Money Transfer Agencies Market Research, 2032

The global money transfer agencies market was valued at $14.9 billion in 2022, and is projected to reach $65.9 billion by 2032, growing at a CAGR of 16.2% from 2023 to 2032.

The money transfer agencies market encompasses a diverse set of businesses and service providers that enable the seamless transfer of monetary assets between individuals or entities, often across geographic borders. These agencies leverage a variety of methods, including digital platforms, physical agent networks, and financial technology innovations, to facilitate transactions. Their services are crucial for supporting international remittances, business payments, and personal financial needs, catering to the demands of a globalized world while adhering to regulatory requirements and industry standards.

The adoption of digital technologies and mobile devices has made it easier for people to send and receive money electronically. Money transfer agencies that offer user-friendly mobile apps and online platforms tend to experience significant growth. Further, money transfer agencies often target emerging markets where banking infrastructure is less developed. As these markets grow and access to financial services expands, the demand for money transfer services increases. Furthermore, economic growth in source countries have led to increased remittances resulting in growth of money transfer agencies market. Thus, these factors notably contributes towards the growth of money transfer agencies market.

However, transaction costs and increased regulatory scrutiny are limiting the expansion of money transfer agencies market. On the contrary, opportunity to access unexplored markets and the availability of industry professionals are expected to create lucrative opportunities for the market in upcoming years. Moreover, money transfer agencies providers are exploring the use of blockchain technology to enhance the security, transparency, and efficiency of cross-border transactions. This is expected to fuel the money transfer agencies market opportunity market in upcoming years.

The report focuses on growth prospects, restraints, and trends of the money transfer agencies market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the money transfer agencies market outlook.

Segment Review

The money transfer agencies market is segmented into Service Type and End User.

The money transfer agencies market is segmented into service type, end user, and region. On the basis of service type, it is categorized into money transfer and currency exchange. On the basis of end user, it is classified into business and individual. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

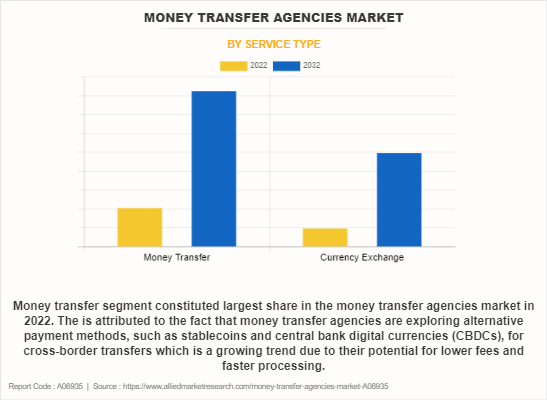

By service type, the money transfer segment acquired a major size of money transfer agencies market in 2022. The is attributed to the fact that money transfer agencies are exploring alternative payment methods, such as stablecoins and central bank digital currencies (CBDCs), for cross-border transfers which is a growing trend due to their potential for lower fees and faster processing.

By region, the North America dominated the money transfer agencies market in 2022. This is attributed to the fact that a sizable immigrant population in North America is fuelling a considerable increase in demand for foreign remittances. Further, various people in North America use money transfer agencies to send funds to family members and friends in other countries. These agencies provide a convenient and often cost-effective way to transfer money internationally, which is particularly important for immigrants and expatriates.

The key players operating in the global money transfer agencies market include Ria Financial Services, Skrill, MoneyGram, SMALL WORLD FINANCIAL SERVICES, Remitly, Inc., Xoom Corporation (Paypal), Wise Payments Limited, WorldRemit, The Western Union, and XE.com Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the money transfer agencies industry.

Market Trends and Landscape

Increase in partnerships to develop the money transfer practices and adoption of the advanced technologies are some of the trends flourishing the money transfer agencies market growth. For instance, in June 2023, IndusInd Bank has forged a strategic partnership with Wise, a global technology company specializing in secure money transfers. The collaboration aimed to provide convenient and efficient online inward remittance services specifically tailored for Non-Resident Indians (NRIs) residing in the U.S. and Singapore.

Furthermore, introduction of new and innovative products in the market by key players is expected to boost the growth of money transfer agencies market during the forecast period. For instance, in March 2021, MoneyGram International, Inc., launched 'MoneyGram as a Service,' a new business line that enables other companies to access its leading global money transfer network through its powerful API-driven infrastructure and best-in-class technology.

COVID-19 pandemic has a negative impact on the money transfer agencies industry. One of the most immediate impacts was the reduction in remittances. As the global economy faced uncertainty and job losses due to lockdowns and economic slowdowns, many migrant workers had reduced incomes or lost their jobs, leading to a decrease in remittance flows to their home countries. However, the pandemic accelerated the shift towards digital money transfer services. Money transfer agencies invested in enhancing their online and mobile platforms to accommodate increased demand for digital transactions as people avoided physical branches. Further, the pandemic introduced volatility in currency exchange rates, which affected the cost and value of cross-border transfers. Customers became more sensitive to exchange rate fluctuations. Thus, these factors overall had a negative impact on money transfer agencies market.

