Molded Plastics Market Research, 2031

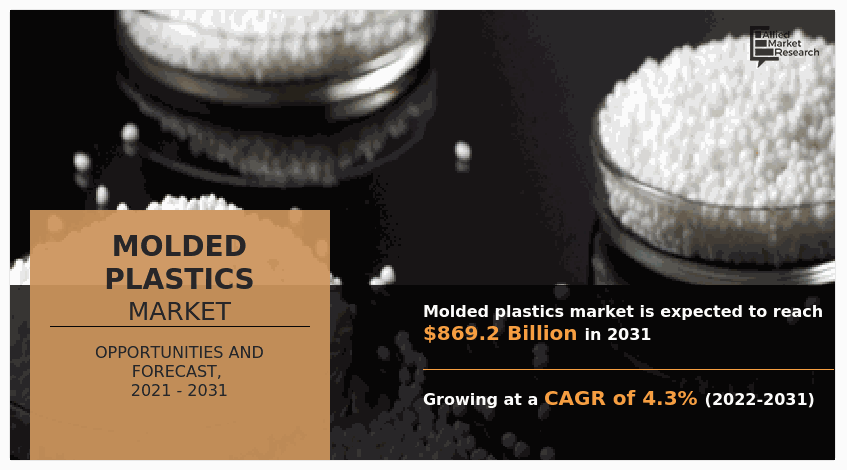

The global molded plastics market was valued at $573.3 billion in 2021, and is projected to reach $869.2 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031.The surge in demand for lightweight materials is a significant driver for the molded plastics market, as industries increasingly seek solutions that enhance energy efficiency and performance. Lightweight materials contribute to reduced overall product weight, which is essential for applications where fuel efficiency and reduced emissions are priorities, such as in automotive and aerospace sectors.

Introduction

Molded plastics refer to a category of plastic materials that are shaped into specific forms through a manufacturing process known as molding. This process involves heating plastic resin until it becomes pliable, then injecting, compressing, or blowing it into a mold that defines the desired shape. Once cooled, the plastic solidifies, retaining the intricate details of the mold. This versatility in manufacturing allows the production of a wide range of products, from simple components to complex assemblies, across various industries.

These are used in various applications such as building & construction, automotive & transportation, consumable & electronics, packaging, and others such as medical, stationary, and textiles, owing to their high ductility, tensile strength, impact resistance, moisture resistance, and greater design flexibility. In addition, these are used in the manufacturing of car fascia, bumpers, grilles, headlight pods, panels, fenders, wheel wells, engine cover, table components, air flow ducts, equipment, exterior fascia & decorative panels, and other components. These are used to produce electrical conduits, rain water & sewage pipes, plumbing, gas distributions pipes, storage tanks, flooring tiles & rolls, PVC sheets, insulating membranes, and other construction materials.

Key Market Dynamics

Increase in awareness regarding hygiene-related activities has led to growth of the packaging sector where molded plastics are widely used in the production of complex and intricate-shaped plastics. For instance, according to a report published by the National Investment Promotion and Facilitation Agency in October 2020, the packaging industry was worth over $917 billion in 2019, and is expected to reach $1.05 trillion by 2024, growing at a CAGR of 2.8%. This acts as one of the key drivers responsible for growth of the molded plastics market during the forecast period. In addition, the building & construction sector is growing rapidly in both developed and developing economies including the U.S., China, India, and others, owing to increased demand for commercial space such as offices, hotels, malls, industrial corridors, and others. Furthermore, surge in investments in building infrastructure have led the building & construction sector to witness a significant growth. For instance, according to a report published by Invest India in August 2021, the Indian government has an investment budget of $1.4 trillion on infrastructure in which 16% of the amount is contributed toward the development of urban infrastructure. Molded plastics offer limitless possibilities in design achieved by bending, molding, and extrusion. They are low conductors of heat and electricity; thus are widely used as insulating materials, cladding panels, and pipes in offices, malls, residential facilities, and other construction sites. These are the major molded plastics market growth factors.

However, sources such as crude oil, naphtha, and natural gas are the prominent feedstock used in the production of petrochemicals, which is further used for the production of various molded plastic products. Thus, the dependency of molded plastic manufacturers over these highly volatile commodities may have a direct impact on the scalability and profitability of molded plastic manufacturers. Furthermore, several countries such as Taiwan, Bangladesh, the UK, China, and others have made efforts to ban the use of various plastic-based products. This has set back the key manufacturers from producing molded plastics. Moreover, microplastic particles have been detected in a wide range of shape, size, and concentration in food and drinking water that may cause several health-related problems such as irritation in eye, vision failure, respiratory problems, dizziness, genotoxic, cardiovascular, and gastrointestinal problems. These factors hamper the market growth of the molded plastics market.

On the contrary, as the automotive industry continues to evolve, there is an increase in focus on lightweight materials to enhance fuel efficiency and reduce emissions. Molded plastics offer an excellent solution due to their lightweight nature, which helps manufacturers meet stringent regulatory standards while also improving vehicle performance.

