More Electric Aircraft Market Research, 2033

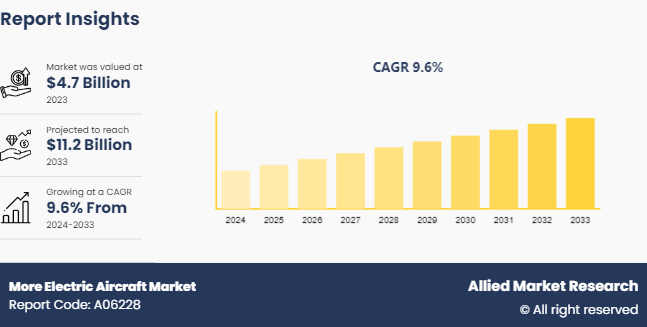

The global more electric aircraft market size was valued at $4.7 billion in 2023, and is projected to reach $11.2 billion by 2033, growing at a CAGR of 9.6% from 2024 to 2033.

Market Introduction and Definition

More electric aircraft uses electrical power to manage non-engine systems on airplanes. Using electrical systems for braking, surface control, and propulsion can significantly increase aircraft performance. The market has expanded rapidly due to the use of hover systems and technological advances in aircraft power production and conversion systems. In addition, potential clients from various backgrounds are eagerly awaiting the upgrade of their fleets to innovative electrical systems.

These methods improve dispatch dependability while lowering airplane maintenance expenses. The use of electrical components in aircraft systems has led to a strong demand for electric aircraft.

The future of modern aviation depends on electrical power. These trustworthy systems will drive market expansion during the forecast period. However, these systems are costly and need significant investments for installation, operation, and maintenance.

Key Takeaways

The more electric aircraft market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major more electric aircraft industry participants along with authentic industry journals, trade associations releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Developments

In March 2024, Airbus unveiled its full electric CityAirbus NextGen prototype at the inauguration of the new CityAirbus test center in Donauwörth, Germany. The new facility is designed to test systems for eVTOLs and is part of Airbus’ ongoing and long-term investment in Advanced Air Mobility (AAM) .

In July 2023, Boeing and its subsidiary Aurora Flight Sciences partnered with GE Aerospace to support the flight tests using a modified Saab 340B aircraft as part of NASA’s Electrified Powertrain Flight Demonstration (EPFD) project.

In September 2023, Safran and Cuberg partnered to develop battery systems for advanced electric aviation. Future generations of aircraft will benefit from a high-performance propulsive energy storage system developed by Safran Electrical & Power and Cuberg using their complementary technologies and skills.

Key Market Dynamics

The growing focus on aircraft electrification fuels the expansion of the electric aircraft industry. Airlines and businesses are expanding their investments in electrification technology to cut carbon emissions and improve sustainability. Electrification enables the replacement of heavy, fuel-dependent equipment with lighter, more energy-efficient electric components. As the aviation industry prioritises sustainability, the adoption of more electric aircraft powered by modern electrical systems becomes critical to accomplishing these objectives, hence driving market development and innovation.

These aircraft utilize modern electrical components and technologies for flight control, landing gear functioning, environmental management, and more. The transition to electric systems aims to increase aircraft efficiency, save maintenance costs, and improve environmental sustainability by reducing reliance on fossil fuels and optimising power management.

Innovation in the Global More Electric Aircraft Market

Technological advancements in the global more electric aircraft industry signifies a fundamental shift in the aircraft sector, favouring electrical systems over old hydraulic and pneumatic systems. This shift is driven by the need to enhance fuel efficiency, reduce emissions, and minimise operating costs. Advancements in electric propulsion systems, which replace traditional jet engines with electric motors, have resulted in considerable reductions in fuel consumption and pollution. The development of high-capacity, lightweight batteries and energy storage technologies is crucial to extending flight times and improving reliability. Power electronics have also advanced significantly, improving the efficiency and control of electrical systems.

According to Roland Berger, advanced air mobility is expected to grow at the highest rate in the coming few years, and urban air taxis are expected to dominate the full-electric advanced air mobility market. NASA hosted an advanced air mobility national campaign promoting confidence in the public and expediting the urban, suburban, rural, and regional advanced air mobility by 2022.

