. Many competitors, architects, and builders are reusing stockpiled shipping containers for building homes.

For instance, the UK-based Z Modular offers modular homes built from used shipping containers for student housing, multifamily, and workforce housing. Furthermore, increase in trend of green buildings across developed countries, such as the U.S., the UK, France, and Germany, is anticipated to offer lucrative opportunities for the expansion of the permanent modular construction industry.

In addition, increase in investments in infrastructure is anticipated to offer lucrative growth opportunities for the market players during forecast period.

Rise in need for protection of architecture from environmental impacts, increase in government focus on green building concepts, and modular construction for space constraints in large cities are anticipated to drive the growth of the market. In addition, rising infrastructure spending in various countries, such as Germany, France, India, and others, surges the demand for modular construction, and thus drives the growth of the market. For instance, in Hesse region, a total of 6,796 buildings were completed in 2020, out of which 11,640 included prefabricated homes.

A rise in focus toward affordable housing structures and increase in need for modular construction, owing to features, such as quicker build, easy to relocate, and portability, are anticipated to provide lucrative growth opportunities for the market. In addition, urban population is focusing on modular construction to afford cheaper living as these containers require less cost as compared to traditional container houses. In 2020, the U.S. government's housing program funded around $10 million to build modular construction buildings. In addition, scarcity of housing units in developing economies, such as Africa and India, is expected to provide lucrative opportunities for the expansion of modular construction market size during the forecast period.

Modular construction is one of the leading trends in the UAE’s construction industry. Its flexibility offers a wider range of materials and sizes, while its modularity enables easier customization during assembly.

Modular construction is used in a variety of projects across the country, from prefab houses and residential communities to hotels, hospitals and many other facilities. These projects demonstrate the speed, cost-effectiveness and sustainability features of modular construction methods, which are becoming increasingly popular in the region.

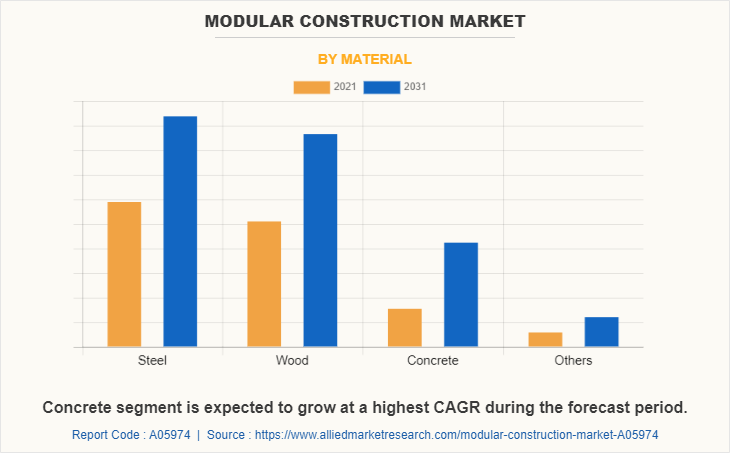

By Material:

On the basis of material, modular construction market is segmented into steel, wood, concrete and others. In 2021, steel segment registered the highest revenue and concrete segment is expected to grow at a significant CAGR, as concrete modular construction requires shorter construction time and is significantly cost-effective. Moreover, steel modular construction offers enhanced stability to tall buildings with rapid on-site installation, which are approximately 8 units per day. Moreover, four-sided modules, open-sided modules, special stair or lift modules, and non-load bearing modules are used in the design of buildings of steel construction.

Furthermore, steel modular construction is suitable for residential developments, commercial, mixed retail, and car parking in urban areas, owing to its strength and durability. Moreover, increase in preference toward steel modular construction in developing countries, such as India and China, is anticipated to propel the growth of the steel based modular construction buildings.

Developed countries, such as the U.S., Japan, the UK, and others, had implemented initiatives that focus on building, designing, and installing green building concept. This modular construction has features, such as cost-effective and energy-effective prefabricated products, for construction, which, in turn, drive the growth of the modular construction market. Factors, such as reduced cost and time required for modular construction and rise in demand for prefabricated products for residential and commercial construction activities, drive the growth of the market.

