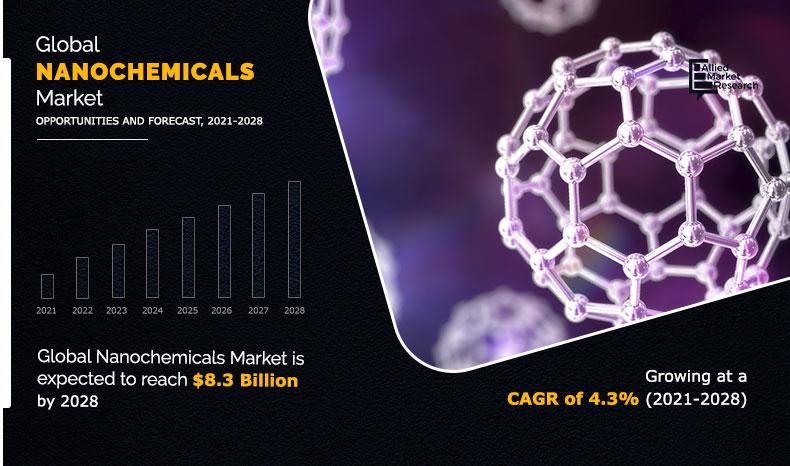

Nanochemicals Market Outlook - 2021–2028

The global nanochemicals market was valued at $5.4 billion in 2020, and is anticipated to generate $8.3 billion by 2028. The market is projected to experience growth at a CAGR of 4.3% from 2021 to 2028.

In the recent years, the nanochemicals market has witnessed a sharp upsurge due to increase in polymer and ceramic demands. In addition, nanochemicals has found quite a demand in the medical field and the pharmaceuticals sectors, owing to increase in advancements and demand in these markets. Also, these are used in metallic, electronic chemicals, cleaners, industrial & specialty gases, and in various other rubber chemicals industries because of its non-resistant and fast reactions. It is also used in various kind of batteries because of less flame, lighter weight, high power density, and quick charging facilities. In developing countries like India, the demand for nanochemicals is increasing day by day because of development of new buildings. The nano chemicals are used in the manufacturing of nano-sized ceramic which in turn gives color to the ceramics in different applications. Also, the paint which is being developed using nanochemicals have very high refractive index and are very bright and hence will last longer.

The nanochemicals market is segmented on the basis of type, application, and region. Depending on type, the market is classified into metallic nano chemicals, ceramic nano chemicals, polymer nano chemicals, and other. By application, the market is divided into semiconductors & electronics, pharmaceuticals, food & agriculture, energy, textiles, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

The key players operating in the market are BASF SE, DuPont, Evonik Industries AG, Huntsman Corporation, Merck KGaA, Mitsubishi Chemical Holding, SABIC, Solvay S.A., Sumitomo Corporation, and Thermo Fischer Scientific. The players in the market have adopted several strategies, such as type launch and business expansion, to sustain the market competition.

Nanochemicals Market, by Type

By type, the ceramic nanochemicals segment dominated the market in 2020 owing to the increased application in building & construction industry. However, polymer nanochemicals are projected to grow at a higher pace during the forecast period. This is attributed to increase in pharmaceuticals and semiconductors applications.

By Type

Polymer Nanochemicals is projected as the most lucrative segment.

Nanochemicals Market, by Application

By application, the pharmaceutical segment dominated the nanochemicals market growth in 2020 owing to various properties of nanochemicals that are effective in drug delivery and thus widely used in the treatment and therapeutic solutions. The semiconductors & electricals segment is expected to grow at a notable CAGR during the forecast period owing to increased use of nano particles in computation sector.

By Application

Semiconductors & Electronics are projected as the most lucrative segment.

Nanochemicals Market, by region

By region, the nanochemicals market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the nanochemicals market share in 2020 owing to technological advancement that benefits the growth of the region. Europe and Asia-Pacific are expected to grow at a higher CAGR during the forecast period due to rise in activities in nanochemicals in countries such as France, China, India, Malaysia, Spain and South Korea.

