Mylar Market Research, 2031

The global mylar market size was valued at $10.7 billion in 2021, and is projected to reach $20.4 billion by 2031, growing at a CAGR of 6.9% from 2022 to 2031.

Report Key Highlighters:

- 20 countries are covered in the mylar market report. The segment analysis of each country in both value ($million) and volume (kilotons) during the forecast period 2021-2031 is covered in the report.

- Historical data and regulations are also covered in the report.

- Over 3,700 product literatures, annual reports, industry releases, and other such documents of major industry participants have been reviewed in order to obtain a better understanding of the market.

Mylar is a polyester resin that is used to create heat-resistant plastic films and sheets. It gives excellent tensile strength, chemical and dimensional stability, transparency, reflectivity, gas and scent packaging qualities, and electrical insulation make it popular. Mylar films are used in the food sector to create flexible packaging and lids such as yoghurt lids, roasting bags, and coffee foil pouches. Mylar manufacturing process begins with a film of molten polyethylene terephthalate (PET) being extruded onto a chill roll, which quenches it into the amorphous state. Mylar is a material that is used to wrap comic books and to save documents. It is used to give a glossy surface and protective coating on paper and textiles. Mylar is employed as an electrical and thermal insulator, as well as a reflective substance and as a decorative material. It may be found in a variety of products, including musical instruments, transparency film, and kites.

Growing demand from food & beverages, cosmetics & personal care, and electrical & electronics sectors is predicted to propel the market growth during the forecast period

Mylar is used by many end-use industries such as food & beverages, cosmetics & personal care, electrical & electronics, and others. Mylar bags are used in the food & beverage industries for the long-term preservation of dry commodities such as grains, beans, and flour. Coffee, almonds, cookies, chips, chocolate, and grains may all be stored in mylar bags.

Mylar is utilized in a wide variety of goods in cosmetics and personal care because it is an excellent way to preserve items stored in a survival cache from moisture, light, and air. Skin and hair care, soaps and cleansers, dental hygiene, feminine hygiene, shavers, make-up, and fragrances were all designed to cleanse, soothe, heal, protect, and adorn the body. Mylar may also be used to make miniature electrical capacitor components. Mylar in electric devices also catches and stores electrical energy. In these applications, it is frequently employed as an insulator between two pieces of metal that carry electrical currents. In some loads, mylar wraps are employed between hard pellets and wad walls to prevent friction. It will be resistant to friction and heat, which should improve the specific product.

However, the non-biodegradable nature of mylar is anticipated to hamper the growth of the Mylar market. Mylar is not certified as biodegradable; however, it may be recycled using a variety of methods. Mylar balloons contribute significantly to ocean pollution, but latex balloons are not as environmentally beneficial as they appear. Mylar bags are not recyclable through most recycling programs. This is due to the fact that they are constructed of two materials: PET plastic and metal. Although all of these materials are recyclable on their own, recycling Mylar bags is difficult since the two elements must be separated. On the contrary, surge in demand for mylar tapes is expected to generate lucrative opportunities for the global mylar market.

The Mylar market is segmented into application, end-use industry, and region. On the basis of application, the market is categorized into labels, bags and pouches, laminates, and others. On the basis of end-use industry, the market is categorized into food & beverages cosmetics & personal care electrical & electronics, pharmaceutical, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The mylar market share is analyzed across all significant regions and countries.

Asia-Pacific is projected to register a robust growth during the forecast period. In Asia-Pacific, mylar is used as a strong, thin polyester film that is used in photography, recording tapes, and insulation. Mylar is commonly employed in the motor slot, phase, and liner insulation, as interlayer insulation in transformer automatic coil inserting machines for wedge insertion, reflecting 97% of radiant heat. Mylar film is excellent for both food and non-food applications. Microwave and medical packaging, tape backing, plastic wrap, plastic cards, printed films, protective coatings such as solar and safety window films, release films, transformer insulation films, and flexible printed circuits are the most prevalent uses in Asia-Pacific.

China is projected to register a robust growth during the forecast period. The growing preference of Chinese customers for items like fish, meat, and vegetables, mostly retort-packed to make them shelf-stable, is pushing the mylar business. Furthermore, ready-made meals have grown in favor among the country's customers. Increasing demand for convenient food packaging is growing the mylar market faster. Better food quality, safety, and shelf life of packaged food are in high demand, leading in a more convenient packaging industry.

