Motor Soft Starter Market Research, 2032

The global motor soft starter market was valued at $2.4 billion in 2022, and is projected to reach $4.5 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

Motor soft starters have become integral components within various industries, particularly in optimizing motor control and ensuring efficient operations. These systems facilitate the controlled startup of electric motors, reducing inrush currents and mechanical stress while enabling smooth acceleration. Their adaptability and scalability make them indispensable technologies in diverse industrial applications, catering to different sectors and operational requirements, whether in manufacturing, utilities, or oil and gas.

Motor soft starters have become integral components within various industries, particularly in optimizing motor control and ensuring efficient operations. These systems facilitate the controlled startup of electric motors, reducing inrush currents and mechanical stress while enabling smooth acceleration. Their adaptability and scalability make them indispensable technologies in diverse industrial applications, catering to different sectors and operational requirements, whether in manufacturing, utilities, or oil and gas.

An inherent advantage of motor soft starters lies in their ability to enhance operational efficiency. They effectively manage the startup of electric motors across varying load conditions, adapting to different voltage levels and diverse machinery requirements. This adaptability, spanning from standard industrial equipment to more complex machinery, showcases their versatility and utility across industries, optimizing energy consumption and equipment lifespan.

Moreover, motor soft starters play a crucial role in ensuring a consistent and stable operation of electric motors. By mitigating inrush currents and providing controlled acceleration, these starters contribute to a steady and uninterrupted workflow. Their rapid response to changing operational conditions within machinery aids in maintaining a reliable and smooth motor operation, a vital aspect of ensuring operational stability across industrial sectors.

The growth of the motor soft starter market is influenced by several factors. The increasing emphasis on energy efficiency across industries, coupled with the drive toward industrial automation, has propelled the demand for these systems. Especially in sectors where precision control and reduced mechanical stress are critical, such as manufacturing and oil and gas, soft starters are indispensable, optimizing operations and ensuring equipment longevity.

Furthermore, these systems offer a scalable and adaptable solution for diverse industrial needs. Whether in small-scale production units or large industrial complexes, motor soft starters are configured to meet specific requirements, catering to a wide range of applications. Their adaptability and efficiency address the varied needs of different industries, making them a sought-after technology for improving motor control and operational efficiency.

However, challenges persist in the adoption of motor soft starters, particularly concerning awareness and expertise. Limited understanding of their benefits and operational nuances might hinder their widespread adoption in certain industries. In addition, ensuring proper maintenance and operation requires technical expertise, posing a challenge in regions with limited access to skilled personnel.

Addressing these challenges involves enhancing awareness through education and training programs, emphasizing the efficiency and benefits of soft starters in optimizing motor operations. Moreover, investing in skill development and technical training will be pivotal in ensuring the effective and sustainable operation of these systems, promoting their wider adoption across industries.

Despite these challenges, the motor soft starter market holds significant growth potential. Their efficiency, adaptability, and role in optimizing motor operations make them indispensable solutions across diverse industrial sectors. As industries evolve toward more efficient and sustainable practices, the development and innovation of motor soft starters will play a crucial role in meeting these evolving needs and ensuring streamlined motor control operations.

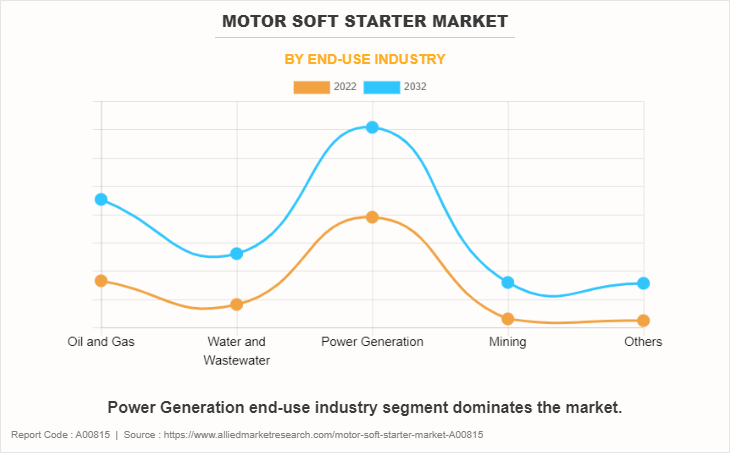

The motor soft starter market scope is segmented on the basis of voltage, power rating, application, end-use industry, and region. By voltage, the market is divided into low voltage, and medium voltage. By power rating, the market is segregated into up to 100 KW, and above 100 KW. On the basis of application, it is segregated into pumps, fans, and compressors. On the basis of end-use industry, it is bifurcated into oil and gas, water and wastewater, power generation, mining, and others. Region-wise, the motor soft starter market trends are analyzed across North America, Europe, Asia-Pacific, and LAMEA.

