The global motorized quadricycle market size was valued at $460.1 million in 2021, and is projected to reach $1,156.6 million by 2031, growing at a CAGR of 9.9% from 2022 to 2031.

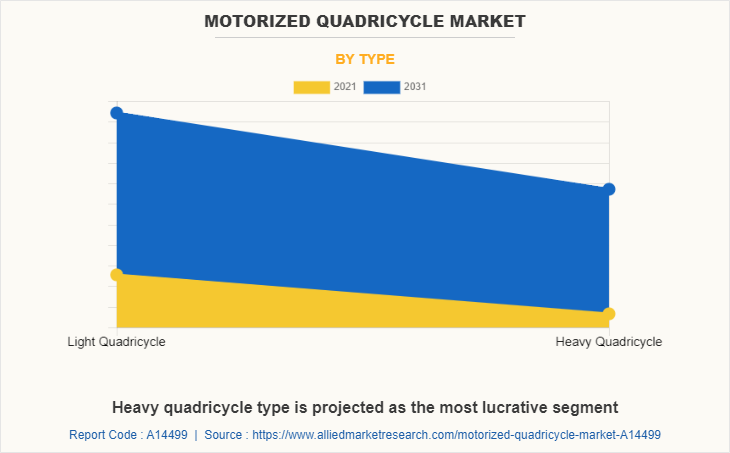

A motorized quadricycle, also known as a microcar, is a four-wheeled motor vehicle that falls into the same category as mopeds which offers a speed range of 45 to 100 kilometers per hour. It is a new category of a mini fuel-efficient vehicle, which is majorly used in urban areas for local transportation amid high traffic congestion in developed cities. Also, these vehicles are light in weight compared to conventional four-wheelers; hence, they emit low carbon in the environment. Motorized quadricycles are divided into the L6e light quadricycle and the L7e heavy quadricycle. Light quadricycles are limited to a speed of 45 kmph, while heavy quadricycles are not speed-limited and may have a speed of up to 100 kmph. However, motorized quadricycles are exempt from the stringent regulations and safety inspections required for passenger cars. They can operate and drive on public highways without a full driving license.

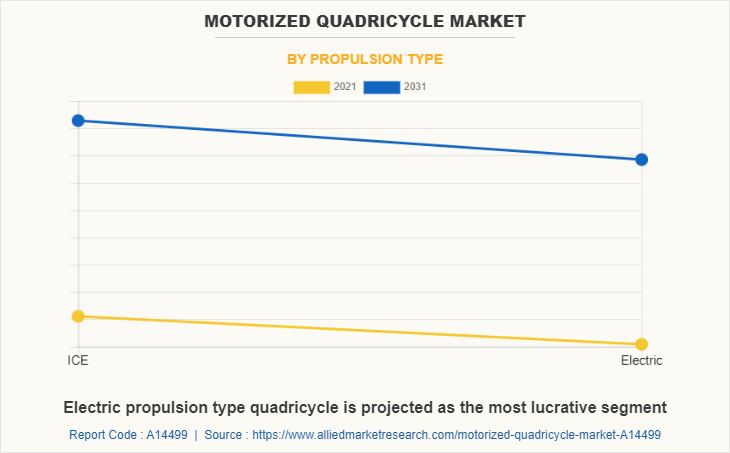

Currently, with the increase in level of vehicular emissions globally, several OEMs are focusing on developing battery-powered lightweight quadricycles that can deliver performance equivalent to conventional ones and increase savings on fuel costs. For instance, in June 2020, Goupil, a pioneer in electrical utility vehicles, launched G6, the new utility vehicle to offer high-quality services in the category of electric utility vehicles under 3.5 tons. This new utility vehicle comes with a comprehensive set of standard equipment: a 3-seater cab, electric windows, heated wing mirrors, regenerative braking, light and rain sensor, 5000W heater. Furthermore, OEMs have heavily invested in R&D to develop fully automated motorized quadricycles.

