The global multirotor drone market was valued at $1.86 billion in 2021, and is projected to reach $6.30 billion by 2031, growing at a CAGR of 13.1% from 2022 to 2031.

Multirotor drone is a type of unmanned aerial vehicle (UAV) that has more than one motor that powers the propellers to take flight and maneuver the aircraft. Multirotor drones work on the principle of the traditional helicopter and are the most common type of drones for creating maps and models. These drones are of several types such as tricopters (3 rotors), quadcopters (4 rotors), hexacopters (6 rotors), and octocopters (8 rotors). In addition, these drones can navigate small spaces with ease, and a GPS receiver equipped in drones enables them to hover and maintain a defined path using waypoints. Moreover, these drones are a suitable option for long-time aerial operations and hold enhanced capacity to carry lightweight payload such as camera.

The growth of the global multirotor drone market is propelled due to surge in nonmilitary applications and demand for drone operability in extreme conditions. However, limited operational bandwidth of the drones and stringent drone regulations are the factors that are likely to hamper the expansion of the market. Furthermore, technological advancements are expected to offer growth opportunities during the forecast period.

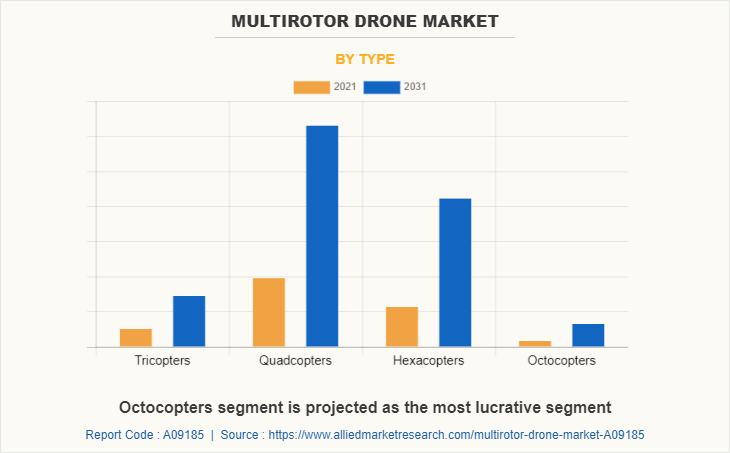

The global multirotor drone market is segmented on the basis of type, payload, application, end use, and region. By type, it is segmented into tricopters, quadcopters, hexacopters, and octocopters. On the basis of payload, it is classified into camera & imaging solutions, control systems, tracking systems, and others.

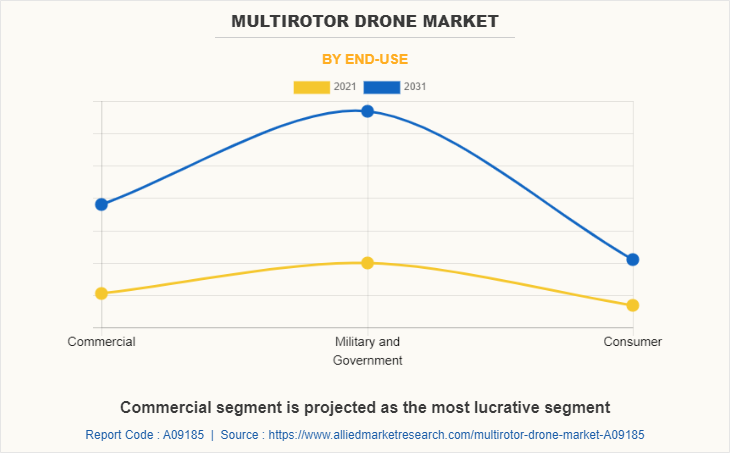

Depending on application, it is fragmented into surveillance, inspection & monitoring, research, aerial photography, and others. As per end use, it is categorized into commercial, defense, and others. Region wise, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the multirotor drone market report comprises Aero Systems West Inc., Aerovironment, Inc., AUAV (Australian UAV Pty Ltd.), Autel Robotics, Centeye, Inc., Cyberhawk Innovations Ltd., DJI Innovations, Draganfly Inc., Embention, IdeaForge Technology Pvt. Ltd., Israel Aerospace Industries (IAI), Microdrones GmbH, Parrot Drone SAS, Tomahawk Robotics Inc., and XAG Co. Ltd.

Surge in non-military applications

In recent years, there has been an increase in the demand for multirotor drones for commercial and business applications. The ability of the multirotor drone to carry heavier and higher capacity of payload make it suitable for different end-uses. Therefore, multirotor drones are used in aerial photography, surveillance and delivery applications, as well as in asset protection, disaster response, and search & rescue operations.