Top Impacting Factors

Growth in Digitalization in Financial Sector

The adoption of digital technologies and mobile devices has made it easier for people to send and receive money electronically. Money transfer agencies that offer user-friendly mobile apps and online platforms tend to experience significant growth. In addition, money transfer agencies are increasingly embracing digital channels. Mobile apps and online platforms have become primary channels for customers to initiate transactions, leading to a more convenient and user-friendly experience. Further, the rise of fintech companies has disrupted the traditional money transfer industry. Fintech firms often offer lower fees and faster transactions, forcing traditional agencies to innovate and compete, ultimately driving growth. Furthermore, the increasing alliances and partnerships with the regional agencies and banks are driving the market. For instance, in October 2023, National Bank of Oman partnered with Federal Bank of India, a prominent player in cross-border remittance and non-resident Indian banking services, to simplify money transfer. Through this strategic partnership, Federal Bank will contribute its expertise to collaborate with NBO in introducing a revolutionary money transfer service from Oman to India. Thus, the growing digitalization in financial sector is driving the money transfer agencies market.

Integration of Blockchain and Cryptocurrency

Some money transfer agencies are exploring blockchain technology and cryptocurrencies like Bitcoin for cross-border transactions. These technologies offer the potential for faster and cheaper transfers, though regulatory hurdles remain. Further, money transfer agencies are exploring the use of blockchain technology to enhance the security, transparency, and efficiency of cross-border transactions. Blockchain's decentralized ledger can reduce fraud, improve tracking, and streamline settlement processes. Furthermore, stablecoins, which are cryptocurrencies controlled to the value of a stable asset like a fiat currency, are gaining traction for cross-border remittances. They offer the advantages of cryptocurrencies, such as speed and lower fees, while minimizing price volatility. Thus, the integration of cryptocurrencies and blockchain is propelling the growth of money transfer agencies market.

Increase in Demand for Cross-border Transactions

Customers are demanding faster cross-border transactions. Money transfer agencies are working to provide real-time or near-real-time settlement of funds to meet these expectations. Further, integration with mobile wallets and digital payment platforms is becoming more common. This allows recipients to receive funds directly into their digital wallets, increasing convenience. Furthermore, some agencies are offering multicurrency accounts to customers, allowing them to hold and manage funds in different currencies, simplifying international transactions. Moreover, the growth of cross-border e-commerce is driving demand for efficient cross-border payment solutions. Money transfer agencies are adapting their services to meet the needs of online shoppers. Thus, the increasing demand for cross-border transactions is fueling the growth of money transfer agencies market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the money transfer agencies market analysis from 2022 to 2032 to identify the prevailing money transfer agencies market share.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the money transfer agencies market size segmentation assists to determine the prevailing merchant banking services market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global money transfer agencies market trends, key players, market segments, application areas, and market growth strategies.

Money Transfer Agencies Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 65.9 billion |

| Growth Rate | CAGR of 16.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Service Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Remitly Global, Inc, XE.com Inc., The Western Union, Xoom Corporation (Paypal), MoneyGram., Ria Financial Services., Skrill (Paysafe Holdings UK Limited), Small World Financial Services Group Limited, WorldRemit, Wise Payments Limited |

Analyst Review

The money transfer agencies market is witnessing dynamic trends that are reshaping the landscape of cross-border transactions and remittances. Further, digital transformation stands out as a central theme, with agencies increasingly adopting user-friendly online platforms and mobile apps to meet the growing demand for convenience and speed in financial transactions. This shift is accompanied by the rise of fintech disruptors, which are challenging traditional agencies with competitive fees and innovative solutions. Furthermore, regulatory changes are another pivotal trend, as governments worldwide focus on strengthening compliance measures to combat financial crimes, while agencies strive for seamless global operations. In addition, the integration of blockchain technology and cryptocurrencies is gaining momentum, promising enhanced security, transparency, and efficiency in cross-border transfers. Moreover, collaborative partnerships between money transfer agencies and a diverse array of financial institutions, such as banks and digital wallets, are expanding their reach and accessibility. Ultimately, these trends reflect an industry adapting to the evolving needs and preferences of a globalized world, where the efficient and secure movement of money is more crucial than ever.

The key market players are adopting strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in March 2023, Western Union partnered with MoMo, the alliance enabling customers to receive Western Union money transfers on the MoMo app. Collecting funds can be completed in just a few easy steps. Customers can search for ‘Western Union’ on the MoMo App and input their money transfer control number (MTCN). Once complete, they will be able to route their transfers to the MoMo app, and then into their bank accounts held with any of MoMo’s 50 partner banks.

Moreover, some of the key players profiled in the report are Ria Financial Services, Skrill, MoneyGram, SMALL WORLD FINANCIAL SERVICES, Remitly, Inc., Xoom Corporation (Paypal), Wise Payments Limited, WorldRemit, The Western Union, and XE.com Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The money transfer agencies market is estimated to grow at a CAGR of 16.2% from 2023 to 2032.

The money transfer agencies market is projected to reach $65.87 billion by 2032.

Growth in digitalization in financial sector, integration of blockchain and cryptocurrency, and increase in demand for cross-border transactions majorly contribute toward the growth of the market.

The key players profiled in the report include money transfer agencies market analysis includes top companies operating in the market such as Ria Financial Services, Skrill, MoneyGram, SMALL WORLD FINANCIAL SERVICES, Remitly, Inc., Xoom Corporation (Paypal), Wise Payments Limited, WorldRemit, The Western Union, and XE.com Inc.

The key growth strategies of money transfer agencies players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...