Multivendor ATM Software Market Statistics, 2026

Multivendor ATM software provides end user one software interface across multiple platforms which simplifies the back-end of their ATM system. Multivendor ATM software enables financial institutions to buy the specific ATM model needed for a certain function at a particular location and to choose hardware from any ATM supplier. The multivendor ATM software market size was valued at $1,139 million in 2018, and is projected to reach $6,234 million by 2026, growing at a CAGR of 23.6% from 2019 to 2026.

The multivendor ATM software provides easy software updates as there is only a single application for all ATMs, instead of different applications for each ATM vendor. Also, banks can add and deploy new features faster to enhance their competitive position and meet new customer requirements. The software provides ATM deployers with significant competitive advantages including complete freedom in the creation of new transaction workflows, an automated end-to-end testing capability, faster time to market, and powerful scripted transaction switching, which enriches transaction workflows and renews legacy infrastructure investments.

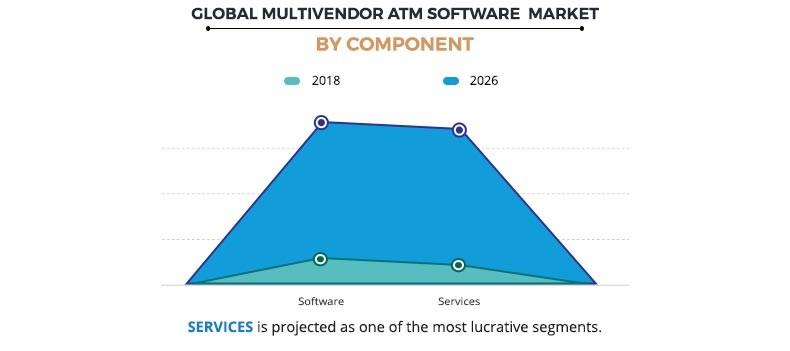

By Component, the software segment was the highest contributor to the multivendor ATM software market in 2018, and is projected to remain dominant during the forecast period, due to rise in awareness about the multiple benefits offered by multivendor ATM software, which includes reduced time to market, easier software updates, and others. However, the services segment is expected to witness highest growth, owing to increase in use of advanced analytics for predictive maintenance in multivendor ATM support services. For instance, IBM offers single agnostic vendor supporting bank’s multivendor branch environment. It helps in reducing downtime and decrease operational risk with single-source support for the bank’s multi-vendor IT ecosystem.

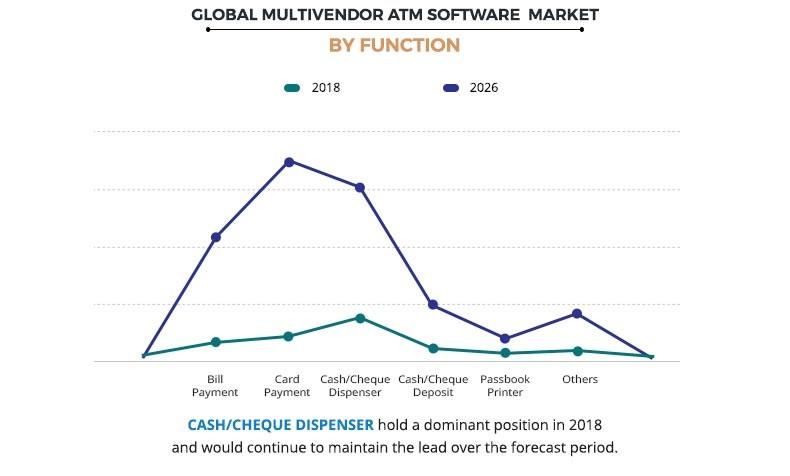

The cash/cheque dispenser segment dominated the multivendor ATM software market in 2018, and is expected to continue this trend during the forecast period. This is attributed to several advancements in financial institutes and banking sections. For instance, card less cash dispensing is also gaining traction in the recent years. Moreover, the launch of modern self-service teller machines embedded with advanced functionalities is further expected to boost the growth for this segment. However, the card payment industry is expected to witness highest CAGR during the forecast period owing to increase in adoption of multivendor ATM software among banks to remain compliant with EMV card payment standards.

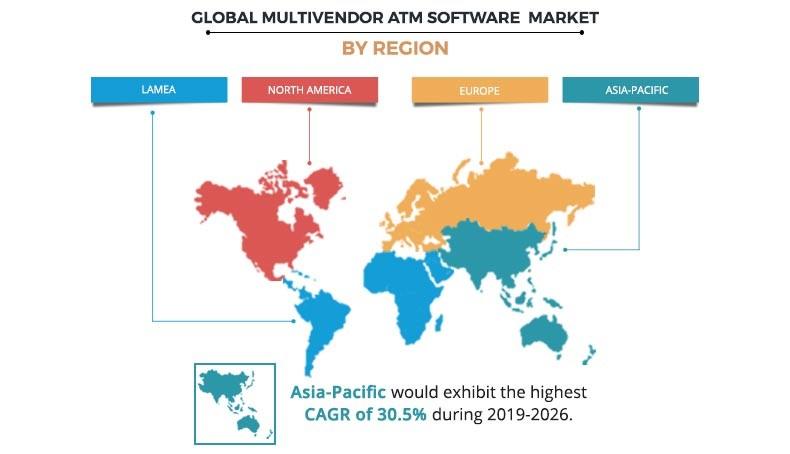

Europe dominated the overall multivendor ATM software market share in 2018, as several major European banks are seriously studying ‘thin client’ ATM architecture, which is expected to see the traditional ATM replaced by a streamlined model. Owing to this, the processing power that currently resides on the terminal is moved to a central location, which is opportunistic for the market. Moreover, Europe is home to several of the largest banks in the world and these institutions have significant purchasing power and sophisticated procurement processes, which is expected to fuel the adoption of multivendor ATM software in this region.

