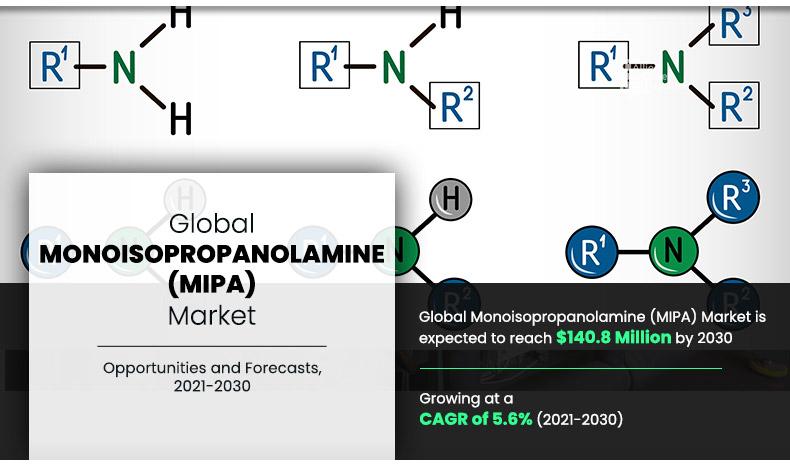

Monoisopropanolamine (MIPA) Market Statistics – 2030

The global monoisopropanolamine (MIPA) market was valued at $82.2 million in 2020, and is projected to reach $140.8 million by 2030, growing at a CAGR of 5.6% from 2021 to 2030. Monoisopropanolamine (MIPA also known as isopropanolamine is an organic compound that is used as an acidic herbicide neutralizer, pH regulator, and reactive agent.

Use of monoisopropanolamine for neutralizing fatty acid chemical compounds and sulfonic acid-based surfactants is the key market trend. In addition, MIPA based chemical compounds improve color & heat stability and improve oil solubility as compared with ethanolamine. This in turn has surged the use of MIPA in chemical industry for production of buffer and alkaline chemicals. Other use of MIPA includes production of reactive & processing agents, corrosion inhibitors, pH regulators, and pigment dispersants. All these factors are driving its demand in the global market. In addition, use of monoisopropanolamine for formulation of cosmetic products, shaving creams, and mascara is the key market trend. Baby shampoo products and bubble bathing products are another example that uses MIPA during their formulation. MIPA is also used during production of hair color products, hair bleaching products, and other skin care products, which is driving the adoption of MIPA in personal care industry. All these factors collectively surge the demand for monoisopropanolamine (MIPA), thereby augmenting the global market growth.

However, monoisopropanolamine (MIPA) if exposed beyond the maximum concentration levels may cause irritation and burn in eyes and skin. Moreover, breathing monoisopropanolamine can irritate the nose and throat causing coughing and wheezing. Furthermore, its open discharge may cause severe skin and eye irritation in rabbits, whilst nasal and lung irritation in other animals. In addition to this, several cases of dermatitis have been registered among the workforce dealing with monoisopropanolamine. These factors restrain the demand for monoisopropanolamine among various end-use industries. Also, several environmental agencies such as the U.S. Environmental Protection Agency (U.S. EPA), Central Pollution Control Board (CPCB), European Union (EU), and others, have laid down acts and regulations for handling and use of monoisopropanolamine, which is expected to hamper the market growth during the forecast period.

On the contrary, the increasing R&D activities have surged the potential applications of monoisopropanolamine in several end-use sectors. For instance, chemical industry has started using monoisopropanolamine for solubilizing & neutralizing fatty acids and sulfonic acid-based surfactants. Moreover, it is widely used as an emulsifier in producing weather resistant coatings. Also, it is widely adopted as corrosion inhibitor in various industries such as metals & metallurgy, oil & gas, chemical manufacturing, and others. In addition to this, it is used as emulsifiers, dispersants, and wetting agents in a wide array of applications, including gas purification, cement and concrete processing aids, cosmetic formulations, metalworking fluids, and others. Furthermore, monoisopropanolamine has given excellent results in synthesis of various drugs at very low cost. These factors are anticipated to increase the sales of monoisopropanolamine in several end-use sectors; thus, creating lucrative opportunities for the market.

The monoisopropanolamine (MIPA) market is segmented on the basis of end-use industry and region. By end-use industry, the global monoisopropanolamine market is divided into chemical industry, personal care, agrochemical, pharmaceuticals, metalworking, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Monoisopropanolamine (MIPA) market, by region

The Asia-Pacific monoisopropanolamine market accounted for 54.4% of the market share in 2020, and is projected to grow at the highest CAGR of 6.3% during the forecast period. Rise in agriculture, metal working, personal care, and chemical manufacturing sectors have enhanced the performance of monoisopropanolamine in the Asia-Pacific region. China's metalworking sector is increasing rapidly, which has forced the manufacturers to produce high-quality monoisopropanolamine in the region. Moreover, the personal care & cosmetics industry in India has witnessed a rapid surge in demand, where monoisopropanolamine is widely used in manufacturing various cosmetic products. For instance, according to a report published by India Brands Equity Foundation, India’s beauty, cosmetic and grooming market is projected to reach $20 billion by 2025.

By Region

Asia-Pacific would exhibit highest CAGR of 6.3% during 2021-2030.

Monoisopropanolamine (MIPA) market, by end-use industry

In 2020, the chemical end-use industry was the largest revenue generator, and is anticipated to grow at a CAGR of 5.7% during the forecast period. MIPA based chemical compounds improve color & heat stability and improve oil solubility as compared to ethanolamine. This in turn has surged the use of MIPA in chemical industry for production of buffer and alkaline chemicals. Other uses of MIPA include production of reactive & processing agents, corrosion inhibitors, pH regulators, and pigment dispersants. All these factors are driving the demand of the global market. MIPA is also used in production of LCD and paint strippers, reaction intermediate products, and waterborne coatings is a considerable factor that is expected to offer new growth opportunities during the forecast period.