By Region

Asia-Pacific is projected as the most lucrative market.

Covid-19 Impact Analysis

- The coronavirus's unfavorable global effects are already evident and have impacted the demand for nanochemicals in 2020.

- The World Health Organization has declared a public health emergency after the COVID-19 virus outbreak in December 2019. The disease has spread to over 100 nations and has resulted in massive deaths all across the world. Exports & imports, global manufacturing, tourism, and financial sectors have all been heavily damaged.

- The downward pressure on the global economy, which had previously shown signs of improvement, has escalated once more. The outbreak of the virus has added danger factors to the international economy's already declined development. Many international groups have stated that the global economy is experiencing its most difficult moment since the financial crisis.

- However, there is a positive impact in the nanochemicals industry during the pandemic because huge investments were made in the sector for vaccine development along with evaluating the impacts and ways to treat individuals in different ways. Stem therapy and plasma therapy are some of the examples.

Key Benefits For Stakeholders

- The report provides an in-depth analysis and nanochemicals market forecast along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the nanochemicals market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the nanochemicals industry for strategy building.

- A comprehensive analysis of the factors that drive and restrain the market growth is provided.

- The qualitative data in this report aims on nanochemicals market trends, dynamics, and developments.

- The nanochemicals market size is provided in terms of revenue.

Key Market Segments

By Type

- Metallic Nanochemicals

- Ceramic Nanochemicals

- Polymer Nanochemicals

- Other

By Application

- Semiconductors & Electronics

- Pharmaceuticals

- Food & Agriculture

- Energy

- Textiles

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Players

- BASF SE

- DuPont

- Evonik Industries AG

- Huntsman Corporation

- Merck KGaA

- Mitsubishi Chemical Holding

- SABIC

- Solvay S.A.,

- Sumitomo Corporation

- Thermo Fischer Scientific

Nanochemicals Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Evonik Industries AG, Thermo Fisher Scientific Inc., DuPont., SABIC, MITSUBISHI CHEMICAL HOLDINGS, Solvay S.A., SUMITOMO CORPORATION, BASF SE, MERCK KGaA, HUNTSMAN CORPORATION |

Analyst Review

The nanochemicals market is highly consolidated in nature. It has applications in various industries such as defense, textiles, manufacturing, pharmaceuticals, semiconductors, and energy generation. The recent trends in the market show a sharp upsurge in the nanochemicals market due to increase in polymer and ceramic nanochemicals demand. These products are widely popular in North America and Europe owing to their extensive use in the military equipment. The nanochemical materials are used in developing batteries, which exhibit quick charging, have very light weight, is more efficient, and can hold the electrical charge longer as compared to the traditional batteries, which in turn helps in saving time. Such applications have led the market toward a notable growth rate. However, these are small in size and exhibit fast reaction mechanisms, which can be very hazardous to human body and the environment and thus hinder the growth of the market in the upcoming years.

Increase in polymer and ceramic demands are the key factors driving the Nanochemicals market.

The market share of Nanochemicals market $5.4 billion in 2020.

The rising use of medicines has also led to rise in demand of Nanochemicals in-addition with food & beverage industry.

Europe and Asia-Pacific will provide more business opportunities for Nanochemicals market in future.

Business expansion and acquisition are the key growth strategies of Nanochemicals market players.

The leading players in the market are BASF SE, DuPont, Evonik Industries AG, Huntsman Corporation, Merck KGaA, Mitsubishi Chemical Holding, SABIC, Solvay S.A., Sumitomo Corporation, and Thermo Fischer Scientific.

Pharmaceutical’s segment based on application holds the maximum market share of the Nanochemicals market.

Food & beverage, pharmaceuticals, semiconductors & electronics, automotive, and cosmetics are the potential customers of Nanochemicals industry.

Loading Table Of Content...