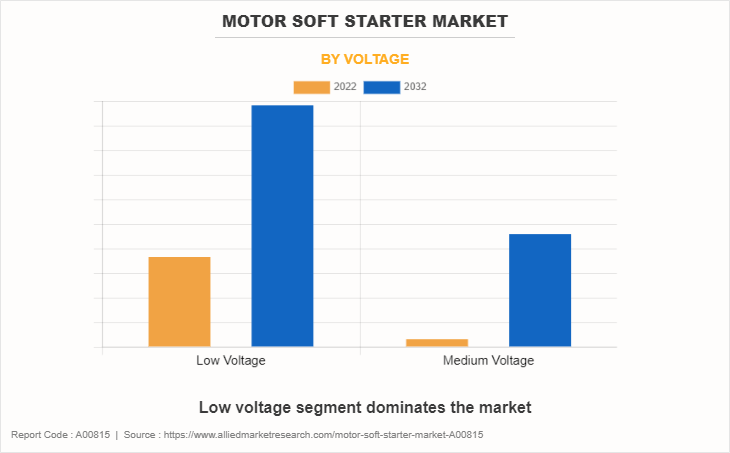

Based on voltage, the low voltage segment held the highest market share in 2022, accounting for nearly two-thirds of the global motor soft starter market share, and is estimated to maintain its leadership status throughout the motor soft starter market forecast. Energy efficiency remains a pivotal focus, with soft starters reducing power surges during motor start-up, aligning perfectly with the escalating emphasis on sustainable practices. Integration with Industry 4.0 through IoT technologies is reshaping operational efficiency, enabling remote monitoring, predictive maintenance, and enhanced control.

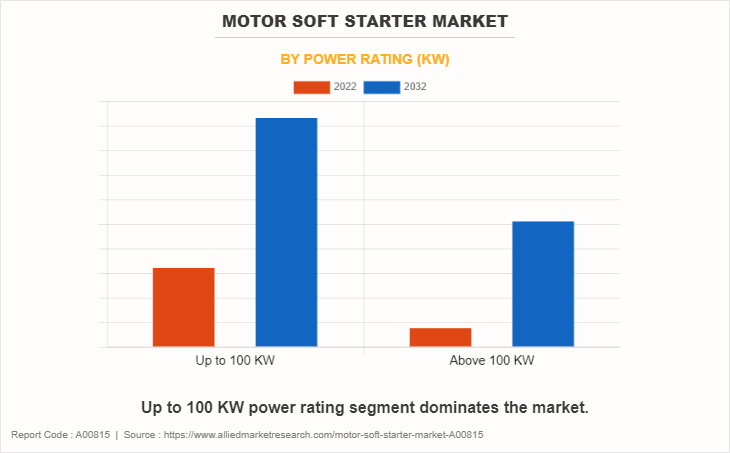

Based on power rating, up to 100 KW segment held the highest market share in 2022, accounting for more than three-fifths of the global soft starter market revenue, and is estimated to maintain its leadership status throughout the forecast period. The market for motor soft starters above 100KW power ratings is driven by automation, stringent energy efficiency regulations, technological advancements, heavy industries like mining and steel, the renewable energy sector, smart systems like IoT, and large motor involvement in global infrastructure projects.