In addition, these vehicles are anticipated to replace conventional taxis in the near future and are an alternative to two-wheel riders, as they are exposed to extreme weather conditions. For instance, in 2019, Bajaj Auto entered into a strategic tie-up with Uber for introducing its new range of motorized quadricycle ‘Bajaj Qute’. Uber will be including the Bajaj Qute range in its UberXS services, which is a unique step toward rewriting the rules of public transportation and mobility services.

Presently, quadricycles are largely used in European countries owing to the flexible regulations in the region. According to the European Regulation 168/2013/EU, which governs the manufacturing and approval of this, the minimum age to drive a light quadricycle is 14 years with an AM license and for heavy quadricycles, the minimum age is 16 years with an AM license. Thus, the demand for this among elderly and young population is increasing at a significant rate.

The factors such as rise in traffic congestion, increase in demand for lightweight vehicles, and stringent governments rules and regulations supplement the growth of the market. However, lack of passenger safety and low speed of motorized quadricycles are the factors expected to hamper the market growth. In addition, incorporation of cutting-edge technology in motorized quadricycles and rise in popularity & demand for quadricycles among the elderly and young population creates market opportunities for the key players operating in the market.

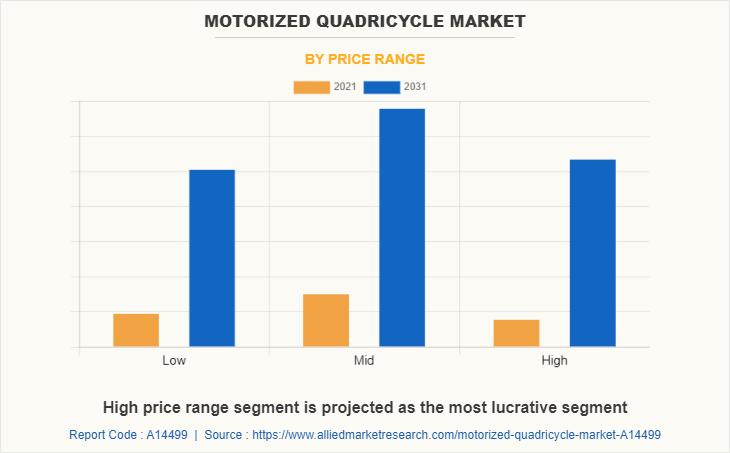

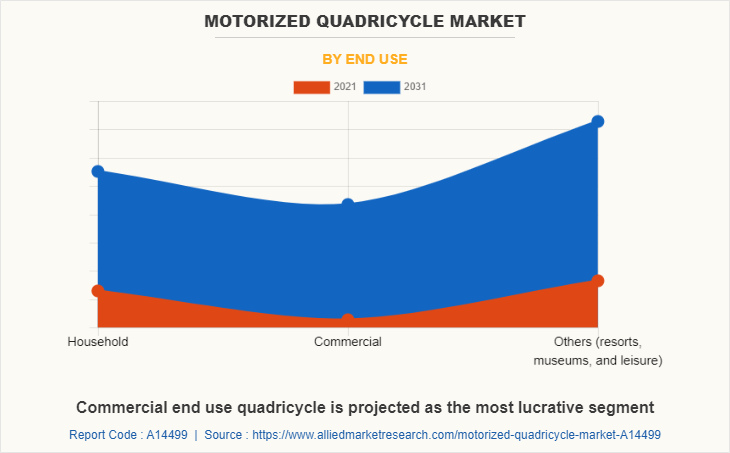

The motorized quadricycle market is segmented on the basis of type, propulsion type, end use, price range, and region. By type, the market is divided into light quadricycle and heavy quadricycle. By propulsion type, it is fragmented into internal combustion engine (ICE) and electric. By end use, it is divided into household, commercial, and others (resorts, museums, and leisure). By price range, it is categorized into low, mid, and high. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the motorized quadricycle market are Alke, Bajaj Auto Ltd., Goupil, Italcar Industrial S.r.l., LIGIER GROUP, Mahindra Electric Mobility Limited, Piaggio & C. SpA, Renault Group, Squad Mobility BV, and Yamaha Golf-Car Company.