However, Asia-Pacific is expected to grow at the highest rate during the multivendor ATM software market forecast period due to factors such as major shift toward open architectures as marked by the rapid adoption of ATM hardware using the Microsoft Windows operating system and the move toward TCP/IP-based networks fuels the growth of the market.

The report focuses on the growth prospects, restraints, and multivendor ATM software market analysis. The study provides Porter’s five forces analysis of the multivendor ATM software industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the multivendor ATM software market trends.

Segment Review

The multivendor ATM software market is segmented into component, function, end user, and region. Based on component, the market is bifurcated into software and services. On the basis of function, it is classified into bill payment, card payment, cash/cheque dispenser, cash/cheque deposit, passbook printer, and others. Depending on end user, the market is categorized into banks & financial institutions and independent ATM deployer. Region wise, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The key players operating in the multivendor ATM software industry include Auriga SpA, Clydestone Group, Diebold Nixdorf, Incorporated, GRGBanking, KAL, Nautilus Hyosung America Inc., NCR Corporation, Printec Group, and Vortex Engineering Pvt. Ltd., Incorporated.

Top Impacting Factors

Ongoing modernization of older ATM estates, increase in demand for modern ATM software and hardware, and rise in demand for self-service ATM software in various financial sectors, and increase in awareness about the benefits of multivendor ATM software are the key factors that impact the growth of the multivendor ATM software market. However, limitations in terms of ATM management and complexity in working with ATM suppliers are expected to hamper the market growth. Furthermore, integration of new technologies such as contactless payments, QR codes and touch screens are expected to provide lucrative opportunities for the multivendor ATM software market growth.

Ongoing modernization of older ATM estates

The replacement of legacy ATMs installed worldwide is expected to gather even greater momentum in and after 2019. It is expected that around 90% of all ATMs that ship globally will replace an existing installation. As part of this modernization, the ongoing growth of contactless transactions and mobile pre-staging is projected to gain momentum to maximize convenience for users. Also, the ability of the ATM to offer "branch in a box" functionality and deliver more than 90% branch-based technology through an automated channel is also estimated to experience a further boost in 2019 and beyond. In recent years, embracing modernization has become more important for financial institutions and ATM deployers than ever.

The BFSI industry is witnessing rapid growth and customers are expecting the evolution of the ATM channel to match the recent trends in other industries such as retail, travel, or hospitality. Multivendor ATM software enables seamless alignment with current and future needs. Owing to this, it is estimated to play a vital role, particularly as consumers demand a consistency between mobile and physical channels, expeditious adoption of these software in the future drive the multivendor ATM software market.

Rise in demand for self-service ATM software in various financial sectors

The next generation of ATMs and self-service is based on advanced software, which is expected to drive the demand for multivendor ATM software. Banks and financial institutions are increasingly using advanced ATM software platforms to modernize customer identification and authentication, improve customer personalization, and maximize the performance of their ATMs through self-service channels. Though most ATM transactions are still carried out using the traditional card and PIN combination, advanced software platforms support a wider range of technologies and form factors. In a self-service interaction, NFC and contactless are emerging as the front runners, with QR codes and pre-staged transactions.

Moreover, end users are working with the key players to benefit from ATM availability and up-to-date security measures, resulting in maximum self-service availability for consumers and protection for the financial institution’s brand. Furthermore, vendors of the market are providing advanced self-service software in the market, which is expected to provide lucrative opportunities for the multivendor ATM software market.

Key Benefits for Multivendor ATM Software Market:

- This study includes the multivendor ATM Software market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities of the global market.

- The multivendor ATM software market size is quantitatively analyzed from 2018 to 2026 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the multivendor ATM Software market.

Multivendor ATM Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Function |

|

| By End User |

|

| By Region |

|

| Key Market Players | AURIGA SPA, CLYDESTONE GROUP, GRGBANKING, DIEBOLD NIXDORF, INCORPORATED, PRINTEC GROUP, NCR CORPORATION, KAL, Vortex Engineering Pvt Ltd, Incorporated, Nautilus Hyosung America, Inc., SALZBURGER BANKEN SOFTWARE |

Analyst Review

In accordance with several interviews that were conducted of the top level CXOs, the adoption of multivendor ATM software has increased over time to deliver a compelling consumer experience at the ATM as it is a widely recognized as a success factor for both financial institutions and independent ATM operators. Also, the ability of this software to overcome the innovation challenges posed by aging and inflexible infrastructure, and vendor dependencies is increasing its popularity among the end users. The adoption of multivendor ATM software is expected to rise in the upcoming years as number of financial institutions are adopting mergers and acquisitions as well as many deployers are operating ATM fleets comprising models from a number of manufacturers. Easier application maintenance and the ability to extend the software to support new features are key benefits of moving to a single ATM software environment. Also, reduced costs of development, testing, and deployment, and the ability to extend functionality quickly at a lower cost are some of the benefits of multivendor ATM software, which increases its adoption among the end users.

In the current business scenario, providers of ATM software include both manufacturers and independent companies. Banks typically procure complete solutions that combine the transaction application with a middleware platform enabling it to operate on different terminals of the manufacturers. Some financial institutions (FIs) as well as third-party software companies source only the platform, and build their own application on top of it. NCR is the largest provider of multivendor solutions and has strong presence in the U.S. and China. Diebold Nixdorf, Incorporated and KAL also have a combined presence equal to NCR and acquires a major share of this market.

Loading Table Of Content...