In addition, increase in urban population and industrialization in developed countries, such as the U.S., Japan, France, and Canada, surges the demand for modular construction, owing to features such as space issues, movability, and easy of transport. Modular construction is compact and easy to move from one place to other, which drives the growth of the market. However, modular or prefabrication products need to install heating ventilation and air conditioning systems in extreme cold and hot regions, which is anticipated to hamper the growth of the market. Conversely, upsurge in demand for new construction and increase in focus toward affordable housing structures are anticipated to provide lucrative opportunities for the modular construction market growth.

Modular building is an increasingly popular sustainable solution to a wide variety of construction needs. Developers and contractors can now leverage the benefits of this construction precast method to keep up with evolving and stay ahead of the curve. In addition, modular construction offers a faster and more reliable path to project completion, with the potential for up to 50% reduction in overall build time. By fabricating modules off-site in controlled conditions, risk factors such as weather delays or labor shortages are significantly minimised, providing peace of mind while optimising efficiency and cost savings throughout your construction process.

Moreover, modular construction has many advantages that can help to keep projects on budget. From reduced material waste and labor costs to lowered transportation fees and loan interest rates, modular building help businesses achieve cost savings compared to traditional construction methods that helps the modular construction market to grow.

In addition, off-site fabrication of modules provides an unparalleled level of quality control, with a controlled environment and standard designs at the factory. This ensures that all fabricated modules and prefab houses meet a high standard, making precision engineering achievable on each piece. It is safer for workers thanks to its factory setting. Potential hazards, such as exertion and exposure to dangerous tools or equipment, are significantly lowered when the bulk of a project’s activities take place within the four walls of an industrial space allowing employees greater peace of mind while onsite work continues with minimised risk.

Moreover, the environmental benefits of modular construction are hard to ignore. Since most of the work is done in factories, there’s less disruption to natural habitats around the project site. Additionally, waste materials can be recycled and reused in future buildings, which helps reduce carbon emissions and energy consumption while still delivering quality results. Finally, since modular buildings require fewer resources overall (like materials), they have a smaller impact on their surrounding environment which offers positive impact over the growth of modular construction market.

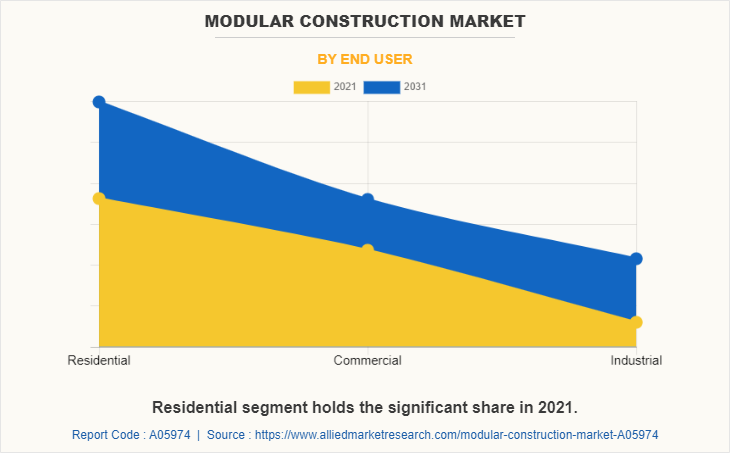

By End User:

On the basis of end user, modular construction market is segmented into residential, commercial and industrial. In 2021, residential segment registered the highest revenue and industrial segment is expected to grow at a significant CAGR, as industrial sector is adopting modular construction due to lower construction cost. Moreover, residential modular construction includes fixed and relocatable housing units developed for temporary purpose. In addition, it includes vocational homes, rest rooms, temporary kitchens, retirement homes, recreational homes, and student homes. According to the European Union and Eurostat, residential construction of Germany increased from 5.9% to 6% from 2019 to 2020. In addition, over the last few years, residential construction witnessed substantial increase, owing to increase in investments in North American, Asia-Pacific, and African countries.

Furthermore, the North America residential construction market is expected to grow at a significant rate during the forecast period, as builders attempt to meet the demand for increasing residential complexes, owing to rise in urbanization. Asia-Pacific has surpassed Europe, in terms of revenue contribution, and is expected to increase to 50% of the overall spending by 2022. Thus, increase in population, rise in disposable income, and rapid urbanization are expected to provide opportunities for growth in developing countries such as India.