Market Segmentation

The more electric aircraft market is segmented into aircraft type, platform, system, and region. On the basis of aircraft type, the market is divided into fixed wing and rotary wing. On the basis of platform, the market is segregated into commercial aircraft and military aircraft. On the basis of system, the market is classified into aircraft configuration & management system, flight control & mission management system, air pressurization & conditioning system, and power generation & management system. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America led the more electric aircraft market size in 2023 and is expected to further grow at a considerable CAGR due to the presence of significant industry players in the region. Furthermore, significant technical improvements in the region are projected to fuel market expansion. Asia-Pacific held a significant more electric aircraft market share in 2023 and is expected to develop at the fastest CAGR due to the region's growing aerospace industry during the projected period. The launch of numerous new companies into the regional market, as well as government efforts, drive market growth in 2023, and it is expected to rise exponentially during the forecast period.

For example, in June 2023, General Electric's aerospace division announced that it had signed an agreement with India's state-owned Hindustan Aeronautics to jointly manufacture engines in India to power fighter planes for the Indian Air Force. Europe accounted for a significant market share in 2022. The region's substantial market share is due to rising purchasing power among nations and emerging key players. The region's rising war conditions fuel more electric aircraft market growth because they increase government defence and equipment procurement.

Competitive Landscape

The major players operating in the more electric aircraft market include Honeywell International Inc., RTX Corporation, Safran, General Electric Company, Eaton Corporation plc, Moog Inc., Parker-Hannifin Corporation, Lockheed Martin Corporation, Thales Group, and United Technologies Corporation.

Key Players

The more electric aircraft market involves several major players crucial to different stages of the value chain. Companies such as Airbus S.A.S., Honeywell International Inc., and RTX Corporation are notable for their contributions to design, manufacturing, and distribution. The market is influenced by technological advancements, the demand for energy-efficient solutions, and the adoption of automation in manufacturing processes.

With an increased emphasis on environmentally friendly aircraft, numerous laws on aviation emissions have been established. Manufacturers are transitioning towards more electric aircraft as emissions standards become more stringent. The market for electric aircraft is increasing as original equipment manufacturers (OEMs) recognise the architecture's potential benefits, including as higher fuel efficiency, lower maintenance costs, and increased reliability through the use of current power electronics.

Industry Trends:

In 2022, the U.S. Air Force is funding the development of an electric fighter aircraft. Similarly, the U.S. Department of Energy awarded $253 million to support the development of more electric aircraft technologies.

In 2020, according to the UNWTO, tourism contributes 10% of the world's GDP, making it one of the main sources of income in the modern world, with 57% of cross-border travelers using aircraft. In the last 15 years, the number of passengers in commercial aviation has doubled.

In 2022, the Indian aviation ministry approved the construction of 21 greenfield airports in the country. New airlines in the region have helped to boost the growth of the market.

According to an International Air Transport Association (IATA) report, global passenger demand reached 85.5% of 2019 levels over the course of 2023.

Key Sources Referred

India Brand Equity Foundation

National Ocean Industries Association

Occupational Safety and Health Administration

ANSI Organisation

U.S. Department of Transportation

National Aeronautics and Space Administration

International Transport Forum

Maryland Department of Natural Resources

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the more electric aircraft market analysis from 2023 to 2033 to identify the prevailing more electric aircraft market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the more electric aircraft segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global more electric aircraft market forecast statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global more electric aircraft market trends, key players, market segments, application areas, and market growth strategies.

More Electric Aircraft Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 11.2 Billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 324 |

| By Aircraft Type |

|

| By Platforn |

|

| By System |

|

| By Region |

|

| Key Market Players | General Electric Company, Honeywell International Inc.,, Parker-Hannifin Corporation, RTX Corporation, Safran, United Technologies Corporation, Moog Inc., Lockheed Martin Corporation, Thales Group, Eaton Corporation plc |

The more electric aircraft market was valued at $4.7 Billion in 2023.

The upcoming trends of More Electric Aircraft Market include growing focus on aircraft electrification, which fuels the expansion of the electric aircraft industry.

North America is the largest regional market for more electric aircraft market.

The commercial aircraft is the leading platform of more electric aircraft market.

Parker-Hannifin Corporation, Lockheed Martin Corporation, Safran, General Electric Company, Eaton Corporation plc are one of the top companies to hold the market share in More Electric Aircraft.

Loading Table Of Content...