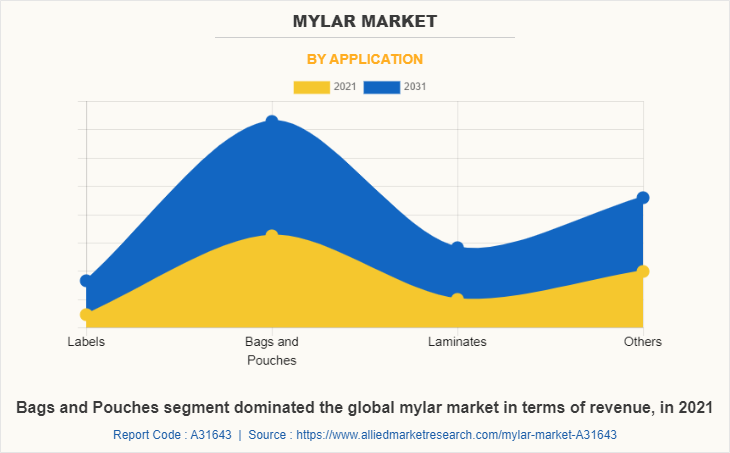

The bags and pouches segment accounted for the largest share of the global mylar market in terms of revenue, in 2021. Mylar bags are among the most widely used and significant materials in the modern world. These bags can increase shelf life, protect items from the weather, and minimize transit weight. Due to the thick foil lamination layer, Mylar bag films have a very low Oxygen Transmission Rate which provides three levels of protection against moisture, light, and odor. Mylar is highly flexible and thin, while simultaneously being extremely robust and resilient. It is puncture-resistant and simple to use. Mylar bags and pouches can be used to preserve dry and dehydrated goods such as pearl barley, brown sugar, whole wheat flour, brown rice, granola, chips, and dried meat for up to five years. Dried eggs, almonds, seeds, milled grains, and other fresh or wet food products should not be kept in a mylar bag for an extended period of time.

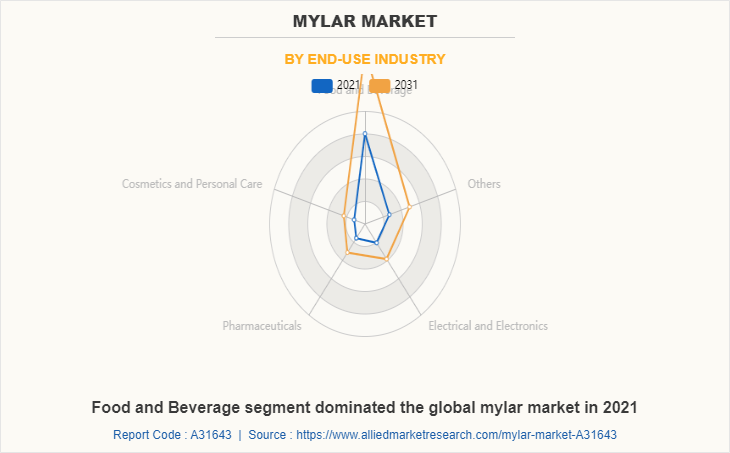

The food and beverage segment dominated the global mylar market in 2021. Mylar food and beverage packaging are essential for keeping and delivering food items to their destination without compromising taste or quality. It protects the contents from toxins and moisture, prevents spills and tampering, and aids with the preservation of shape and quality. Mylar food packaging has also grown in popularity as a way of transmitting information such as nutritional value, expiry date, price, and provenance of the packed items.

Key Players and Strategies:

The major players operating in the global Mylar market include BCW Diversified, Inc., CS Hyde Company, FINE PACKAGE CO., LTD., Grafix Plastics, IMPAK CORPORATION, Jarrett Industries, Protective Packaging Corporation, RH Nuttall, Tekra Corporation, and Uline Company. These players have been adopting various strategies to gain higher share or to retain leading positions in the market. For instance, in the year 2021 Tekra Corporation expanded its mylar business by introducing some new textures to their ProTek weatherable polyester films lines, which include a velvet and a fine matte finish. These materials are intended to provide a tactile feel to the surface and are being sold alongside their existing ProTek Weatherable Clear Gloss Polyester.

Historical Trends:

DuPont Teijin Films introduced mylar in the early 1950s, which are composed of polyethylene terephthalate. It is a chemically inert and dimensionally stable biaxially orientated film. Mylar is a good moisture, oil, and grease barrier. Lamination, coating, embossing, printing, and dyeing are done with it. Mylar is also widely utilized in heat seal packaging.