Furthermore, molded plastics are used in various automotive components, including dashboards, interior trims, bumpers, and even structural parts. This diversification in applications drives demand, as automakers seek to replace traditional materials such as metal and glass with more versatile and cost-effective options. The ability to mold plastics into complex shapes allows for innovative designs that enhance both aesthetics and functionality, making them an attractive choice for manufacturers. All these factors are anticipated to offer new growth opportunities for the global molded plastics market during the forecast period.

Market Segmentation

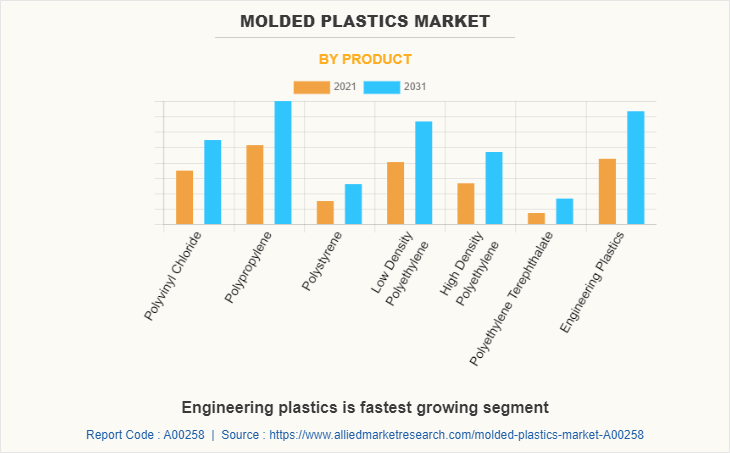

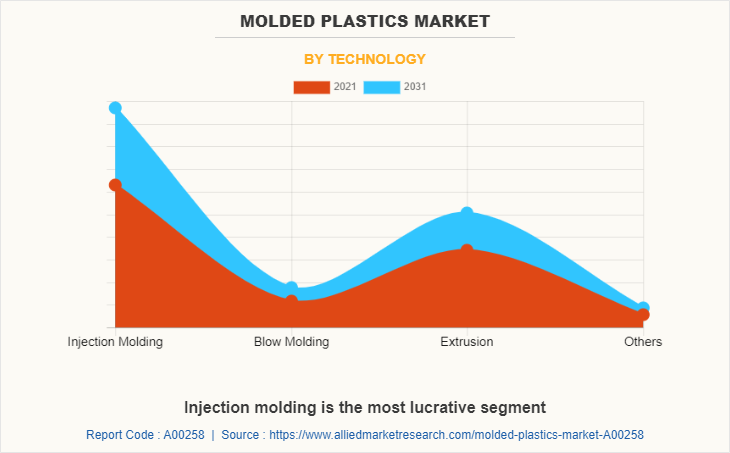

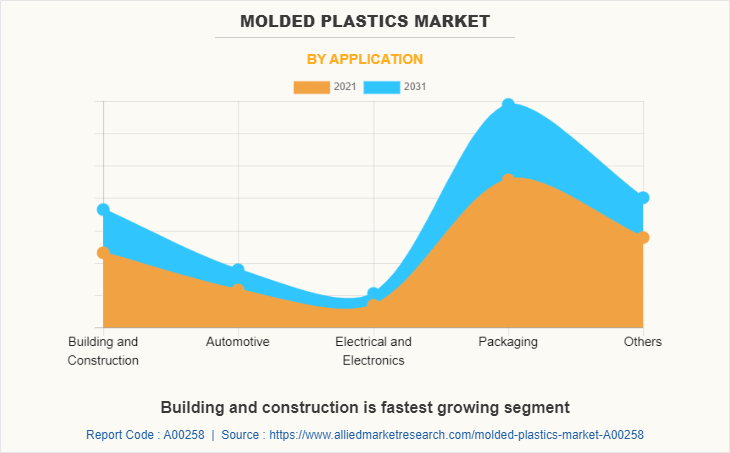

The molded plastics market is segmented on the basis of product, technology, application, and region. On the basis of product, the market is categorized into polyvinyl chloride, polypropylene, polystyrene, low density polyethylene, high density polyethylene, polyethylene terephthalate, and engineering plastics. On the basis of technology, it is divided into injection molding, blow molding, extrusion, and others. By application, it is classified into building & construction, electrical & electronics, automotive and packaging. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The leading players of the molded plastics market include Atlantis Plastics, Inc., China Plastic Extrusion Ltd, DuPont, Eastman Chemical Company, GSH Industries, Mitsubishi Chemical Corporation, Mitsui Chemicals Inc, Petro Packaging Company, Inc., Pexco LLC., and PSI Molded Plastics.