In addition, in agriculture sector, multirotor drones are utilized for proper monitoring of irrigation systems and performance analysis. In construction sector, multirotor drones are utilized for structure and job site inspection, employee monitoring, security, surveying, and 2D & 3D data creation. Similarly, in several others sectors multirotor drones are used to perform different tasks. Thus, such extensive use of multirotor drones in non-military applications is expected to drive the growth of the multirotor drone industry during the forecast period.

Demand for drone operability in extreme conditions

Multirotor drone can perform a variety of tasks in distant or hazardous location. However, multirotor drones are not able to fly in all types of weather. The weather conditions such as precipitation, strong winds, and cold temperatures can affect the performance of multirotor drones. For instance, precipitation can damage the electronics of the multirotor drone. There has been an increase in demand for drones which can operate in extreme conditions owing to such factors. Moreover, few drone manufacturers have already started to develop & introduce new drones which can operate in extreme conditions.

For instance, in 2020, AeroVironment launched a multirotor vertical take-off landing hybrid drone named as Quintex Recon. The drone take advantage of range & speed of multirotor drone with efficiency of a fixed-wing UAV. Quintex Recon has the capacity to withstand wind speeds of 32 kmph and can operate in temperatures ranging between -17 degree Celsius and 49 degree Celsius, with a maximum range of 20 km for 45 minutes over a single battery flight.

The multirotor drone market is segmented into Type, Payload, Application and End-Use.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the multirotor drone market analysis from 2021 to 2031 to identify the prevailing multirotor drone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the multirotor drone market segmentation assists to determine the prevailing market opportunities.

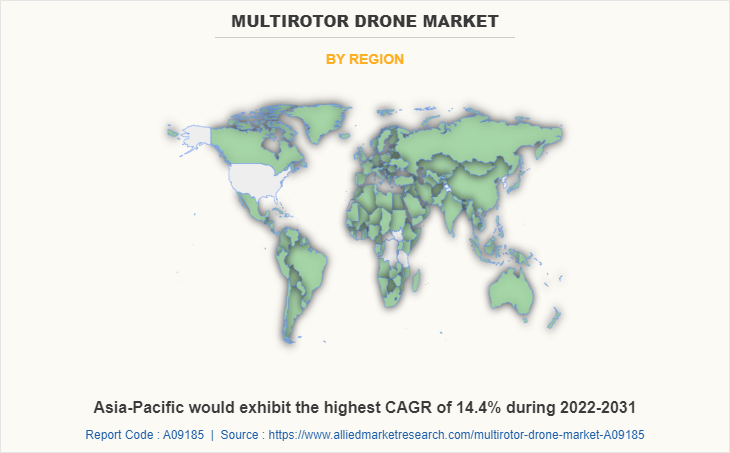

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global multirotor drone market trends, key players, market segments, application areas, and market growth strategies.

Multirotor Drone Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Payload |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | AeroVironment Inc., Tomahawk Robotics, Inc., Parrot Drone SAS, DJI Innovations, Autel Robotics, ideaForge Technology Pvt. Ltd., Draganfly Inc., Embention, Microdrones GmbH, Israel Aerospace Industries, Cyberhawk Innovations Ltd., Australian UAV Pty Ltd, Aero Systems West Inc., XAG Co., Ltd., Centeye, Inc. |

Analyst Review

The global multirotor drone market is expected to witness significant growth owing to enhancement in efficiency and operations offered by multirotor drone systems across a wide range of applications.

Increase in operational efficiency and rise in demand for improved surveillance are expected to drive the multirotor drone market growth during the forecast period. Moreover, advancement in drone technologies and increase in defense expenditure globally are the major factors that are expected to supplement the multirotor drone market. However, strict drone regulations and lack of skilled & trained personnel are factors that are expected to restrain the growth of the multirotor drone market during the forecast period.

To gain a significant market share, major players have adopted different strategies, for instance, partnership, product launch, and product development. Among these, product launch is the leading strategy used by prominent players such as Aero Systems West Inc., Autel Robotics, Centeye, Inc., Cyberhawk Innovations Ltd., and DJI Innovations. Aforementioned companies launched cutting-edge multirotor drone products seeking to grab a fair share of the market.

The global multirotor drone market was valued at $1.86 billion in 2021 and is projected to reach $6.30 billion in 2031.

North America is the largest regional market for multirotor drone.

The leading applications are surveillance, inspection, and monitoring.

Some leading companies in the market include Aero Systems West Inc., Aerovironment, Inc., Cyberhawk Innovations Ltd., DJI Innovations, Draganfly Inc., Israel Aerospace Industries (IAI), Microdrones GmbH, and Parrot Drone SAS among others.

The upcoming trends in the market include greater application in commercial applications and development of autonomous solutions.

Loading Table Of Content...