Molecular Spectroscopy Market Research, 2034

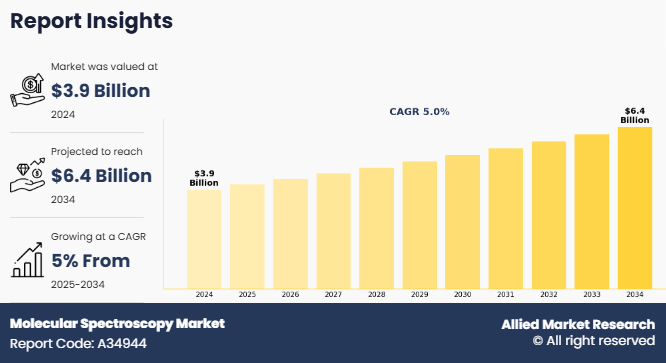

The global molecular spectroscopy market size was valued at $3.9 billion in 2024, and is projected to reach $6.4 billion by 2034, growing at a CAGR of 5% from 2025 to 2034. The molecular spectroscopy market growth is driven by the rising demand for advanced analytical techniques across pharmaceuticals, biotechnology, food safety, environmental testing, and materials science. For instance, according to the International Federation of Clinical Chemistry and Laboratory Medicine (IFCC), global testing volumes are expected to rise significantly by 2030 due to increased disease burden, stricter regulatory standards, and the need for precise molecular-level analysis. This growing emphasis on high-throughput and accurate detection methods continues to create sustained demand, thus driving the global molecular spectroscopy market growth.

Molecular spectroscopy is an analytical technique that measures the interaction of electromagnetic radiation with molecules to identify, quantify, and study their structure, composition, and dynamics. It plays a vital role in drug discovery, molecular diagnostics, environmental monitoring, food quality assurance, and chemical research. Molecular spectroscopy techniques such as nuclear magnetic resonance (NMR), infrared (IR), ultraviolet-visible (UV-Vis), Raman, and mass spectroscopy provide critical insights into molecular properties and chemical processes. These tools are extensively utilized for applications ranging from biomarker discovery and pharmaceutical quality control to pollutant detection and nanomaterial characterization. Due to its precision, versatility, and ability to deliver non-destructive, real-time analysis, molecular spectroscopy has become an indispensable technology in both industrial and academic research worldwide.

Key Takeaways

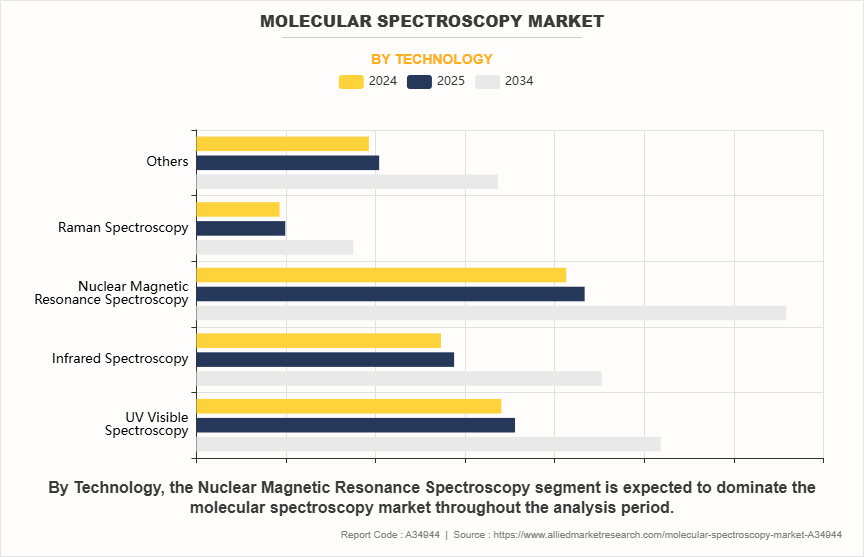

- On the basis of technology, the NMR spectroscopy segment dominated the molecular spectroscopy market in terms of revenue in 2024 However, the Raman spectroscopy segment is anticipated to grow at the fastest CAGR during the forecast period.