Rising traffic congestion

The increasing urbanization indicates the rising complexities in cities across the globe, with traffic congestion, being one of those issues. The elevated sales of vehicles since the consumers’ growing inclination toward cost-efficient and environment-friendly cars will act as a driving factor for the automobile sector. Although, the rapid increase in vehicle sales resulted in traffic congestion and a lack of parking space in developing cities. For instance, major countries in Europe such as France, Spain, Italy, etc. witness heavy traffic congestion and smog formation due to several vehicles present on the road. Increased traffic congestion has also significantly increased commute time, which is a significant concern for end users. This has fueled the demand for compact and small-sized cars. Several governments have adopted initiatives to handle growing traffic congestion. Thus, motorized quadricycles are expected to present themselves as an effective solution in the upcoming years. Also, low cost, reduced stringency of regulations, and tax benefits, especially on electric quadricycles, are likely to drive the growth of the market.

Increasing demand for lightweight vehicles

The automotive industry is racing toward a new world with growing sustainability, changing consumer behavior, encompassing electric vehicles, connected cars, mobility fleet sharing, and improving lifestyles. For instance, according to European Automobile Manufacturers’ Association (ACEA), in June 2021, passenger car registrations in the European Union increased by 10% compared to last year's same month owing to their hybrid nature & increased fuel efficiency. Meanwhile, many manufacturers are focusing on developing lightweight quadricycles that can develop performance and control the fuel emission of the vehicle. The effort to utilize lightweight materials for manufacturing is likely to reduce the weight of the vehicle considerably. As per the European Regulation Act, the weight of these vehicles should not exceed 750 kg. Hence, the majority of the manufacturers are installing lightweight components that have fewer linkages and, in turn, would lead to increased performance and reduced fuel emissions. Furthermore, quadricycles typically weigh less than 550 kg and provide continuous maximum power of less than 15kW. These factors are subsequently responsible for excellent fuel efficiency, which is expected to further drive their adoption amongst the urban population.

Lack of passenger safety

Road accidents are a significant concern worldwide, especially when driving on roads with heavy traffic & terrible weather conditions. According to World Health Organization, nearly 1.25 million people die in road accidents each year. Over the past few years, consumers’ lifestyles have become hectic with unfavourable driving protocols witnessed, such as surfing, messaging, and speaking on the phone while driving, which eventually results in automotive accidents. In recent years, crash tests conducted by Euro NCAP established that motorized quadricycles lacked passenger safety even at a speed of 50 kmph. These tests included frontal and side crash tests, which exposed passengers’ safety in these vehicles. Thus, a lack of awareness of passenger safety in current models will restrain the growth of the market during the forecast period.

Incorporation of cutting-edge technology in motorized quadricycles

Various companies are investing in the R&D of the quadricycles owing to their advantages. Besides, companies are strategically planning to deploy electric quadricycles in the market. For instance, in June 2020, Goupil, a pioneer in electrical utility vehicles, launched G6, the new utility vehicle to offer high-quality services in the category of electric utility vehicles under 3.5 tonnes. This new utility vehicle comes with a comprehensive set of standard equipment: a 3-seater cab, electric windows, heated wing mirrors, regenerative braking, light and rain sensor, 5000W heater. Furthermore, OEMs have heavily invested in R&D to develop fully automated motorized quadricycles. Manufacturers aim to equip technologically advanced features and components that are fuel-efficient, environment-friendly, and increase passengers’ safety. Manufacturers are also equipping micro-cars (quadricycles) with high-end cameras, LiDAR, RADAR, and sensors. These high-end sensors and RADARs can perform even in extreme weather conditions.