The modular construction market is segmented on the basis of type, material, end user and region. On the basis of type, the market is bifurcated into permanent and relocatable. On the basis of material, the market is classified into steel, wood, concrete, and others. On the basis of end user, the market is divided into residential, commercial, and industrial. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Region:

On the basis of region, modular construction market is segmented into North America, Europe, Asia-Pacific and LAMEA. In 2021, North America registered the highest revenue and Asia-Pacific is expected to grow at a significant CAGR, owing to developing economies, such as China and India which are expected to support market expansion, owing to increase in demand for residential construction. In addition, there is an increase in construction-related activities and growth in housing for single and multi-unit dwellings. The modular construction industry is witnessing rapid growth, owing to space related issues, rise in population and increased urbanization.

This is expected to drive the demand for residential sector, thereby accelerating the need for affordable housing units. In addition, increase in demand for container infrastructure in residential improvement & repair is expected to fuel the market growth in the region. In addition, the U.S. ranks third in the list of countries with maximum population, witnessing a continuous population increase. This scenario is expected to surge the demand for compact and low-cost infrastructure in the market. Increased consumer expenditure, owing to improved household net worth, reduced unemployment rates, improved consumer confidence, and advances in overall economic conditions drives the residential market in North America.

COMPETITION ANALYSIS

The major players having significant modular construction market share profiled in the report included are ATCO, Anderco Pte. Ltd, Giant Containers Inc, Bechtel Corporation, Lendlease Corporation, SG Blocks Inc, Skanska AB, Speed House Group of Companies, Supertech Industries LLC, Fluor Corporation, and Modulaire Group.

Major companies in the market have adopted product launch as their key developmental strategies to offer better products and services to customers in the modular construction market.

Key Benefits For Stakeholders

- This report provides a quantitative the modular construction market analysis, modular construction market forecast, market segments, current trends, estimations, and dynamics of the market analysis from 2021 to 2031 to identify the prevailing modular construction market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the modular construction market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global modular construction market trends, key players, market segments, application areas, and market growth strategies.

Modular Construction Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 234.7 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Tempohousing, Supertech Industries, ATCO Ltd., Bechtel Corporation, Speed House Group of Companies, Honomobo Corporation, Skanska AB, Lendlease Corporation, Giant Containers Inc., SG Blocks, Inc. |

Analyst Review

Modular construction is also known as prefabrication. It is used in modular construction, modular offices, restrooms, bathrooms, locker rooms, workplace housing, mobile cafes, flat rack components, bathrooms, bedrooms, and entire building. It is also used in oil & gas field and power plant industries. It has features such as shorter building time, lower risk, higher quality, and requires low cost.

Surge in demand for construction of prefabricated construction, owing to affordable housing structures drives the growth of the modular construction market. There has been a rise in demand for modular construction products, owing to reduction in cost and time required for construction, ease of installation, and lack of space in large cities. This, in turn, drives the growth of the modular construction market. Increase in focus toward affordable residential, commercial, and industrial spaces has significant impact on the market growth. Moreover, modular construction buildings are developed using containers that protect from changes in external environment and are easy to install & relocate.

Rise in population shifts from rural to urban areas, which need more shopping complexes and modular shelters is expected to provide a significant opportunity for the modular construction market, thereby fueling the growth of the modular construction market.

However, lack of reliability on modular construction in earthquake prone regions and dearth of skilled labor in developing countries are anticipated to hamper the growth of the modular construction market. Moreover, increase in investment in infrastructure is anticipated to provide lucrative opportunities for the growth of the modular construction market.

The global modular construction market was valued at $131,052.1 million in 2021, and is projected to reach $234,660 million by 2031, registering a CAGR of 6.1% from 2022 to 2031.

The forecast period considered for the global modular construction market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global modular construction market report can be obtained on demand from the website.

The base year considered in the global modular construction market report is 2021.

The top companies holding the market share in the global modular construction market report are ATCO, Anderco Pte. Ltd, Giant Containers Inc, Bechtel Corporation, Lendlease Corporation, SG Blocks Inc, Skanska AB, Speed House Group of Companies, Supertech Industries LLC, Fluor Corporation, and Modulaire Group.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By material, the steel segment is the highest share holder of modular construction market.

Loading Table Of Content...