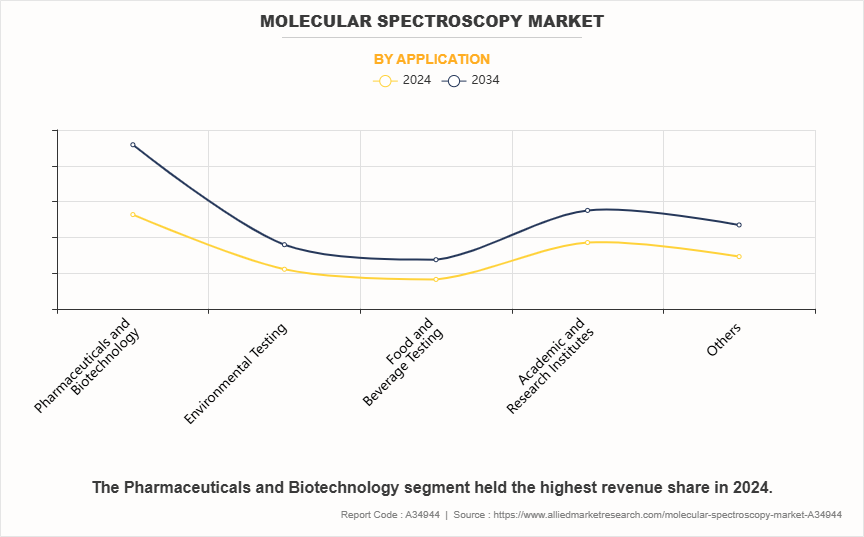

- On the basis of application, the pharmaceuticals and biotechnology segment dominated the molecular spectroscopy market in terms of revenue in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

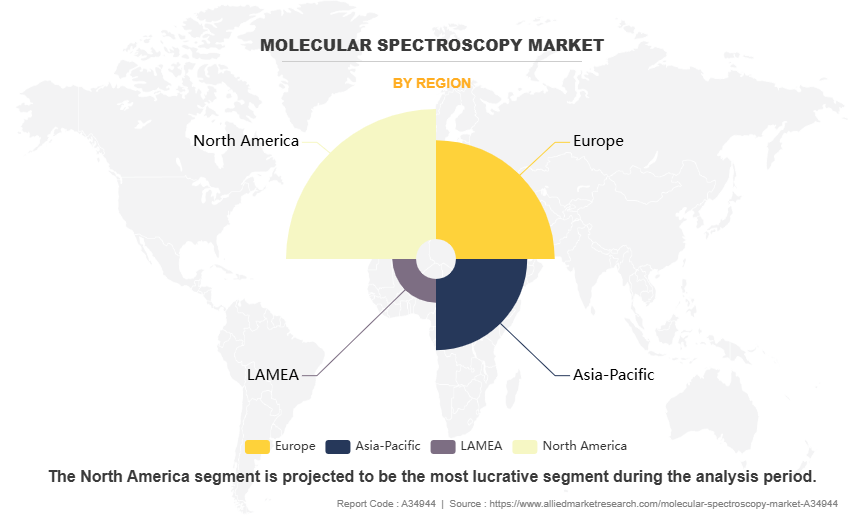

- Region wise, North America generated the largest revenue in molecular spectroscopy market in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The molecular spectroscopy market size is experiencing strong growth, fueled by its indispensable role in pharmaceutical, biotechnology, food, environmental, and materials science applications. One of the primary drivers for the molecular spectroscopy market is the increasing adoption of molecular spectroscopy techniques in drug discovery and development. Pharmaceutical companies are leveraging advanced tools such as nuclear magnetic resonance (NMR), infrared (IR), Raman, and mass spectroscopy to accelerate molecular characterization, optimize lead compounds, ensure drug purity, and comply with stringent regulatory requirements. This trend is further supported by the growing pipeline of biologics and complex molecules, which demand high-precision analytical solutions throughout the R&D and manufacturing cycle and drive the molecular spectroscopy market.

Additionally, the rising focus on food safety and quality assurance is a significant contributor to growth of the Molecular Spectroscopy industry. Regulatory agencies worldwide are imposing stricter standards for detecting contaminants, adulterants, and chemical residues in food and beverages. Molecular spectroscopy techniques such as IR and UV-Vis are increasingly being deployed for rapid, non-destructive testing to ensure compliance and safeguard public health. The expansion of the processed food industry in emerging economies further accelerates adoption, as manufacturers seek reliable quality control technologies which further drive the molecular spectroscopy market growth.