The Asia-Pacific molded plastics market size is projected to grow at the highest CAGR of 4.3% during the forecast period and accounted for 47.4% of molded plastics market share in 2021. This is attributed to the proliferating demand for molded plastics in building & construction and consumer electronic sectors where molded plastics are used as a prime insulating material. For instance, according to a report published by the United Nations Statistics Division in July 2021, China witnessed around 28.7% of the global manufacturing output for consumer electronic products. In addition to this, countries such as India and Australia have witnessed a rapid increase in automotive sectors where molded plastics are widely used in manufacturing of car fascia, bumpers, grilles, headlight pods, panels, fenders, wheel wells, engine cover, table components, air flow ducts, equipment, exterior fascia & decorative panels, and other components. For instance, according to a report published by India Brands Equity Foundation in December 2021, the number of passenger vehicles stood at 279,745 units in March 2021, registering a growth of 28.39% as compared to 217,879 units in March 2020.

In 2021, the polypropylene segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.0% during the forecast period. Polypropylene-based molded plastics are versatile, safe, and low cost molded plastics generally used in the packaging and automotive industry. In the automotive industry, molded polyethylene is used in automotive dashboard, bumpers, grills, bottle caps, music systems, wire spools, storage containers, one-piece chairs, seat panels, mechanical parts, and other components. Furthermore, polypropylene molded plastics are tough, translucent, have low coefficient of friction, and offers good chemical resistance as compared to other types of molded plastics. This factor has escalated the growth of this segment in the global market.

By technology, the injection molding segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 4.4% during forecast period. This is attributed to the fact that injection molding technology is the most popular technology used for producing molded plastics. In addition, it uses automated processes to reduce the manufacturing cost and waste production during the manufacturing process. These factors have augmented the growth of the injection molding segment in the global molded plastics market.

By application, the packaging application segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 4.2% during the forecast period. This is attributed to the increase in global trade that has rationalized tariffs and lowered trade barriers, which in turn have given rise to international trade in packaging machinery and materials where molded plastics are widely used to manufacture packaging parts and components to increase the aesthetic value and consumer friendliness of the packaging products.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the molded plastics market analysis from 2021 to 2031 to identify the prevailing molded plastics market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the molded plastics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global molded plastics market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

According to CXOs of leading companies, the global molded plastics market is expected to exhibit high growth potential. Molded plastics are used to produce a wide range of plastic-based products, parts, and forms such as pipes, tubes, films, wraps, sheets, and other custom products in a variety of end use sectors such as building & construction, automotive, packaging, industrial, and others. High volume plastic materials that require efficient electrical insulation, high tensile strength, flexibility, and ease of machining are accomplished with molded plastics.

In addition, molded plastics are employed as substitute over metals owing to its corrosion resistance properties that make customers more linear toward purchasing molded plastics-based products. In addition, factors such as reduced raw material price, easy availability, and arrival of local players enhance performance of molded plastics in several end use industries. CXOs further added that sustained economic growth and development of the packaging sector have increased the popularity of molded plastics.

Molded Plastics Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mitsubishi Chemical Corporation, DuPont, China Plastic Extrusion Ltd., GSH Industries, EASTMAN CHEMICAL COMPANY, Mitsui Chemicals Inc, Petro Packaging Company, Inc, PSI Molded Plastics, Pexco LLC, Atlantis Plastics, Inc. |

Analyst Review

According to CXOs of leading companies, the global molded plastics market is expected to exhibit high growth potential. Molded plastics are used to produce a wide range of plastic-based products, parts, and forms such as pipes, tubes, films, wraps, sheets, and other custom products in a variety of end use sectors such as building & construction, automotive, packaging, industrial, and others. High volume plastic materials that require efficient electrical insulation, high tensile strength, flexibility, and ease of machining can be accomplished with the use of molded plastics.

In addition, molded plastics are employed as substitute over metals owing to its corrosion resistance properties that make customers more linear toward purchasing molded plastics-based products. In addition, factors such as reduced raw material price, easy availability, and arrival of local players enhance performance of molded plastics in several end use industries.

CXOs further added that sustained economic growth and development of the packaging sector have increased the popularity of molded plastics.

Nowadays, molded plastics are used in the automotive industry, molded polyethylene is used in automotive dashboard, bumpers, grills, bottle caps, music systems, wire spools, storage containers, one-piece chairs, seat panels, mechanical parts, and other components.

The packaging end useapplication segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 4.2% during the forecast period.

The Asia-Pacific molded plastics market size is projected to grow at the highest CAGR of 4.3% during the forecast period and accounted for 47.4% of molded plastics market share in 2021.

The global molded plastics market was valued at $573.3 billion in 2021.

The leading players of the molded plastics market include Atlantis Plastics, Inc., China Plastic Extrusion Ltd, DuPont, Eastman Chemical Company, GSH Industries, Mitsubishi Chemical Corporation, Mitsui Chemicals Inc, Petro Packaging Company, Inc., Pexco LLC., and PSI Molded Plastics.

Loading Table Of Content...