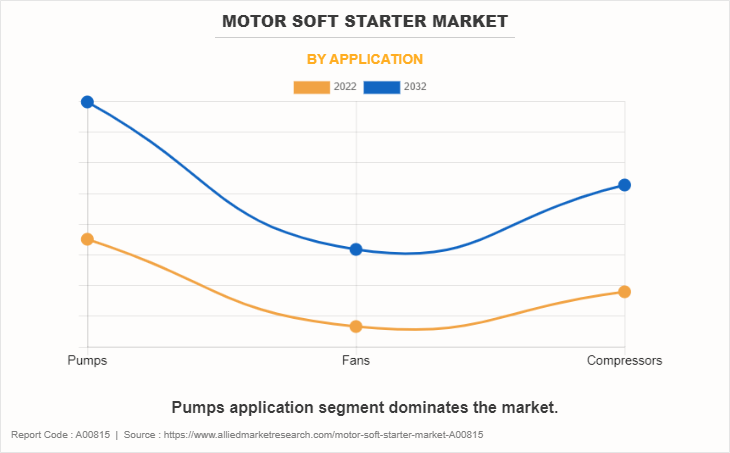

Based on the application, the pumps segment held the highest market share in 2022, accounting for nearly half of the global motor soft starter market revenue, and is estimated to maintain its leadership status throughout the forecast period. The market for motor soft starters in fan applications is thriving due to energy efficiency, regulatory changes, and technological advancements. With industrial automation, the need for sophisticated motor control solutions is increasing. Soft starters offer cost savings, extended motor lifespan, and environmental concerns. Opportunities lie in HVAC sectors, and retrofitting existing systems is gaining traction.

Based on the end-use industry, power generation held the highest market share in 2022, accounting for more than two-fifths of the global motor soft starter market revenue, and are estimated to maintain their leadership status throughout the forecast period. The oil and gas industry is shifting towards efficiency, technological innovation, and compliance in motor soft starters. These starters reduce power consumption and offer enhanced control, monitoring, and diagnostic capabilities. The integration of IoT enables remote monitoring and operational optimization.

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global motor soft starter market revenue, and is likely to dominate the market during the forecast period. However, the Asia-Pacific region is expected to witness the fastest CAGR growth from 2023 to 2032.

Regional Developments In Motor Soft Starters Market:

In North America, the motor soft starter market is integral to various industrial sectors, particularly in the U.S., where stringent energy efficiency regulations drive the adoption of advanced motor control solutions. These starters find extensive use in manufacturing, utilities, and infrastructure projects, aiding in optimizing energy consumption and reducing mechanical stress on motors, aligning with the region's focus on efficient industrial operations.

Within Europe, motor soft starters contribute significantly to automation and energy efficiency initiatives. European countries emphasize sustainability and energy conservation, leading to widespread adoption of soft starters in manufacturing plants, renewable energy projects, and infrastructure developments. The region's commitment to reducing carbon emissions further boosts the market for these energy-efficient solutions.

In the Asia Pacific, diverse industrial landscapes and growing automation drive the demand for motor soft starters. Nations such as China and India, with increase in manufacturing sectors and infrastructure projects, rely on these starters to ensure controlled motor acceleration, addressing the region's need for efficient energy utilization while supporting rapid industrialization.

Latin American countries recognize the significance of motor soft starters in optimizing industrial processes. In Brazil and Mexico, where industrial sectors flourish, these starters are crucial for efficient motor control, aligning with the region's focus on enhancing productivity while minimizing energy wastage, contributing to sustainable industrial growth.

In Africa, motor soft starters are instrumental in supporting industrialization and infrastructure development. These solutions play a vital role in sectors such as mining, agriculture, and utilities, aiding in equipment protection and energy efficiency. In regions with limited grid infrastructure, soft starters enable reliable motor control, essential for the region's industrial progress.

Throughout this period, the market has seen consistent growth owing to the indispensable role of soft starters in optimizing motor operations, reducing energy wastage, and ensuring the longevity of equipment. The market's evolution has been closely tied to technological advancements, regulatory changes promoting energy efficiency, and a growing understanding of the benefits offered by soft starters across industries.

Historical Development:

The motor soft starters market has witnessed steady growth since 2015, driven by various factors such as increasing industrial automation, emphasis on energy efficiency, and technological advancements in motor control systems. While specific market data might vary depending on regions and sectors, The below mentioned is an overview of the historical growth development of the motor soft starters market from 2015:

2015-2017:

- Steady Growth: The market for motor soft starters saw consistent growth during this period. Industries increasingly recognized the benefits of using soft starters in optimizing motor control, reducing inrush currents, and extending equipment lifespan.

- Rising Industrial Automation: Growing automation in manufacturing, oil and gas, and other sectors propelled the demand for efficient motor control solutions, contributing to market expansion.

- Technological Advancements: Ongoing improvements in soft starter technology, including better control algorithms and enhanced communication interfaces, attracted industries looking for more advanced and reliable solutions.

2018-2020:

- Acceleration in Demand: The market experienced accelerated growth as industries intensified their focus on energy efficiency and operational optimization.