Environmental monitoring represents another fast-growing application area. With heightened concerns over pollution, climate change, and resource sustainability, spectroscopy is being utilized to detect and analyze air, water, and soil contaminants at trace levels. Governments and environmental agencies are adopting molecular spectroscopy to meet regulatory mandates, while industries are incorporating it into sustainability initiatives to minimize ecological impact.

Moreover, the integration of molecular spectroscopy with advanced technologies such as artificial intelligence (AI), machine learning, and cloud-based analytics is enhancing accuracy, speed, and data interpretation capabilities further drive growth of the molecular spectroscopy market. Portable and handheld spectroscopy devices are also gaining traction, enabling on-site and real-time analysis in pharmaceuticals, agriculture, forensic science, and industrial quality control. These innovations are expanding the user base beyond laboratories into point-of-care and field applications.

Emerging markets in Asia-Pacific, Latin America, and the Middle East are opening new avenues for growth of the molecular spectroscopy market. Expanding healthcare infrastructure, increasing pharmaceutical production, and heightened food safety awareness are driving molecular spectroscopy demand in these regions. Local manufacturing of cost-effective instruments, coupled with government investments in research and innovation, is further supporting molecular spectroscopy market penetration. The combination of regulatory pressure, technological advancement, and widening applications is expected to sustain the strong growth momentum of the global molecular spectroscopy market during molecular spectroscopy market forecast period.

Segmental Overview

The molecular spectroscopy market outlook is segmented by technology, application, and region. On the basis of technology, molecular spectroscopy market segmented into UV-visible spectroscopy, infrared (IR) spectroscopy, nuclear magnetic resonance (NMR) spectroscopy, Raman spectroscopy, and others. On the basis of application, the molecular spectroscopy market is classified into pharmaceuticals & biotechnology, environmental testing, food & beverage testing, academic & research institutes, and others. Region-wise, the molecular spectroscopy market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Technology

On the basis of technology, the nuclear magnetic resonance (NMR) spectroscopy segment dominated the molecular spectroscopy market share in 2024, owing to its critical role in structural elucidation of complex molecules, biomarker discovery, and metabolomics research. NMR provides unmatched precision in characterizing molecular structures, protein-ligand interactions, and drug metabolism pathways, making it indispensable in pharmaceutical R&D and life sciences. Additionally, continuous technological advancements such as cryogen-free magnets and benchtop NMR systems have expanded accessibility, fueling demand across academic and industrial laboratories.

However, the Raman spectroscopy segment is expected to register the highest CAGR during the forecast period owing to its growing adoption in real-time, non-destructive analysis across diverse industries such as pharmaceuticals, forensics, food safety, and environmental monitoring. Raman spectroscopy’s ability to analyze samples without extensive preparation, combined with its compatibility with aqueous environments, makes it highly versatile. The emergence of portable Raman devices, integration with AI-driven spectral analysis, and its increasing use in rapid point-of-care diagnostics and counterfeit drug detection are accelerating adoption globally. These advantages position Raman spectroscopy as a leading technology for fast, reliable, and field-deployable molecular analysis.

By Application

On the basis of application, the pharmaceuticals & biotechnology segment dominated the molecular spectroscopy market share in 2024 and is anticipated to register the highest CAGR during the forecast period, due to the rising demand for advanced molecular characterization in drug discovery, biologics development, and quality assurance. Spectroscopy techniques are integral for ensuring drug purity, detecting contaminants, and supporting regulatory compliance. The growth of personalized medicine, expansion of biosimilars, and increased clinical trial activity are further driving adoption. Continuous investment by pharmaceutical companies and CROs in high-throughput, precise analytical solutions continues to strengthen this segment’s dominance.

By Region

Region-wise, North America was the largest shareholder in the molecular spectroscopy market in 2024, owing to its strong pharmaceutical and biotechnology ecosystem, high research funding, and advanced healthcare infrastructure. The presence of leading market players, well-established academic and clinical research institutions, and stringent regulatory standards requiring molecular-level analysis have boosted adoption. In addition, the U.S. government’s investments in biomedical research, precision medicine initiatives, and environmental monitoring programs support robust demand. Technological innovations, coupled with early adoption of cutting-edge spectroscopy systems across industries including food safety and forensics, further reinforce North America’s leadership in the global molecular spectroscopy market.