By End-use Industry

Personal care end-use industry is the most lucrative segment

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current market trends and future estimations of global monoisopropanolamine (MIPA) market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Monoisopropanolamine (Mipa) Market

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe. The monoisopropanolamine (MIPA) market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on chemical manufacturing, metalworking, cosmetics, and other end-use sectors. For instance, according to a report published by the American Chemistry Council (ACC), the U.S. chemical output fell by 3.6% in 2020 after a 0.1% dip in 2019. Furthermore, to control the surge of novel coronavirus cases, there is a drastic shift of investments from other sectors toward healthcare.

- Also, several monoisopropanolamine manufacturing companies have either shut down or shrank their operations, due to the risk of infection among the workforce. This has temporarily hampered the production rate of the monoisopropanolamine (MIPA) market.

- In addition, the falling income of customers has led contraction in the demand for cosmetic products where monoisopropanolamine is widely used as an intermediate in producing various cosmetics & beauty care products. Furthermore, the industry has faced various problems related to transportation, the non-availability of a skilled workforce, and reduced export/import orders amid the COVID-19 period. This has led the monoisopropanolamine (MIPA) market to witness a downfall in demand.

- However, the emerging applications of monoisopropanolamine for synthesis of various drugs in the pharmaceutical sector may lead the monoisopropanolamine (MIPA) market to recover post COVID-19 scenario. For instance, according to an article published by the Business Standard, the second wave of COVID has pushed the growth of the Indian pharmaceutical industry to 59% in April 2020.

- Furthermore, increasing applications of monoisopropanolamine in agrochemical sector for manufacturing various herbicides may lead the monoisopropanolamine (MIPA) market to witness a significant growth in demand. For instance, according to an economic survey conducted by the Indian Ministry of Finance, the agriculture and allied activities in India clocked a growth of 3.4% during 2020-21. In addition to this, as the restrictions imposed due to lockdowns are being lifted, the monoisopropanolamine manufacturing sector is expected to recover soon, owing to an increase in demand for personal care & cosmetics, agrochemicals, and chemical intermediates in both developed and developing economies.

Monoisopropanolamine (MIPA) Market Report Highlights

| Aspects | Details |

| By END-USE INDUSTRY |

|

| By Region |

|

| Key Market Players | LANXESS, ZHEJIANG XINHUA CHEMICAL CO., LTD, ALKYL AMINES CHEMICALS LIMITED, ARKEMA S.A., ANHUI SINOTECH INDUSTRIAL CO., LTD., LTD., ORION CHEM PVT. LTD., BASF SE, MUBY CHEMICALS, HANGZHOU LINGRUI CHEMICAL CO., LTD, THE DOW CHEMICAL COMPANY, SASOL, EASTMAN CHEMICAL COMPANY, OQ SAOC, ACETO, HONGBAOLI GROUP CO., LTD |

Analyst Review

The global monoisopropanolamine (MIPA) market is expected to exhibit high growth potential owing to its use in pharmaceuticals, agrochemical, and metal working end-use industries. MIPA is a strong neutralizing agent and an active agent that finds it application in crop protection products such as herbicides is the key market trend. Emergence of drug-resistant pathogenic bacteria has increased the risk of bacterial diseases in crops. This in turn has pushed the demand for development of antibiotic surrogates that are used to stop the spread of bacterial infection in cultivated crops. Racemic and chiral carbazole derivatives are recent developments in the agrochemical sector that contains MIPA and are used to stop the spread and growth of drug-resistant pathogenic bacteria. This in turn is anticipated to boost the demand for the global market.

Metal working industry is another consumer of MIPA that is used to minimize friction during buffing of metal pieces, cutting of metal products, and production of metal cleaning fluids. In addition, MIPA improves lubricity, foam suppression, control pH, and reduces friction in metal working fluids. All these factors collectively drive the growth of the global market and are thereby predicted to offer new opportunities during the forecast period.

Increase in demand from agricultural sector and growing use of monoisopropanolamine in personal care & cosmetic end-use industry are the key factors boosting the MIPA market growth.

The global monoisopropanolamine (MIPA) market was valued at $82.2 million in 2020, and is projected to reach $140.8 million by 2030, growing at a CAGR of 5.6% from 2021 to 2030.

Alkyl Amines Chemicals Limited, Arkema S.A., BASF SE, Eastman Chemical Company, Lanxess, Sasol, and The Dow Chemical Company are the most established players of the global MIPA market.

Chemical industry is projected to increase the demand for MIPA.

The monoisopropanolamine (MIPA) market analysis is done on the basis of end-use industry and region. On the basis of end-use industry, it is fragmented into chemical industry, personal care, agrochemical, pharmaceuticals, metal working, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The growth of the global monoisopropanolamine (MIPA) market is due to its use in coatings, pesticides & fungicides, waterborne coating, and metalworking fluids. Monoisopropanolamine (MIPA) is used as a key intermediate for the production of various agrochemicals such as bentazone, glyphosate, atrazine, and other triazine-based herbicides that are further used to manipulate or control undesirable vegetation in farms. The growing population has surged the demand for crops, which in turn has generated better momentum for agricultural sector.

Emulsifying agent, stabilizer, chemical intermediate, and a neutralizer in personal care, agrochemical, and pharmaceutical applications are expected to drive the adoption of MIPA market.

The monoisopropanolamine (MIPA) market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on chemical manufacturing, metalworking, cosmetics, and other end-use sectors.

Loading Table Of Content...