In 1955, Eastman Kodak used Mylar as a support for photographic film and called it "ESTAR Base". The extremely thin and durable film allowed 6,000-foot (1,800-meter) reels to be exposed on long-distance U-2 reconnaissance flights.

In 1964, NASA launched Echo II, a 40-metre (131-foot) diameter balloon made of a 9-micrometre (0.00035 in) thick mylar film sandwiched between two layers of 4.5-micrometre (0.00018 in) thick aluminum foil linked together. Echo 2 was developed as a rigidized passive communications spacecraft for experimenting with propagation, tracking, and communication systems.

Beginning in the late 1970s, certain more costly (and longer-lasting) foil balloons composed of thin, unstretchable, less permeable metallized films like Mylar (BoPET) began to be manufactured which became a versatile expression medium for any special occasion.

Key Regulations:

All mylar manufactured and supplied for food packaging conforms with FDA regulation 21CFR177.1630. The regulation specifies polyester films that are safe to use in contact with all forms of food. Uncoated PET films are expressly certified for use in oven cooking or baking at temperatures above 120°C (250°F). Polymer coated films are prohibited to usage below 120°C (250°F).

According to Drugs & Drug Paraphernalia 384, owing to regulatory restrictions, all mylar bags that are not transparent or single-colored must be removed from the Amazon shop by August 5, 2022.

COVID-19 Analysis:

- COVID-19 presented many packaging firms with new challenges and had a positive impact on mylar packaging, which is usually used to store dry foodstuffs like white rice, wheat, flour, beans, sugar, and oats.

- During and after the lockdown, a large number of people switched to online food shopping, a trend that will surely continue. E-commerce currently one of the most widely preferred channels around the globe is witnessing significant growth in demand of packaging solutions. With more physical retailers shifting to online sales channels is further fueling the demand for e-commerce packaging solutions due to their high tensile strength, chemical and dimensional stability, transparency, and reflectivity.

- The companies are implementing various techniques to increase production volume and are attempting to develop innovative solutions at a low cost that can meet customer requirements at a lower cost and support the overall breakthrough required for increased mylar packaging penetration sustainability.

- During and after the COVID-19 pandemic, packaging manufacturers are witnessing higher demand from sectors such as food & beverages, pharmaceuticals, and other essential commodities such as pouches and bags are currently considered essentials, and consumers stocking up these items.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mylar market analysis from 2021 to 2031 to identify the prevailing mylar market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mylar market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global mylar market trends, key players, market segments, application areas, and market growth strategies.

Mylar Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 20.4 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 262 |

| By Application |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Tekra Corporation, FINE PACKAGE CO., LTD., Protective Packaging Corporation, BCW Diversified, Inc., CS Hyde Company, Jarrett Industries, RH Nuttall, IMPAK CORPORATION, Uline Company, Grafix Plastics |

Analyst Review

According to the perspective of the CXOs of leading companies, the mylar market is anticipated to grow in near future due to its extensive use in applications such as labels, bags and pouches, laminates, and others. Mylar packaging is made up of a number of layers of laminated food-grade plastic and metal. It protects the contents of the bag by acting as a robust light, moisture, and oxygen barrier.

Rise in demand for mylar in packaging is projected to drive market expansion throughout the projected period. Mylar is not biodegradable; as, it may be recycled in a number of ways. Mylar balloons greatly contribute to ocean pollution, but latex balloons are not as ecologically friendly as they look. However, the non-biodegradability of mylar is expected to restrain industry expansion. The Asia-Pacific region is projected to register a robust growth during the forecast period.

The global mylar market was valued at $10.7 billion in 2021 and is projected to reach $20.4 billion by 2031, growing at a CAGR of 6.9% from 2022 to 2031.

Growing demand from food & beverages, cosmetics & personal care, and electrical & electronics sectors is predicted to propel the mylar market growth during the forecast period.

Bags and pouches is the leading application of Mylar Market.

Asia-Pacific is the largest regional market for Mylar.

The major players operating in the global Mylar market include BCW Diversified, Inc., CS Hyde Company, FINE PACKAGE CO., LTD., Grafix Plastics, IMPAK CORPORATION, Jarrett Industries, Protective Packaging Corporation, RH Nuttall, Tekra Corporation, and Uline Company.

Loading Table Of Content...