However, Asia-Pacific is anticipated to register the highest CAGR during the molecular spectroscopy marketforecast period owing to rapid industrialization, expanding pharmaceutical manufacturing, and increasing investment in R&D infrastructure. Countries such as China, India, and South Korea are witnessing growing demand for spectroscopy in drug development, quality testing, and environmental analysis. Rising government initiatives to improve food safety and healthcare standards, coupled with the expansion of academic research capabilities, are fueling adoption. Additionally, the availability of cost-effective instruments and rising collaborations with global companies are making spectroscopy technologies more accessible. These factors collectively position Asia-Pacific as the fastest-growing regional market.

Competition Analysis

Competitive analysis and profiles of the major players in the molecular spectroscopy market includes Bruker Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent technologies, inc., Shimadzu Corporation, ABB, JEOL Ltd., HORIBA, JASCO, and VIAVI Solutions Inc. The key players have adopted launch, acquisition, advancement, partnership as the key strategies for expansion of their product portfolio.

Recent Developments in Molecular Spectroscopy Industry

- In April 2025, HORIBA, a global leader in analytical and measurement technologies, announced the launch of the PoliSpectra Rapid Raman Plate Reader (RPR) for Raman High-Throughput Screening (HTS). RPR technology enables efficient monitoring of bioprocesses and drug discovery workflows with rapid, non-destructive analysis of 96 wells within one minute.

- In March 2025, HORIBA, a global leader in analytical and measurement technology, announced an expanded portfolio of instruments tailored to meet the rigorous demands of the pharmaceutical industry. Its current suite of offerings encompasses applications across the entire pharmaceutical lifecycle from drug discovery and development to manufacturing and quality control.

- In February 2025, Bruker Corporation announced the launch of the VERTEX NEO Platform, with its first product, the VERTEX NEO R. This release marks a continuation of providing high-end Fourier-Transform Infrared (FTIR) instrumentation for unparalleled and disturbance-free academic and industrial research and development.

- In April 2024, Bruker Corporation, the leading provider of nuclear magnetic resonance (NMR) spectroscopy solutions, announced the introduction of novel high-resolution solid-state NMR scientific capabilities that can enable unprecedented structural biology discoveries in large proteins, membrane proteins, and protein aggregates. It launched a new ultra-fast CP/MAS iProbe as the latest innovation in solid-state NMR technology. Featuring a 160 kHz Magic Angle Spinning (MAS) system, it takes high-resolution MAS and proton detection on solid biological samples to the next level, enabling new scientific discoveries.

- In February 2024, Bruker Corporation announced the launch of the new BEAM – the first dedicated single-point spectrometer unleashing the full power of FT-NIR spectroscopy, taking in-process control for solid samples to the next level. Unlike common single-point analyzers based on filter or diode-array technology, the BEAM uses FT-NIR technology based on Bruker's RockSolidTM interferometer to ensure it can perform the same applications with the same precision, accuracy, and long-term stability expected from a high-end lab-based system.

- In February 2024, Bruker Corporation announced the acquisition of Nanophoton Corporation, a pioneer focused on advanced research Raman microscopy systems. Headquartered in Osaka, Nanophoton offers a broad portfolio of advanced Raman microscopes, serving academic and industrial research customers, primarily in Japan. This acquisition fills a gap in Bruker's molecular microscopy portfolio, and Bruker is looking forward to offering fast, flexible, and sensitive Nanophoton Raman microscopy systems worldwide for research and development in life sciences, biopharma, advanced materials, semiconductors, and polymers.

- In January 2024, Bruker Corporation announced the acquisition of Tornado Spectral Systems Inc., a Canadian company specializing in process Raman instruments, primarily used in pharma and biotech quality control applications. Tornado, with over a decade of experience in innovative and industry-proven Raman solutions, will enhance Bruker's biopharma PAT portfolio with its well-established products.

- In April 2023, Bruker Corporation, at the Experimental Nuclear Magnetic Resonance Conference (ENC 2023), announced innovations for NMR spectroscopy in life science, pharma, and cleantech research to enable discoveries in functional structural biology, drug discovery, and battery research. It launched the Ascend Evo 400 new standard 400 MHz NMR magnet with a liquid helium hold-time of one year to reduce costs of ownership and enhance operational convenience.

