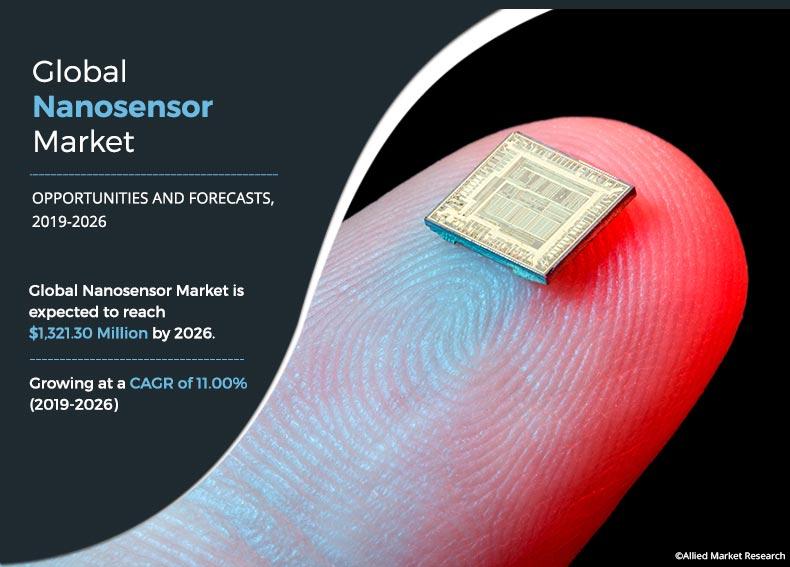

Nanosensors Market Outlook - 2026

The global nanosensors market is expected to generate revenue worth $536.6 million in 2019 and is projected to reach $1,321.30 million by 2026, registering a CAGR of 11.0% during the forecast period.

Nanoscience and nanosensors are the study of nanoparticles and devices, which find their application across all the science fields such as chemical, bio-medical, mechanics, and material science among others. The nanosensors market encompasses the production and application of physical, chemical, and biological systems and devices at scales ranging from individual atoms or molecules to around 100 nanometers.

Nano Sensor carries a significant impact and serves as a revolutionary and beneficial technology across various industrial domains, including communication, medicine, transportation, agriculture, energy, materials & manufacturing, consumer products, and households. The U.S. National Nano Sensor Initiative has estimated that around 20,000 researchers are working in the field of nanosensors. For the UK, the Institute of Occupational Medicine has estimated that approximately 2,000 people are employed in new nanosensor companies and universities where they may be potentially exposed to nanoparticles. Furthermore, various organizations globally are investing in the nanosensors market and its emerging applications. For instance, in 2018, Osaka University-led researchers combined nanosensor technology and artificial intelligence for rapid diagnosis of influenza.

Nanoscale sensors and devices may provide cost-effective continuous monitoring of the structural integrity and performance of bridges, tunnels, rails, parking structures, and pavements over time. Moreover, nanoscale sensors, communications devices, and other innovations enabled by nanoelectronics support an enhanced transportation infrastructure that can communicate with vehicle-based systems to help drivers maintain lane position, avoid collisions, adjust travel routes to avoid congestion and improve driver interfaces to onboard electronics. All these factors are expected to be the major nanosensors market trends globally.

Factors such as a surge in the adoption of nanosensors in medical diagnosis & imaging and technological advancements in nanotech devices drive the growth of the global nanosensors market size. However, issues arising in the deployment of nanodevices in extreme conditions and the high cost of the technology act as the major barriers, thereby hampering the nanosensors market growth. On the contrary, an increase in support and R&D funding from government organizations and the emergence of self-powered nanotech devices are anticipated to offer lucrative opportunities for the nanosensors market forecast.

Segmentation Overview:

The nano sensors market analysis is studied under type, application, and region. Based on type of nanosensors, the market is categorized into optical, chemical, physical, biosensor, and others.

By Type

Biosensor segment is projected as one of the most lucrative segments.

The applications covered in the study include electronics, energy, chemical manufacturing, aerospace & defense, healthcare, and others.

By Application

Healthcare segment is expected to secure leading position during forecast period.

By region, the nanosensors market is analyzed across North America, Europe, Asia-Pacific, and LAMEA along with their prominent countries.