In addition, growing vehicle emission concerns and depletion of non-renewable energy resources have attracted the attention of several governments to invest in electric vehicles. European countries are among the frontrunners in adopting electric mobility. Hence, the increasing adoption of EVs around the world is expected to create lucrative opportunities for the global motorized quadricycle industry.

KEY BENEFITS FOR STAKEHOLDERS

- This study presents analytical depiction of the global motorized quadricycle market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall motorized quadricycle market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global motorized quadricycle market with a detailed impact analysis.

- The current motorized quadricycle market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Motorized Quadricycle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1156.6 million |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 272 |

| By Price Range |

|

| By Type |

|

| By Propulsion Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Yamaha Golf-Car Company, Italcar Industrial S.r.l., Goupil, Ligier Group, Renault Group, Squad Mobility BV, Alke, Bajaj Auto Ltd, Piaggio & C. SpA, Mahindra Electric Mobility Limited |

Analyst Review

The rise in demand for cost-effective personal transportation is likely to be the main factor driving the worldwide motorized quadricycle market. It has been witnessed that elderly population accounts for a majority of the demand for motorized quadricycles owing to low cost, light weight and ease of handling of the vehicle. This trend is expected to exist throughout the forecast period.

Furthermore, several regulatory bodies in developed countries are making efforts to promote electromobility and reduce automotive emissions by supporting electric vehicles. This is mandatory because the growing population and rising demand for mobility resulted in the increased traffic congestion in major countries such as France and Germany. Hence, motorized quadricycles, especially the electric variants, can prove to be an excellent solution to this issue. For instance, the German Federal Government’s ‘National Electromobility Development Plan’ aims to reduce the dependency on conventional fuel driven vehicles and emissions by speeding up research & development in battery electric vehicles. The plan aims to make Germany a market leader in the electromobility market by the end of 2020.

Presently, manufacturers are focusing on developing lightweight quadricycles that can develop performance and control the fuel emission of the vehicle. The effort to utilize lightweight materials for manufacturing is likely to reduce the weight of the vehicle considerably. As per the European Regulation Act, the weight of these vehicles should not exceed 750 kg. Hence, most of the manufacturers are installing lightweight components that have fewer linkages and, in turn, would lead to increased performance and reduced fuel emissions.

Meanwhile, these started gaining immense popularity across the European countries as an affordable and electric vehicle for personal mobility needs, and additional benefits in terms of fuel efficiency and maintenance costs were ‘add-ons’ to their increasing popularity. Moreover, key players active in this market are also focusing on strategic tie-ups and collaborations to reap substantial profits from the combined expertise and shared resource pools.

Among the analyzed regions, Europe is the highest revenue contributor, followed by Asia-Pacific, North America, and LAMEA. On the basis of forecast analysis, North America is expected to lead during the forecast period, due to surge in technological innovations in automobile industry and increase in focus by manufacturers in motorized quadricycle industry on superior performance and comfort. Moreover, ride-sharing companies in this region are looking forward to implementing highly autonomous self-driven taxis, which would replace conventional taxis in the near future.

The global motorized quadricycle market is projected to reach $1,156.5 million by 2031, registering a CAGR of 9.9% from 2022 to 2031.

The leading players operating in the motorized quadricycle market are Alke, Bajaj Auto Ltd., Goupil, Italcar Industrial S.r.l., LIGIER GROUP, Mahindra Electric Mobility Limited, Piaggio & C. SpA, Renault Group, Squad Mobility BV, and Yamaha Golf-Car Company.

Europe is the largest regional market for motorized quadricycles owing to the various initiatives taken by the European Union (EU) to encourage the use of environment-friendly and compact vehicles to curb traffic congestion on roads.

Increasing demand for lightweight vehicles and rising traffic congestion are the upcoming trends of motorized quadricycle market in the world.

Based on the type, the light quadricycle (L6e) segment is anticipated to dominate the market over the forecast period as they have a seating capacity of two people, are light in weight, and ensure the safety of passengers by sufficiently protecting occupants from extreme weather conditions.

Loading Table Of Content...