- In April 2023, HORIBA, a global leader in analytical and measurement technology, announced the new LabRAM Odyssey, a fully automated and remotely controllable system. The LabRAM Odyssey replaces the best seller LabRAM HR Evolution. Developed on the same platform, the LabRAM Odyssey is now more user friendly and offers new functionalities, advanced confocal imaging capabilities in 2D and 3D, and is fully compliant with all market requirements.

- In November 2022, Bruker Optics announced the launch of the MOBILE-IR II – a portable, battery-powered Fourier Transform Infrared (FT-IR) spectrometer that delivers the high spectral performance of a laboratory benchtop system. This powerful mobile spectrometer will enable users worldwide to bring routine and advanced FT-IR applications to the field.

- In August 2022, HORIBA Scientific, a global leader in fluorescence spectroscopy solutions, announced that its Aqualog a compact benchtop spectrometer, is featured in a new approved ASTM (American Society for Testing and Materials) method for Detection of Water-Soluble Petroleum Oils with A-TEEM (Absorbance-Transmission and Fluorescence Excitation and Emission Matrices) Optical Spectroscopy and Multivariate Analysis.

- In April 2022, HORIBA Scientific and Digital Surf, creator of the Mountains software platform for image and surface analysis in microscopy and metrology, announced the release of graphYX, a new software range for users of HORIBA's Raman spectroscopy solutions, comprising two product levels: graphYX and graphYX-3D.

- In March 2022, Bruker Corporation announced new capabilities for its benchtop Fourier transform (FT) nuclear magnetic resonance (NMR) spectrometer, the Fourier 80, which does not require special lab infrastructure or cryogens, and offers excellent 1H sensitivity of 200:1 for gradient spectroscopy proton probes. A new adjustable temperature option increases experimental flexibility, while new solutions for pharma and food analysis provide improved synthesis and process control, bringing NMR capabilities to more research and analytical laboratories.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the molecular spectroscopy market analysis from 2024 to 2034 to identify the prevailing molecular spectroscopy market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the molecular spectroscopy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global molecular spectroscopy market trends, key players, market segments, application areas, and market growth strategies.

Molecular Spectroscopy Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 6.4 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 278 |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Bruker Corporation, VIAVI Solutions Inc., Horiba Ltd., JEOL Ltd., Shimadzu Corporation, JASCO, PerkinElmer, Inc, ABB Ltd. |

Analyst Review

The market growth is primarily driven by technological advancements, expanding applications in pharmaceuticals and biotechnology, and increasing demand for precise analytical techniques. CXOs highlight that the rising adoption of molecular spectroscopy in drug discovery, quality control, and environmental monitoring, along with its growing role in food safety testing, further supports market expansion.

The increase in investments in research and development, the integration of AI and machine learning in spectroscopy data analysis, and the demand for miniaturized, portable spectrometers are key factors driving adoption of molecular spectroscopy. However, they pointed out that high instrument costs, complexity in data interpretation, and regulatory challenges pose significant restraints to market growth.

North America dominates the market due to its well-established research infrastructure, high adoption of advanced analytical technologies, and strong presence of key spectroscopy manufacturers. However, the Asia-Pacific region is expected to witness the highest CAGR during the forecast period, driven by rising government investments in scientific research, increasing pharmaceutical production, and expanding biotechnology sectors in emerging economies.

The largest regional market for molecular spectroscopy is North America, driven by strong pharmaceutical and biotechnology industries, advanced healthcare infrastructure, significant R&D investments, and strict regulatory standards supporting analytical technologies.

The Molecular Spectroscopy Market was valued for $3,936.24 million in 2024 and is estimated to reach $6,423.90 million by 2034, exhibiting a CAGR of 5% from 2025 to 2034.

The top companies hold the market share include Bruker Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent technologies, inc., Shimadzu Corporation, ABB, JEOL Ltd., HORIBA, JASCO, and VIAVI Solutions Inc.

The leading application of the molecular spectroscopy market is in the pharmaceutical and biotechnology sector, where it is extensively used for drug discovery, development, quality control, and regulatory compliance, making it the largest revenue-generating segment.

The global molecular spectroscopy market is driven by advancements in AI-based analytics, miniaturization, and portable devices, enabling real-time and field applications. Growing demand from pharma, biotech, food safety, and environmental sectors, along with hybrid spectroscopy systems, is shaping future market growth.

Loading Table Of Content...

Loading Research Methodology...