- Regulatory Emphasis on Efficiency: Stringent energy efficiency regulations globally spurred the adoption of motor soft starters as a means to comply with these standards and reduce energy consumption during motor startups.

- Increased Awareness: Industries became more aware of the benefits of soft starters in protecting equipment, reducing maintenance costs, and optimizing energy usage, contributing to a surge in demand.

2021-2023:

- Continued Growth Trajectory: The motor soft starter market continued on an upward trajectory, driven by the increasing emphasis on sustainable practices, energy efficiency, and motor soft starter industry-specific needs.

- Integration with IoT and Smart Technologies: Innovations in integrating soft starters with IoT devices and smart grid systems emerged, enhancing their capabilities for remote monitoring, predictive maintenance, and improved control.

- Diverse Industry Adoption: Adoption expanded beyond traditional sectors to newer industries, driven by the need for precise motor control, equipment protection, and operational efficiency.

Competitive analysis and profiles of the major motor soft starter market players, such Siemens AG, Schneider Electric, Rockwell Automation, Mitsubishi Electric, Danfoss A/S, Emerson Electric, ABB Ltd., Larsen & Toubro, Eaton, and Toshiba Corporation. are focusing their investment on technologically advanced, cost-effective, and more secure products and solutions for various applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the motor soft starter market analysis from 2022 to 2032 to identify the prevailing motor soft starter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the motor soft starter market size segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global motor soft starter market trends, key players, market segments, application areas, and motor soft starter market growth strategies.

Motor Soft Starter Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.5 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Voltage |

|

| By Power Rating (KW) |

|

| By Application |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Larsen & Toubro, Siemens AG, Emerson Electric, Toshiba Corporation, Mitsubishi Electric, Danfoss A/S, Eaton, ABB Ltd., Schneider Electric, Rockwell Automation |

Analyst Review

The motor soft starter market is currently experiencing a transformative phase, poised for significant growth in the coming years, as per insights gathered from industry leaders and Chief Executive Officers (CXOs). This evolution is primarily driven by the increasing demand for efficient motor control solutions across diverse sectors, including manufacturing, utilities, and oil and gas, necessitating sophisticated soft starter technologies.

Motor soft starters play a crucial role in optimizing motor operations, reducing inrush currents, and ensuring smooth startups across various industries. Their adaptability and versatility make them integral in diverse applications, from industrial manufacturing plants to critical infrastructures such as offshore platforms and utilities.

One of the primary drivers propelling the expansion of the motor soft starter market is the escalating emphasis on energy efficiency and operational optimization. Industries worldwide face stringent energy efficiency regulations, compelling them to adopt technologies that minimize power wastage during motor startups. Soft starters offer a solution to this challenge by reducing energy consumption, aligning with regulatory standards, and contributing to long-term operational efficiency.

Industries, encompassing manufacturing, utilities, and infrastructure, rely on soft starters to streamline motor operations, ensuring equipment protection and process efficiency. As a result, the demand for these solutions remains robust, with industries recognizing their indispensable role in achieving reliable and energy-efficient motor control.

However, the market is not without its challenges. The initial investment required for installing advanced soft starter systems is a notable barrier for potential buyers. Yet, the long-term cost savings and energy efficiency benefits often outweigh the upfront expenditure, promoting their adoption. Moreover, proper operation and maintenance necessitate adequate training and technical support, highlighting the importance of comprehensive customer services to optimize performance and longevity.

The global motor soft starter market presents promising opportunities across various regions, including North America, Europe, Asia-Pacific, and the Middle East. Despite challenges, the industry is poised to address them by advancing soft starter technology and aligning with industry demands for enhanced efficiency and reliability in motor operations. As industries continue to prioritize energy efficiency and automation, the motor soft starter market is anticipated to thrive, driven by innovations in technology and a commitment to meeting evolving industrial needs.

Increased Integration of IoT Technology, Adoption of Advanced Communication Interfaces, Emphasis on Energy-Efficient Designs, Enhanced Control Algorithms, Growth in Remote Monitoring Capabilities are the upcoming trends of motor soft starter market in the world.

North America is the largest regional market for Motor Soft Starter.

Pumps is the leading application of Motor Soft Starter Market.

$4.5 billion is the estimated industry size of Motor Soft Starter market by 2032.

Siemens AG, Schneider Electric, Rockwell Automation, Mitsubishi Electric, and Danfoss A/S are the top companies to hold the market share in Motor Soft Starter

Loading Table Of Content...

Loading Research Methodology...