By Geography

Asia Pacific region would exhibit the highest CAGR of 13.10% during 2019-2026

The key market leaders profiled in the nanosensors industry include Agilent Technologies, Inc., Analog Devices, Inc., Applied Nanotech, Bruker Corporation, Honeywell International Inc., Biosensors International Group, Ltd., Kleindiek Nanotechnik GmbH, Omron Corp., Lockheed Martin Corp., and Texas Instruments. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration, and business expansion, to increase the nanotechnology market share during the forecast period.

Top Impacting Factors:

Factors such as a surge in the adoption of nanosensors in medical diagnosis & imaging and technological advancements in nanotech devices drive the growth of the global nanosensor market. However, issues arising in the deployment of nanodevices in extreme conditions and the high cost of the technology act as the major barriers, thereby hampering the nanosensor market growth. On the contrary, an increase in support and R&D funding from government organizations and the emergence of self-powered nanotech devices are anticipated to offer lucrative opportunities for the nanosensor market forecast.

Surge in Adoption of Nanosensors in Medical Diagnosis:

The healthcare, life-science, and biomedical sectors are some of the major initial markets for nanosensors owing to the increase in the need for rapid, compact, accurate, and portable diagnostic sensing systems. As Urgent Care Centers (UCC) and Retail Clinics Centers (RC) have become popular for convenient care and fast & accurate response of equipment and systems used in Emergency Departments for diagnosis in hospitals require the need of systems that deploy Nano-sensors for diagnosis, and assist in the growth of nanosensors market share globally.

Emergence of Self-Powered Nanotech Devices:

A Nano system is composed of not only nanodevices but also Nano-power-source (Nano-battery). For any system to be self-sufficient, it must harness its energy from its surrounding environment and store this harnessed energy for later use. Thus, researchers working in the field of nanosensors aim to design self-powered nanosystems that exhibit ultra-small size, super sensitivity, extraordinary multi-functionality, and extremely low power consumption. These systems are expected to be applicable in sensing, medical science, defense technology, and personal electronics. Wireless devices and implanted biomedical devices need to be self-powered without using the battery. This is attributed to the fact that the power source is crucial for independent, sustainable, and continuous operations of implantable biosensors, ultrasensitive chemical & biomolecular sensors, nanorobotics, micro-electromechanical systems, remote & mobile environmental sensors, homeland security, and portable electronics, which provides lucrative nanosensors market opportunity globally.

Key Benefits for Nanosensors Market:

- This study includes the analytical depiction of the global nanosensors market along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information regarding the key drivers, restraints, and opportunities.

- The current nanosensors market forecast is quantitatively analyzed from 2018 to 2025 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Nanosensors Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | BRUKER CORPORATION, BIOSENSORS INTERNATIONAL GROUP, LTD., TEXAS INSTRUMENT, LOCKHEED MARTIN CORP., ANALOG DEVICES, INC., HONEYWELL INTERNATIONAL INC, APPLIED NANOTECH (PEN INC), KLEINDIEK NANOTECHNIK GMBH, OMRON CORP., AGILENT TECHNOLOGIES |

Analyst Review

Nanosensors are the electronic devices developed at nanoscales, which find their application across all other science fields such as chemistry, biology, physics, and material science. It encompasses the application in electronics, energy, chemical manufacturing, aerospace & defense, healthcare at scales ranging from individual atoms or molecules to around 100 nanometers.

Nanosensor-based diagnostic techniques that are currently under development may provide two major benefits such as detection and monitoring at various stages of treatments. Urgent Care Centers (UCC) and Retail Clinics Centers (RC) have become popular for convenient care and fast response of Emergency Departments requires the need of systems which deploys Nano-sensors for diagnosis. Further, the increasing rates of patients who have diabetes and other health problems that require regular diagnosis is encouraging healthcare companies and government bodies in various countries for investment in developments of diagnostics techniques.

Various organizations globally are investing in nanotechnology and nanosensor. For instance, in 2018, Osaka University-led researchers, in a joint research project with The University of Tokyo, Kyoto University, and Waseda University, constructed integrated gene logic-chips called gene nanochips. Using integrated factors on the nanochips, these self-contained nanochips can switch genes on and off within a single chip, preventing unintended crosstalk.

The key players profiled in the report include Agilent Technologies, Inc., Analog Devices, Inc., Applied Nanotech, Bruker Corporation, Honeywell International Inc., Biosensors International Group, Ltd., Kleindiek Nanotechnik GmbH, Omron Corp., Lockheed Martin Corp. and Texas Instruments.

Loading Table Of Content...